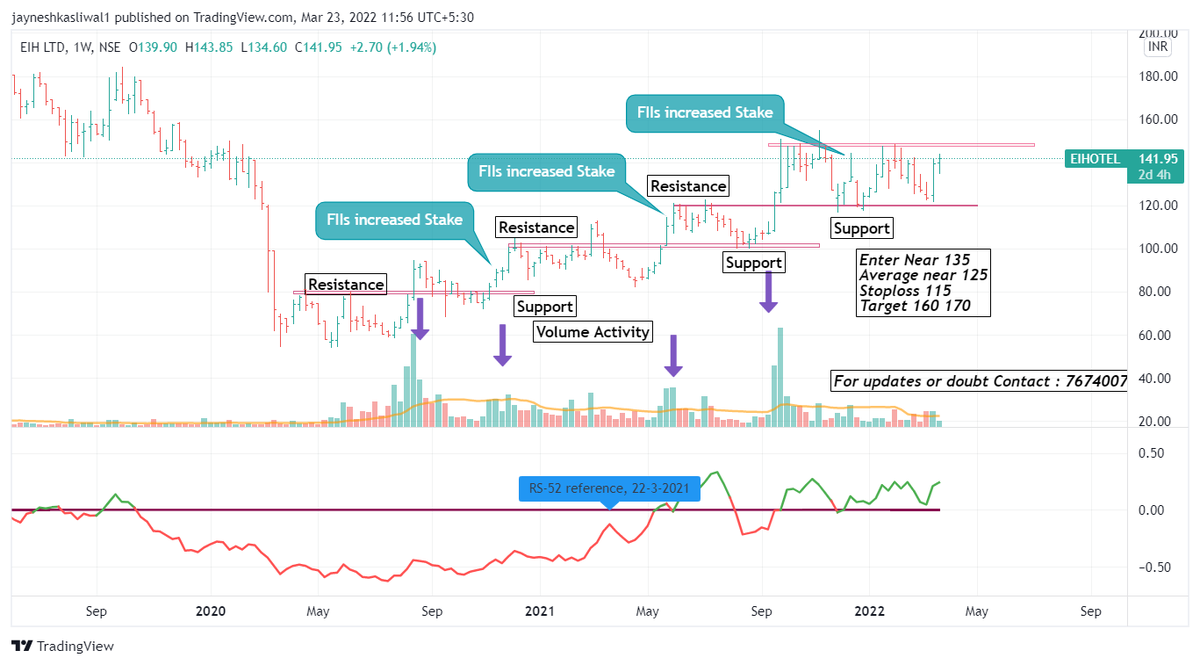

EIHOTEL

Stock in Stage 2 Uptrend

Strong Support at 30 WEMA

RS>0

Strong Volumes and Institutional Holding Increasing

Targets 200+

Stoploss 115

Retweet if you want more Analysis

More from JayneshKasliwal

Complete Backtest and Indicator link

🧵 A Thread 🧵

𝗦𝗲𝘁𝘂𝗽:

🔸 Monthly Option Buying

🔸 50 ema on 3 min timeframe

🔸 Supertrend 10 , 3

🔸 Chart : Banknifty , Nifty Futures as we backtested on futures

🔸 Entry 9:20 to 3:00

🔸 Max 3 Entries per day

🔸 Premium nearest to 200 Rs only

[2/18]

Why Monthly Option buying ?

🔸 Less theta decay compared to weekly options

🔸 Less Volatility

🔸 Supertrend and MA Settings

[3/18]

🔸 Indicator Link

🔸 Click on the below 𝘭𝘪𝘯𝘬 -> 𝘈𝘥𝘥 𝘵𝘰 𝘍𝘢𝘷𝘰𝘶𝘳𝘪𝘵𝘦𝘴 -> 𝘈𝘥𝘥 𝘰𝘯 𝘊𝘩𝘢𝘳𝘵 from favourites and start using it !

🔸 https://t.co/zVXavqLBto

[4/18]

𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿 𝗦𝗲𝘁𝘁𝗶𝗻𝗴𝘀 :

🔸 Max 6 Trades per day ( Both CE and PE buy)

🔸 Timings 9:20 am to 3:00 pm

🔸 Supertrend : 10,3

🔸 Moving Average 50 ema

[5/18]

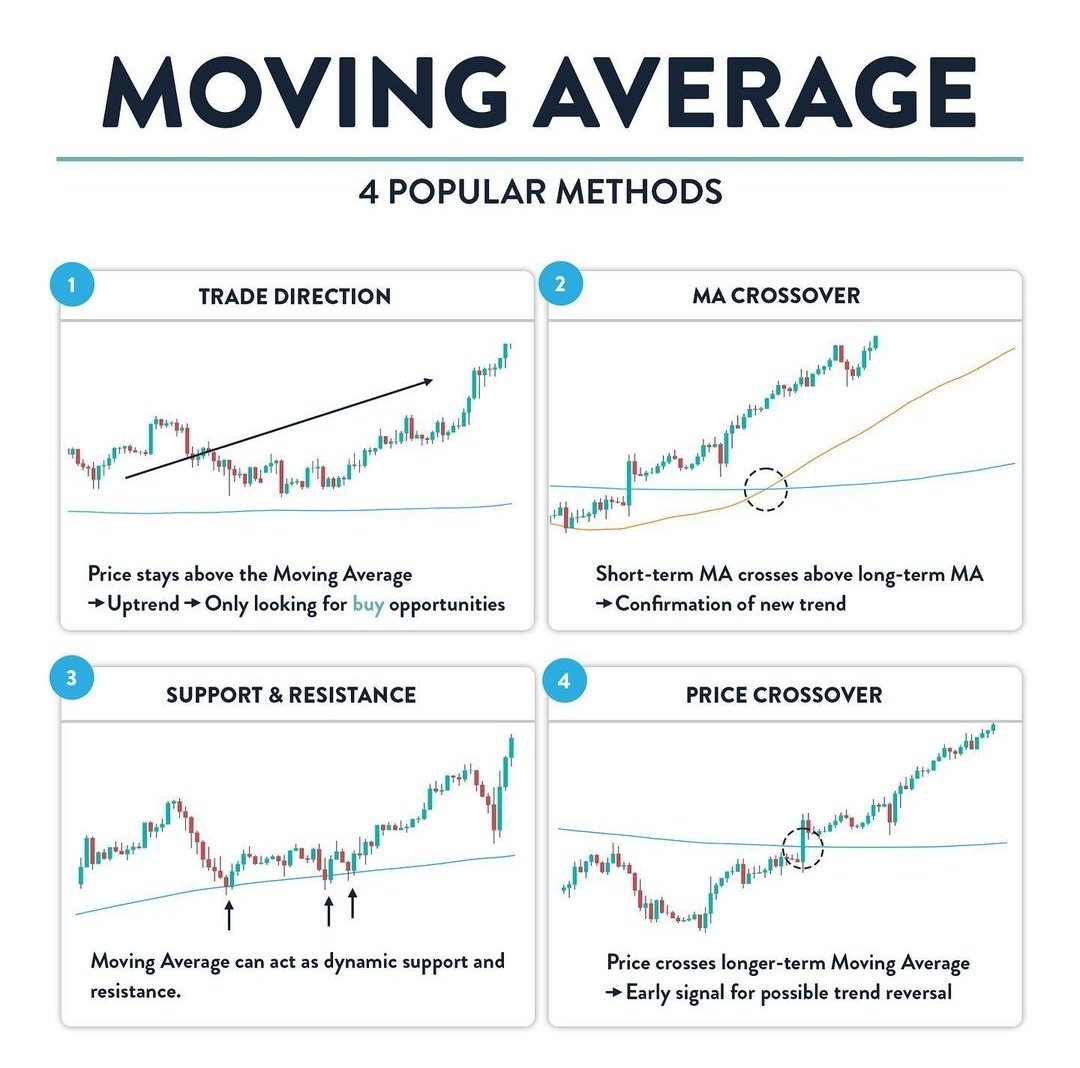

A mega thread to understand the Use of 21 , 50 and 200 ema.

4 Effective uses of Exponential Moving Averages !

Retweet and Share 🔄

#stockmarkets #nifty

@kuttrapali26 @caniravkaria

Once Can refer the use of Moving Averages Throught this thread

ULTIMATE GUIDE TO 21 and 200 Moving Average

— JayneshKasliwal (@JayneshKasliwal) November 14, 2021

SUNDAY THREAD \U0001f516

A trend Following System That will Help You Improve Trading immensely.

RETWEET AND SHARE \U0001f504@kuttrapali26 @AmitabhJha3 #stocks #StockMarket

1/n

4 Popular uses of moving averages

1. Identifying the direction of trend

2. MA crossover

3. Dynamic Support and Resistance

4. Price Crossing above Key EMAs

Note : In chart 21 ema is red , 50 ema is green and 200 ema is black

2/n

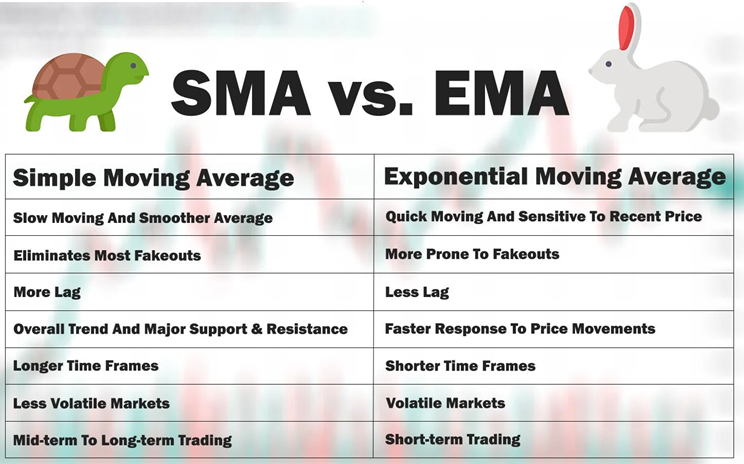

Why EMA and not SMA ?

EMA is fast , accurate and prices in recent data !

3/n

Use 1 : Identifying the trend of stock on dtf

The 21 ema will tell us the Short term trend of a stock , while the 200 ema will tell us the long term trend of a stocks

Any EMA that is sloping

:upwards trend is BULLISH

:sideways trend is NEUTRAL

:downwards trend is BEARISH

4/n

Option Strategies free of cost

Here is a thread of all 🧵

A Retweet would help :)

Begin Your Algo Trading Journey

https://t.co/xIA6SIgGRj

1/n

Banknifty Option Selling Strategy :

https://t.co/r6vxQY212o

2/n

Banknifty option Buying :

https://t.co/w3QukixFD2

3/n

Advanced Intraday Strangle :

https://t.co/v1KynrLb03

4/n

You May Also Like

Curated the best tweets from the best traders who are exceptional at managing strangles.

• Positional Strangles

• Intraday Strangles

• Position Sizing

• How to do Adjustments

• Plenty of Examples

• When to avoid

• Exit Criteria

How to sell Strangles in weekly expiry as explained by boss himself. @Mitesh_Engr

• When to sell

• How to do Adjustments

• Exit

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Beautiful explanation on positional option selling by @Mitesh_Engr

Sir on how to sell low premium strangles yourself without paying anyone. This is a free mini course in

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

1st Live example of managing a strangle by Mitesh Sir. @Mitesh_Engr

• Sold Strangles 20% cap used

• Added 20% cap more when in profit

• Booked profitable leg and rolled up

• Kept rolling up profitable leg

• Booked loss in calls

• Sold only

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

2nd example by @Mitesh_Engr Sir on converting a directional trade into strangles. Option Sellers can use this for consistent profit.

• Identified a reversal and sold puts

• Puts decayed a lot

• When achieved 2% profit through puts then sold

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0