In his book, Big Debt Crises, Dalio studied more than 48 debt crises that have occurred throughout history.

Ray Dalio understands the macro environment as well as anyone.

While most investment managers were down big during the Great Financial Crisis, Dalio’s fund was up 8.7% in 2008.

Here is how Dalio views our global economy today:

In his book, Big Debt Crises, Dalio studied more than 48 debt crises that have occurred throughout history.

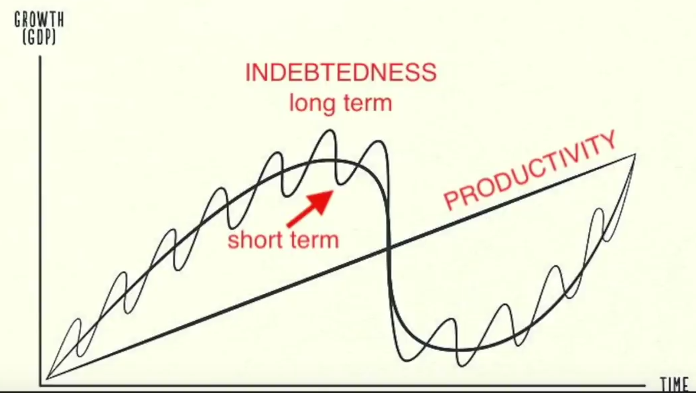

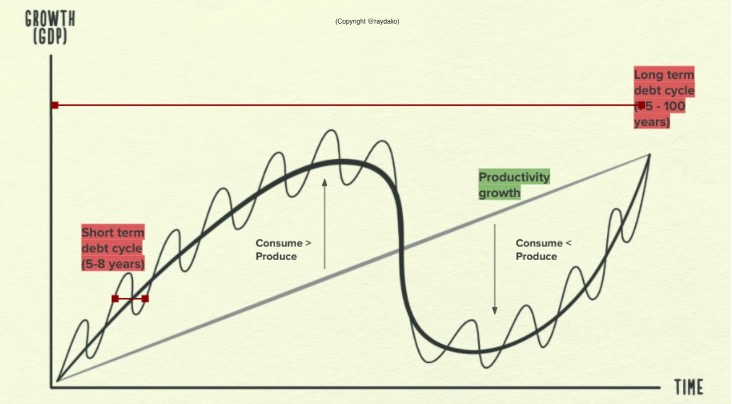

• Productivity Growth

• The Short-Term Debt Cycle

• The Long-Term Debt Cycle

In the long run, the economy is primarily driven by productivity

In the short run, the economy is primarily driven by credit and debt

Dalio defines credit as the giving of buying power.

The buying power is given to the borrower in exchange for a promise to pay it back, which is debt.

It’s especially good when credit is used by individuals and businesses to expand the production of the overall economy.

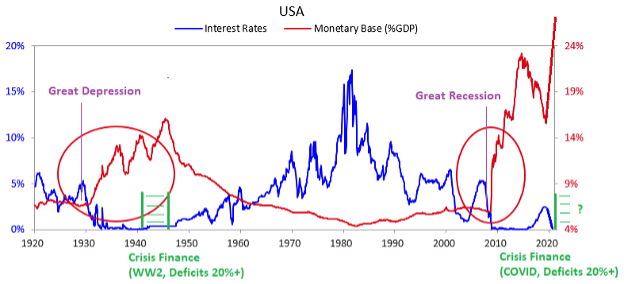

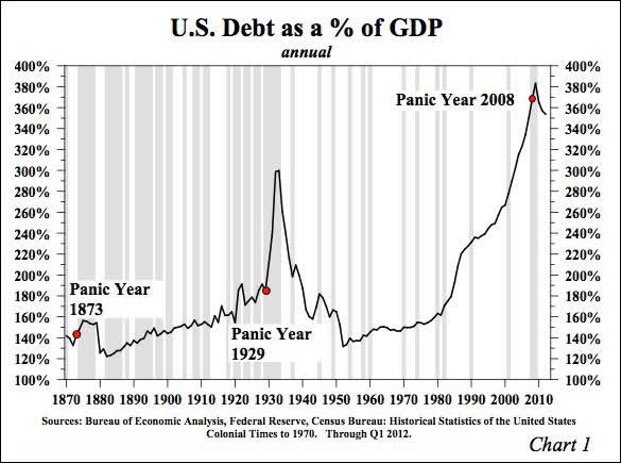

Dalio warns that throughout history, most countries eventually run into debt crises because policymakers generally err on the side of being too loose with credit.

In order to pay that back, that person will need to spend less than they make at some point in the future.

More credit ➡️ more spending ➡️ higher incomes ➡️ higher asset prices 🔁

Less credit ➡️ less spending ➡️ lower incomes ➡️ lower asset prices 🔁

Credit exacerbates the natural boom/bust cycle.

The short-term debt cycle, widely known as the business cycle, occurs roughly every 5-8 years.

Interest rates are a key driver in debt accumulation, as cheap money incentivizes individuals, companies, and countries to take on debt at artificially low-interest rates.

• Austerity (spending less)

• Debt defaults/restructurings

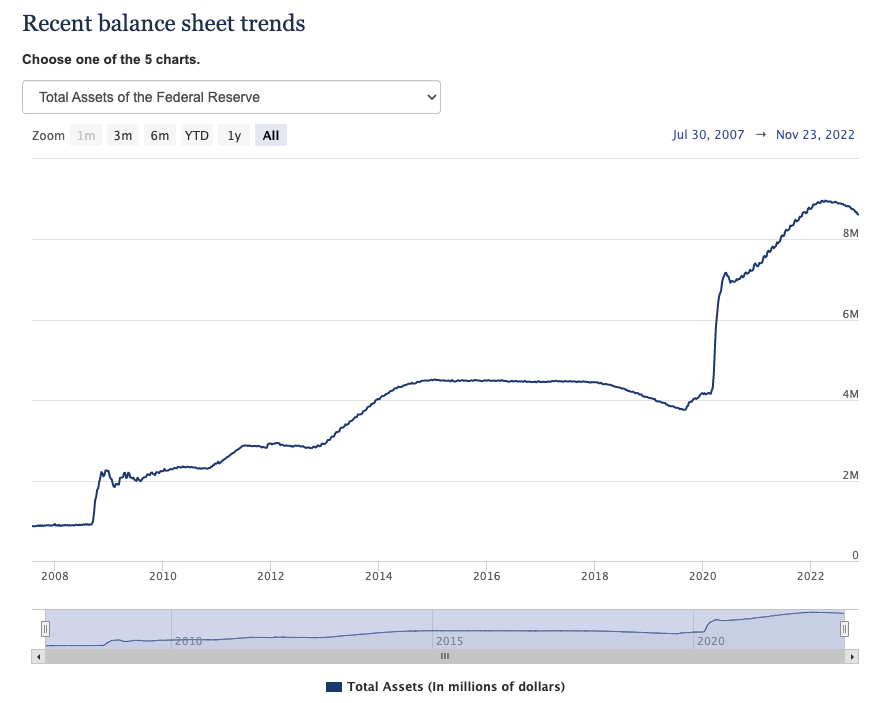

• The central bank printing money

• Wealth redistribution

It’s the easiest way out and the most effective tool relative to the other options.

This has been the Fed’s playbook since the GFC.

Going forward, I expect:

• The Federal Reserve funds US government deficits, leading to continued currency devaluation relative to real goods and services.

• Artificially low-interest rates with negative real rates.

Here’s Dalio explaining why:

• Have a solid emergency fund

• Live within your means

• Eliminate unnecessary debts

• Own a diversified portfolio

• Own quality, cash flow positive companies

Focus on what you can control.

https://t.co/8zDSOeubbi

Ray Dalio understands the macro environment as well as anyone.

— Clay Finck (@Clay_Finck) November 29, 2022

While most investment managers were down big during the Great Financial Crisis, Dalio\u2019s fund was up 8.7% in 2008.

Here is how Dalio views our global economy today: pic.twitter.com/rXFusmWVrk

You May Also Like

Department List of UCAS-China PROFESSORs for ANSO, CSC and UCAS (fully or partial) Scholarship Acceptance

1) UCAS School of physical sciences Professor

https://t.co/9X8OheIvRw

2) UCAS School of mathematical sciences Professor

3) UCAS School of nuclear sciences and technology

https://t.co/nQH8JnewcJ

4) UCAS School of astronomy and space sciences

https://t.co/7Ikc6CuKHZ

5) UCAS School of engineering

6) Geotechnical Engineering Teaching and Research Office

https://t.co/jBCJW7UKlQ

7) Multi-scale Mechanics Teaching and Research Section

https://t.co/eqfQnX1LEQ

😎 Microgravity Science Teaching and Research

9) High temperature gas dynamics teaching and research section

https://t.co/tVIdKgTPl3

10) Department of Biomechanics and Medical Engineering

https://t.co/ubW4xhZY2R

11) Ocean Engineering Teaching and Research

12) Department of Dynamics and Advanced Manufacturing

https://t.co/42BKXEugGv

13) Refrigeration and Cryogenic Engineering Teaching and Research Office

https://t.co/pZdUXFTvw3

14) Power Machinery and Engineering Teaching and Research

1) UCAS School of physical sciences Professor

https://t.co/9X8OheIvRw

2) UCAS School of mathematical sciences Professor

3) UCAS School of nuclear sciences and technology

https://t.co/nQH8JnewcJ

4) UCAS School of astronomy and space sciences

https://t.co/7Ikc6CuKHZ

5) UCAS School of engineering

6) Geotechnical Engineering Teaching and Research Office

https://t.co/jBCJW7UKlQ

7) Multi-scale Mechanics Teaching and Research Section

https://t.co/eqfQnX1LEQ

😎 Microgravity Science Teaching and Research

9) High temperature gas dynamics teaching and research section

https://t.co/tVIdKgTPl3

10) Department of Biomechanics and Medical Engineering

https://t.co/ubW4xhZY2R

11) Ocean Engineering Teaching and Research

12) Department of Dynamics and Advanced Manufacturing

https://t.co/42BKXEugGv

13) Refrigeration and Cryogenic Engineering Teaching and Research Office

https://t.co/pZdUXFTvw3

14) Power Machinery and Engineering Teaching and Research

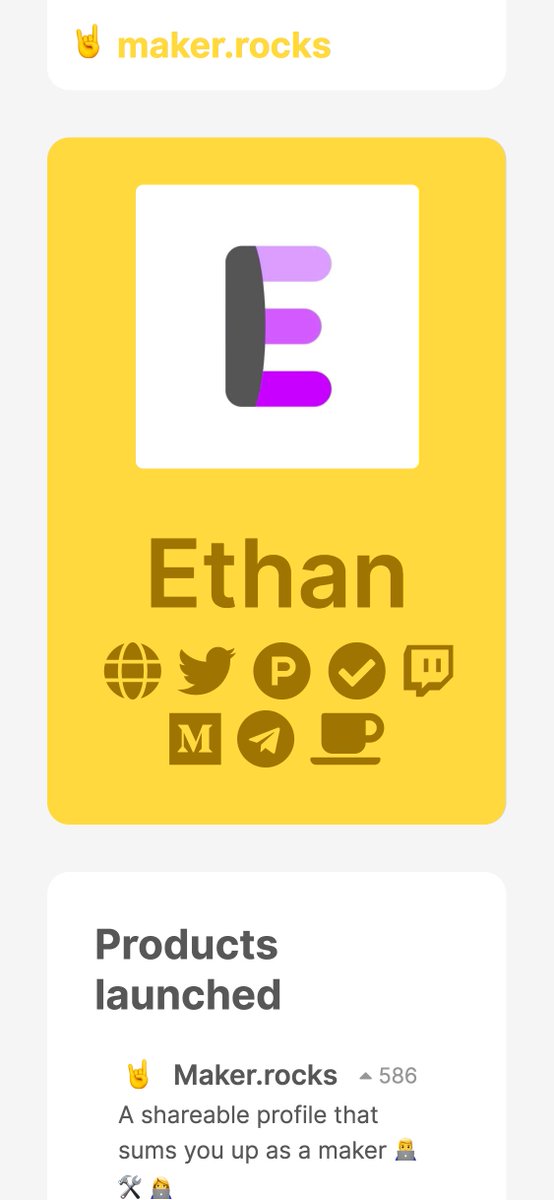

First update to https://t.co/lDdqjtKTZL since the challenge ended – Medium links!! Go add your Medium profile now 👀📝 (thanks @diannamallen for the suggestion 😁)

Just added Telegram links to https://t.co/lDdqjtKTZL too! Now you can provide a nice easy way for people to message you :)

Less than 1 hour since I started adding stuff to https://t.co/lDdqjtKTZL again, and profile pages are now responsive!!! 🥳 Check it out -> https://t.co/fVkEL4fu0L

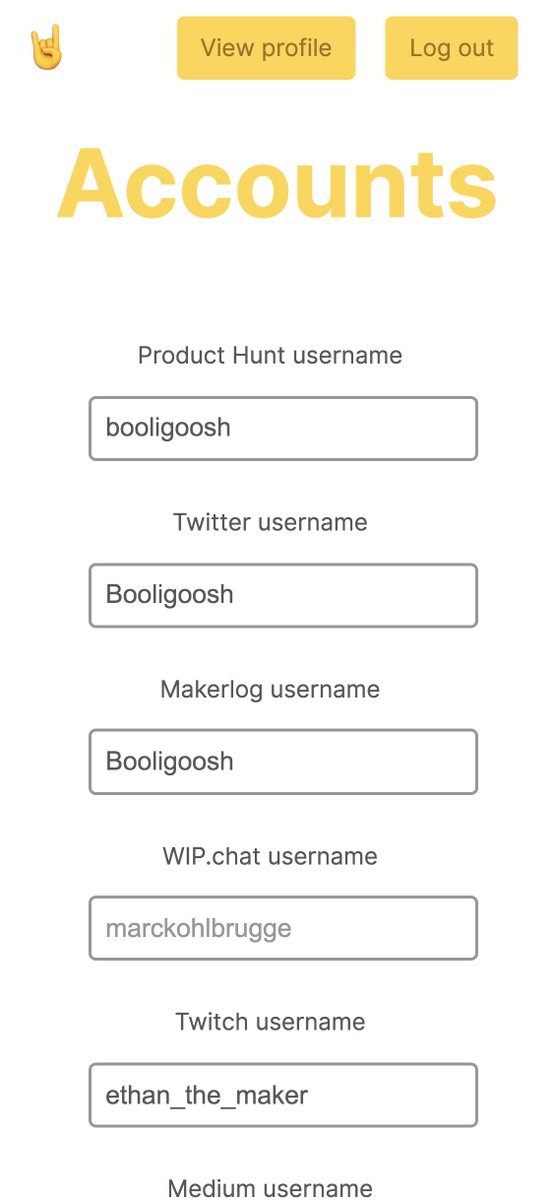

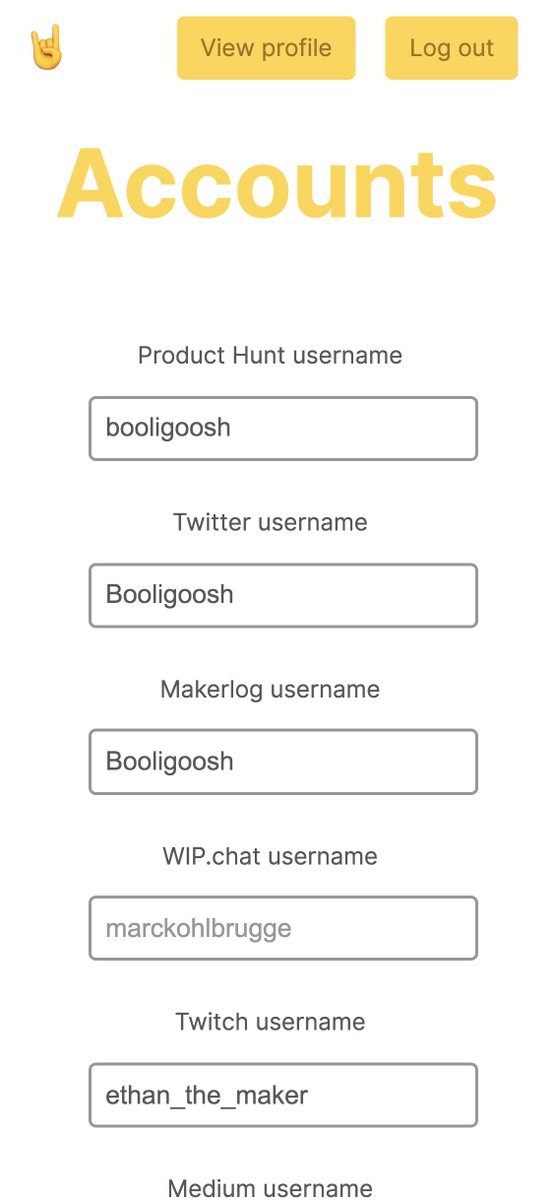

Accounts page is now also responsive!! 📱✨

💪 I managed to make the whole site responsive in about an hour. On my roadmap I had it down as 4-5 hours!!! 🤘🤠🤘

Just added Telegram links to https://t.co/lDdqjtKTZL too! Now you can provide a nice easy way for people to message you :)

Less than 1 hour since I started adding stuff to https://t.co/lDdqjtKTZL again, and profile pages are now responsive!!! 🥳 Check it out -> https://t.co/fVkEL4fu0L

Accounts page is now also responsive!! 📱✨

💪 I managed to make the whole site responsive in about an hour. On my roadmap I had it down as 4-5 hours!!! 🤘🤠🤘