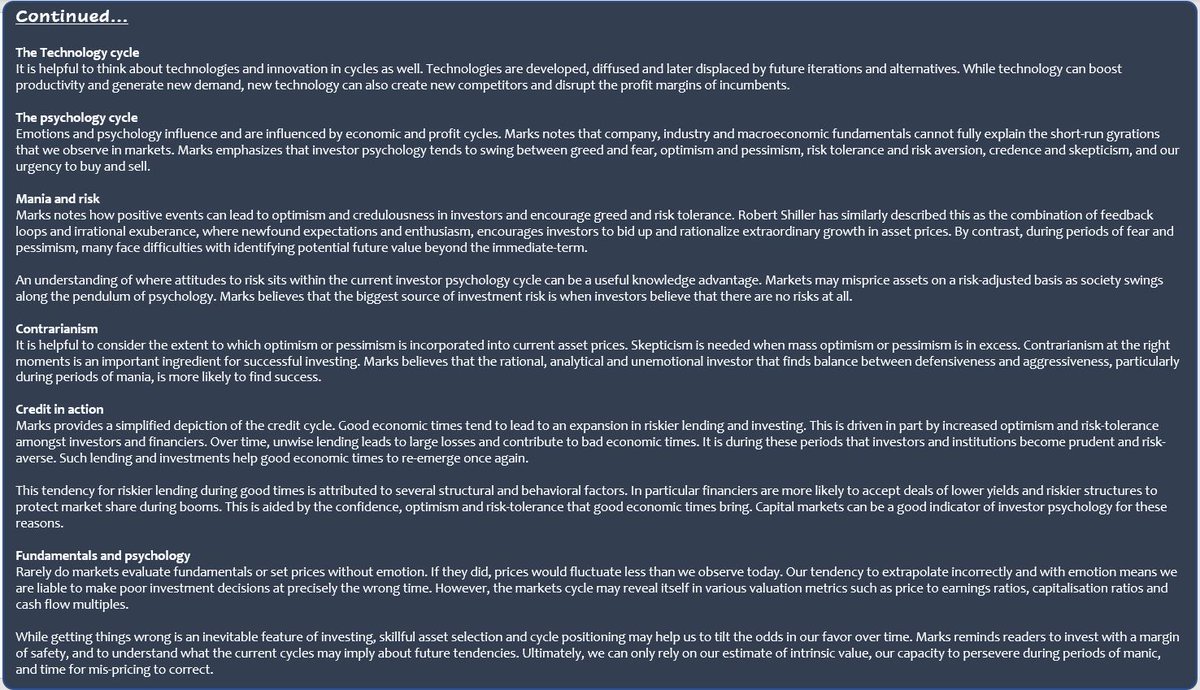

Excellent article on Investor psychology & Market cycles based on Howard Marks' "Mastering the Market Cycle".

cc: @dmuthuk @Gautam__Baid

✔️Mania and risk

"The combination of feedback loops and irrational exuberance, where newfound expectations and enthusiasm, encourages investors to bid up and rationalize extraordinary growth in asset prices.

An understanding of where attitudes to risk sits within the current investor psychology cycle can be a useful knowledge advantage.

Marks believes that the biggest source of investment risk is when investors believe that there are no risks at all.

It is helpful to consider the extent to which optimism or pessimism is incorporated into current asset prices. Skepticism is needed when mass optimism or pessimism is in excess. Contrarianism at the right moments is an important ingredient for successful investing

More from Ram Bhupatiraju

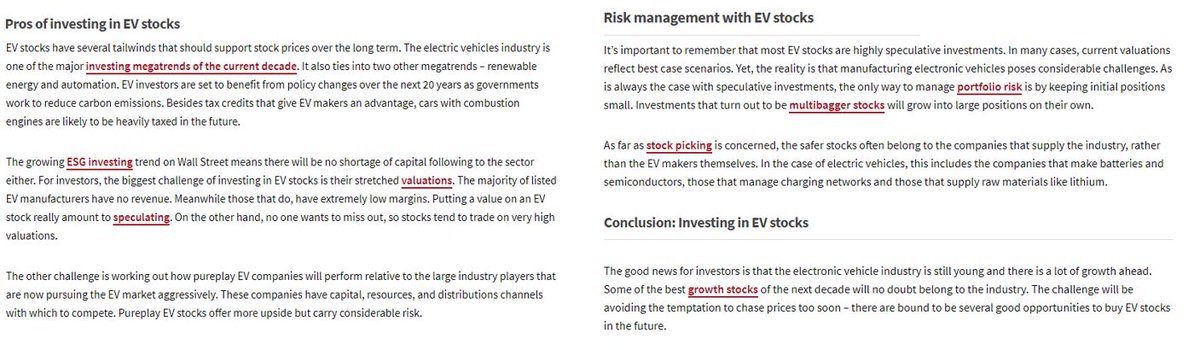

Two good articles (general/informative/balanced) on two of the hottest topics in the Market over the last year. SPACs and EVs. h/t @CatanaCapital 👏

1⃣ What are SPACs and should you invest in them?

https://t.co/HGz7sDv52Y

$SPCE $IPOE $CCIV ..

Watch out for 👇

2⃣ EV Stocks – There is more to the electronic vehicles market than Tesla, BYD & NIO..

https://t.co/96PFrJMLdw

$TSLA $BYDDF $NIO $CCIV $XPEV $LI $PLUG $BLNK $LAZR $BIDU ...

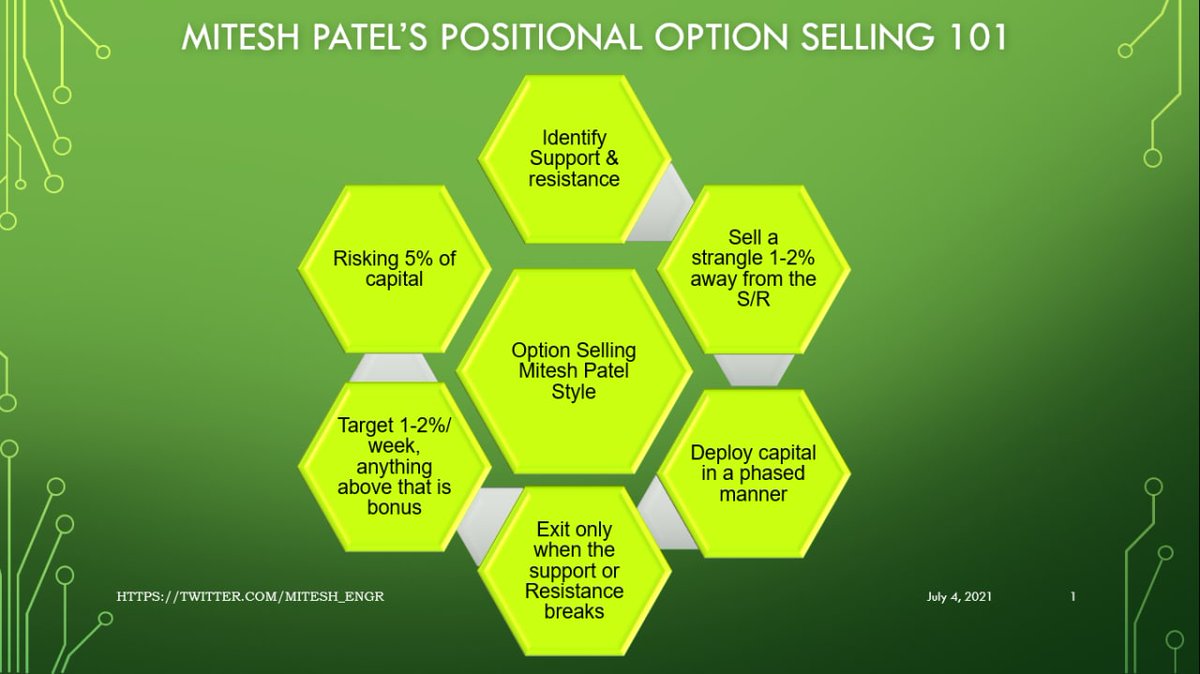

Important to balance the opportunity set, risk Management, position sizing.👇

1⃣ What are SPACs and should you invest in them?

https://t.co/HGz7sDv52Y

$SPCE $IPOE $CCIV ..

Watch out for 👇

2⃣ EV Stocks – There is more to the electronic vehicles market than Tesla, BYD & NIO..

https://t.co/96PFrJMLdw

$TSLA $BYDDF $NIO $CCIV $XPEV $LI $PLUG $BLNK $LAZR $BIDU ...

Important to balance the opportunity set, risk Management, position sizing.👇

The (investing) world is full of noise📢. Tune that out and find your signal.🗼

Investing websites/blogs that I shared during the @FintwitSummit last weekend. With some minor changes and lot of additional commentary in the thread below. ⬇️⬇️

My investing diet 🗒️

✔️Zero Financial TV.

✔️Very little Market & Stock prices commentary/content.

✔️Lot of Company produced presentations/statements.

✔️ Lot of Investing Podcasts (thread some other time).

✔️Lot of below awesome content whenever I find time.

Tech : Have to start with my favorite sector

✅ @stratechery

For deeper understanding of Platforms and Aggregators.

https://t.co/VsNwRStY9C

✅ @benedictevans

Phenomenal essays related to

✅ @adam_hartung

Extremely good if you are into following & investing in strong/durable trends.

https://t.co/IOE1pmkqbi

✅ @BaillieGifford

Mind blowing, if you're into extremely patient and visionary style of

✅ @StackInvesting

Must read if you love the combination of Software + Investing

https://t.co/WQ1yBYzT2m

✅ @hhhypergrowth

Phenomenal writing if you love technical deep dives into SaaS

https://t.co/kcLKITRLz1

✅ @Beth_Kindig

Sharp Tech focused

Investing websites/blogs that I shared during the @FintwitSummit last weekend. With some minor changes and lot of additional commentary in the thread below. ⬇️⬇️

My investing diet 🗒️

✔️Zero Financial TV.

✔️Very little Market & Stock prices commentary/content.

✔️Lot of Company produced presentations/statements.

✔️ Lot of Investing Podcasts (thread some other time).

✔️Lot of below awesome content whenever I find time.

Tech : Have to start with my favorite sector

✅ @stratechery

For deeper understanding of Platforms and Aggregators.

https://t.co/VsNwRStY9C

✅ @benedictevans

Phenomenal essays related to

✅ @adam_hartung

Extremely good if you are into following & investing in strong/durable trends.

https://t.co/IOE1pmkqbi

✅ @BaillieGifford

Mind blowing, if you're into extremely patient and visionary style of

✅ @StackInvesting

Must read if you love the combination of Software + Investing

https://t.co/WQ1yBYzT2m

✅ @hhhypergrowth

Phenomenal writing if you love technical deep dives into SaaS

https://t.co/kcLKITRLz1

✅ @Beth_Kindig

Sharp Tech focused

More from Investing

THE MONEY PRINTING GAME:

A pleb's guide to using @Keeper_DAO's hiding game to acquire $Rook below market price and arb it like a pro.

Before reading this thread, please read this one to provide a bit of context:

https://t.co/jLeUJRIjLG

Here we go!

1/

Before we really get into the meat of this... please do understand that the hiding game is currently in alpha. Hardware wallets don't work w/ it yet (they will soon).

Sometimes orders go unfilled (improving every day).

2/

A bit more context:

Limit orders on an amm aren't limit orders in the traditional sense. They are actually arbitrage opportunities for keepers. Keepers are bots that operate in the dark forest of ethereum.

3/

Now, let's say you use a service like 1inch or matcha to set your limit orders.

Let's say eth is $900 and you want to sell at $1000.

Eth pumps to $1040 rapidly, a keeper fills your limit order for $1000... everyone is happy. But wait... who gets the extra $40 here?

4/

Hint: it's not you! But what if you could?

This is where the hiding game comes in.

https://t.co/6sBlUWfw00

When you submit a limit order through the hiding game, @Keeper_DAO takes the $40 (or w/e amount) referenced above (this is MEV) and pushes it to the treasury.

5/

A pleb's guide to using @Keeper_DAO's hiding game to acquire $Rook below market price and arb it like a pro.

Before reading this thread, please read this one to provide a bit of context:

https://t.co/jLeUJRIjLG

Here we go!

1/

Ok I couldn't resist myself...

— 0x_Infinitum (@CryptoMessiah) February 3, 2021

OOOONNEEE more $Rook post.

Before i get into the REALLY cool shit i want to talk about, let me discuss the arb mining mechanics that were present during the initial distribution phase.

See this image, that's the keeperdao treasury.

1/ pic.twitter.com/Z2sMsZN9jo

Before we really get into the meat of this... please do understand that the hiding game is currently in alpha. Hardware wallets don't work w/ it yet (they will soon).

Sometimes orders go unfilled (improving every day).

2/

A bit more context:

Limit orders on an amm aren't limit orders in the traditional sense. They are actually arbitrage opportunities for keepers. Keepers are bots that operate in the dark forest of ethereum.

3/

Now, let's say you use a service like 1inch or matcha to set your limit orders.

Let's say eth is $900 and you want to sell at $1000.

Eth pumps to $1040 rapidly, a keeper fills your limit order for $1000... everyone is happy. But wait... who gets the extra $40 here?

4/

Hint: it's not you! But what if you could?

This is where the hiding game comes in.

https://t.co/6sBlUWfw00

When you submit a limit order through the hiding game, @Keeper_DAO takes the $40 (or w/e amount) referenced above (this is MEV) and pushes it to the treasury.

5/