Stocks are not supposed to have over 100% short interest. Naked short selling is illegal. This set-up should never happen. Kudos to those who took advantage.

Irresistible to leave this moment alone - a thread to share some investment lessons:

1/ Size matters.

Melvin entered 2021 circa $12 billion in AUM and runs a highly levered balance sheet. That’s a lot of short exposure to move around if needed.

Stocks are not supposed to have over 100% short interest. Naked short selling is illegal. This set-up should never happen. Kudos to those who took advantage.

Keynes said “markets can be irrational longer than you can be solvent.” I suspect this won't take down any significant hedge fund, but it definitely hurts.

Academic finance teaches that “a short sale has unlimited downside and limited upside. Those events almost never play out, until they do.

On the short side, VW stock in 2008.

And on the long side (leveraged), CMBX in November 2008

Both traded to completely irrational levels for a time. True left tail events for those in the positions.

Peter Bernstein’s famous line about risk. A global pandemic leading to a soaring market? Negative interest rates? Online traders crushing monster hedge funds?

Beware those who think in certainties instead of probabilities. @AnnieDuke

We know the outcome of this with near certainty (99%+ probability). GME stock will fall back to a fundamental level when the weighing machine takes over from the voting machine. We have absolutely no idea when - a day, week, month, 5 years? No idea.

My understanding is that Gabe Plotkin is one of the very best investors (process, not outcome). I highly doubt #melvincapital missed much in advance. And yet, here we are. No rebates, volatility, untethered trading - shorting is brutal.

Melvin entered 2021 circa $12 billion in AUM and runs a highly levered balance sheet. That’s a lot of short exposure to move around if needed. And obviously, it's not alone in shorting stocks.

More from Finance

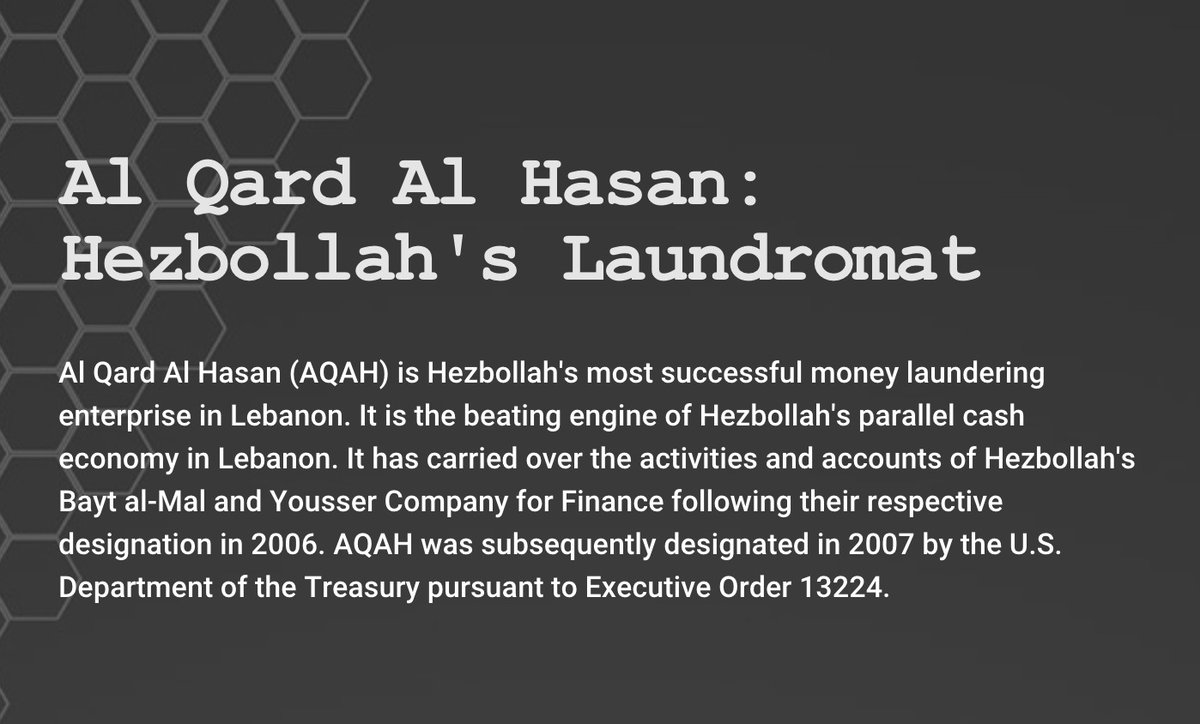

Last week Hizbollah's finance institution Al Qard el Hasan was hacked by Spiderz. A group of people took that Data and tried to make sense out of it. Below are the findings

https://t.co/eGLqvb28o5

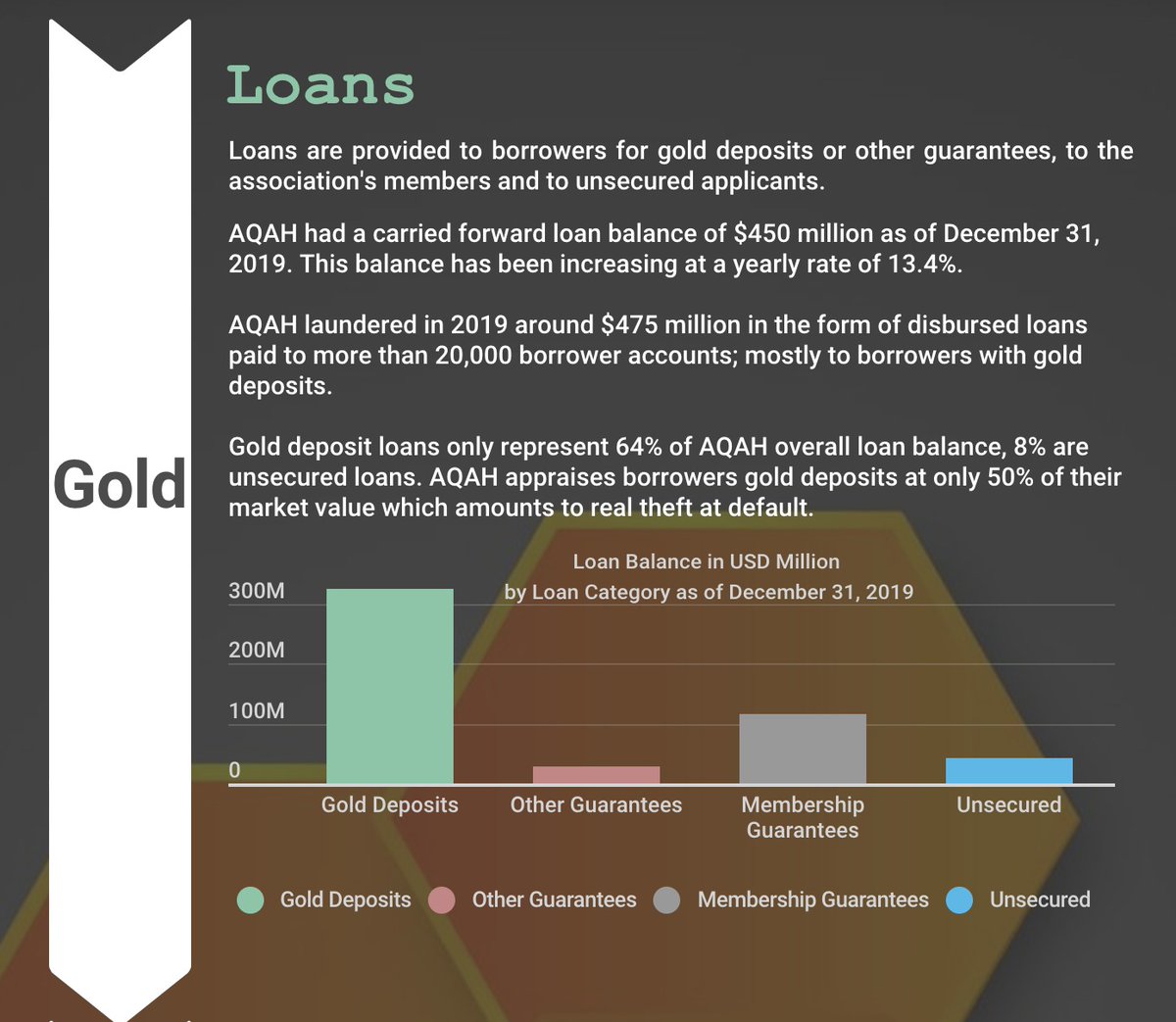

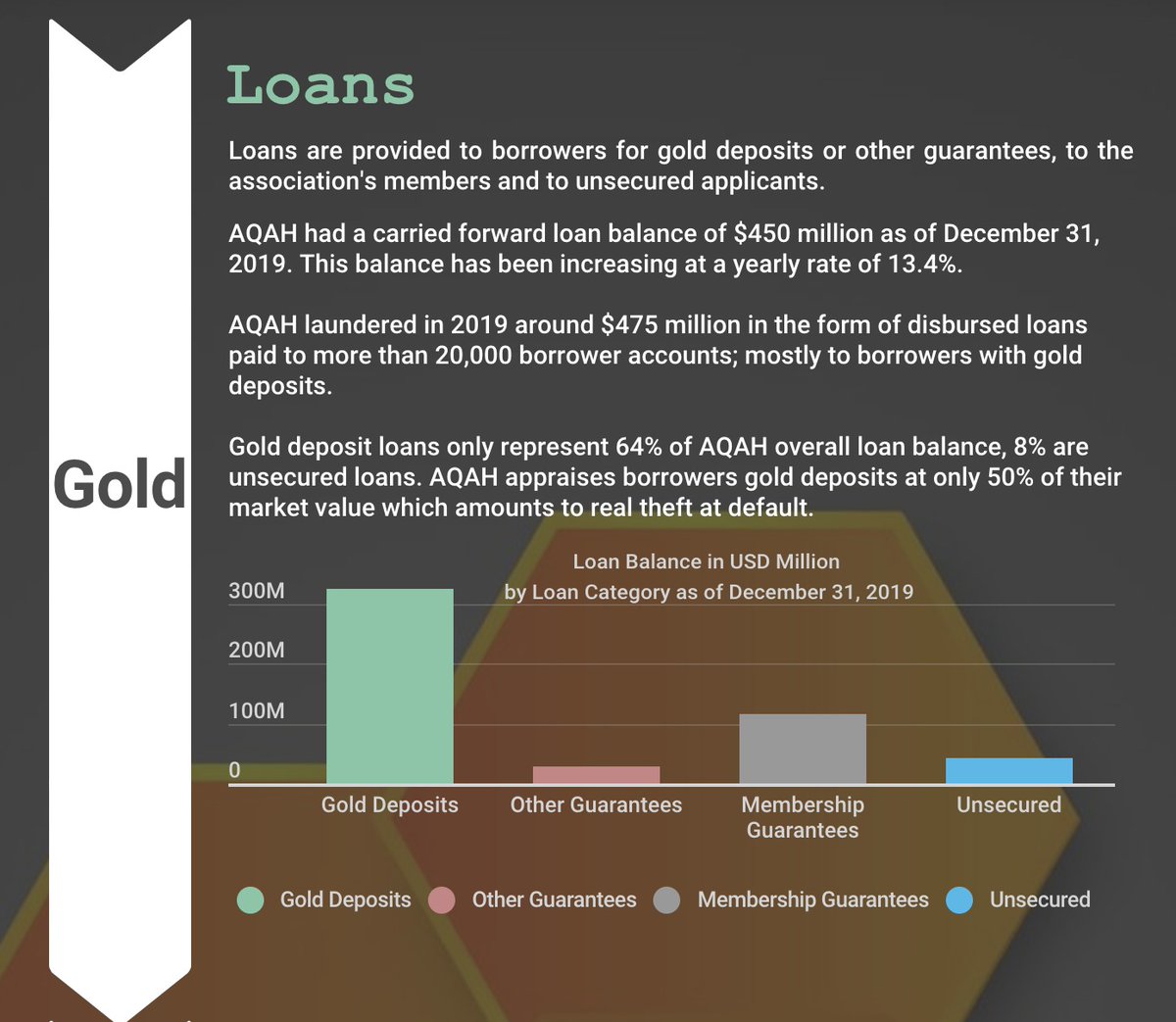

Loans are provided to borrowers for gold deposits or other guarantees, to the association's members and to unsecured applicants.

AQAH had a carried forward loan balance of $450 million as of December 31, 2019. This balance has been increasing at a yearly rate of 13.4%.

AQAH laundered around $475 million in 2019 in the form of disbursed loans paid to more than 20,000 borrower accounts; mostly to borrowers with gold deposits.

Deposits accounts have been offered to 307,000 members of the association, 83,000 contributors as well as to 600 companies. AQAH closed 2019 with an overall depositors accounts balance of around $500 million.

https://t.co/eGLqvb28o5

Loans are provided to borrowers for gold deposits or other guarantees, to the association's members and to unsecured applicants.

AQAH had a carried forward loan balance of $450 million as of December 31, 2019. This balance has been increasing at a yearly rate of 13.4%.

AQAH laundered around $475 million in 2019 in the form of disbursed loans paid to more than 20,000 borrower accounts; mostly to borrowers with gold deposits.

Deposits accounts have been offered to 307,000 members of the association, 83,000 contributors as well as to 600 companies. AQAH closed 2019 with an overall depositors accounts balance of around $500 million.