PAKISTAN-INDIA WATER ISSUES – HOW INDIA STOPPED WATER IN PAKISTAN's CANALS IN 1948

Thread

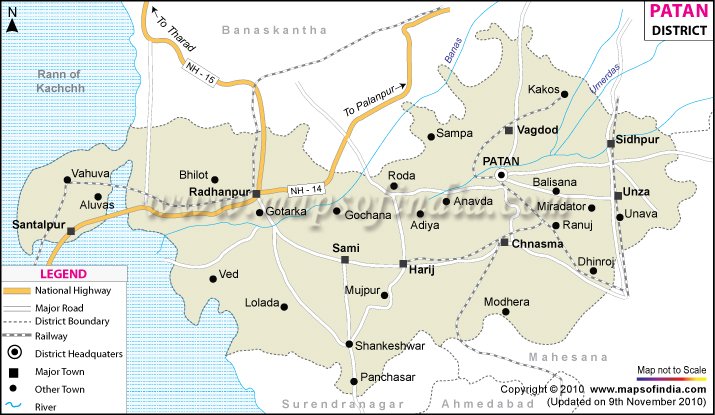

After partition in 1947, the water system was also bifurcated between Pakistan n India.

India cheated Pakistan when on April 1, 1948, India suddenly n without warning stopped...

1/n

...the supply of waters flowing into Pakistan's Central Bari Doab and Dipalpur Canals.

The boundary award on the partition of the sub-continent had left the headworks of these canals in Indian territory, and in accepting it India had implied her willingness to leave...

2/n

...the historic distribution of common waters undisturbed.

India's action was therefore in flagrant disregard not only of international law n morality, but of her solemn commitments with Pakistan and a gross violation of this country's historical rights over common waters.

3/n

Faced with a threat of utter desolation of millions of acres of fertile land, Pakistan had perforce to sign a document with India in which she agreed to "India's progressively diminishing water supplies to these canals and to the West Punjab government's tapping...

4/n

...alternative resources".

A specific reservation was made in the document with regard to India's claim that she had full property rights over waters flowing into her territory, and could therefore use them as she liked.

The issue was, however, to be examined...

5/n