@Paga announced investment in Ethiopian-based software development firm, Apposit for an undisclosed amount. The deal gave Paga full access to the expertise of Apposit’s engineers and technicians.

This is our summary of some of the notable Corporate Deals that affected Nigerian companies in 2020.

The thread starts here...

@Paga announced investment in Ethiopian-based software development firm, Apposit for an undisclosed amount. The deal gave Paga full access to the expertise of Apposit’s engineers and technicians.

@AccessBank acquired Kenyan Based TNB for an undisclosed amount.

@LeapFrog III Insurance acquired 38.8% major equity stake in AIICO Insurance for N5.28bn. This was a move to boost the capital base of AIICO Insurance.

@Farmcrowdy acquired a majority stake in Best Foods for an undisclosed amount in its bid to explore the meat business.

@FieldIntelligence secured $3.6m in a Series A funding round led by Blue Haven Initiative, Sunu Capital, Accion Venture Lab and Imperial Venture Fund.

@UnitedCapital successfully raised a sum of N5.3bn in a Series 1 and 2 CP Issuance.

@DangoteCement also completed the Issuance of N100bn Series 1 Fixed Rate Senior Unsecured Bonds due in April 2025.

@ChipperCash secured $13.8m Series A funding from Deciens Capital, a US-based venture capital and private equity firm.

Energicity Corp closed a $3.25m seed investment led by Sustainability-focused venture capital fund and Ecosystem Integrity Fund.

Nigerian based e-commerce platform @TradeDepot raised $10m in a preSeries B equity round, led by Partech, IFC, We-Fi, and MSA Capital.

Nigeria’s JET Motor Company raised $9m funding after creating an electric vehicle.

Dangote Cement listed its N50bn Commercial Paper Notes in Series 17 & 18 under its N150bn CP Programme

Inq, a subsidiary of Convergence partners acquired 100% stakes of Vodacom operations in Nigeria, Côte d’Ivoire, and Zambia.

Heineken Brouwerijen B.V purchased additional 3.3m units of Nigerian Breweries shares.

Global fintech giant Stripe acquired Nigeria’s fintech startup, @Paystack in a deal worth $200m and the biggest M&A deal in Nigerian tech history.

@Kuda raised $10m funding led by Target Global alongside Entrée Capital and SBI Investment.

December 2020

@InfraCo Africa completed a $27m equity investment in Nigeria’s InfraCredit with the aim of growing the credit institution.

More from Economy

https://t.co/fa3GX9VnW0

Innocuous 1 sentence, but its a full economic theory at play.

Let me break it down for you. (1/n)

91 day TBills at 3.03%. Interest rates are even lower than RBI has them.

— Deepak Shenoy (@deepakshenoy) January 6, 2021

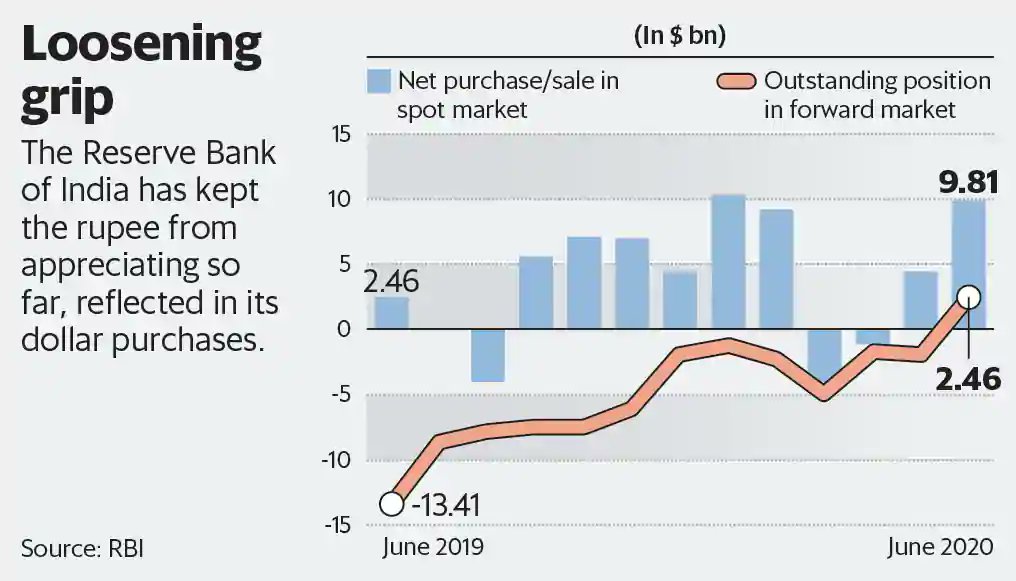

On September 30, 2020, I wrote an article for @CFASocietyIndia where I explained that RBI is all set to lose its ability to set interest rates if it continues to fiddle with the exchange rate (2/n)

What do I mean, "fiddle with the exchange rate"?

In essence, if RBI opts and continues to manage exchange rate, then that is "fiddling with the exchange rate"

RBI has done that in the past and has restarted it in 2020 - very explicitly. (3/n)

First in March 2020, it opened a Dollar/INR swap of $2B with far leg to be unwound in September 2020.

Implying INR will be bought from the open markets in order to prevent INR from falling vis a vis USD (4/n)

The Second aspect is now, that dollar inflow is happening, and the forex reserves swelled -> implying the rupee is appreciating, RBI again intervened from September, by selling INR in spot markets. (5/n)

https://t.co/9kpWP7ovyM

The first thing to understand is that energy is not globally fungible. Electricity decays as it leaves its point of origin; it’s expensive to transport. There is a huge excess (hydro) in many areas.

Let's discuss the environmental cost of bitcoin. Because despite all the push for sustainable and green investment in the tech sector, there's a giant smoldering Chernobyl sitting at the heart of Silicon Valley which a lot of investors would prefer you remain quiet about. \U0001f9f5 (1/)

— Stephen Diehl (@smdiehl) January 17, 2021

In other words, it can also be variable. It's estimated that in Sichuan there is twice as much electricity produced as is needed during the rainy season. Indeed, there is seasonality to how Bitcoin mining works. You can see here:

Bitcoin EXPORTS energy in this scenario. Fun fact, most industrial nations would steer this excess capacity towards refining aluminum by melting bauxite ore, which is very energy intensive.

You wouldn't argue that we are producing *too much* electricity from renewables, right?

"But what about the carbon footprint! ITS HUGE!"

Many previous estimates have quite faulty methods and don't take into account the actual energy sources. Is it fair to put a GHG equivalent on hydro or solar power? That would seem a bit disingenuous, no?

Well that's exactly what some have done.

You May Also Like

Like company moats, your personal moat should be a competitive advantage that is not only durable—it should also compound over time.

Characteristics of a personal moat below:

I'm increasingly interested in the idea of "personal moats" in the context of careers.

— Erik Torenberg (@eriktorenberg) November 22, 2018

Moats should be:

- Hard to learn and hard to do (but perhaps easier for you)

- Skills that are rare and valuable

- Legible

- Compounding over time

- Unique to your own talents & interests https://t.co/bB3k1YcH5b

2/ Like a company moat, you want to build career capital while you sleep.

As Andrew Chen noted:

People talk about \u201cpassive income\u201d a lot but not about \u201cpassive social capital\u201d or \u201cpassive networking\u201d or \u201cpassive knowledge gaining\u201d but that\u2019s what you can architect if you have a thing and it grows over time without intensive constant effort to sustain it

— Andrew Chen (@andrewchen) November 22, 2018

3/ You don’t want to build a competitive advantage that is fleeting or that will get commoditized

Things that might get commoditized over time (some longer than

Things that look like moats but likely aren\u2019t or may fade:

— Erik Torenberg (@eriktorenberg) November 22, 2018

- Proprietary networks

- Being something other than one of the best at any tournament style-game

- Many "awards"

- Twitter followers or general reach without "respect"

- Anything that depends on information asymmetry https://t.co/abjxesVIh9

4/ Before the arrival of recorded music, what used to be scarce was the actual music itself — required an in-person artist.

After recorded music, the music itself became abundant and what became scarce was curation, distribution, and self space.

5/ Similarly, in careers, what used to be (more) scarce were things like ideas, money, and exclusive relationships.

In the internet economy, what has become scarce are things like specific knowledge, rare & valuable skills, and great reputations.