Follow up post on GME answering common questions (e.g. if they short is still >100% of float, wouldn't that cause another short

Short positions opened in last 3 days was ~35M shares all above $300 suggesting that the cost basis has been reset. The original shorters have likely covered already.

More from Finance

1/ My Mission: To Spread Financial Wellness (thread)

Here’s what "financial wellness" means to me

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

2/ Mindset

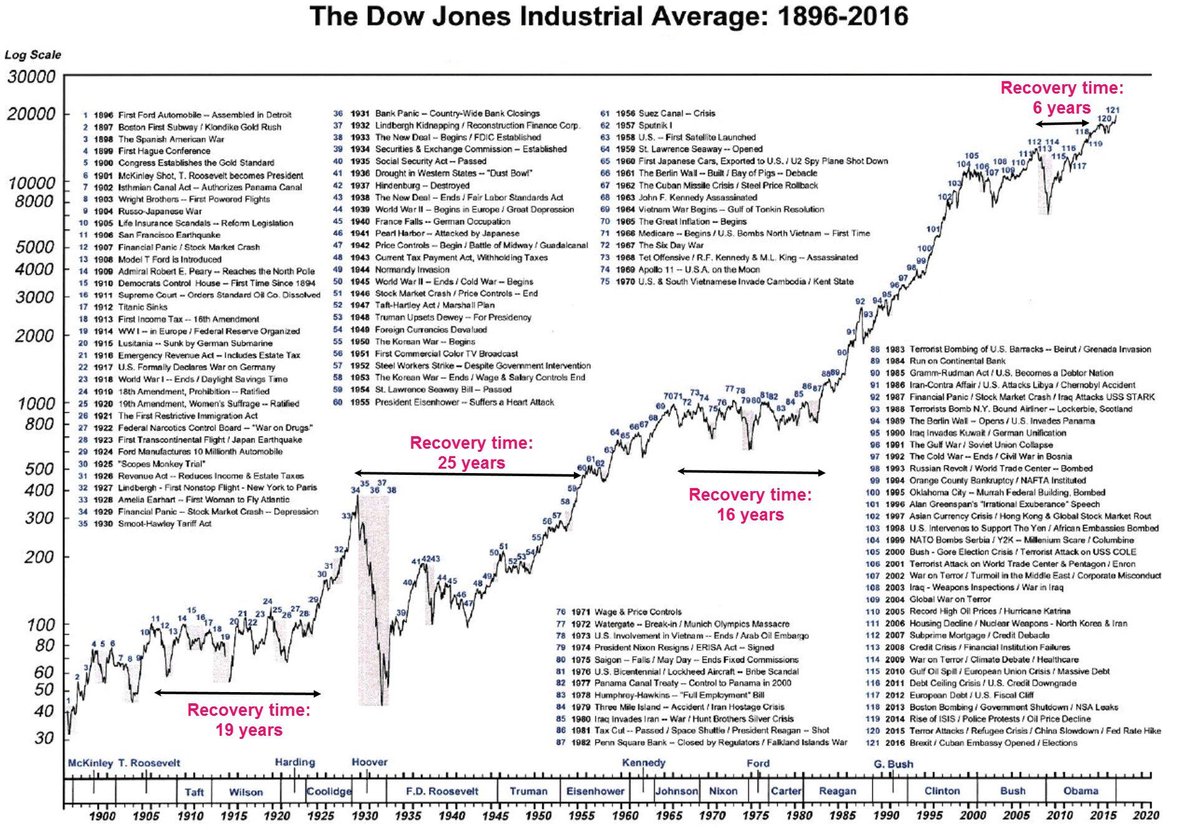

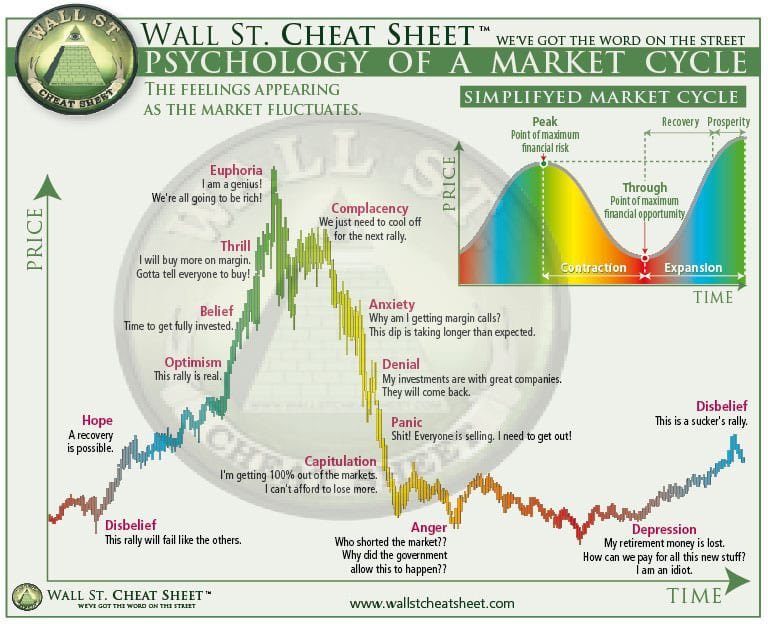

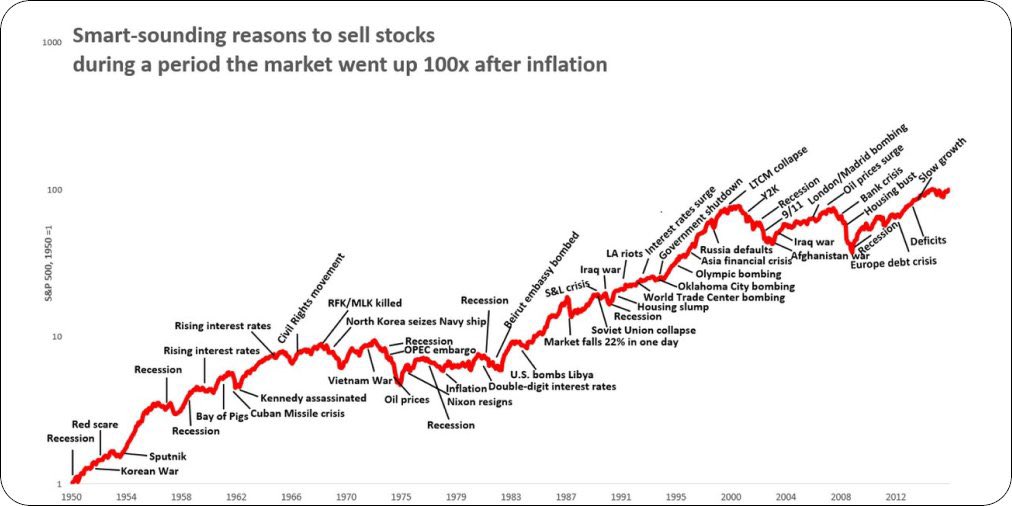

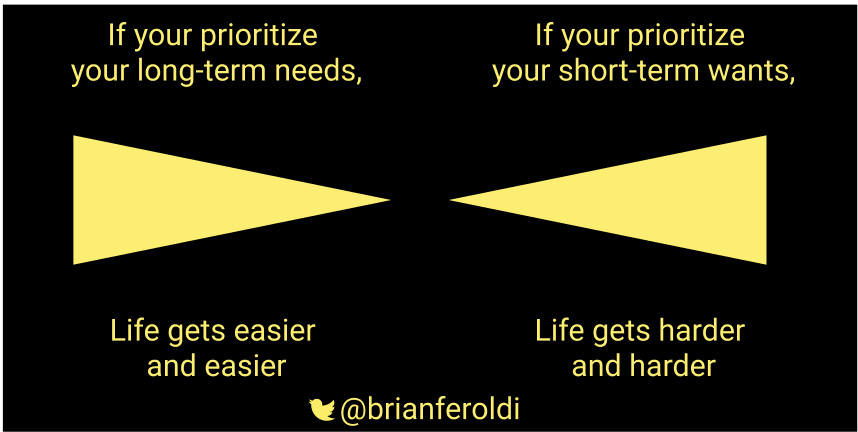

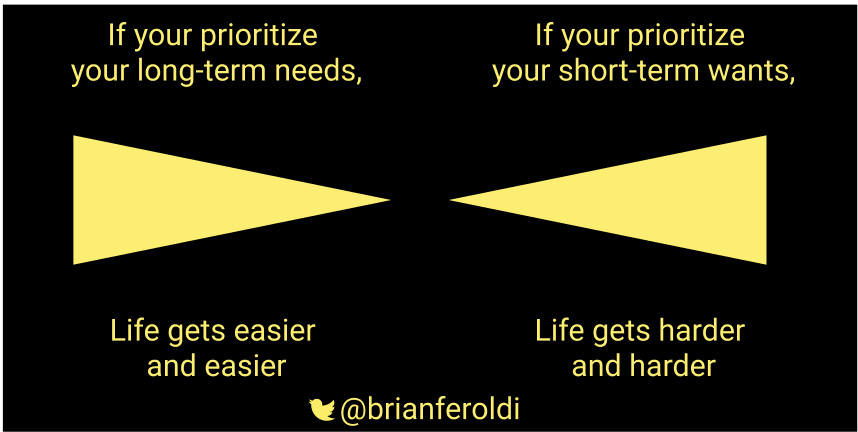

Humans are programmed to think short-term

Evolutionary, thinking short-term makes sense. It helps with survival.

Financial wellness is all about training yourself to develop a long-term mindset

Not easy -- it takes practice

3/ Mindset

If you join the right tribes, you can’t help but improve

My favs:

@AffordAnything

@ChooseFiFI

FinTwit

@MicroCapClub

@themotleyfoolFool

@visualizevalue

Twitter / Podcasts / Blogs / YouTube -- when used correctly -- are amazing

4/ Mindset

Educate yourself - constantly!

Especially about:

1⃣Money

2⃣Relationships

3⃣Health

These 3 categories have an outsized influence on all areas of your life

Books

5/ Career

In the beginning, focus on growing your income

Do more than what is expected

Become a lynchpin

Find a career that you ENJOY (<- important!) that also has high-income potential

Start a side hustle (<- important!)

Build your talent

Here’s what "financial wellness" means to me

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

2/ Mindset

Humans are programmed to think short-term

Evolutionary, thinking short-term makes sense. It helps with survival.

Financial wellness is all about training yourself to develop a long-term mindset

Not easy -- it takes practice

3/ Mindset

If you join the right tribes, you can’t help but improve

My favs:

@AffordAnything

@ChooseFiFI

FinTwit

@MicroCapClub

@themotleyfoolFool

@visualizevalue

Twitter / Podcasts / Blogs / YouTube -- when used correctly -- are amazing

1/ YouTube is an AMAZING resource when used properly (Thread)

— Brian Feroldi (@BrianFeroldi) November 7, 2020

Here are my favorite YouTube channels:

Top 5:

Mark Rober - @MarkRober

Real Engineering

Smarter Every Day - @smartereveryday

Stuff Made Here - @stuffmadehere

Wintegartan - @wintergatan

More \U0001f447\U0001f447\U0001f447\U0001f447\U0001f447

4/ Mindset

Educate yourself - constantly!

Especially about:

1⃣Money

2⃣Relationships

3⃣Health

These 3 categories have an outsized influence on all areas of your life

Books

1/ Book recommendations (thread)

— Brian Feroldi (@BrianFeroldi) November 20, 2020

Start Here:

Choose FI

Richest Man in Babylon

Millionaire Next Door

Rich Dad, Poor Dad

The Wealthy Barber

\u2b07\ufe0f\u2b07\ufe0f\u2b07\ufe0f\u2b07\ufe0f\u2b07\ufe0f

5/ Career

In the beginning, focus on growing your income

Do more than what is expected

Become a lynchpin

Find a career that you ENJOY (<- important!) that also has high-income potential

Start a side hustle (<- important!)

Build your talent

Boosting your salary is a great way to turbo-charge wealth building

— Brian Feroldi (@BrianFeroldi) November 1, 2020

Here's the good news: Your salary is negotiable!@themotleyfool and @ChooseFi have some AMAZING free resources for scoring a big raise:

Use them!

\U0001f447\U0001f447\U0001f447

You May Also Like

Nano Course On Python For Trading

==========================

Module 1

Python makes it very easy to analyze and visualize time series data when you’re a beginner. It's easier when you don't have to install python on your PC (that's why it's a nano course, you'll learn python...

... on the go). You will not be required to install python in your PC but you will be using an amazing python editor, Google Colab Visit https://t.co/EZt0agsdlV

This course is for anyone out there who is confused, frustrated, and just wants this python/finance thing to work!

In Module 1 of this Nano course, we will learn about :

# Using Google Colab

# Importing libraries

# Making a Random Time Series of Black Field Research Stock (fictional)

# Using Google Colab

Intro link is here on YT: https://t.co/MqMSDBaQri

Create a new Notebook at https://t.co/EZt0agsdlV and name it AnythingOfYourChoice.ipynb

You got your notebook ready and now the game is on!

You can add code in these cells and add as many cells as you want

# Importing Libraries

Imports are pretty standard, with a few exceptions.

For the most part, you can import your libraries by running the import.

Type this in the first cell you see. You need not worry about what each of these does, we will understand it later.

==========================

Module 1

Python makes it very easy to analyze and visualize time series data when you’re a beginner. It's easier when you don't have to install python on your PC (that's why it's a nano course, you'll learn python...

... on the go). You will not be required to install python in your PC but you will be using an amazing python editor, Google Colab Visit https://t.co/EZt0agsdlV

This course is for anyone out there who is confused, frustrated, and just wants this python/finance thing to work!

In Module 1 of this Nano course, we will learn about :

# Using Google Colab

# Importing libraries

# Making a Random Time Series of Black Field Research Stock (fictional)

# Using Google Colab

Intro link is here on YT: https://t.co/MqMSDBaQri

Create a new Notebook at https://t.co/EZt0agsdlV and name it AnythingOfYourChoice.ipynb

You got your notebook ready and now the game is on!

You can add code in these cells and add as many cells as you want

# Importing Libraries

Imports are pretty standard, with a few exceptions.

For the most part, you can import your libraries by running the import.

Type this in the first cell you see. You need not worry about what each of these does, we will understand it later.