it seems dumb, and almost counter-intuitive to approach such a complex game like trading with such a simple approach like shapes...but maybe when markets start acting stupid its okay to dumb down our approach.

TRIANGLE MASTERCLASS - a thread.

what's the simplest, most effective method of trading a market that trends as hard as cryptocurrencies?

trendlines.

one trendline on its own is strong, but when you put two together you quickly realize just how powerful this simple tool can be.

it seems dumb, and almost counter-intuitive to approach such a complex game like trading with such a simple approach like shapes...but maybe when markets start acting stupid its okay to dumb down our approach.

anybody can draw some lines on a chart any way they'd like. sometimes, we let our bias affect our charts rather than the other way around.

i personally have done this more times than i can count.

you want a fluid bias that can change easily, rather than one relying on 10 steps of conflicting confirmation before entering a new trade

i mean, how much simpler can it be than "above this line bullish, below this line bearish" ? 😂

one trendline on its own can be enough to make a good trade, but when you put two together it can turn a good trade into a great one.

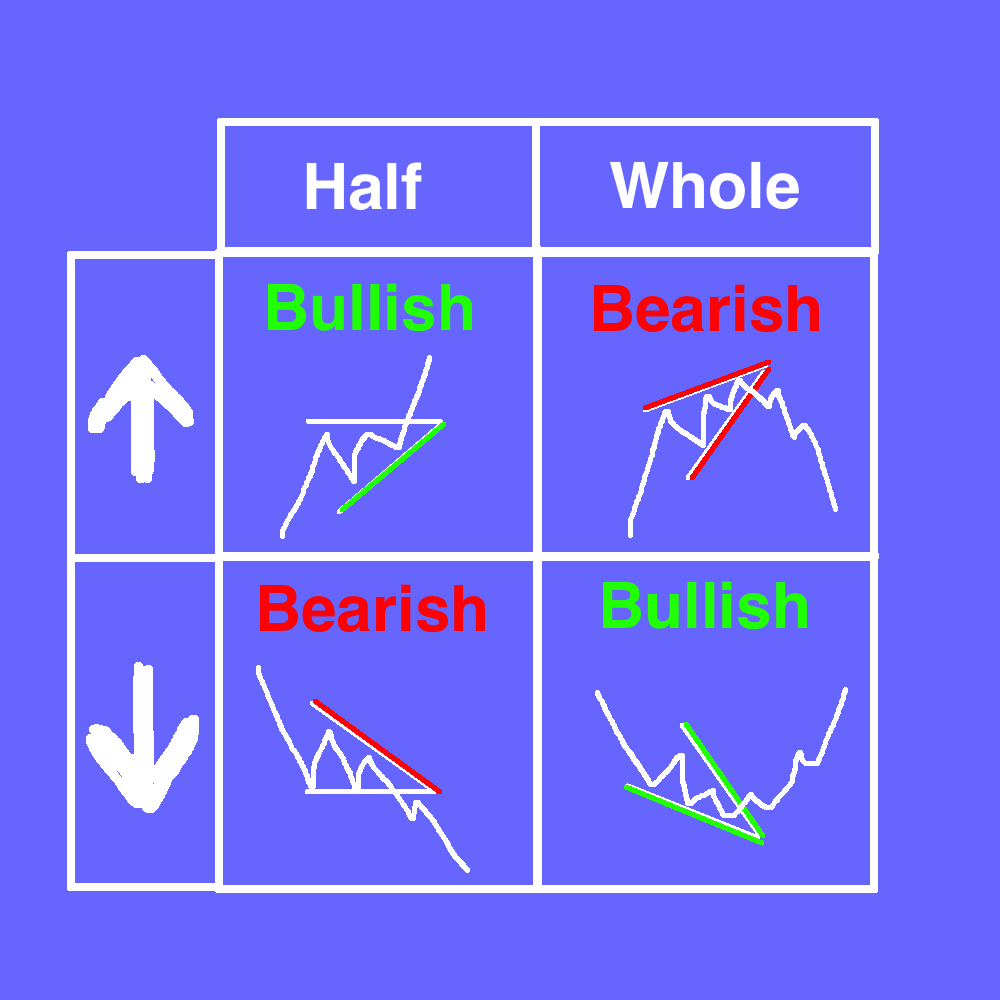

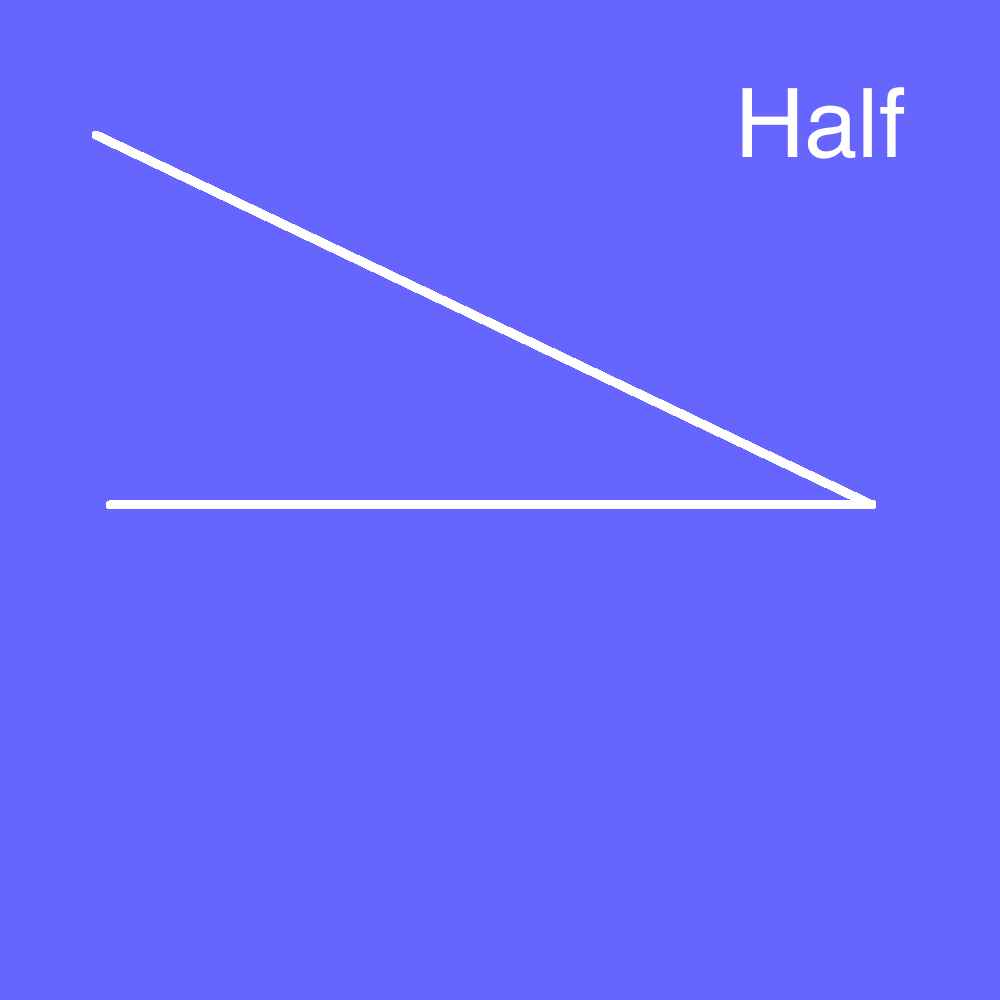

two types: halves and wholes

two directions: up and down

why are they called halves?

well...simply because they're halves of wholes.

it then becomes very simple as the direction of the side thats not flat dictates if you're bullish or bearish.

trendline up = bullish ... trendline down = bearish

it's that simple.

wholes are interesting because with halves, your trendline dictates that price will *CONTINUE* in that direction...

while with wholes your trendlines actually dictate that price will *REVERSE*

well...that wouldn't be true in every market environment.

but when you're participating in a market that trends as hard as crypto is right now...it certainly can be

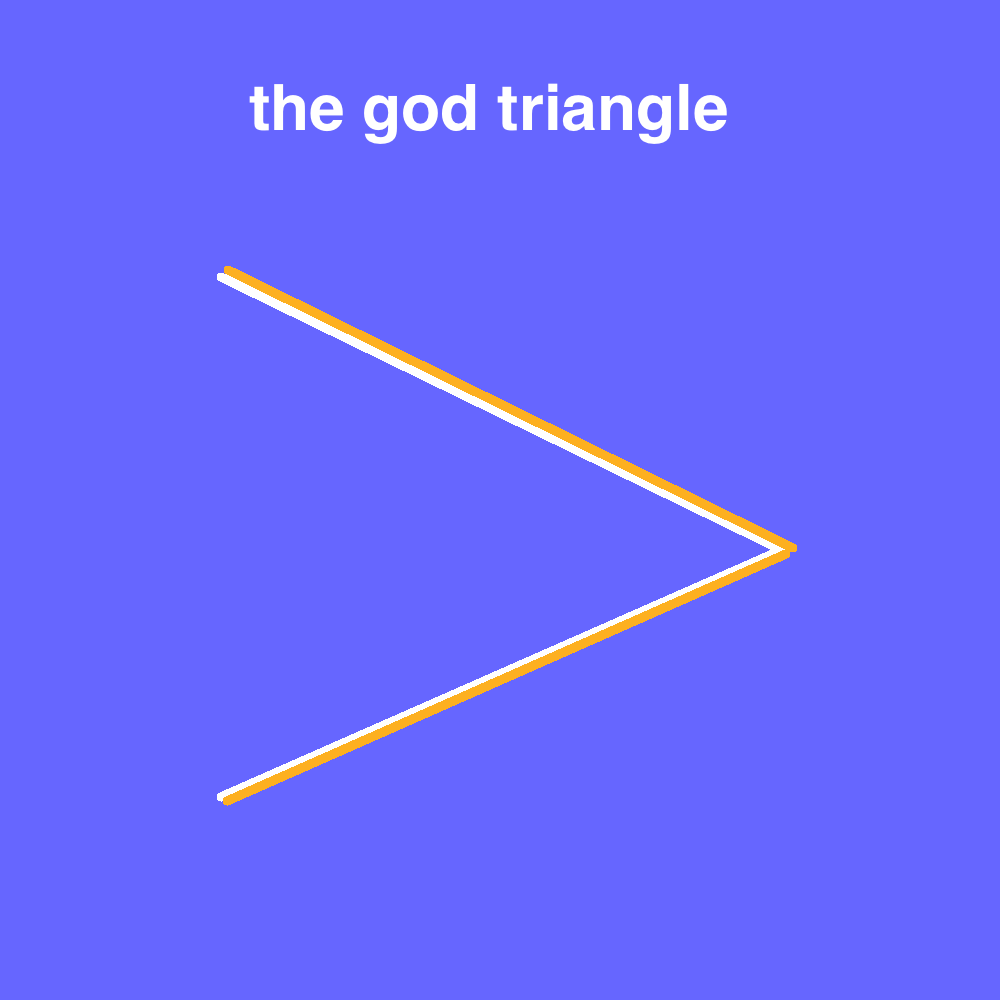

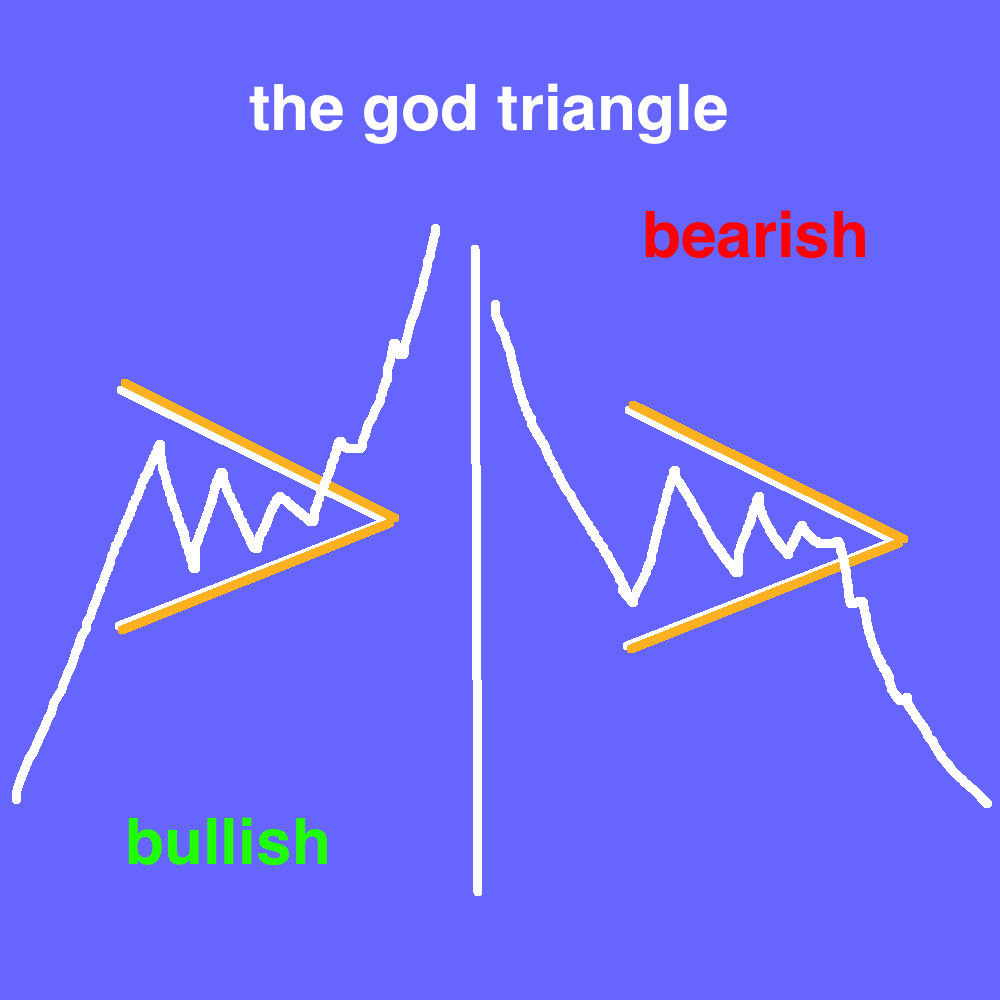

the god triangle.

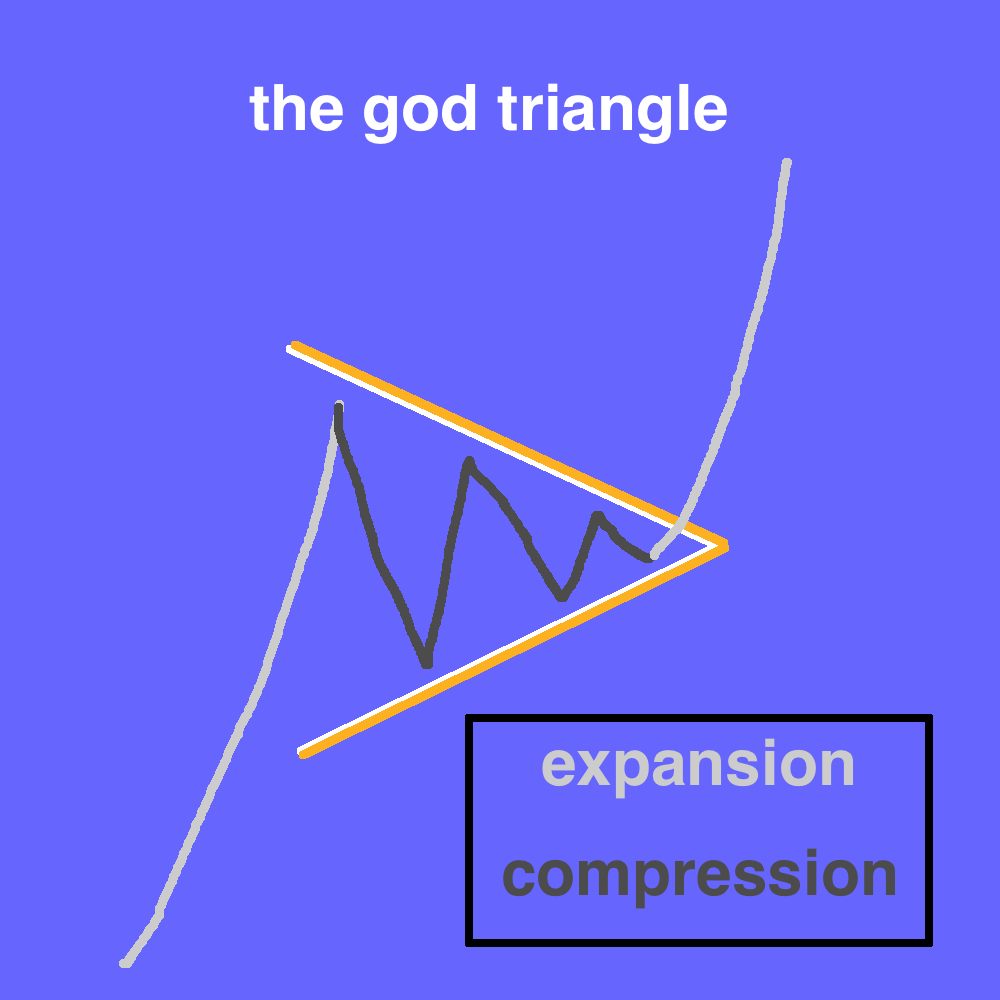

the way way that price cycles, momentum does as well.

coins rally, then they cool off, and then they either rally more or reverse.

it represents a continuation in trend.

so if price was going *up* into the triangle, its bullish

if price was going *down* into the triangle, its bearish

within the triangle, price is compressing.

remember price goes up, then stalls, then either keeps going up or reverses.

expansion -> compression -> expansion

you place your stoploss either below the trendline...or below the previous low that was set within the triangle

this is how you give yourself high hit-rate, high R/R plays.

the god triangle gives you the best of both worlds.

for more trading tips & tutorials join the nearly 5,000 others learning today!

https://t.co/DFOPJPdZKd

More from Crypto

We should be proud about @0xPolygon. But don't invest if you don't understand what they do just like any other asset class.

Should you invest in Polygon (Matic)?

— LearnApp (@LearnApp_co) June 12, 2021

\U0001f4a1 Here's @PrateekLearnapp's take on #Matic, as shared on @CNBCTV18News.

What are your thoughts on #Polygon (Matic)? \U0001f4ac

Read the full article here \U0001f449 https://t.co/rmLTV0WFo2#crypto #cryptocurrencies pic.twitter.com/9k1lclN7oL

1/ Welcome to #DeFi Wednesday.

Let's talk about how interest-bearing cash on a blockchain is going to revolutionise boring corporate treasury management that concerns every company is is a larger business than all crypto trading in the world.

Enter the thread

👇👇👇

2/ Blockchain community is often seen as toxic maxis and redditors who shill other their weekly favourite shitcoin in the hope of getting Lambo.

Sometimes we also do things that progress humanity towards the better future and interest-bearing cash is one of those things.

3/ Less chad and more things that actually matter:

My incomplete theory of interest-bearing cash is also available also as a blog post:

https://t.co/uiG0fZiVyu

It is 15 pages. Pick your slow poison or die fast by continue reading here.

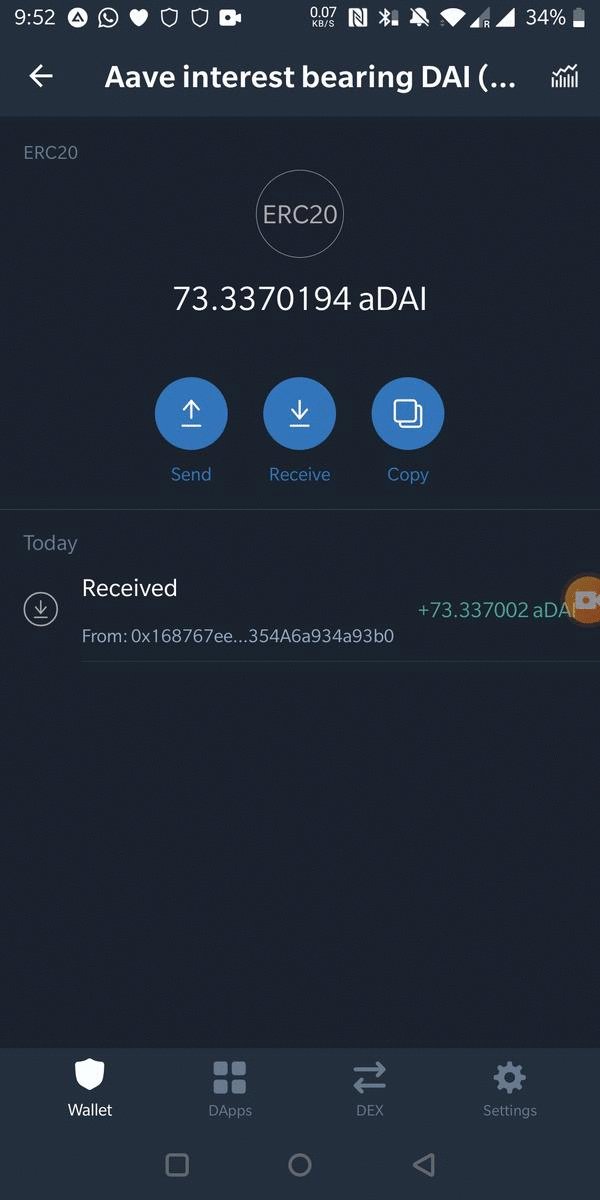

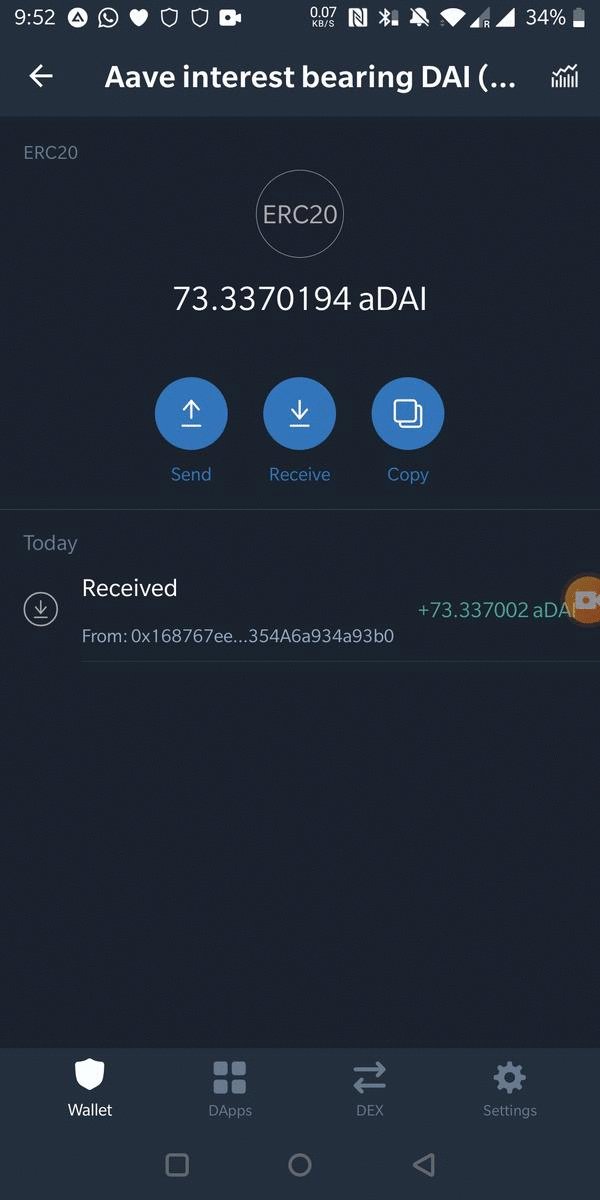

4/ First time in the history we have an ability to create interest-bearing cash-like instruments.

Interest-bearing cash ticks up dollar (euro) balance real-time in your wallet.

Here is a demonstration using @aaveaave aDAI, based on @makerdao DAI, and @TrustWalletApp

5/ Interest-bearing cash is not like your bank's saving account. Your money in a bank is not yours, but bank's. There are some flaws in the current banking system causing a headache for Chief Financial Officers (CFOs)

Let's talk about how interest-bearing cash on a blockchain is going to revolutionise boring corporate treasury management that concerns every company is is a larger business than all crypto trading in the world.

Enter the thread

👇👇👇

2/ Blockchain community is often seen as toxic maxis and redditors who shill other their weekly favourite shitcoin in the hope of getting Lambo.

Sometimes we also do things that progress humanity towards the better future and interest-bearing cash is one of those things.

3/ Less chad and more things that actually matter:

My incomplete theory of interest-bearing cash is also available also as a blog post:

https://t.co/uiG0fZiVyu

It is 15 pages. Pick your slow poison or die fast by continue reading here.

4/ First time in the history we have an ability to create interest-bearing cash-like instruments.

Interest-bearing cash ticks up dollar (euro) balance real-time in your wallet.

Here is a demonstration using @aaveaave aDAI, based on @makerdao DAI, and @TrustWalletApp

5/ Interest-bearing cash is not like your bank's saving account. Your money in a bank is not yours, but bank's. There are some flaws in the current banking system causing a headache for Chief Financial Officers (CFOs)

1/ @MIT discussing the need for blockchain gateways to achieve interoperability across different blockchain networks, and to support the cross-blockchain mobility of virtual assets

https://t.co/PbjQkSlTT3

@quant_network are collaborating with MIT in the creation of ODAP

$QNT

2/ "In order for blockchain-based services to scale globally, blockchain networks must be able to interoperate with one another following a standardized protocol and interfaces (APIs)"

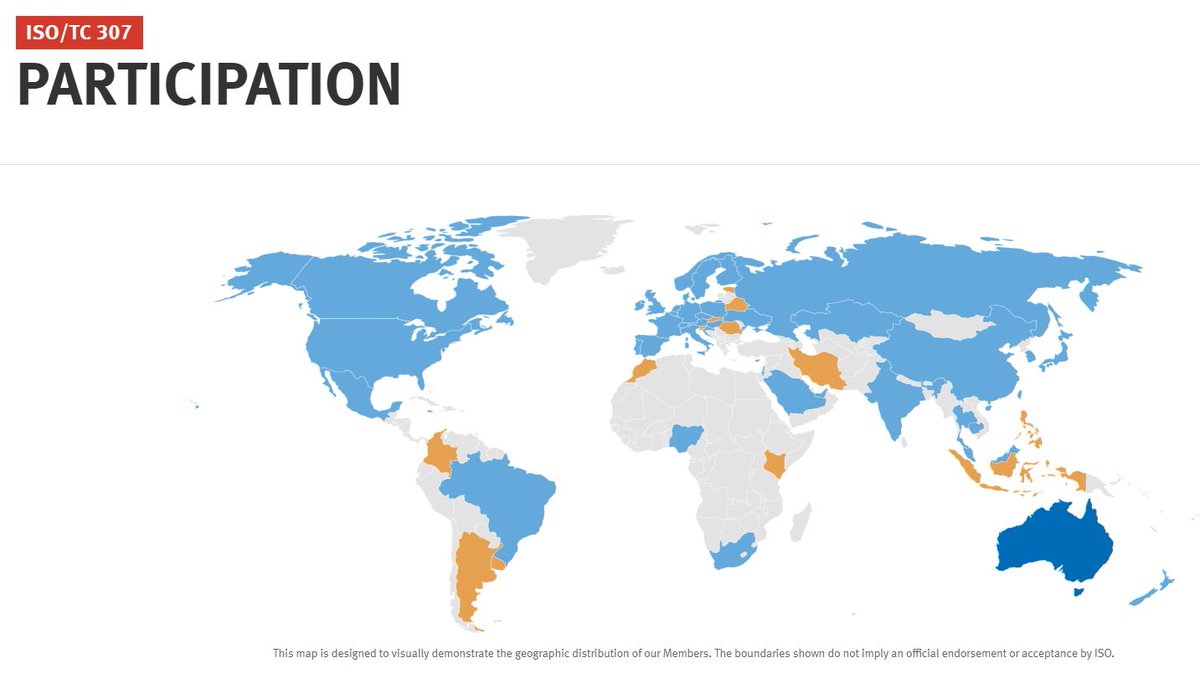

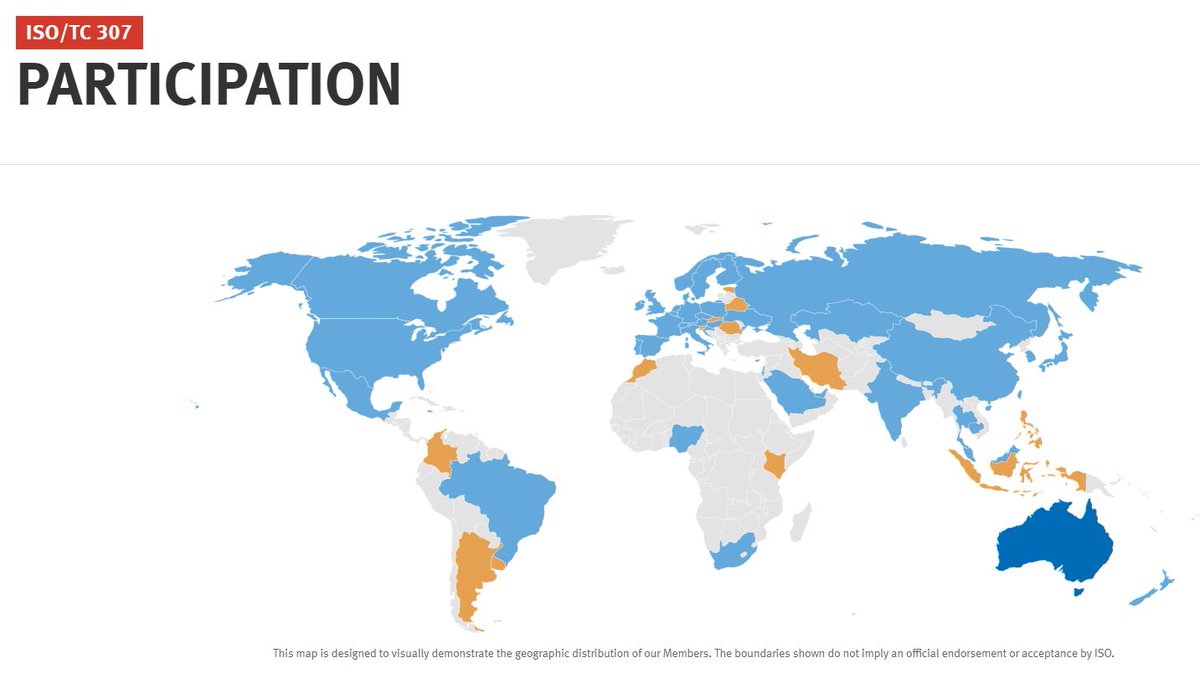

Gilbert founded ISO TC307 which 60 countries are working towards standardizing the interfaces

3/ "We believe that a blockchain gateway is needed for blockchain networks to interoperate in a manner similar

to border gateway routers in IP networks. Just as border gateway routers use the BGPv4 protocol to interact with one another in a peered fashion we believe that a...

4/ blockchain gateway protocol will be needed to permit the movement of virtual assets and related information across blockchain networks in a secure and privacy-preserving manner"

You can read more about the gateway protocol ODAP in this 21 tweet

5/

"We motivate the need for blockchain gateways and blockchain gateway protocols in the following summary:

✅Enables blockchain interoperability:

Blockchain gateways provide an interface for the interoperability between blockchain/DLT systems that operate distinct consensus...

https://t.co/PbjQkSlTT3

@quant_network are collaborating with MIT in the creation of ODAP

$QNT

2/ "In order for blockchain-based services to scale globally, blockchain networks must be able to interoperate with one another following a standardized protocol and interfaces (APIs)"

Gilbert founded ISO TC307 which 60 countries are working towards standardizing the interfaces

3/ "We believe that a blockchain gateway is needed for blockchain networks to interoperate in a manner similar

to border gateway routers in IP networks. Just as border gateway routers use the BGPv4 protocol to interact with one another in a peered fashion we believe that a...

4/ blockchain gateway protocol will be needed to permit the movement of virtual assets and related information across blockchain networks in a secure and privacy-preserving manner"

You can read more about the gateway protocol ODAP in this 21 tweet

See this 21-tweet thread about the creation of an Internet scale protocol to move digital assets involving Quant, MIT, US Government, Intel, Juniper, Payment and Telecom companies \U0001f447https://t.co/n7VGIIlAvq pic.twitter.com/mTUEmCMFZM

— Seq (@CryptoSeq) December 22, 2020

5/

"We motivate the need for blockchain gateways and blockchain gateway protocols in the following summary:

✅Enables blockchain interoperability:

Blockchain gateways provide an interface for the interoperability between blockchain/DLT systems that operate distinct consensus...

You May Also Like

THREAD PART 1.

On Sunday 21st June, 14 year old Noah Donohoe left his home to meet his friends at Cave Hill Belfast to study for school. #RememberMyNoah💙

He was on his black Apollo mountain bike, fully dressed, wearing a helmet and carrying a backpack containing his laptop and 2 books with his name on them. He also had his mobile phone with him.

On the 27th of June. Noah's naked body was sadly discovered 950m inside a storm drain, between access points. This storm drain was accessible through an area completely unfamiliar to him, behind houses at Northwood Road. https://t.co/bpz3Rmc0wq

"Noah's body was found by specially trained police officers between two drain access points within a section of the tunnel running under the Translink access road," said Mr McCrisken."

Noah's bike was also found near a house, behind a car, in the same area. It had been there for more than 24 hours before a member of public who lived in the street said she read reports of a missing child and checked the bike and phoned the police.

On Sunday 21st June, 14 year old Noah Donohoe left his home to meet his friends at Cave Hill Belfast to study for school. #RememberMyNoah💙

He was on his black Apollo mountain bike, fully dressed, wearing a helmet and carrying a backpack containing his laptop and 2 books with his name on them. He also had his mobile phone with him.

On the 27th of June. Noah's naked body was sadly discovered 950m inside a storm drain, between access points. This storm drain was accessible through an area completely unfamiliar to him, behind houses at Northwood Road. https://t.co/bpz3Rmc0wq

"Noah's body was found by specially trained police officers between two drain access points within a section of the tunnel running under the Translink access road," said Mr McCrisken."

Noah's bike was also found near a house, behind a car, in the same area. It had been there for more than 24 hours before a member of public who lived in the street said she read reports of a missing child and checked the bike and phoned the police.

The entire discussion around Facebook’s disclosures of what happened in 2016 is very frustrating. No exec stopped any investigations, but there were a lot of heated discussions about what to publish and when.

In the spring and summer of 2016, as reported by the Times, activity we traced to GRU was reported to the FBI. This was the standard model of interaction companies used for nation-state attacks against likely US targeted.

In the Spring of 2017, after a deep dive into the Fake News phenomena, the security team wanted to publish an update that covered what we had learned. At this point, we didn’t have any advertising content or the big IRA cluster, but we did know about the GRU model.

This report when through dozens of edits as different equities were represented. I did not have any meetings with Sheryl on the paper, but I can’t speak to whether she was in the loop with my higher-ups.

In the end, the difficult question of attribution was settled by us pointing to the DNI report instead of saying Russia or GRU directly. In my pre-briefs with members of Congress, I made it clear that we believed this action was GRU.

The story doesn\u2019t say you were told not to... it says you did so without approval and they tried to obfuscate what you found. Is that true?

— Sarah Frier (@sarahfrier) November 15, 2018

In the spring and summer of 2016, as reported by the Times, activity we traced to GRU was reported to the FBI. This was the standard model of interaction companies used for nation-state attacks against likely US targeted.

In the Spring of 2017, after a deep dive into the Fake News phenomena, the security team wanted to publish an update that covered what we had learned. At this point, we didn’t have any advertising content or the big IRA cluster, but we did know about the GRU model.

This report when through dozens of edits as different equities were represented. I did not have any meetings with Sheryl on the paper, but I can’t speak to whether she was in the loop with my higher-ups.

In the end, the difficult question of attribution was settled by us pointing to the DNI report instead of saying Russia or GRU directly. In my pre-briefs with members of Congress, I made it clear that we believed this action was GRU.