A 🧵on the basics of block and bulk deals.

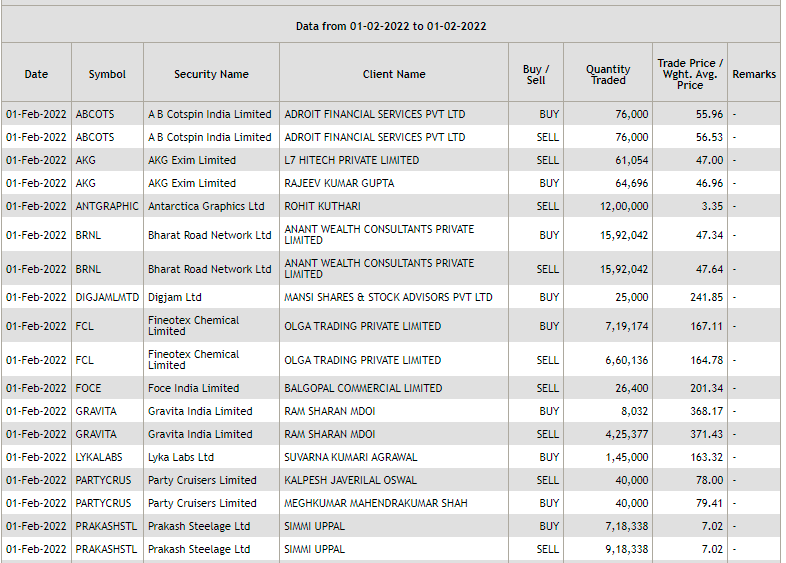

Block and bulk deals are large purchases of stocks by investment banks, mutual funds, hedge funds, pension funds, FIIs, and promoters. Tracking block and bulk deals can help give you a sense of what these large players are thinking.

Morning trading window from 8:45 AM to 9:00 AM.

Afternoon trading window from 2:05 PM to 2:20 PM

https://t.co/pwTyzWTnUL

https://t.co/g9BbHiEag3

Block reference price is determined in 2 ways:

The previous day’s closing price for the morning trading window.

Volume-weighted average price (VWAP) of the stock between 1:45 to 2:00 PM for the afternoon.

Yes, the parties can also carry out the bulk deal as a block deal if it meets the requirement of both the deals.

If the transaction involves 0.5 % of the shares of a company

Requirement for block deal: Deal value is Rs 10 crores, or the number of shares traded are more than 5 lakh

However, investment decisions should not be made based on indicators alone, but also based on fundamentals.

More from Finance

Ivor Cummins has been wrong (or lying) almost entirely throughout this pandemic and got paid handsomly for it.

He has been wrong (or lying) so often that it will be nearly impossible for me to track every grift, lie, deceit, manipulation he has pulled. I will use...

... other sources who have been trying to shine on light on this grifter (as I have tried to do, time and again:

Example #1: "Still not seeing Sweden signal versus Denmark really"... There it was (Images attached).

19 to 80 is an over 300% difference.

Tweet: https://t.co/36FnYnsRT9

Example #2 - "Yes, I'm comparing the Noridcs / No, you cannot compare the Nordics."

I wonder why...

Tweets: https://t.co/XLfoX4rpck / https://t.co/vjE1ctLU5x

Example #3 - "I'm only looking at what makes the data fit in my favour" a.k.a moving the goalposts.

Tweets: https://t.co/vcDpTu3qyj / https://t.co/CA3N6hC2Lq

He has been wrong (or lying) so often that it will be nearly impossible for me to track every grift, lie, deceit, manipulation he has pulled. I will use...

... other sources who have been trying to shine on light on this grifter (as I have tried to do, time and again:

Ivor Cummins BE (Chem) is a former R&D Manager at HP (sourcre: https://t.co/Wbf5scf7gn), turned Content Creator/Podcast Host/YouTube personality. (Call it what you will.)

— Steve (@braidedmanga) November 17, 2020

Example #1: "Still not seeing Sweden signal versus Denmark really"... There it was (Images attached).

19 to 80 is an over 300% difference.

Tweet: https://t.co/36FnYnsRT9

Example #2 - "Yes, I'm comparing the Noridcs / No, you cannot compare the Nordics."

I wonder why...

Tweets: https://t.co/XLfoX4rpck / https://t.co/vjE1ctLU5x

Example #3 - "I'm only looking at what makes the data fit in my favour" a.k.a moving the goalposts.

Tweets: https://t.co/vcDpTu3qyj / https://t.co/CA3N6hC2Lq

You May Also Like

The entire discussion around Facebook’s disclosures of what happened in 2016 is very frustrating. No exec stopped any investigations, but there were a lot of heated discussions about what to publish and when.

In the spring and summer of 2016, as reported by the Times, activity we traced to GRU was reported to the FBI. This was the standard model of interaction companies used for nation-state attacks against likely US targeted.

In the Spring of 2017, after a deep dive into the Fake News phenomena, the security team wanted to publish an update that covered what we had learned. At this point, we didn’t have any advertising content or the big IRA cluster, but we did know about the GRU model.

This report when through dozens of edits as different equities were represented. I did not have any meetings with Sheryl on the paper, but I can’t speak to whether she was in the loop with my higher-ups.

In the end, the difficult question of attribution was settled by us pointing to the DNI report instead of saying Russia or GRU directly. In my pre-briefs with members of Congress, I made it clear that we believed this action was GRU.

The story doesn\u2019t say you were told not to... it says you did so without approval and they tried to obfuscate what you found. Is that true?

— Sarah Frier (@sarahfrier) November 15, 2018

In the spring and summer of 2016, as reported by the Times, activity we traced to GRU was reported to the FBI. This was the standard model of interaction companies used for nation-state attacks against likely US targeted.

In the Spring of 2017, after a deep dive into the Fake News phenomena, the security team wanted to publish an update that covered what we had learned. At this point, we didn’t have any advertising content or the big IRA cluster, but we did know about the GRU model.

This report when through dozens of edits as different equities were represented. I did not have any meetings with Sheryl on the paper, but I can’t speak to whether she was in the loop with my higher-ups.

In the end, the difficult question of attribution was settled by us pointing to the DNI report instead of saying Russia or GRU directly. In my pre-briefs with members of Congress, I made it clear that we believed this action was GRU.