Everybody knows the old adage “Son, this is gonna hurt me more than it’s gonna you.” Let me explain something to you people who feel the sadistic need to provoke me so that you can talk about my so called “anger issues” or anything else that you think you can find to...

More from For later read

We want to collate all references to DRASTIC in academic papers & media articles

Here are a few:

medium article by @emmecola

thorough report by @netpoette

@ColinDavdButler 's Paper

Please add any links to this thread. Tks!

2. More References

Papers by @MonaRahalkar and @BahulikarRahul

Papers by @Rossana38510044 and @ydeigin

Medium articles & papers by

@gdemaneuf & @Rdemaistre

Papers by @flavinkins (Daoyu Zhang)

Papers by "Anon" & "interneperson"

French News - le Monde

Can anyone remember any more?

3. More References

Papers & Blog Posts by @Harvard2H (Sirotkin & Sirotkin)

260 Questions for WHO collated by @billybostickson

If you find mentions of our individual names or "DRASTIC" in Papers or News, please forward here to this thread as links or screenshots.

Histoire du COVID-19 – chapitre 6 - Partie 2 : Pourquoi le séquençage complet du virus RaTG13 n'a pas été communiqué par Shi Zheng Li avant février 2020 ? https://t.co/MYEZZSAzaE

SARS-CoV-2: lab-origin hypothesis gains traction

BY ANNETTE GARTLAND ON OCTOBER 12, 2020

https://t.co/sPs1y8Herg

#Cardano “Understanding Kamali”

#Cardano will be the underpinning of the emergence of Africa.

To grasp the full weight of the SOLUTIONS #Cardano can provide it is pertinent to read “Understanding Africa” as I will draw directly from the PROBLEMS laid out.

(2/50)

Here is a link if you have not already read

(1/38) #Cardano \u201cUnderstanding Africa\u201d (Part 1 of 2)

— FatCat (@fatcatofcrypto) February 10, 2021

This thread will be split into two parts with the 2nd coming out on Sunday.

Part 1 will layout the pervasive PROBLEMS Africa faces whereas Part 2 will apply direct technologies @InputOutputHK can implement as SOLUTIONS. pic.twitter.com/n3I91bnddq

(3/50)

What I will attempt to do here, is to create an immersive world for you to be placed in to grasp the weight and size of problems from the ground level and then take a grass-roots approach at solving them using #Cardano and its technology.

(4/50)

As an investor and community member of #Cardano, this should be extremely important to you as you have a stake (pun intended) in this.

“You are paid in direct proportion to the difficulty of the problems you solve” - @elonmusk

(5/50)

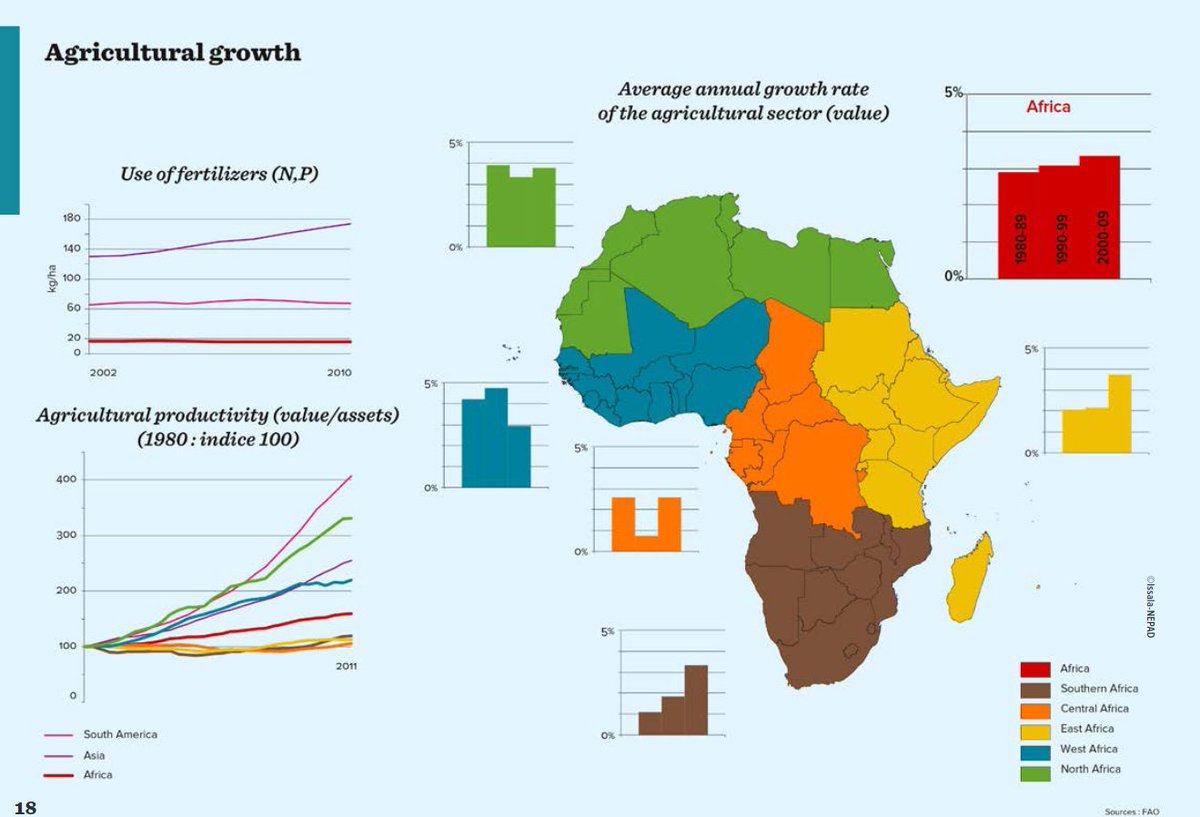

In Africa, agribusiness, more than any other sector, has the potential to reduce poverty and drive economic growth. Agriculture accounts for nearly half of the continent’s gross domestic product and employs 60 percent of the labor force.

This is an excellent report, and I'm glad to have joined the study group. The central focus on avoiding war is understandable--a US-China war would be catastrophic and should be avoided. But protecting Taiwan's security and prosperity requires doing more. 1/x https://t.co/P0Sg4LJcpV

— Bonnie Glaser / \u845b\u4f86\u5100 (@BonnieGlaser) February 12, 2021

Normally as it might seem churlish to be so critical, but @cfr is so high-profile & the co-authors so distinguished I think it’s key to be clear. If not, people - including in Beijing - could get the wrong idea & this report could do real harm if influential on defense issues. 2/

BLUF: The defense discussion in this report does not engage at the depth needed to add to this critical debate. Accordingly conclusions in report are ill-founded - & in key parts harmful/misleading, esp that US shldnt be prepared defend Taiwan directly (alongside own efforts). 3/

The root of the problem is that report doesn't engage w the real debate on TWN defense issues or, frankly, the facts as knowable in public. Perhaps the most direct proof of this: The citations. There is nothing in the citations to @DeptofDefense China Military Power Report...4/

Nor to vast majority of leading informed sources on this like Ochmanek, the @RANDCorporation Scorecard, @CNAS, etc. This is esp salient b/c co-authors by their own admission have v little insight into contemporary military issues. & both last served in govt in Bush 43. 5/

You May Also Like

==========================

Module 1

Python makes it very easy to analyze and visualize time series data when you’re a beginner. It's easier when you don't have to install python on your PC (that's why it's a nano course, you'll learn python...

... on the go). You will not be required to install python in your PC but you will be using an amazing python editor, Google Colab Visit https://t.co/EZt0agsdlV

This course is for anyone out there who is confused, frustrated, and just wants this python/finance thing to work!

In Module 1 of this Nano course, we will learn about :

# Using Google Colab

# Importing libraries

# Making a Random Time Series of Black Field Research Stock (fictional)

# Using Google Colab

Intro link is here on YT: https://t.co/MqMSDBaQri

Create a new Notebook at https://t.co/EZt0agsdlV and name it AnythingOfYourChoice.ipynb

You got your notebook ready and now the game is on!

You can add code in these cells and add as many cells as you want

# Importing Libraries

Imports are pretty standard, with a few exceptions.

For the most part, you can import your libraries by running the import.

Type this in the first cell you see. You need not worry about what each of these does, we will understand it later.

Curated the best tweets from the best traders who are exceptional at managing strangles.

• Positional Strangles

• Intraday Strangles

• Position Sizing

• How to do Adjustments

• Plenty of Examples

• When to avoid

• Exit Criteria

How to sell Strangles in weekly expiry as explained by boss himself. @Mitesh_Engr

• When to sell

• How to do Adjustments

• Exit

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Beautiful explanation on positional option selling by @Mitesh_Engr

Sir on how to sell low premium strangles yourself without paying anyone. This is a free mini course in

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

1st Live example of managing a strangle by Mitesh Sir. @Mitesh_Engr

• Sold Strangles 20% cap used

• Added 20% cap more when in profit

• Booked profitable leg and rolled up

• Kept rolling up profitable leg

• Booked loss in calls

• Sold only

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

2nd example by @Mitesh_Engr Sir on converting a directional trade into strangles. Option Sellers can use this for consistent profit.

• Identified a reversal and sold puts

• Puts decayed a lot

• When achieved 2% profit through puts then sold

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0