1/ All Time High Breakout:

Stock that breaks the uptrend are the one that can give massive upmove.

These stocks are considered as strong stocks in the market.

Timeframe should be monthly and if price closes above ATH on any day you can enter.

Example 1:

Bajaj Finance gave a breakout above ATH at around 55 and then it moved up till 5000 levels.

Total returns of 9000% in 10 years.

Simple Strategy, isn't it?

Example 2:

Reliance Chart.

It gave breakout above its All Time High level after 10 years and then never looking back.

Price moved up from 700 to 2600.

Returns of 270% in five years.

How to Follow Stoploss?

Initially keep stoploss at swing low on monthly chart and trail your stoploss accordingly to enjoy massive upmove.

Other ways of Trailing Stoploss can be using 200 EMA or any other indicator.

All Time High Breakout Screener:

This screener will identify stocks that are breaking All time high (10 year high). It needs to be run daily to identify such stocks.

https://t.co/zEUg5SAkgs

2/ Golden Crossover (Two EMA):

It is one of the popular investment strategy widely used by traders/investors.

Common Golden Crossover that is followed is of 20 EMA and 200 EMA.

Enter if 20 EMA goes above 200 EMA.

Exit if 20 EMA goes below 200 EMA.

Time frame: Weekly/Monthly

Let's see some example.

Example 1:

Pidilite Ind gave golden crossover in 2009 at 71 and till now it has not given any exit.

From 71, currently it is trading at 2662.

Returns of 3600% in 13 years.

Example 2:

ITC gave golden crossover in 2003 at around 17 and after that it directly gave exit signal in 2019 at 238.

It gave returns of 1300% in 16 years.

Golden Crossover Strategy is completely rule based system and can be easily implemented.

Screener Link for Golden Crossover:

This is a basic screener that will identify stocks that give golden crossover. You can tweak it if you want or add any other condition.

https://t.co/zZ2iuPO2QW

3/ CCI:

CCI is known as momentum indicator and can be a good for investor with shorter horizon of 2-3 years.

Strategy:

⚡️Weekly/Monthly TF

⚡️Enter: CCI crosses above -100

⚡️Stoploss: CCI crosses below -100

⚡️Exit if CCI crosses above +100 and then it goes below that

Let's see example for this:

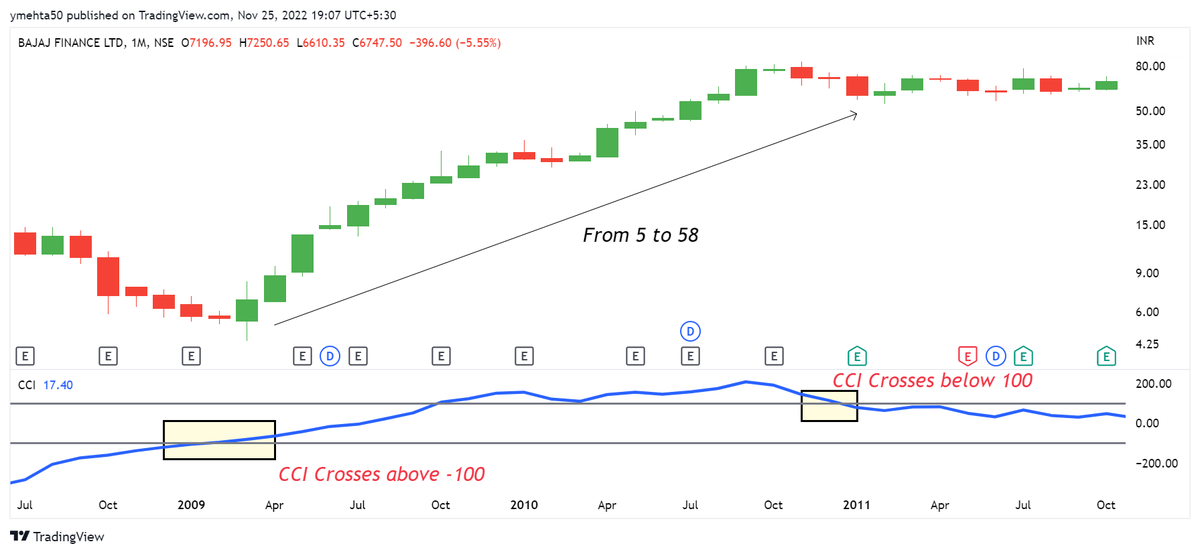

Bajaj Finance Monthly Charts.

CCI crossed above -100 in 2009 and price was around 5.

It gave an exit at around 58 when CCI crossed below +100.

Returns in 1 year: 1000%

Screener Link of CCI:

This screener will identify stocks that are fulfilling entry criteria for CCI.

https://t.co/aGYyXh1tkp

Here if you see entry and exit was within 1 year which is very short.

CCI identifies stocks that are in momentum and can give decent returns in less duration.

4/ RSI:

Just like CCI, RSI is also a momentum indicator.

Strategy:

⚡️Monthly TF

⚡️Enter: RSI crosses above +50

⚡️Stoploss or TSL: RSI crosses below +50

It is also rule based strategy.

Let's see an example.

Laurus Lab Monthly Chart.

RSI crossed above 50 and entry was triggered at 90.

After that, RSI never went below 50.

So far, stock is up from 90 to 450.

Almost 400% returns in 2 years.

Screener for RSI:

This screener needs to be run on month end and it will give out stocks that are fulfilling entry criteria of RSI Investment strategy.

https://t.co/jpr2ptWOSn

Out of all the four strategies that are shared, the first one based on All-Time High Breakout is completely discretionary and rest are rule based.

Also, note stoploss will be big in case of investment strategies so your quantities will be based on proper position sizing.

That's all about a simple Investment Strategy that you can use to compound your capital.

If you found this useful, please RT the first tweet.

Also, for live trading and stock market related updates, you can join our Telegram Channel ⤵️

https://t.co/RblJ0wWKCv