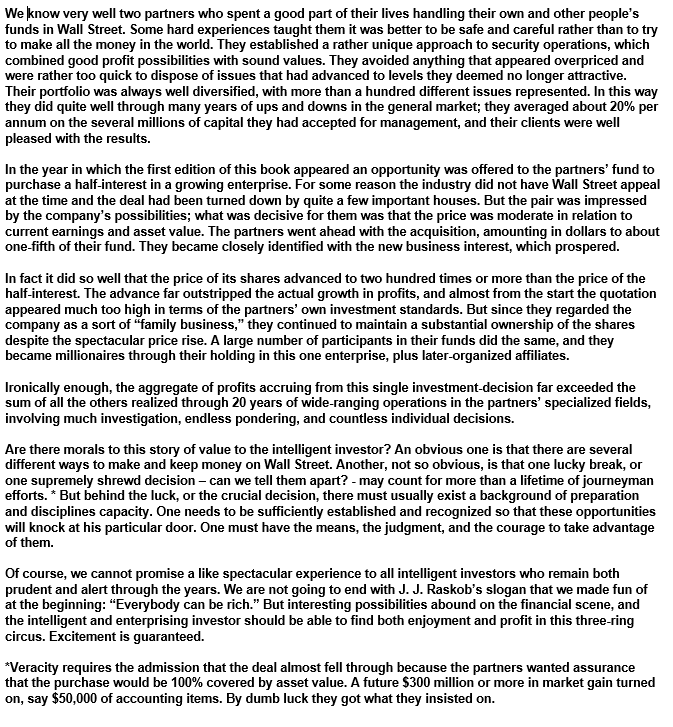

This investment did so well that the price of its shares advanced to two hundred times or more than the price of the half-interest by 1971/1972 2/

Ben Graham managed to compound money at 20%/year for 20 years at his partnership following a value investing strategy

In 1948 he acquired 50% stake in GEICO. It had to be distributed to his investors

They almost didn't make the investment due to some accounting questions 1/

This investment did so well that the price of its shares advanced to two hundred times or more than the price of the half-interest by 1971/1972 2/

An obvious one is that there are several different ways to make and keep money on Wall Street 4/

But behind the luck, or the crucial decision, there must usually exist a background of preparation and disciplines capacity. 5/

More from Dividend Growth Investor

More from Economy

Post-industrial towns, run-down suburbs, coastal communities - these places were already struggling before the crisis and have fared worst in the last year.

What should we do?

Today, @ukonward sets out the beginning of a plan to repair our social fabric. It follows our extensive research over the last year, expertly chaired by @jamesosh, and funded by @jrf_uk, @Shelter and @peoplesbiz.

https://t.co/d3T5uPwG9N

Before I get into recommendations, some findings from previous Onward research.

In 2018, we found 71% of people believe "community has declined in my lifetime"

In 2019, we found 65% would rather live in “a society that focuses on giving people more security” vs 35% for freedom

This was the basis for our identification of 'Workington Man' as the archetypal swing voter in 2019, and led us to predict (correctly) that large numbers of Red Wall seats could fall. A key driver was a desire for security, belonging and pride in place.

There is also a key regional dimension to this. We also tested people's affinity with the UK's direction of travel, across both cultural and economic dimensions - revealing the extraordinary spread below: London vs. the Rest.

https://t.co/HrorW4xaLp

You May Also Like

RT-PCR corona (test) scam

Symptomatic people are tested for one and only one respiratory virus. This means that other acute respiratory infections are reclassified as

4/10

— Dr. Thomas Binder, MD (@Thomas_Binder) October 22, 2020

...indication, first of all that testing for a (single) respiratory virus is done outside of surveillance systems or need for specific therapy, but even so the lack of consideration of Ct, symptoms and clinical findings when interpreting its result. https://t.co/gHH6kwRdZG

2/12

It is tested exquisitely with a hypersensitive non-specific RT-PCR test / Ct >35 (>30 is nonsense, >35 is madness), without considering Ct and clinical context. This means that more acute respiratory infections are reclassified as

6/10

— Dr. Thomas Binder, MD (@Thomas_Binder) October 22, 2020

The neither validated nor standardised hypersensitive RT-PCR test / Ct 35-45 for SARS-CoV-2 is abused to mislabel (also) other diseases, especially influenza, as COVID-19.https://t.co/AkFIfTCTkS

3/12

The Drosten RT-PCR test is fabricated in a way that each country and laboratory perform it differently at too high Ct and that the high rate of false positives increases massively due to cross-reaction with other (corona) viruses in the "flu

External peer review of the RTPCR test to detect SARS-CoV-2 reveals 10 major scientific flaws at the molecular and methodological level: consequences for false positive results.https://t.co/mbNY8bdw1p pic.twitter.com/OQBD4grMth

— Dr. Thomas Binder, MD (@Thomas_Binder) November 29, 2020

4/12

Even asymptomatic, previously called healthy, people are tested (en masse) in this way, although there is no epidemiologically relevant asymptomatic transmission. This means that even healthy people are declared as COVID

Thread web\u2b06\ufe0f\u2b07\ufe0f

— Dr. Thomas Binder, MD (@Thomas_Binder) December 16, 2020

The fabrication of the "asymptomatic (super) spreader" is the coronation of the total nons(ci)ense in the belief system of #CoronasWitnesses.

Asymptomatic transmission 0.7%; 95% CI 0%-4.9% - could well be 0%!https://t.co/VeZTzxXfvT

5/12

Deaths within 28 days after a positive RT-PCR test from whatever cause are designated as deaths WITH COVID. This means that other causes of death are reclassified as

8/8

— Dr. Thomas Binder, MD (@Thomas_Binder) March 24, 2020

By the way, who the f*** created this obviously (almost) worldwide definition of #CoronaDeath?

This is not only medical malpractice, this is utterly insane!https://t.co/FFsTx4L2mw