Lot of comment on RBI becoming Pro Growth & keeping Inflation in back ground. Few Points to ponder.

- Inflation is being pushed on back burner globally. ECB moved from Inflation to Growth long back. US Fed has publicly stated to tolerate higher Inflation.

- Globally feature improvements is considered for Inflation. Feature enhanced product will be non inflationary despite price increases. We look at TV price irrespective of its transition from B & W to LCD.

From CPI angle it is excessively soft as Inflation is above RBI's target range.

More from Economy

You May Also Like

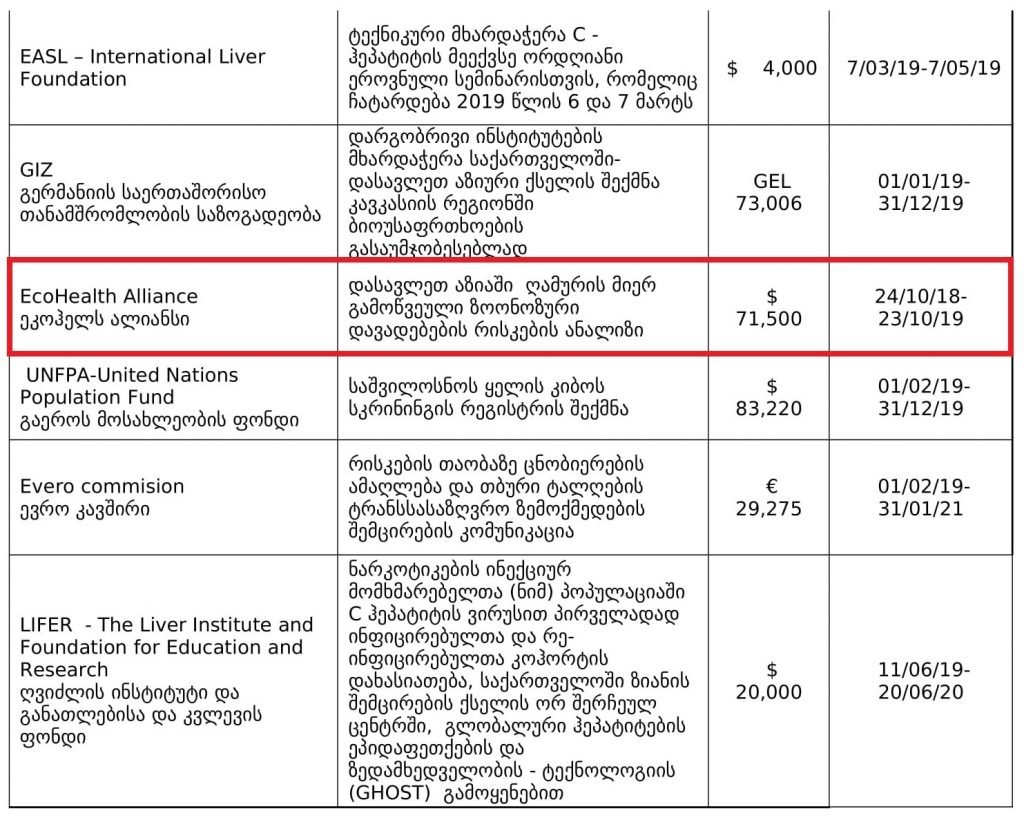

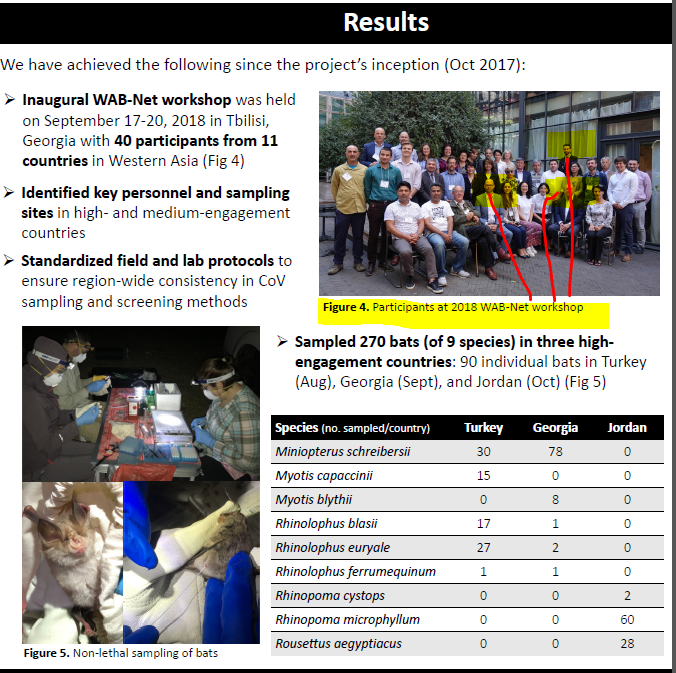

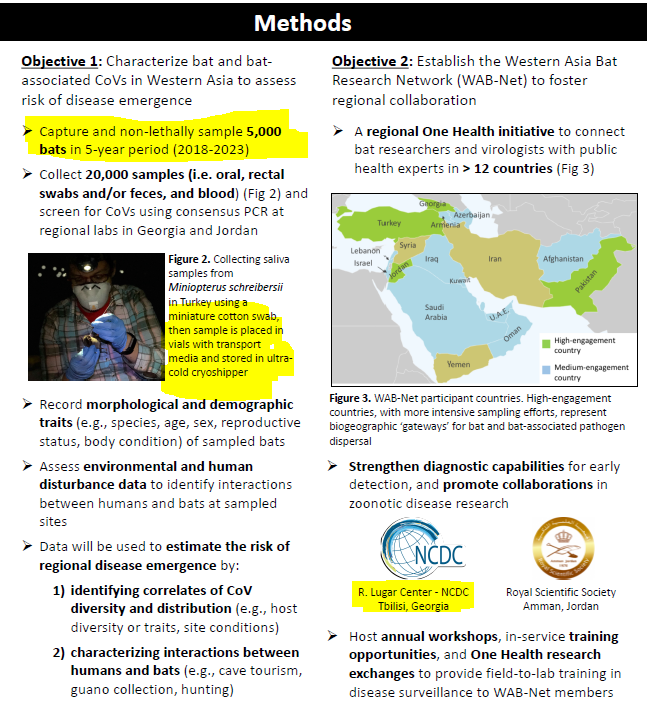

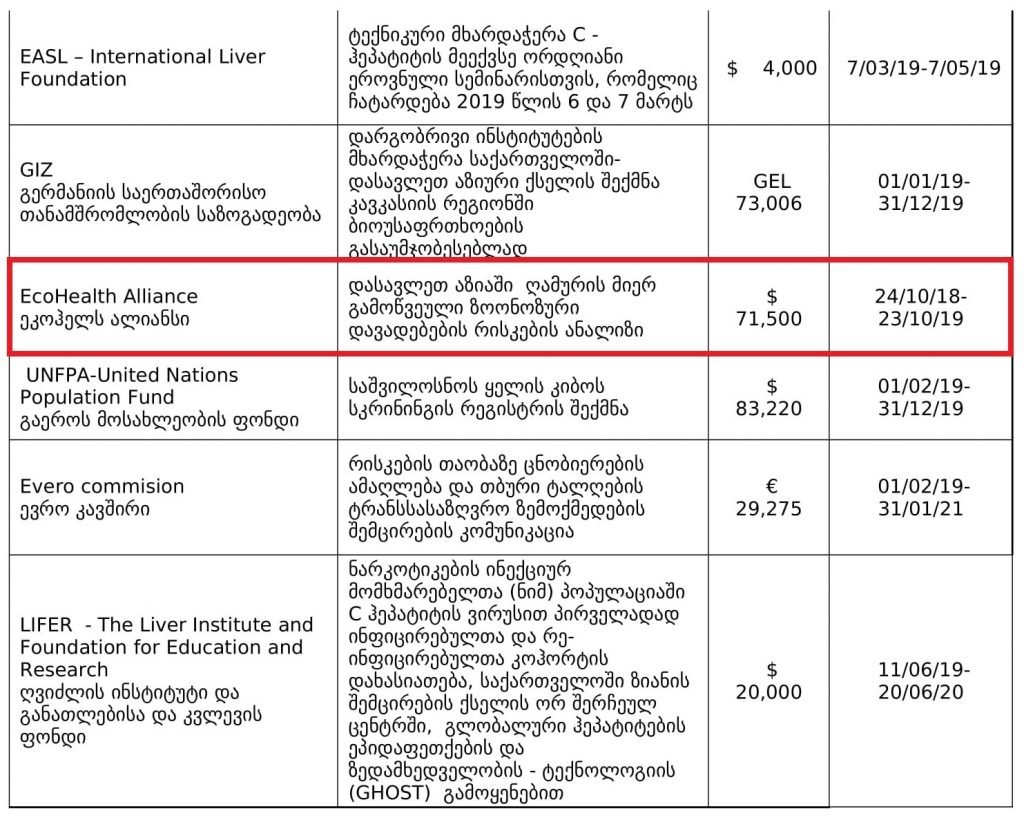

1. Project 1742 (EcoHealth/DTRA)

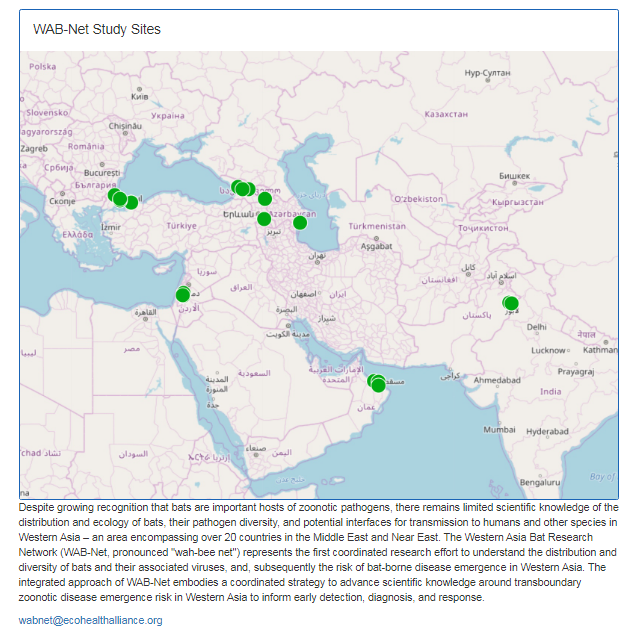

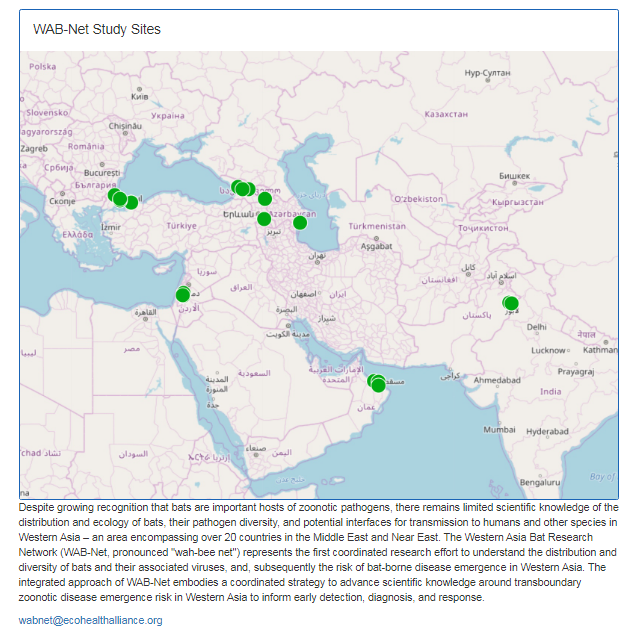

Risks of bat-borne zoonotic diseases in Western Asia

Duration: 24/10/2018-23 /10/2019

Funding: $71,500

@dgaytandzhieva

https://t.co/680CdD8uug

2. Bat Virus Database

Access to the database is limited only to those scientists participating in our ‘Bats and Coronaviruses’ project

Our intention is to eventually open up this database to the larger scientific community

https://t.co/mPn7b9HM48

3. EcoHealth Alliance & DTRA Asking for Trouble

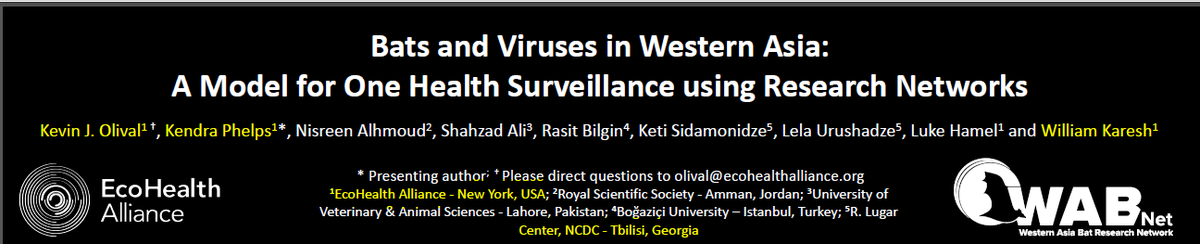

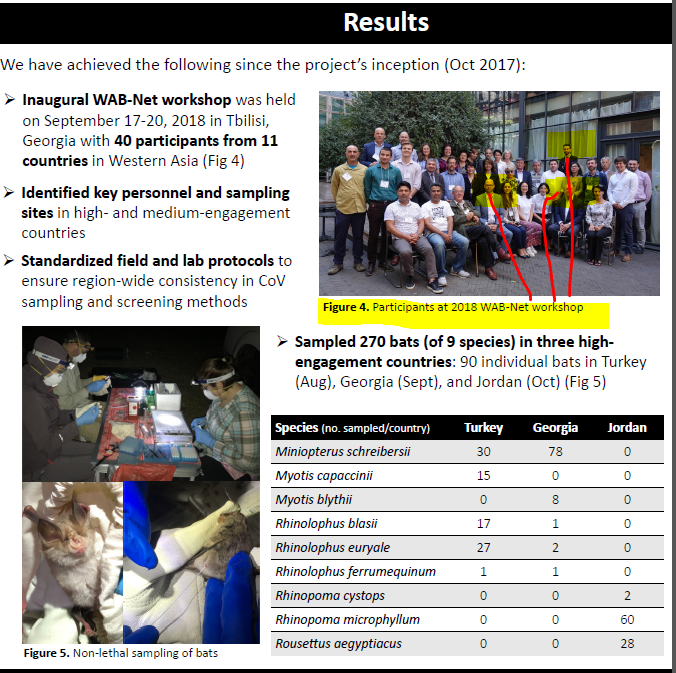

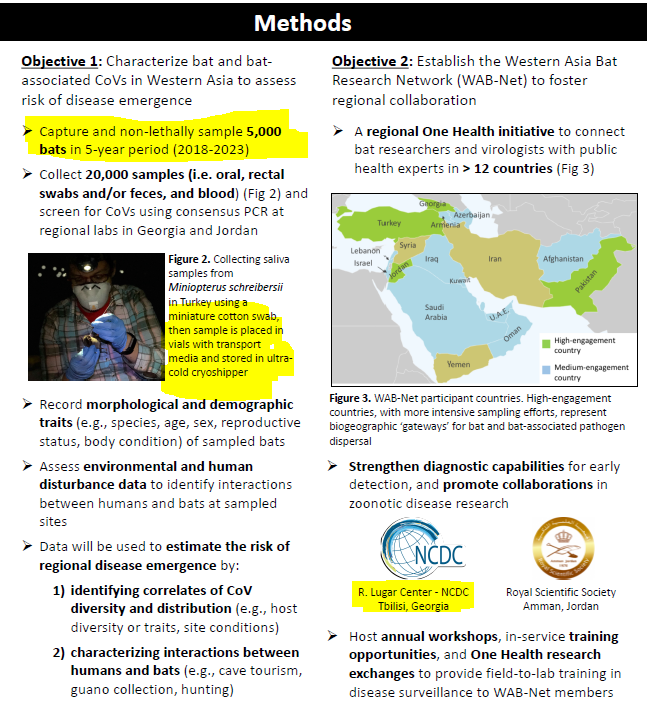

One Health research project focused on characterizing bat diversity, bat coronavirus diversity and the risk of bat-borne zoonotic disease emergence in the region.

https://t.co/u6aUeWBGEN

4. Phelps, Olival, Epstein, Karesh - EcoHealth/DTRA

5, Methods and Expected Outcomes

(Unexpected Outcome = New Coronavirus Pandemic)

Risks of bat-borne zoonotic diseases in Western Asia

Duration: 24/10/2018-23 /10/2019

Funding: $71,500

@dgaytandzhieva

https://t.co/680CdD8uug

2. Bat Virus Database

Access to the database is limited only to those scientists participating in our ‘Bats and Coronaviruses’ project

Our intention is to eventually open up this database to the larger scientific community

https://t.co/mPn7b9HM48

3. EcoHealth Alliance & DTRA Asking for Trouble

One Health research project focused on characterizing bat diversity, bat coronavirus diversity and the risk of bat-borne zoonotic disease emergence in the region.

https://t.co/u6aUeWBGEN

4. Phelps, Olival, Epstein, Karesh - EcoHealth/DTRA

5, Methods and Expected Outcomes

(Unexpected Outcome = New Coronavirus Pandemic)

Great article from @AsheSchow. I lived thru the 'Satanic Panic' of the 1980's/early 1990's asking myself "Has eveyrbody lost their GODDAMN MINDS?!"

The 3 big things that made the 1980's/early 1990's surreal for me.

1) Satanic Panic - satanism in the day cares ahhhh!

2) "Repressed memory" syndrome

3) Facilitated Communication [FC]

All 3 led to massive abuse.

"Therapists" -and I use the term to describe these quacks loosely - would hypnotize people & convince they they were 'reliving' past memories of Mom & Dad killing babies in Satanic rituals in the basement while they were growing up.

Other 'therapists' would badger kids until they invented stories about watching alligators eat babies dropped into a lake from a hot air balloon. Kids would deny anything happened for hours until the therapist 'broke through' and 'found' the 'truth'.

FC was a movement that started with the claim severely handicapped individuals were able to 'type' legible sentences & communicate if a 'helper' guided their hands over a keyboard.

For three years I have wanted to write an article on moral panics. I have collected anecdotes and similarities between today\u2019s moral panic and those of the past - particularly the Satanic Panic of the 80s.

— Ashe Schow (@AsheSchow) September 29, 2018

This is my finished product: https://t.co/otcM1uuUDk

The 3 big things that made the 1980's/early 1990's surreal for me.

1) Satanic Panic - satanism in the day cares ahhhh!

2) "Repressed memory" syndrome

3) Facilitated Communication [FC]

All 3 led to massive abuse.

"Therapists" -and I use the term to describe these quacks loosely - would hypnotize people & convince they they were 'reliving' past memories of Mom & Dad killing babies in Satanic rituals in the basement while they were growing up.

Other 'therapists' would badger kids until they invented stories about watching alligators eat babies dropped into a lake from a hot air balloon. Kids would deny anything happened for hours until the therapist 'broke through' and 'found' the 'truth'.

FC was a movement that started with the claim severely handicapped individuals were able to 'type' legible sentences & communicate if a 'helper' guided their hands over a keyboard.

I hate when I learn something new (to me) & stunning about the Jeff Epstein network (h/t MoodyKnowsNada.)

Where to begin?

So our new Secretary of State Anthony Blinken's stepfather, Samuel Pisar, was "longtime lawyer and confidant of...Robert Maxwell," Ghislaine Maxwell's Dad.

"Pisar was one of the last people to speak to Maxwell, by phone, probably an hour before the chairman of Mirror Group Newspapers fell off his luxury yacht the Lady Ghislaine on 5 November, 1991." https://t.co/DAEgchNyTP

OK, so that's just a coincidence. Moving on, Anthony Blinken "attended the prestigious Dalton School in New York City"...wait, what? https://t.co/DnE6AvHmJg

Dalton School...Dalton School...rings a

Oh that's right.

The dad of the U.S. Attorney General under both George W. Bush & Donald Trump, William Barr, was headmaster of the Dalton School.

Donald Barr was also quite a

I'm not going to even mention that Blinken's stepdad Sam Pisar's name was in Epstein's "black book."

Lots of names in that book. I mean, for example, Cuomo, Trump, Clinton, Prince Andrew, Bill Cosby, Woody Allen - all in that book, and their reputations are spotless.

Where to begin?

So our new Secretary of State Anthony Blinken's stepfather, Samuel Pisar, was "longtime lawyer and confidant of...Robert Maxwell," Ghislaine Maxwell's Dad.

"Pisar was one of the last people to speak to Maxwell, by phone, probably an hour before the chairman of Mirror Group Newspapers fell off his luxury yacht the Lady Ghislaine on 5 November, 1991." https://t.co/DAEgchNyTP

OK, so that's just a coincidence. Moving on, Anthony Blinken "attended the prestigious Dalton School in New York City"...wait, what? https://t.co/DnE6AvHmJg

Dalton School...Dalton School...rings a

Oh that's right.

The dad of the U.S. Attorney General under both George W. Bush & Donald Trump, William Barr, was headmaster of the Dalton School.

Donald Barr was also quite a

Donald Barr had a way with words. pic.twitter.com/JdRBwXPhJn

— Rudy Havenstein, listening to Nas all day. (@RudyHavenstein) September 17, 2020

I'm not going to even mention that Blinken's stepdad Sam Pisar's name was in Epstein's "black book."

Lots of names in that book. I mean, for example, Cuomo, Trump, Clinton, Prince Andrew, Bill Cosby, Woody Allen - all in that book, and their reputations are spotless.