Off the back of the thread below, lots of people asked for one on services & financial services. So here it is. The deal is very thin in both areas, though that was expected. I don't think it amounts to making the deal unfair/unbalanced but it is a missed opportunity. 1/

As many others I'm still working through the detail of the agreement & all the annexes. But some initial thoughts based on my first read & associated documents. My overriding feeling is that it is pretty much exactly as expected in many parts & largely a balanced deal. 1/

— Raoul Ruparel (@RaoulRuparel) December 27, 2020

More from Finance

You May Also Like

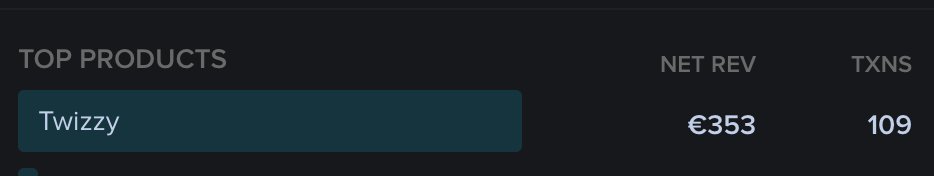

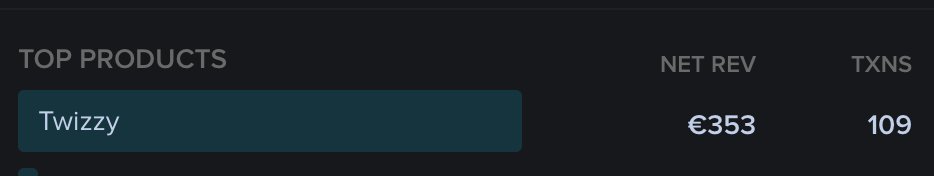

To people who are under the impression that you can get rich quickly by working on an app, here are the stats for https://t.co/az8F12pf02

📈 ~12000 vistis

☑️ 109 transactions

💰 353€ profit (285 after tax)

I have spent 1.5 months on this app. You can make more $ in 2 days.

🤷♂️

I'm still happy that I launched a paid app bcs it involved extra work:

- backend for processing payments (+ permissions, webhooks, etc)

- integration with payment processor

- UI for license activation in Electron

- machine activation limit

- autoupdates

- mailgun emails

etc.

These things seemed super scary at first. I always thought it was way too much work and something would break. But I'm glad I persisted. So far the only problem I have is that mailgun is not delivering the license keys to certain domains like https://t.co/6Bqn0FUYXo etc. 👌

omg I just realized that me . com is an Apple domain, of course something wouldn't work with these dicks

📈 ~12000 vistis

☑️ 109 transactions

💰 353€ profit (285 after tax)

I have spent 1.5 months on this app. You can make more $ in 2 days.

🤷♂️

I'm still happy that I launched a paid app bcs it involved extra work:

- backend for processing payments (+ permissions, webhooks, etc)

- integration with payment processor

- UI for license activation in Electron

- machine activation limit

- autoupdates

- mailgun emails

etc.

These things seemed super scary at first. I always thought it was way too much work and something would break. But I'm glad I persisted. So far the only problem I have is that mailgun is not delivering the license keys to certain domains like https://t.co/6Bqn0FUYXo etc. 👌

omg I just realized that me . com is an Apple domain, of course something wouldn't work with these dicks