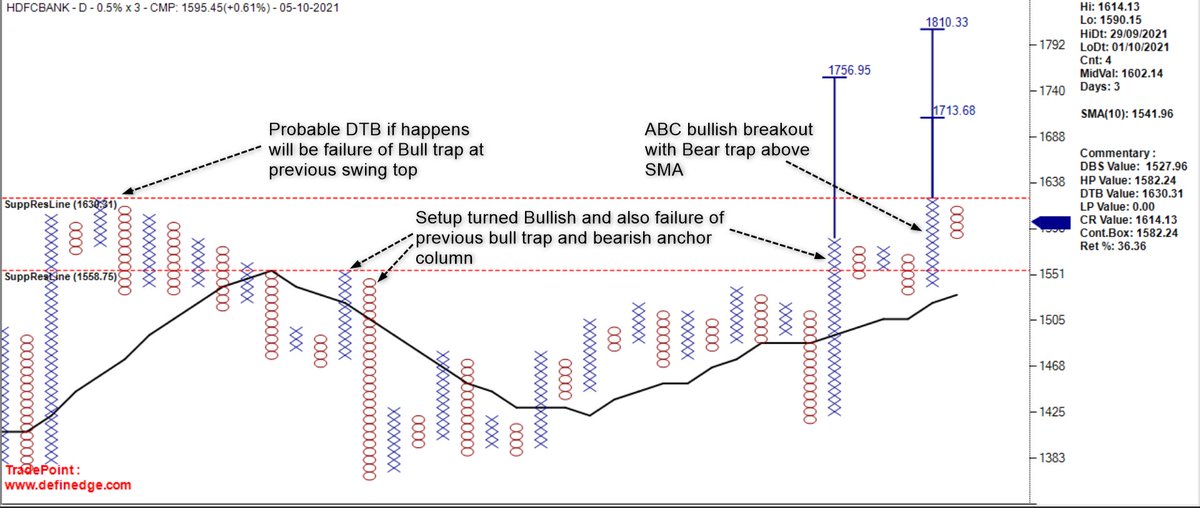

#HDFCBank

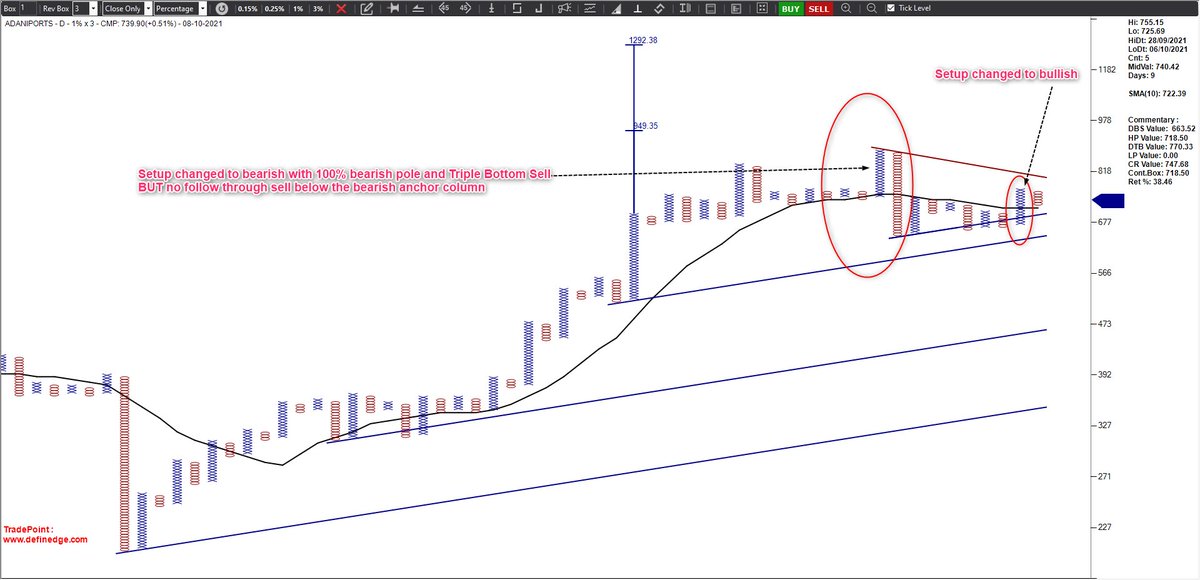

Probable Double Top Buy is associated with multiple bearish failures.

Bullish Breakouts associated with Bearish failures has an extra flavor of bullishness as there is an ingredient of failure of the other side

More from Vithal

More from Hdfcbank

You May Also Like

@NBA @StephenKissler @yhgrad 1. From Day 1, SARS-COV-2 was very well adapted to humans .....and transgenic hACE2 Mice

1. From Day 1, SARS-COV-2 was very well adapted to humans .....and transgenic hACE2 Mice

— Billy Bostickson \U0001f3f4\U0001f441&\U0001f441 \U0001f193 (@BillyBostickson) January 30, 2021

"we generated a mouse model expressing hACE2 by using CRISPR/Cas9 knockin technology. In comparison with wild-type C57BL/6 mice, both young & aged hACE2 mice sustained high viral loads... pic.twitter.com/j94XtSkscj

@NBA @StephenKissler @yhgrad 2. High Probability of serial passaging in Transgenic Mice expressing hACE2 in genesis of SARS-COV-2

1. High Probability of serial passaging in Transgenic Mice expressing hACE2 in genesis of SARS-COV-2!

— Billy Bostickson \U0001f3f4\U0001f441&\U0001f441 \U0001f193 (@BillyBostickson) January 2, 2021

2 papers:

Human\u2013viral molecular mimicryhttps://t.co/irfH0Zgrve

Molecular Mimicryhttps://t.co/yLQoUtfS6s https://t.co/lsCv2iMEQz

@NBA @StephenKissler @yhgrad B.1.1.7 has an unusually large number of genetic changes, ... found to date in mouse-adapted SARS-CoV2 and is also seen in ferret infections.

https://t.co/9Z4oJmkcKj

@NBA @StephenKissler @yhgrad We adapted a clinical isolate of SARS-CoV-2 by serial passaging in the ... Thus, this mouse-adapted strain and associated challenge model should be ... (B) SARS-CoV-2 genomic RNA loads in mouse lung homogenates at P0 to P6.

https://t.co/I90OOCJg7o

(I am forced to do this due to continuous hounding of Sikh Extremists since yesterday)

Rani Jindan Kaur, wife of Maharaja Ranjit Singh had illegitimate relations with Lal Singh (PM of Ranjit Singh). Along with Lal Singh, she attacked Jammu, burnt - https://t.co/EfjAq59AyI

Tomorrow again same thing happens bcoz fudus like you are creating a narrative oh Khalistan. when farmers are asking MSP. (RSS ki tatti khane wale Kerni sena ke kutte).

— Ancient Economist (@_stock_tips) December 5, 2020

U kill sikhs in 1984 just politics. To BC low IQ fudu Saale entire history was politics.

Hindu villages of Jasrota, caused rebellion in Jammu, attacked Kishtwar.

Ancestors of Raja Ranjit Singh, The Sansi Tribe used to give daughters as concubines to Jahangir.

The Ludhiana Political Agency (Later NW Fronties Prov) was formed by less than 4000 British soldiers who advanced from Delhi and reached Ludhiana, receiving submissions of all sikh chiefs along the way. The submission of the troops of Raja of Lahore (Ranjit Singh) at Ambala.

Dabistan a contemporary book on Sikh History tells us that Guru Hargobind broke Naina devi Idol Same source describes Guru Hargobind serving a eunuch

YarKhan. (ref was proudly shared by a sikh on twitter)

Gobind Singh followed Bahadur Shah to Deccan to fight for him.

In Zafarnama, Guru Gobind Singh states that the reason he was in conflict with the Hill Rajas was that while they were worshiping idols, while he was an idol-breaker.

And idiot Hindus place him along Maharana, Prithviraj and Shivaji as saviours of Dharma.