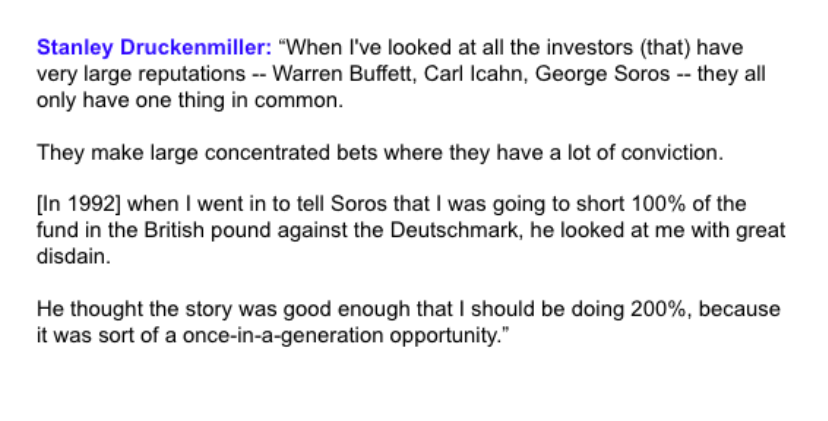

The most memorable interview I did this year was w/ Stanley Druckenmiller, who famously made $1B shorting the British Pound.

The trading legend's track record includes a 30-year stretch returning 30%+ a year (without a single down year).

Here are 8 investing lessons🧵

Follow @TrungTPhan to catch them in your feed.

Here's one you might like: https://t.co/B3SWUCF2cd

ASML is the most important company you've never heard of.

— Trung Phan \U0001f1e8\U0001f1e6 (@TrungTPhan) August 22, 2021

The $300B+ Dutch firm makes the machines that make semiconductors. Each one costs $150m and access to them are a huge geopolitical flashpoint.

Here's a breakdown \U0001f9f5 pic.twitter.com/pARj3x7Kwo

https://t.co/jGZs8brnVR

https://t.co/N7MqxWj2ks