1. Been excited about @JoeNBC's sustained convo today about @KBAndersen's new book Evil Geniuses: The Unmaking of America which explains how the Republican Party radicalized OVER ECONOMICS over the past 30 years. It was launched w the radical tax cuts in Reagan's presidency, but

More from Rachel "The Doc" Bitecofer 📈🔭🍌

1. I think school closures also dragged Ds down in congressional races. To be clear, they wouldn't in a functional democracy not following a herd immunity strategy & normalizing the indifference genocide of up to a half million of its citizens. That "conditional" is a necessary

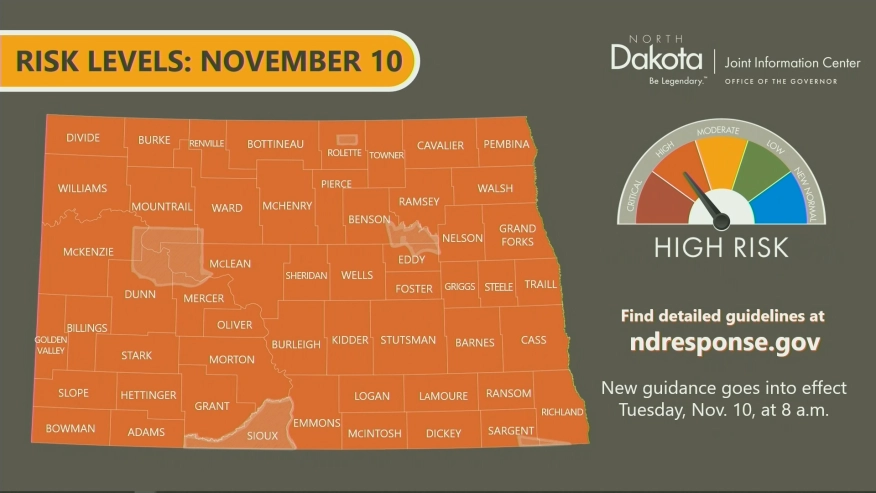

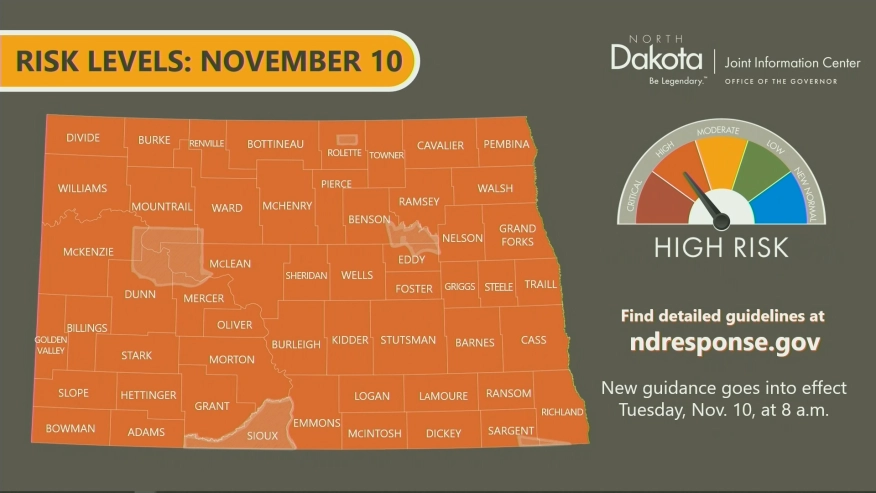

2. component of the "pandemic backlash effect that we have in the U.S. other countries don't have sizable anti-mask movements, ones so large it impedes states like North Dakota who governor @DougForDakota has "led" them to a point where every single county in his large;y rural

3. state has been governed to "high" infection rates. He must feel so successful that liberty & freedom is so abundantly clear all around him! So yes, in a country that has normalized murdering via indifference its old, medical compromised & in the case of

4. COVID- which is a random killer, which sometimes kills young healthy mothers whose own mothers couldn't let their daughter forgo a baby shower bc its such a special part of the birth experience or bc how do you skip the "1 year" baby party when the baby smashes her cake all

5. over her own head? I get it. Those are once in a lifetime events that can't be replaced. So people have been doing them bc their governors & their president esp has told them to do so, that its no big deal, that actually they'd be FOOLS not to hold that gender reveal party,

Every time I see a parent post about how their kids\u2019 school is closing and going virtual, I think of how my kids haven\u2019t physically been to school since early March.

— kim yi dionne (she/her) (@dadakim) November 11, 2020

2. component of the "pandemic backlash effect that we have in the U.S. other countries don't have sizable anti-mask movements, ones so large it impedes states like North Dakota who governor @DougForDakota has "led" them to a point where every single county in his large;y rural

3. state has been governed to "high" infection rates. He must feel so successful that liberty & freedom is so abundantly clear all around him! So yes, in a country that has normalized murdering via indifference its old, medical compromised & in the case of

4. COVID- which is a random killer, which sometimes kills young healthy mothers whose own mothers couldn't let their daughter forgo a baby shower bc its such a special part of the birth experience or bc how do you skip the "1 year" baby party when the baby smashes her cake all

5. over her own head? I get it. Those are once in a lifetime events that can't be replaced. So people have been doing them bc their governors & their president esp has told them to do so, that its no big deal, that actually they'd be FOOLS not to hold that gender reveal party,

More from Economy

What a year: 203 essays about degrowth in English since the beginning of March. Here is a selection of some of my favourites. Thank you @fem_degrowth, @beth_stratford, @thedownshifters, @corbinkbarthold, @degrowth_info for these brilliant texts.

THREAD/

https://t.co/1lFaJM52RX

https://t.co/i5HOfZ19r7

https://t.co/DuPSrrqnzz

https://t.co/0ANveWdvFO

THREAD/

https://t.co/1lFaJM52RX

https://t.co/i5HOfZ19r7

https://t.co/DuPSrrqnzz

https://t.co/0ANveWdvFO

The argument for deficits & debt raising interest rates in the US is not increased credit risk, it is that interest rates are a function of economic fundamentals, flows & policy. Deficits/debt change those.

I can't tell if I'm agreeing or disagreeing with @jc_econ.

Increasing government spending or reducing taxes increases demand (or reduces saving). This raises the price of loanable funds or the interest rate.

In a dynamic context, more demand means a stronger economy, the central bank raises interest rates sooner, and long rates rise.

(As an aside, we are not close to the United States needing to worry about credit risk and the risks are more overstated than understated in most other advanced economies too. But credit risk is not always & everywhere irrelevant, just look at the UK in 1976 or Canada in 1994.)

Interest rates have fallen over the last 20 yrs while debt has risen. This does not necessarily mean that debt rising causes interest rates to fall. It could also mean that other things have happened at he same time that pushed down interest rates more than debt pushed them up.

The suspects for these "other things" include slower productivity growth, slower popln growth, higher inequality, less investment, etc. All of which either increase the supply of saving or reduce the demand for investment, reducing the equilibrium interest rate.

I can't tell if I'm agreeing or disagreeing with @jc_econ.

There is no relationship b/w deficits & interest rates in the US & many other advanced economies. Centuries of dynamic institution building underpin our reserve currency status that allows rates to be a function of economic fundamentals, flows & policy not credit risk 1/3

— Dr. Julia Coronado (@jc_econ) January 26, 2021

Increasing government spending or reducing taxes increases demand (or reduces saving). This raises the price of loanable funds or the interest rate.

In a dynamic context, more demand means a stronger economy, the central bank raises interest rates sooner, and long rates rise.

(As an aside, we are not close to the United States needing to worry about credit risk and the risks are more overstated than understated in most other advanced economies too. But credit risk is not always & everywhere irrelevant, just look at the UK in 1976 or Canada in 1994.)

Interest rates have fallen over the last 20 yrs while debt has risen. This does not necessarily mean that debt rising causes interest rates to fall. It could also mean that other things have happened at he same time that pushed down interest rates more than debt pushed them up.

The suspects for these "other things" include slower productivity growth, slower popln growth, higher inequality, less investment, etc. All of which either increase the supply of saving or reduce the demand for investment, reducing the equilibrium interest rate.

You May Also Like

So friends here is the thread on the recommended pathway for new entrants in the stock market.

Here I will share what I believe are essentials for anybody who is interested in stock markets and the resources to learn them, its from my experience and by no means exhaustive..

First the very basic : The Dow theory, Everybody must have basic understanding of it and must learn to observe High Highs, Higher Lows, Lower Highs and Lowers lows on charts and their

Even those who are more inclined towards fundamental side can also benefit from Dow theory, as it can hint start & end of Bull/Bear runs thereby indication entry and exits.

Next basic is Wyckoff's Theory. It tells how accumulation and distribution happens with regularity and how the market actually

Dow theory is old but

Here I will share what I believe are essentials for anybody who is interested in stock markets and the resources to learn them, its from my experience and by no means exhaustive..

First the very basic : The Dow theory, Everybody must have basic understanding of it and must learn to observe High Highs, Higher Lows, Lower Highs and Lowers lows on charts and their

Even those who are more inclined towards fundamental side can also benefit from Dow theory, as it can hint start & end of Bull/Bear runs thereby indication entry and exits.

Next basic is Wyckoff's Theory. It tells how accumulation and distribution happens with regularity and how the market actually

Dow theory is old but

Old is Gold....

— Professor (@DillikiBiili) January 23, 2020

this Bharti Airtel chart is a true copy of the Wyckoff Pattern propounded in 1931....... pic.twitter.com/tQ1PNebq7d