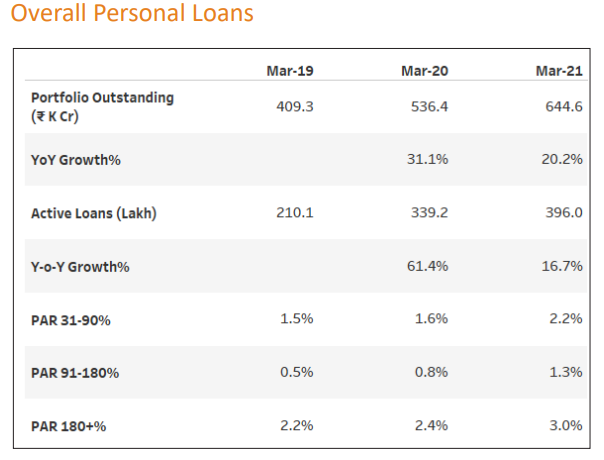

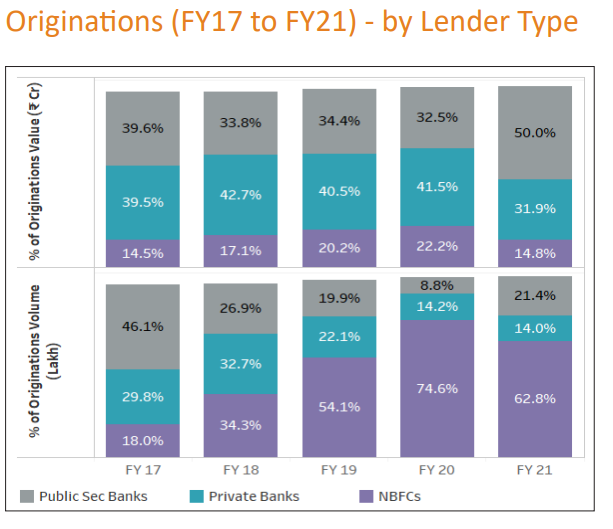

India’s largest lender SBI is gradually capturing the very lucrative unsecured personal loan(PL) market.

A thread 🧵

More from Finance

You May Also Like

1/OK, data mystery time.

This New York Times feature shows China with a Gini Index of less than 30, which would make it more equal than Canada, France, or the Netherlands. https://t.co/g3Sv6DZTDE

That's weird. Income inequality in China is legendary.

Let's check this number.

2/The New York Times cites the World Bank's recent report, "Fair Progress? Economic Mobility across Generations Around the World".

The report is available here:

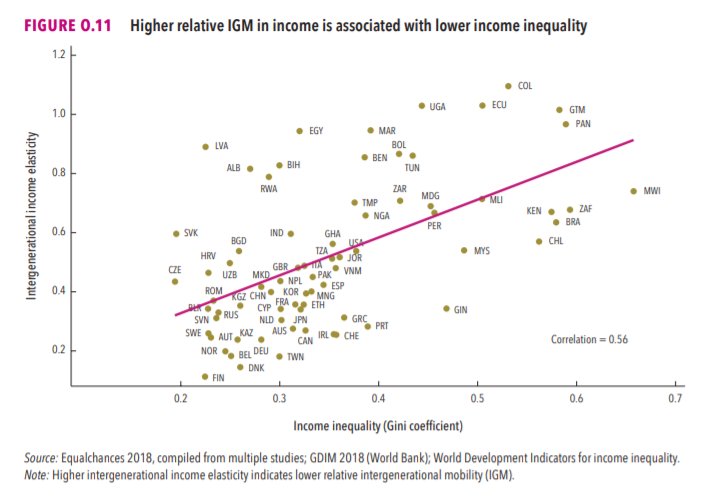

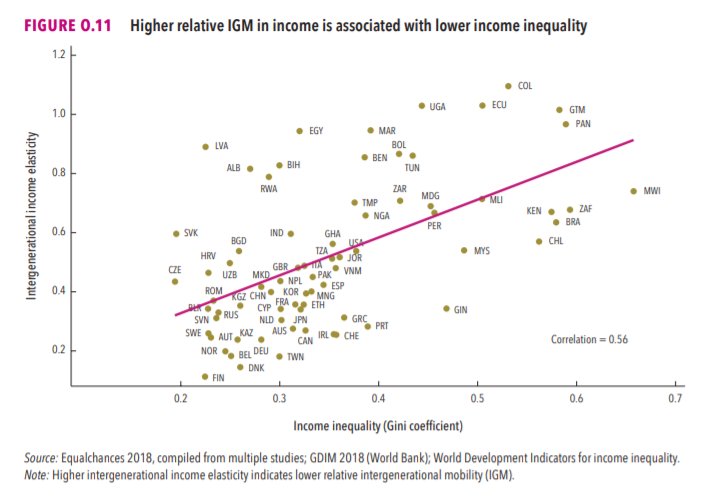

3/The World Bank report has a graph in which it appears to show the same value for China's Gini - under 0.3.

The graph cites the World Development Indicators as its source for the income inequality data.

4/The World Development Indicators are available at the World Bank's website.

Here's the Gini index: https://t.co/MvylQzpX6A

It looks as if the latest estimate for China's Gini is 42.2.

That estimate is from 2012.

5/A Gini of 42.2 would put China in the same neighborhood as the U.S., whose Gini was estimated at 41 in 2013.

I can't find the <30 number anywhere. The only other estimate in the tables for China is from 2008, when it was estimated at 42.8.

This New York Times feature shows China with a Gini Index of less than 30, which would make it more equal than Canada, France, or the Netherlands. https://t.co/g3Sv6DZTDE

That's weird. Income inequality in China is legendary.

Let's check this number.

2/The New York Times cites the World Bank's recent report, "Fair Progress? Economic Mobility across Generations Around the World".

The report is available here:

3/The World Bank report has a graph in which it appears to show the same value for China's Gini - under 0.3.

The graph cites the World Development Indicators as its source for the income inequality data.

4/The World Development Indicators are available at the World Bank's website.

Here's the Gini index: https://t.co/MvylQzpX6A

It looks as if the latest estimate for China's Gini is 42.2.

That estimate is from 2012.

5/A Gini of 42.2 would put China in the same neighborhood as the U.S., whose Gini was estimated at 41 in 2013.

I can't find the <30 number anywhere. The only other estimate in the tables for China is from 2008, when it was estimated at 42.8.

Speech Delay is most common in children nowadays

In ancient times, our grandparents used to follow typical natural way of caring the needs of a child. All they used were more of natural products than chemical based for the growth of child.

One of major step followed was to feed Gurbach Jadd/ Vasa Kommu/ Acorus Calamus for initiating good speech ability in a child. This stem was needed to babies on Tuesdays and Sundays in mother's milk.

Vasa is feed to baby after the 1st bath on 12th day in week. Weekly only thrice it is fed and named as :

Budhwar - Budhi Vasa

Mangalwar - Vaak Vasa

Ravi Vaar - Aayush Vasa

This stem is burnt and rubbed against the grinding stone in mother's milk or warm water to get a paste

The procedure to make it is in the link

https://t.co/uo4sGp7mUm

It should not be given daily to the child. Other main benefits are

1. It clears the phlegm in child's throat caused due to continuous milk intake. It clears the tracts and breathing is effortless.

2. Digestion

For children who haven't got their speech and is delayed than usual should feed this vasa on these days in week atleast for 6months. Don't get carried away with this dialogue

"Some gain speech little late"

In ancient times, our grandparents used to follow typical natural way of caring the needs of a child. All they used were more of natural products than chemical based for the growth of child.

One of major step followed was to feed Gurbach Jadd/ Vasa Kommu/ Acorus Calamus for initiating good speech ability in a child. This stem was needed to babies on Tuesdays and Sundays in mother's milk.

Vasa is feed to baby after the 1st bath on 12th day in week. Weekly only thrice it is fed and named as :

Budhwar - Budhi Vasa

Mangalwar - Vaak Vasa

Ravi Vaar - Aayush Vasa

This stem is burnt and rubbed against the grinding stone in mother's milk or warm water to get a paste

The procedure to make it is in the link

https://t.co/uo4sGp7mUm

It should not be given daily to the child. Other main benefits are

1. It clears the phlegm in child's throat caused due to continuous milk intake. It clears the tracts and breathing is effortless.

2. Digestion

For children who haven't got their speech and is delayed than usual should feed this vasa on these days in week atleast for 6months. Don't get carried away with this dialogue

"Some gain speech little late"