https://t.co/OoFu0YPxiM

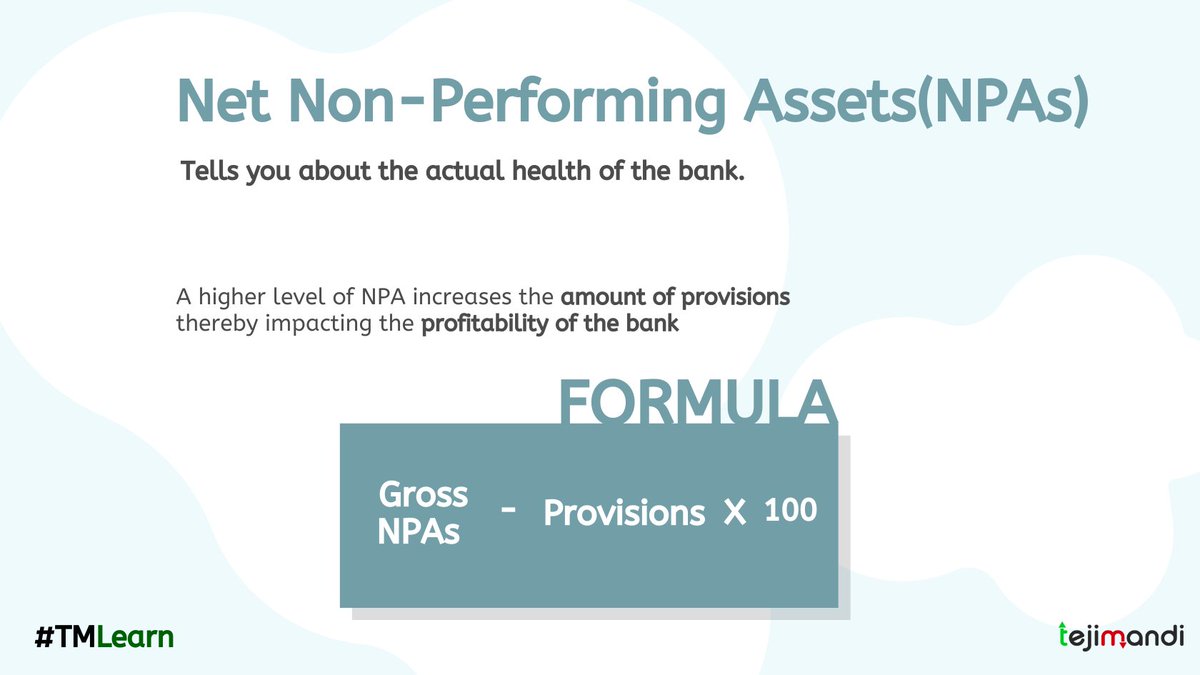

Some Excellent articles on Financial Ratios and Analysis.

h/t @discover_ci 👏

1⃣ Profitability

✔️Determining a Company’s Key Performance Indicators

✔️Collecting Company Financial Statements & Calculating Financial Ratios

✔️Analyzing Operating Results & Financial Ratios

https://t.co/ptipG3cqw0

More from Ram Bhupatiraju

The (investing) world is full of noise📢. Tune that out and find your signal.🗼

Investing websites/blogs that I shared during the @FintwitSummit last weekend. With some minor changes and lot of additional commentary in the thread below. ⬇️⬇️

My investing diet 🗒️

✔️Zero Financial TV.

✔️Very little Market & Stock prices commentary/content.

✔️Lot of Company produced presentations/statements.

✔️ Lot of Investing Podcasts (thread some other time).

✔️Lot of below awesome content whenever I find time.

Tech : Have to start with my favorite sector

✅ @stratechery

For deeper understanding of Platforms and Aggregators.

https://t.co/VsNwRStY9C

✅ @benedictevans

Phenomenal essays related to

✅ @adam_hartung

Extremely good if you are into following & investing in strong/durable trends.

https://t.co/IOE1pmkqbi

✅ @BaillieGifford

Mind blowing, if you're into extremely patient and visionary style of

✅ @StackInvesting

Must read if you love the combination of Software + Investing

https://t.co/WQ1yBYzT2m

✅ @hhhypergrowth

Phenomenal writing if you love technical deep dives into SaaS

https://t.co/kcLKITRLz1

✅ @Beth_Kindig

Sharp Tech focused

Investing websites/blogs that I shared during the @FintwitSummit last weekend. With some minor changes and lot of additional commentary in the thread below. ⬇️⬇️

My investing diet 🗒️

✔️Zero Financial TV.

✔️Very little Market & Stock prices commentary/content.

✔️Lot of Company produced presentations/statements.

✔️ Lot of Investing Podcasts (thread some other time).

✔️Lot of below awesome content whenever I find time.

Tech : Have to start with my favorite sector

✅ @stratechery

For deeper understanding of Platforms and Aggregators.

https://t.co/VsNwRStY9C

✅ @benedictevans

Phenomenal essays related to

✅ @adam_hartung

Extremely good if you are into following & investing in strong/durable trends.

https://t.co/IOE1pmkqbi

✅ @BaillieGifford

Mind blowing, if you're into extremely patient and visionary style of

✅ @StackInvesting

Must read if you love the combination of Software + Investing

https://t.co/WQ1yBYzT2m

✅ @hhhypergrowth

Phenomenal writing if you love technical deep dives into SaaS

https://t.co/kcLKITRLz1

✅ @Beth_Kindig

Sharp Tech focused

More from Investing

🔎 $RTP/@hippo_insurance: SaaS harnessing AI to revolutionize the home insurance industry 🦛🏠

- Everything you need to know

- One-stop-shop for all things smart/connected home

- Higher growth & revenue than closest public competitor $LMND/@Lemonade_Inc

Time for a thread 🧵⬇️

Hippo was founded in 2015 by Assaf Wand, an ex-McKinsey consultant and Eyal Navon, serial entreprenuer and software engineer.

Wand's interest in insurance was inspired by his father's lengthy career in the "antiquated" insurance industry. $RTP

After two years of R&D, fundraising, and product development, Hippo launched in April 2017 in California.

The company's marketing was centered on the delivery of a 60-sec quote for insurance policies, transparent process, and smart home integration.

https://t.co/msy9u2ZpST $RTP

By March 2019, with Hippo insurance available to more than 50% of the homeowners in the US, the company reported a 25% month-over-month sales growth and total insured property value of more than $50 billion, with a 93% customer retention rate.

https://t.co/D5AyWgonVp $RTP

Hippo is going after a slightly different market. Most of the new insurance companies have pitched services to renters and city dwellers made up of the mostly millennial demographic, while Hippo is aiming its services squarely at homeowners. $RTP

https://t.co/MYo9HWDmdV

- Everything you need to know

- One-stop-shop for all things smart/connected home

- Higher growth & revenue than closest public competitor $LMND/@Lemonade_Inc

Time for a thread 🧵⬇️

Hippo was founded in 2015 by Assaf Wand, an ex-McKinsey consultant and Eyal Navon, serial entreprenuer and software engineer.

Wand's interest in insurance was inspired by his father's lengthy career in the "antiquated" insurance industry. $RTP

After two years of R&D, fundraising, and product development, Hippo launched in April 2017 in California.

The company's marketing was centered on the delivery of a 60-sec quote for insurance policies, transparent process, and smart home integration.

https://t.co/msy9u2ZpST $RTP

By March 2019, with Hippo insurance available to more than 50% of the homeowners in the US, the company reported a 25% month-over-month sales growth and total insured property value of more than $50 billion, with a 93% customer retention rate.

https://t.co/D5AyWgonVp $RTP

Hippo is going after a slightly different market. Most of the new insurance companies have pitched services to renters and city dwellers made up of the mostly millennial demographic, while Hippo is aiming its services squarely at homeowners. $RTP

https://t.co/MYo9HWDmdV