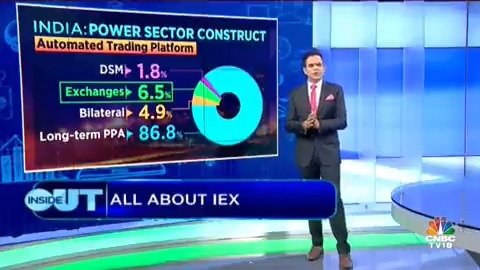

Those who are interested in IEX should read this.

While the market size may grow a lot in the next decade, the government policy risk still stays.

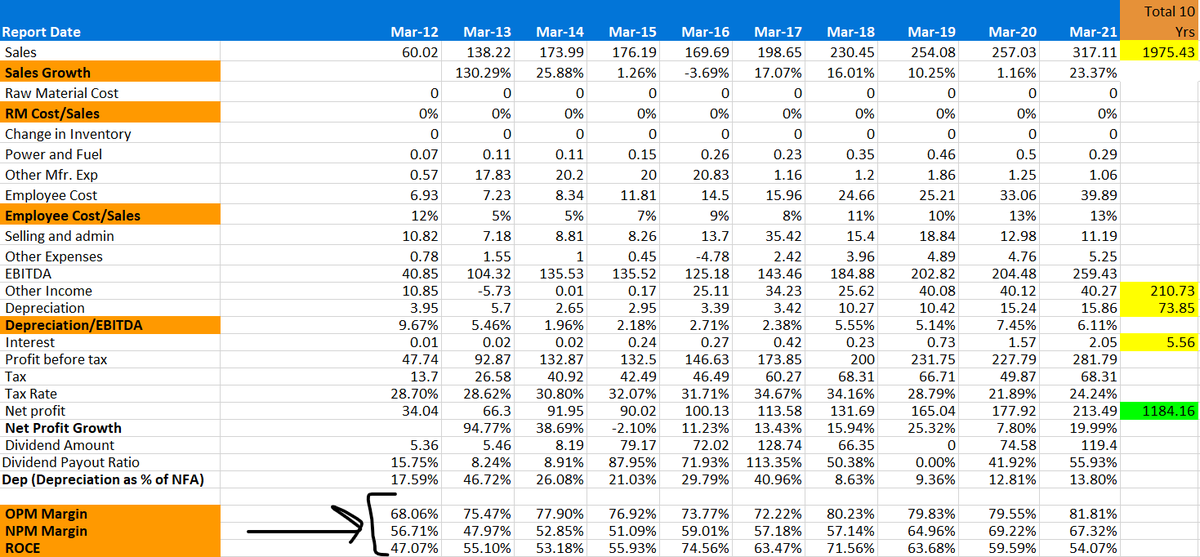

Pic 1: PTC Q4FY21 call

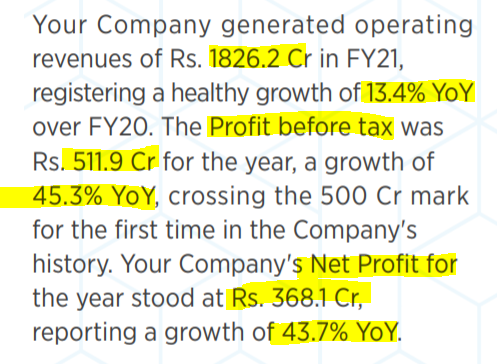

Pic 2: PTC Q1FY22 call

https://t.co/eImnTNEZeX

Long term investing is a peaceful & slow way of creating wealth.And sometime luck plays its role too.

— SmartSyncServices.com (@SmartSyncServ) September 1, 2021

When we researched IEX in 2019 & recommended investors to buy in Mar 2020, we never anticipated such high growth & 470%+ rise in 1.5 Yrs.@MashraniVivekhttps://t.co/qZIdI10ybc pic.twitter.com/v4UYa6fRyn

More from SmartSyncServices.com

More from Iexinfo

250: Electricity in India won't grow

300: It just makes 4paise per trade

350: MBED will erode it's profitablilty

500: Maybe what @itsTarH said about IEX = NSE + Zerodha was right

570: Buys IEX

#JourneyOfAPessimist

Zerodha + NSE = IEX \U0001f4a1\u26a1\ufe0f

— Tar \u26a1 (@itsTarH) June 20, 2021

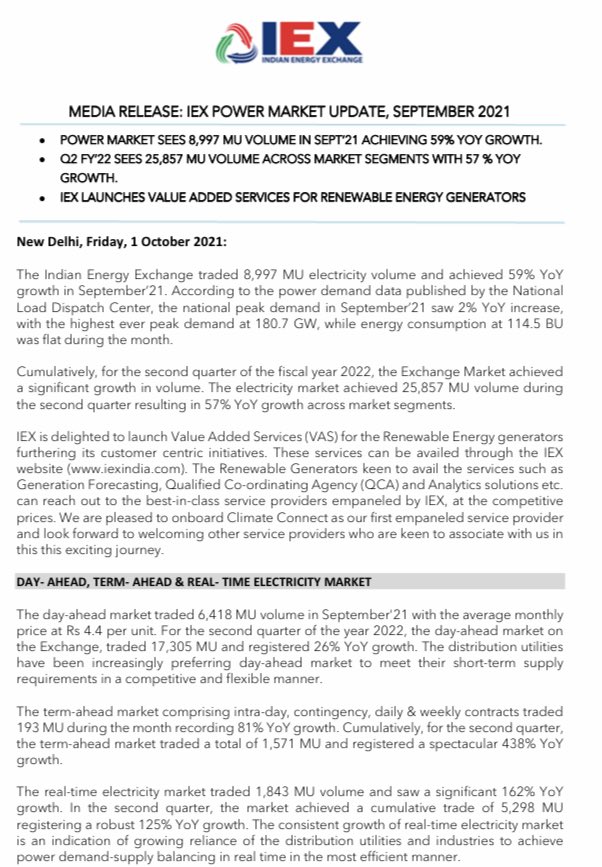

IEX ACHIEVES 59% GROWTH YOY #BREAKING pic.twitter.com/cWZacwq48N

— Redbox India (@REDBOXINDIA) October 1, 2021

#IEX

● POWER MARKET SEES 8,997 MU VOLUME IN SEPT’21 ACHIEVING 59% YOY GROWTH

● Q2 FY’22 SEES 25,857 MU VOLUME ACROSS MARKET SEGMENTS WITH 57 % YOY

GROWTH

● IEX LAUNCHES VALUE ADDED SERVICES FOR RENEWABLE ENERGY GENERATORS

You May Also Like

Decoded his way of analysis/logics for everyone to easily understand.

Have covered:

1. Analysis of volatility, how to foresee/signs.

2. Workbook

3. When to sell options

4. Diff category of days

5. How movement of option prices tell us what will happen

1. Keeps following volatility super closely.

Makes 7-8 different strategies to give him a sense of what's going on.

Whichever gives highest profit he trades in.

I am quite different from your style. I follow the market's volatility very closely. I have mock positions in 7-8 different strategies which allows me to stay connected. Whichever gives best profit is usually the one i trade in.

— Sarang Sood (@SarangSood) August 13, 2019

2. Theta falls when market moves.

Falls where market is headed towards not on our original position.

Anilji most of the time these days Theta only falls when market moves. So the Theta actually falls where market has moved to, not where our position was in the first place. By shifting we can come close to capturing the Theta fall but not always.

— Sarang Sood (@SarangSood) June 24, 2019

3. If you're an options seller then sell only when volatility is dropping, there is a high probability of you making the right trade and getting profit as a result

He believes in a market operator, if market mover sells volatility Sarang Sir joins him.

This week has been great so far. The main aim is to be in the right side of the volatility, rest the market will reward.

— Sarang Sood (@SarangSood) July 3, 2019

4. Theta decay vs Fall in vega

Sell when Vega is falling rather than for theta decay. You won't be trapped and higher probability of making profit.

There is a difference between theta decay & fall in vega. Decay is certain but there is no guaranteed profit as delta moves can increase cost. Fall in vega on the other hand is backed by a powerful force that sells options and gives handsome returns. Our job is to identify them.

— Sarang Sood (@SarangSood) February 12, 2020

Unfortunately the "This work includes the identification of viral sequences in bat samples, and has resulted in the isolation of three bat SARS-related coronaviruses that are now used as reagents to test therapeutics and vaccines." were BEFORE the

chimeric infectious clone grants were there.https://t.co/DAArwFkz6v is in 2017, Rs4231.

https://t.co/UgXygDjYbW is in 2016, RsSHC014 and RsWIV16.

https://t.co/krO69CsJ94 is in 2013, RsWIV1. notice that this is before the beginning of the project

starting in 2016. Also remember that they told about only 3 isolates/live viruses. RsSHC014 is a live infectious clone that is just as alive as those other "Isolates".

P.D. somehow is able to use funds that he have yet recieved yet, and send results and sequences from late 2019 back in time into 2015,2013 and 2016!

https://t.co/4wC7k1Lh54 Ref 3: Why ALL your pangolin samples were PCR negative? to avoid deep sequencing and accidentally reveal Paguma Larvata and Oryctolagus Cuniculus?