"The millions Girardi poured into Democratic political campaigns made him a confidant of generations of power brokers, including Gov. Gavin Newsom, who last year gave the attorney an official role in filling coveted state judgeships."

More from Government

The Government is making the same mistakes as it did in the first wave. Except with knowledge.

A thread.

The Government's strategy at the beginning of the pandemic was to 'cocoon' the vulnerable (e.g. those in care homes). This was a 'herd immunity' strategy. This interview is from

This strategy failed. It is impossible to 'cocoon' the vulnerable, as Covid is passed from younger people to older, more vulnerable people.

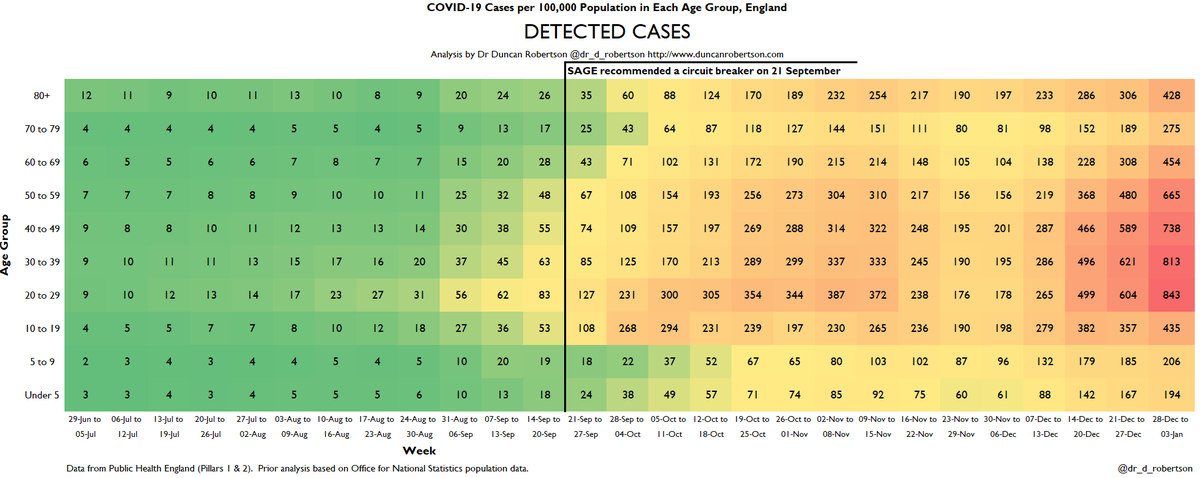

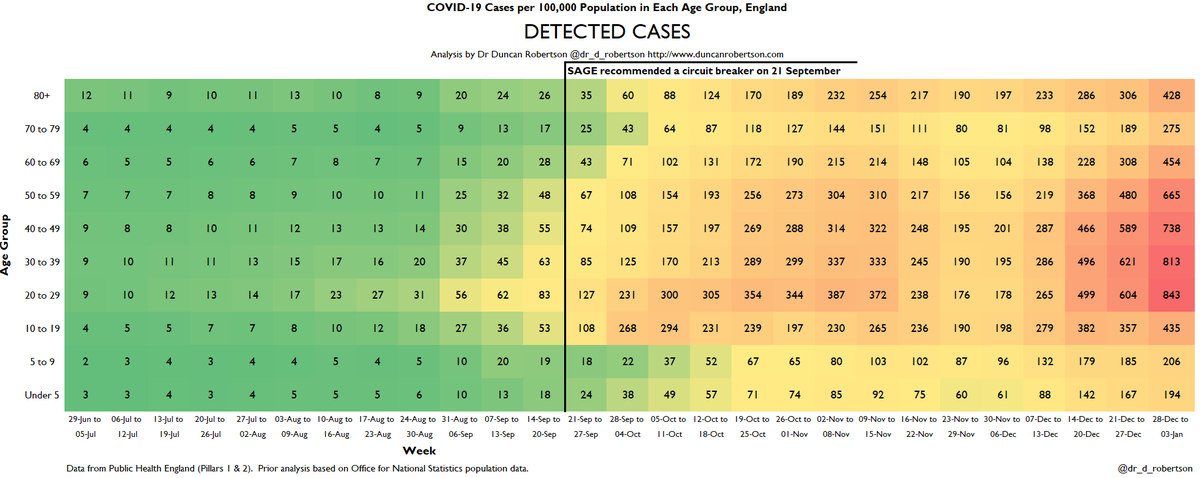

We can see this playing out through heatmaps. e.g. these heatmaps from the second

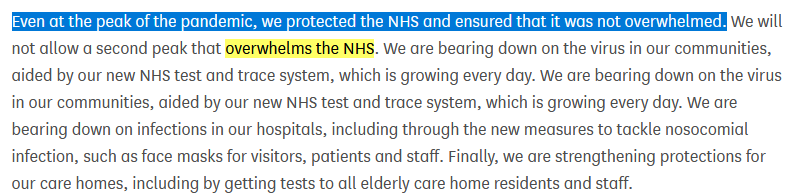

The Government then decided to change its strategy to 'preventing a second wave that overwhelms the NHS'. This was announced on 8 June in Parliament.

This is not the same as 'preventing a second wave'.

https://t.co/DPWiJbCKRm

The Academy of Medical Scientists published a report on 14 July 'Preparing for a Challenging Winter' commissioned by the Chief Scientific Adviser that set out what needed to be done in order to prevent a catastrophe over the winter

A thread.

The Government's strategy at the beginning of the pandemic was to 'cocoon' the vulnerable (e.g. those in care homes). This was a 'herd immunity' strategy. This interview is from

Government #coronavirus science advisor Dr David Halpern tells me of plans to \u2018cocoon\u2019 vulnerable groups. pic.twitter.com/dhECJNbmnI

— Mark Easton (@BBCMarkEaston) March 11, 2020

This strategy failed. It is impossible to 'cocoon' the vulnerable, as Covid is passed from younger people to older, more vulnerable people.

We can see this playing out through heatmaps. e.g. these heatmaps from the second

Here are the heatmaps for Covid detected cases, positivity, hospitalizations, and ICU admissions. This is for the week to 3 January 2021.

— Dr Duncan Robertson (@Dr_D_Robertson) January 7, 2021

I have marked a line on 21 September, when SAGE recommended a circuit breaker, so you can see how the situation has deteriorated since then. pic.twitter.com/SEEVgUVK4j

The Government then decided to change its strategy to 'preventing a second wave that overwhelms the NHS'. This was announced on 8 June in Parliament.

This is not the same as 'preventing a second wave'.

https://t.co/DPWiJbCKRm

The Academy of Medical Scientists published a report on 14 July 'Preparing for a Challenging Winter' commissioned by the Chief Scientific Adviser that set out what needed to be done in order to prevent a catastrophe over the winter

One thing civil servants learn is to write things down. Here is @acadmedsci's 14 July report commissioned by @uksciencechief. For the record.

— Dr Duncan Robertson (@Dr_D_Robertson) September 17, 2020

You May Also Like

The UN just voted to condemn Israel 9 times, and the rest of the world 0.

View the resolutions and voting results here:

The resolution titled "The occupied Syrian Golan," which condemns Israel for "repressive measures" against Syrian citizens in the Golan Heights, was adopted by a vote of 151 - 2 - 14.

Israel and the U.S. voted 'No' https://t.co/HoO7oz0dwr

The resolution titled "Israeli practices affecting the human rights of the Palestinian people..." was adopted by a vote of 153 - 6 - 9.

Australia, Canada, Israel, Marshall Islands, Micronesia, and the U.S. voted 'No' https://t.co/1Ntpi7Vqab

The resolution titled "Israeli settlements in the Occupied Palestinian Territory, including East Jerusalem, and the occupied Syrian Golan" was adopted by a vote of 153 – 5 – 10.

Canada, Israel, Marshall Islands, Micronesia, and the U.S. voted 'No'

https://t.co/REumYgyRuF

The resolution titled "Applicability of the Geneva Convention... to the

Occupied Palestinian Territory..." was adopted by a vote of 154 - 5 - 8.

Canada, Israel, Marshall Islands, Micronesia, and the U.S. voted 'No'

https://t.co/xDAeS9K1kW

View the resolutions and voting results here:

The resolution titled "The occupied Syrian Golan," which condemns Israel for "repressive measures" against Syrian citizens in the Golan Heights, was adopted by a vote of 151 - 2 - 14.

Israel and the U.S. voted 'No' https://t.co/HoO7oz0dwr

The resolution titled "Israeli practices affecting the human rights of the Palestinian people..." was adopted by a vote of 153 - 6 - 9.

Australia, Canada, Israel, Marshall Islands, Micronesia, and the U.S. voted 'No' https://t.co/1Ntpi7Vqab

The resolution titled "Israeli settlements in the Occupied Palestinian Territory, including East Jerusalem, and the occupied Syrian Golan" was adopted by a vote of 153 – 5 – 10.

Canada, Israel, Marshall Islands, Micronesia, and the U.S. voted 'No'

https://t.co/REumYgyRuF

The resolution titled "Applicability of the Geneva Convention... to the

Occupied Palestinian Territory..." was adopted by a vote of 154 - 5 - 8.

Canada, Israel, Marshall Islands, Micronesia, and the U.S. voted 'No'

https://t.co/xDAeS9K1kW