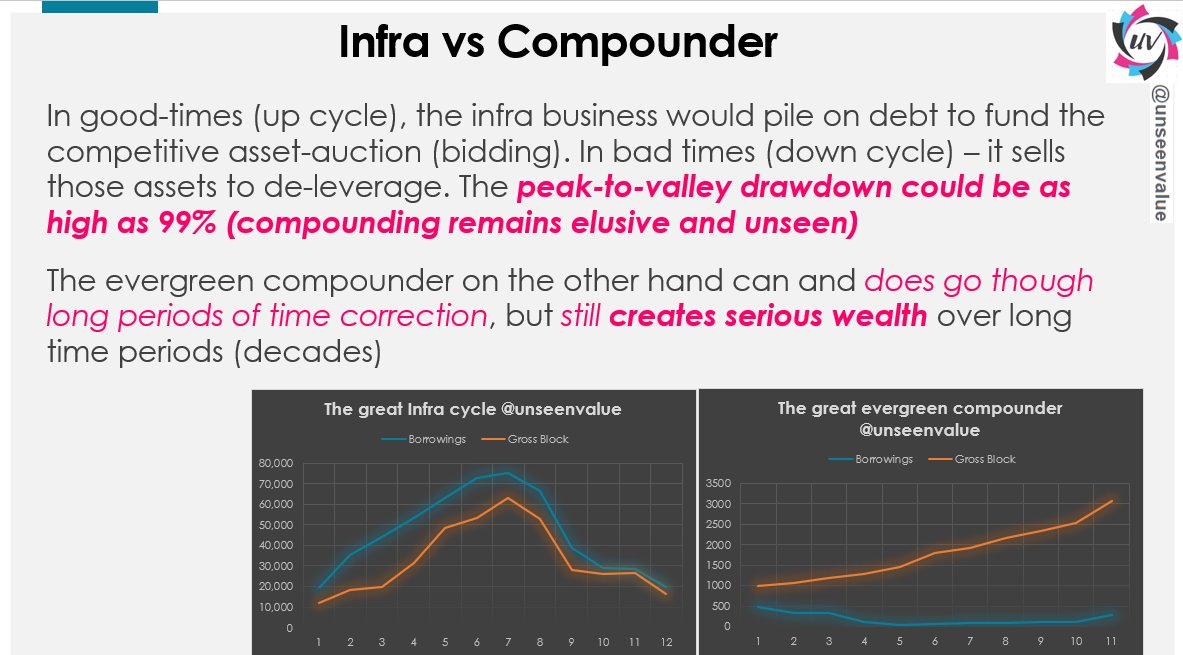

Infra vs Compounder. Get poor fast vs Get rich slowly (unless you buy at the bottom and "luckily" survive the bankruptcy/mortality risk to ride the subsequent fast recovery and then turn "lucky" again to exit in good times resisting your irresistible greed).

More from Sajal Kapoor

1. Listen to various competitors

2. Put your neck on the line (invest your hard earned capital - experience comes by paying tuition fee)

3. Read non-investing books as well (Psychology, history, biographies or whatever non-fiction you like)

4. Read this :

https://t.co/6z3HvtKakL

2. Put your neck on the line (invest your hard earned capital - experience comes by paying tuition fee)

3. Read non-investing books as well (Psychology, history, biographies or whatever non-fiction you like)

4. Read this :

https://t.co/6z3HvtKakL

How to augment your Sector knowledge? Follow these 5 points \U0001f447

— Conviction | Patience (@unseenvalue) May 18, 2019

1. The Five Rules For Successful Stock Investing by Pat Dorsey

2. Con Calls - as many as you can in that sector

3. Annual Reports - as many as you can in that sector

4. Interact with trade/channel partners

5. AGMs pic.twitter.com/2ZOx3nkC4i

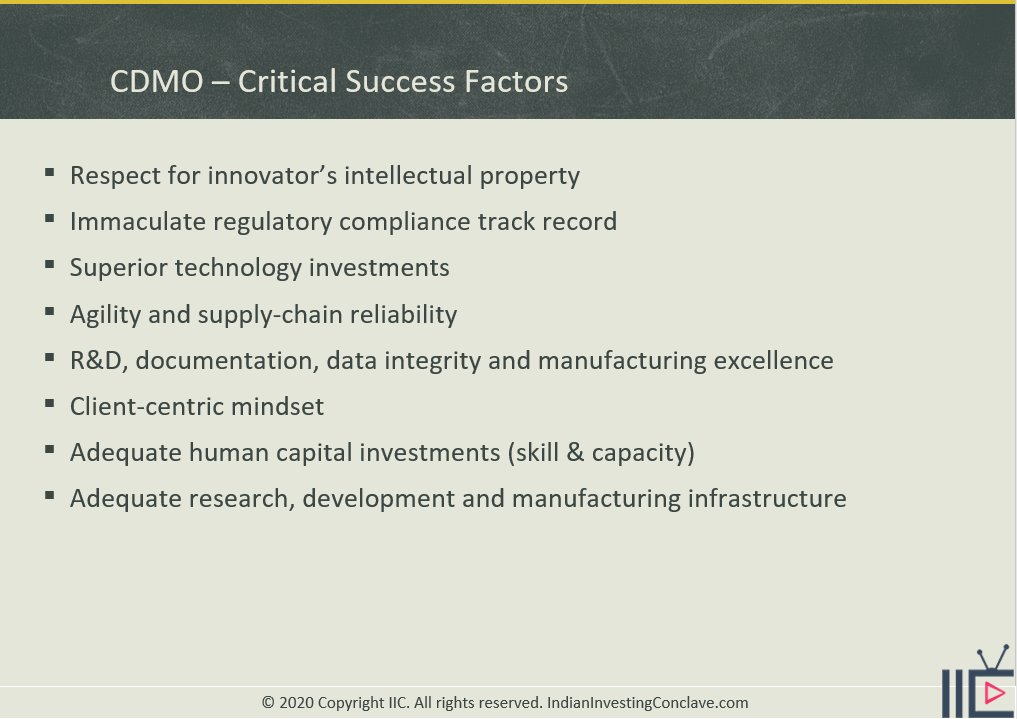

You offer me 80% cost arbitrage (discount relative to Japan/EU/US) along with low confidence / assurance on Critical Success Factors and I won't give you a single NCE/NBE to discover, develop or manufacture. Capex/opex arbitrage is too low in the disruptive-science-pecking-order! https://t.co/O2l8dK4BUv

@unseenvalue Given high capex/opex cost structures of US/Japan/EU, how will they be able to compete with Indian API companies? https://t.co/OYhC2PUZpL

— Hiren (@hiren_investing) August 11, 2021