Categories Gold

7 days

30 days

All time

Recent

Popular

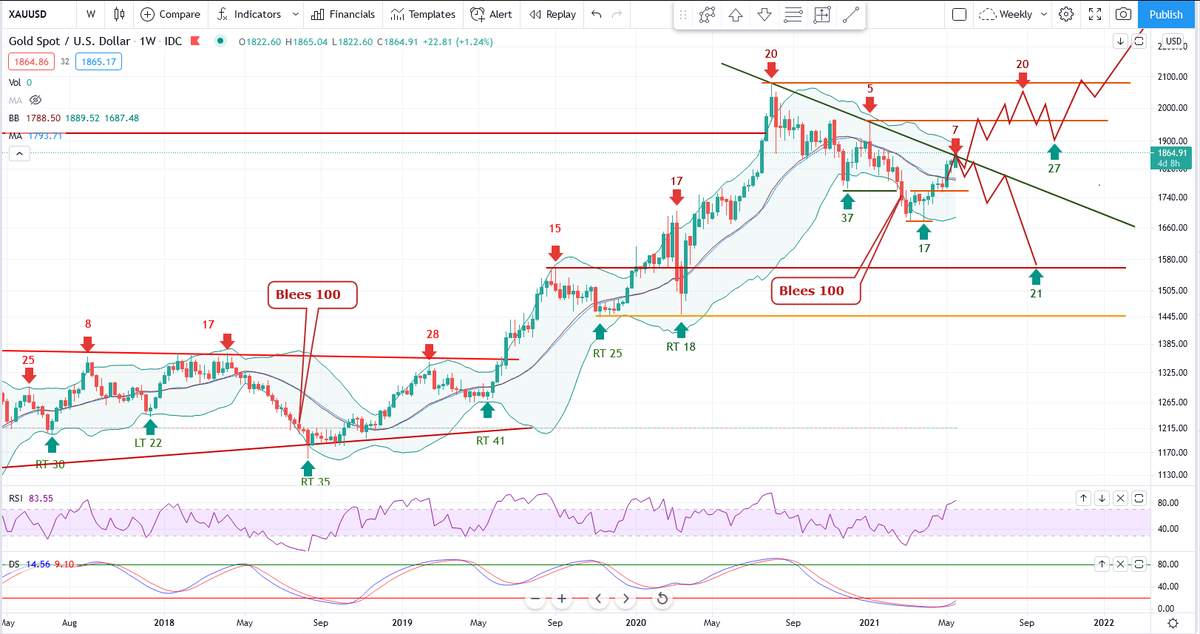

Fast forward to today when I added Gold at 1850. It made a sharp-up move but didn't want to sell for the sake of hedging. The positions were scaled up around 1925 with the fresh SL of 1900.

So far doing good. 2000 is the level I would be looking for. https://t.co/j1kiKRSx0y

So far doing good. 2000 is the level I would be looking for. https://t.co/j1kiKRSx0y

GOLD - 1 9 2 7 from 1 8 5 0

— The_Chartist \U0001f4c8 (@charts_zone) February 24, 2022

No indicators, nothing. Understand the language of the price. https://t.co/l6pEGD7r6D pic.twitter.com/JWZjlTLSBF

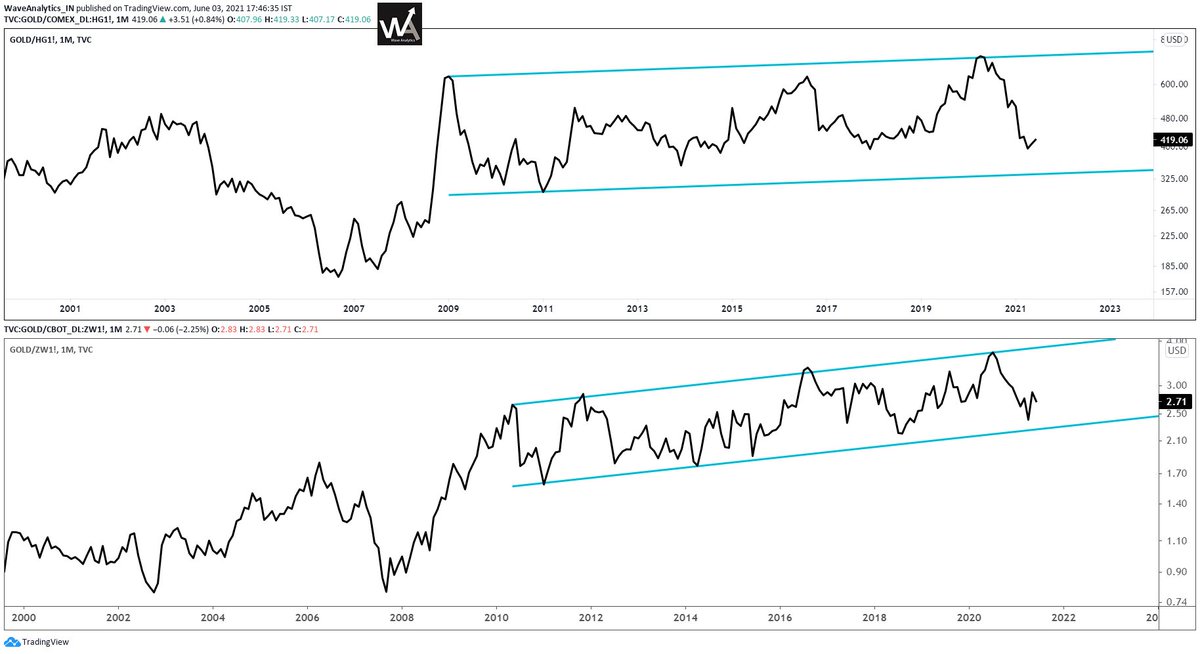

What my simple analysis showed was the decadal breakout in making in #Gold along with the outperformance over S&P500 #SPX

Result?

1850$ to 2070$

Updated chart https://t.co/l6pEGD7r6D

Result?

1850$ to 2070$

Updated chart https://t.co/l6pEGD7r6D

Most interesting chart:

— The_Chartist \U0001f4c8 (@charts_zone) February 12, 2022

Orange line = Gold

Blue Curve = Gold/S&P 500

Previously the ratio crossed 50 days MA in Feb' 20 with Gold giving a breakout on the charts. The previous cross of 50 days MA didn't result in gold breaking out. pic.twitter.com/HRG1fvsILp

From 1850 to 1990$ - the GOLD is getting more interesting. I will be adding up more if the resistance is taken off and the price follows through.

GOLD https://t.co/l6pEGDpAkL

GOLD https://t.co/l6pEGDpAkL

Most interesting chart:

— The_Chartist \U0001f4c8 (@charts_zone) February 12, 2022

Orange line = Gold

Blue Curve = Gold/S&P 500

Previously the ratio crossed 50 days MA in Feb' 20 with Gold giving a breakout on the charts. The previous cross of 50 days MA didn't result in gold breaking out. pic.twitter.com/HRG1fvsILp