2/15

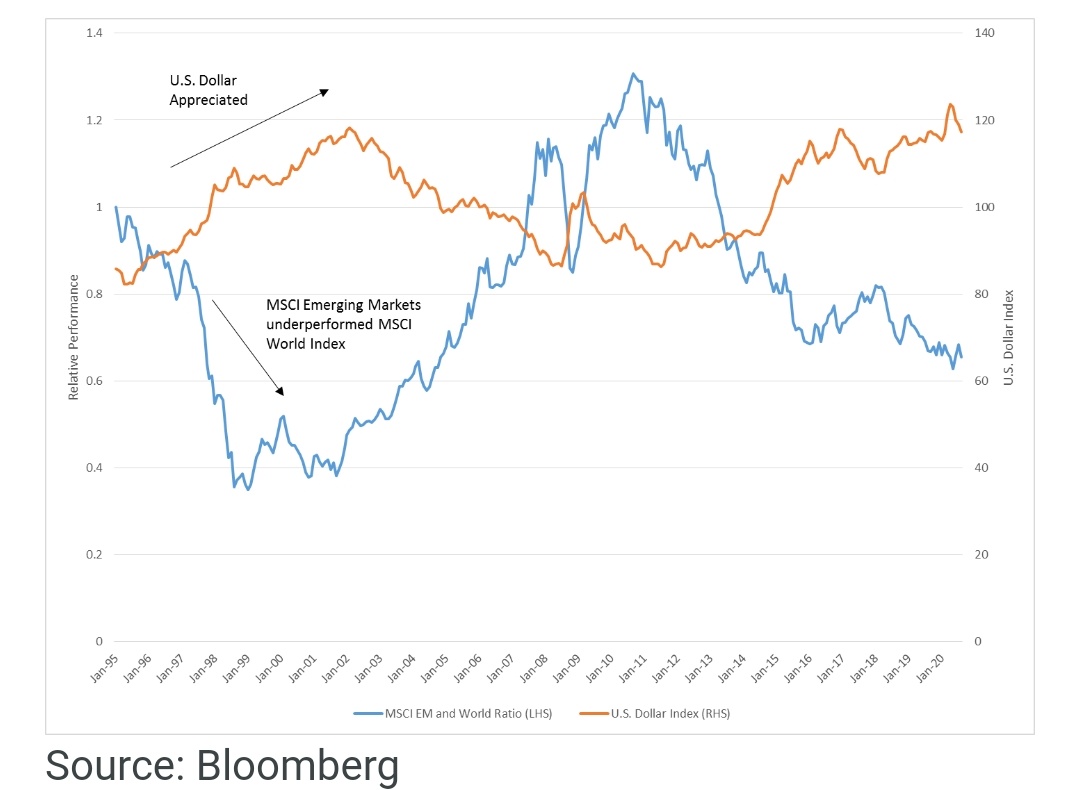

A simple thread to understand relationship between US Dollar and Emerging Markets.

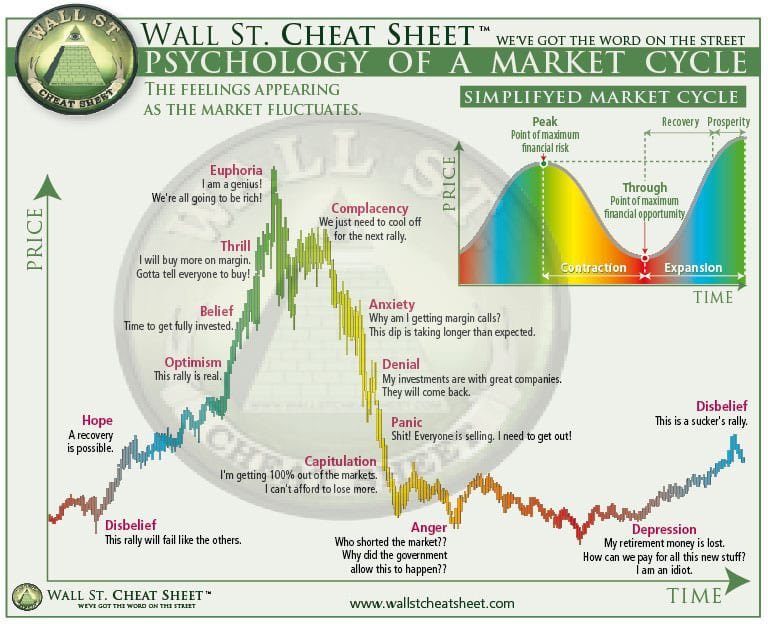

The relationship between the performance of Emerging Market stocks and the US Dollar is one of the tightest macro relationships that exists in investing.

1/15

2/15

When US Dollar weakens, EM index outperform World Index and when US Dollar strengthens EM index underperform World index.

3/15

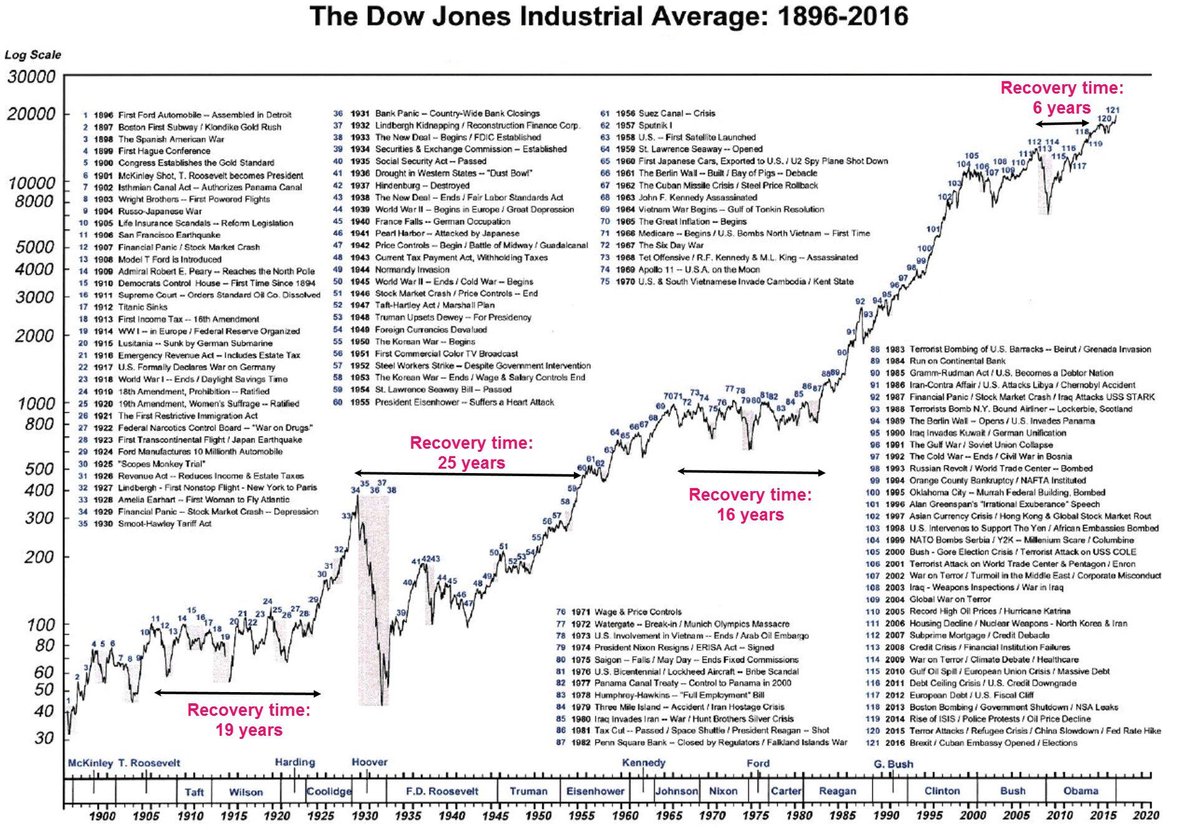

Then from 2001 to 2010, the U.S. dollar depreciated over 18% while the MSCI EM Index outperformed the MSCI World Index by 14% annualised.

4/15

Overall, from 1995 to 2020, this relationship has a correlation of -0.35.

5/15

A weaker dollar allows Emerging Market countries more freedom to provide fiscal stimulus without fearing negative implications for their own economies.

6/15

As case with India, government will be more comfortable to push fiscal stimulus now when INR is stable.

7/15

Emerging markets are a natural choice as they tend to benefit from weakening dollar and grow faster than DMs.

8/15

9/15

10/15

Easy monetary policy weakens the dollar and leads to its depreciation. Since U.S. dollar is a fiat currency, meaning that it is not backed by gold, it can be created anytime easily.

11/15

12/15

13/15

14/15

Since US Fed has expanded its Balance Sheet at record speed, US Dollar may go through a weak patch.

Taking cue from multiple cycles in the past, if US Dollar continues to weaken, Emerging Market stocks may outperform.

Watch this trend closely!

15/15 End

Edelweiss Emerging Market Opportunities Equity Offshore Fund

https://t.co/ea0nbUxAmF

Edelweiss Greater China Equity Offshore Fund

https://t.co/AXEWzfKdhY

More from Finance

You May Also Like

@EricTopol @NBA @StephenKissler @yhgrad B.1.1.7 reveals clearly that SARS-CoV-2 is reverting to its original pre-outbreak condition, i.e. adapted to transgenic hACE2 mice (either Baric's BALB/c ones or others used at WIV labs during chimeric bat coronavirus experiments aimed at developing a pan betacoronavirus vaccine)

@NBA @StephenKissler @yhgrad 1. From Day 1, SARS-COV-2 was very well adapted to humans .....and transgenic hACE2 Mice

@NBA @StephenKissler @yhgrad 2. High Probability of serial passaging in Transgenic Mice expressing hACE2 in genesis of SARS-COV-2

@NBA @StephenKissler @yhgrad B.1.1.7 has an unusually large number of genetic changes, ... found to date in mouse-adapted SARS-CoV2 and is also seen in ferret infections.

https://t.co/9Z4oJmkcKj

@NBA @StephenKissler @yhgrad We adapted a clinical isolate of SARS-CoV-2 by serial passaging in the ... Thus, this mouse-adapted strain and associated challenge model should be ... (B) SARS-CoV-2 genomic RNA loads in mouse lung homogenates at P0 to P6.

https://t.co/I90OOCJg7o

@NBA @StephenKissler @yhgrad 1. From Day 1, SARS-COV-2 was very well adapted to humans .....and transgenic hACE2 Mice

1. From Day 1, SARS-COV-2 was very well adapted to humans .....and transgenic hACE2 Mice

— Billy Bostickson \U0001f3f4\U0001f441&\U0001f441 \U0001f193 (@BillyBostickson) January 30, 2021

"we generated a mouse model expressing hACE2 by using CRISPR/Cas9 knockin technology. In comparison with wild-type C57BL/6 mice, both young & aged hACE2 mice sustained high viral loads... pic.twitter.com/j94XtSkscj

@NBA @StephenKissler @yhgrad 2. High Probability of serial passaging in Transgenic Mice expressing hACE2 in genesis of SARS-COV-2

1. High Probability of serial passaging in Transgenic Mice expressing hACE2 in genesis of SARS-COV-2!

— Billy Bostickson \U0001f3f4\U0001f441&\U0001f441 \U0001f193 (@BillyBostickson) January 2, 2021

2 papers:

Human\u2013viral molecular mimicryhttps://t.co/irfH0Zgrve

Molecular Mimicryhttps://t.co/yLQoUtfS6s https://t.co/lsCv2iMEQz

@NBA @StephenKissler @yhgrad B.1.1.7 has an unusually large number of genetic changes, ... found to date in mouse-adapted SARS-CoV2 and is also seen in ferret infections.

https://t.co/9Z4oJmkcKj

@NBA @StephenKissler @yhgrad We adapted a clinical isolate of SARS-CoV-2 by serial passaging in the ... Thus, this mouse-adapted strain and associated challenge model should be ... (B) SARS-CoV-2 genomic RNA loads in mouse lung homogenates at P0 to P6.

https://t.co/I90OOCJg7o