I wrote about the exceptional opportunity in US NatGas about a week ago, and things are moving quickly...

Let’s do an update and go through some exciting developments. In short, the picture for NatGas continues to improve from all angles.

A thread.

Time for a thread about US NatGas and why it will surprise to the upside...

— BVDDY (@BvddyCorleone) October 22, 2020

There\u2019s an exceptional opportunity setting up in the energy space, in particular for US NatGas and related equities.

I\u2019ll explain the setup in this thread and also reveal my top pick. \U0001f920

More from Economy

On Jan 6, 2021, the always stellar Mr @deepakshenoy tweeted, this:

https://t.co/fa3GX9VnW0

Innocuous 1 sentence, but its a full economic theory at play.

Let me break it down for you. (1/n)

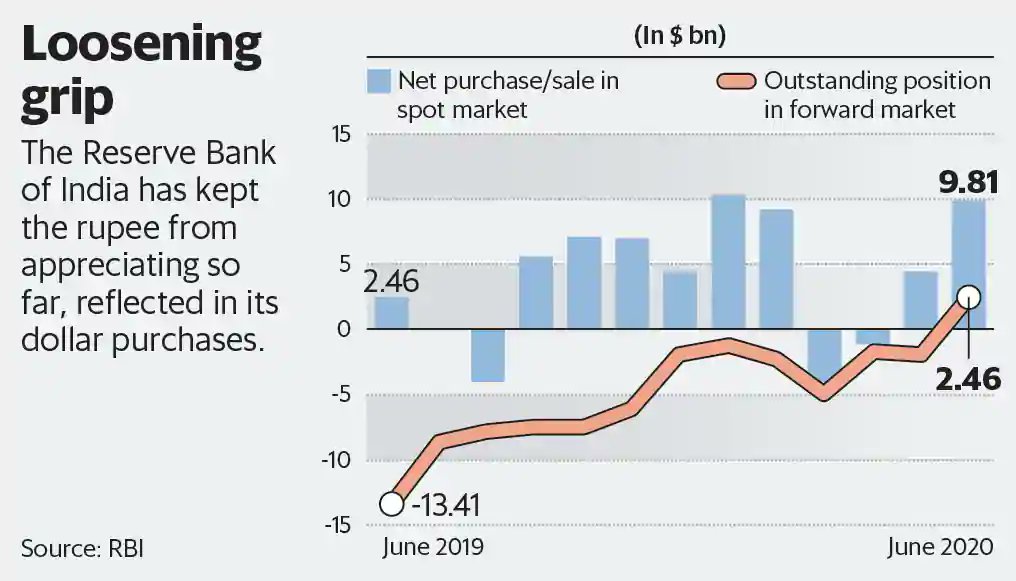

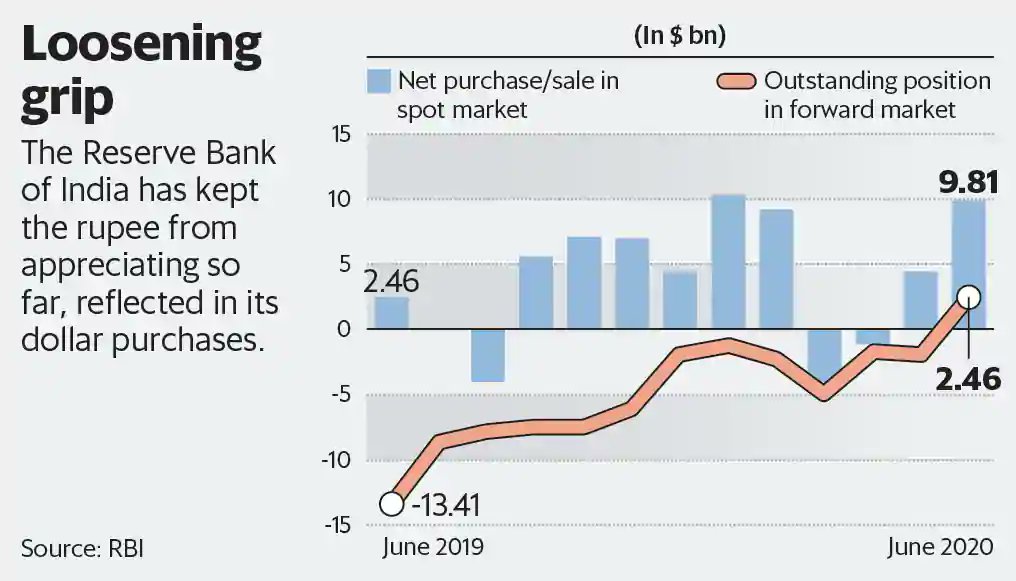

On September 30, 2020, I wrote an article for @CFASocietyIndia where I explained that RBI is all set to lose its ability to set interest rates if it continues to fiddle with the exchange rate (2/n)

What do I mean, "fiddle with the exchange rate"?

In essence, if RBI opts and continues to manage exchange rate, then that is "fiddling with the exchange rate"

RBI has done that in the past and has restarted it in 2020 - very explicitly. (3/n)

First in March 2020, it opened a Dollar/INR swap of $2B with far leg to be unwound in September 2020.

Implying INR will be bought from the open markets in order to prevent INR from falling vis a vis USD (4/n)

The Second aspect is now, that dollar inflow is happening, and the forex reserves swelled -> implying the rupee is appreciating, RBI again intervened from September, by selling INR in spot markets. (5/n)

https://t.co/9kpWP7ovyM

https://t.co/fa3GX9VnW0

Innocuous 1 sentence, but its a full economic theory at play.

Let me break it down for you. (1/n)

91 day TBills at 3.03%. Interest rates are even lower than RBI has them.

— Deepak Shenoy (@deepakshenoy) January 6, 2021

On September 30, 2020, I wrote an article for @CFASocietyIndia where I explained that RBI is all set to lose its ability to set interest rates if it continues to fiddle with the exchange rate (2/n)

What do I mean, "fiddle with the exchange rate"?

In essence, if RBI opts and continues to manage exchange rate, then that is "fiddling with the exchange rate"

RBI has done that in the past and has restarted it in 2020 - very explicitly. (3/n)

First in March 2020, it opened a Dollar/INR swap of $2B with far leg to be unwound in September 2020.

Implying INR will be bought from the open markets in order to prevent INR from falling vis a vis USD (4/n)

The Second aspect is now, that dollar inflow is happening, and the forex reserves swelled -> implying the rupee is appreciating, RBI again intervened from September, by selling INR in spot markets. (5/n)

https://t.co/9kpWP7ovyM

You May Also Like

I’m torn on how to approach the idea of luck. I’m the first to admit that I am one of the luckiest people on the planet. To be born into a prosperous American family in 1960 with smart parents is to start life on third base. The odds against my very existence are astronomical.

I’ve always felt that the luckiest people I know had a talent for recognizing circumstances, not of their own making, that were conducive to a favorable outcome and their ability to quickly take advantage of them.

In other words, dumb luck was just that, it required no awareness on the person’s part, whereas “smart” luck involved awareness followed by action before the circumstances changed.

So, was I “lucky” to be born when I was—nothing I had any control over—and that I came of age just as huge databases and computers were advancing to the point where I could use those tools to write “What Works on Wall Street?” Absolutely.

Was I lucky to start my stock market investments near the peak of interest rates which allowed me to spend the majority of my adult life in a falling rate environment? Yup.

Ironies of Luck https://t.co/5BPWGbAxFi

— Morgan Housel (@morganhousel) March 14, 2018

"Luck is the flip side of risk. They are mirrored cousins, driven by the same thing: You are one person in a 7 billion player game, and the accidental impact of other people\u2019s actions can be more consequential than your own."

I’ve always felt that the luckiest people I know had a talent for recognizing circumstances, not of their own making, that were conducive to a favorable outcome and their ability to quickly take advantage of them.

In other words, dumb luck was just that, it required no awareness on the person’s part, whereas “smart” luck involved awareness followed by action before the circumstances changed.

So, was I “lucky” to be born when I was—nothing I had any control over—and that I came of age just as huge databases and computers were advancing to the point where I could use those tools to write “What Works on Wall Street?” Absolutely.

Was I lucky to start my stock market investments near the peak of interest rates which allowed me to spend the majority of my adult life in a falling rate environment? Yup.