You can always find ways to make it harder for someone to get your #Bitcoin, but if you over-complicate it, you could end up making it even too hard for yourself - many lost their funds this way.

I've received many questions lately, but by far the most common question is “What's the best way to secure #Bittcoin?”

🧵So here’s a thread with my opinion on securing #Bitcoin

You can always find ways to make it harder for someone to get your #Bitcoin, but if you over-complicate it, you could end up making it even too hard for yourself - many lost their funds this way.

This means very different things for different people, depending on your technical experience, understanding of Bitcoin, how much you are holding, etc.

I strongly recommend at least learn to hold your own keys before buying, but if you can’t wait, it’s better to leave it there than holding yourself if that’d make you feel like you have no clue what’s going on.

You should make sure to never enter your backup words on a computer, learn to verify addresses on the device, and so on.

Using your own node is an important improvement in terms of security and privacy, as you cease to rely on 3rd parties for interacting with the Bitcoin network.

That someone could:

- Know which txs you're interested in - privacy issue

- Provide false information - security issue

- Go/ get shut down - resilience issue

Using your own node fix this

Here again, there are many options and a lot to learn, like supply chain attacks, retirement attacks, and other security concerns. You might come up with different answers for your specific needs.

You can consider using an airgapped laptop or an old phone to mitigate that, but there are pros and cons for any choice.

Multisig lets you mix different devices to reduce trust in each one of them, and in case one is compromised - you are still in control of your funds.

I just outlined the order I would sort by the most common approaches from the most user-friendly to the most security-minded, now it's on you to choose.

More from Crypto

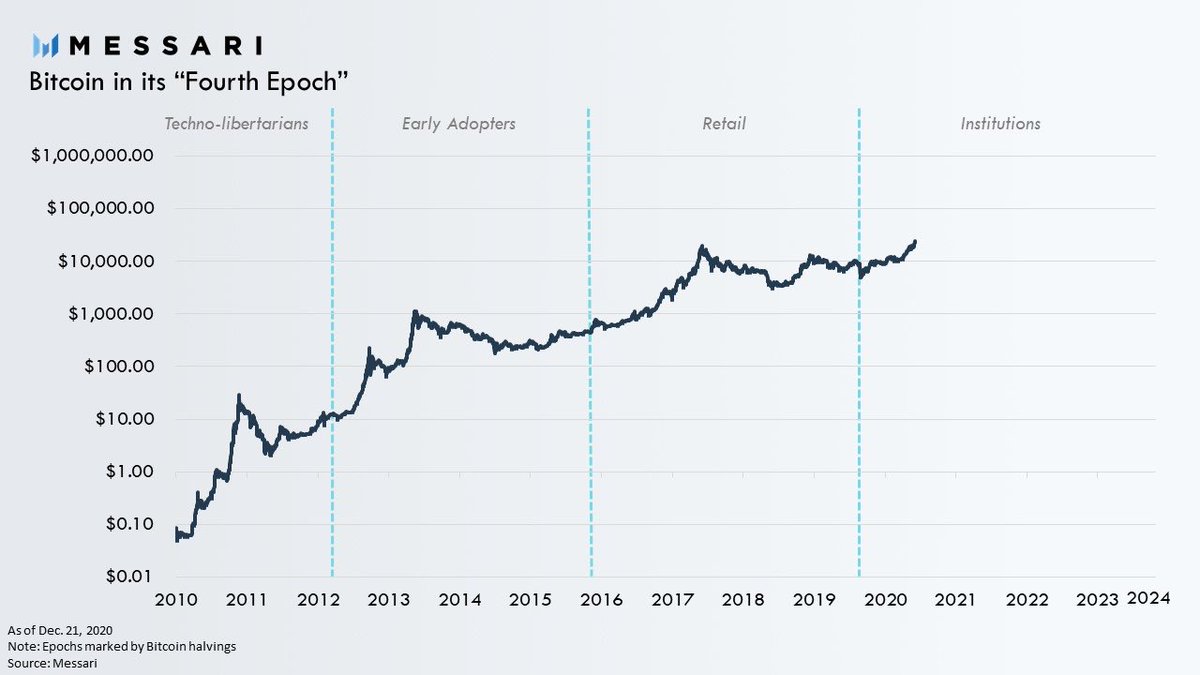

Excited to share our 2020 #Bitcoin review.

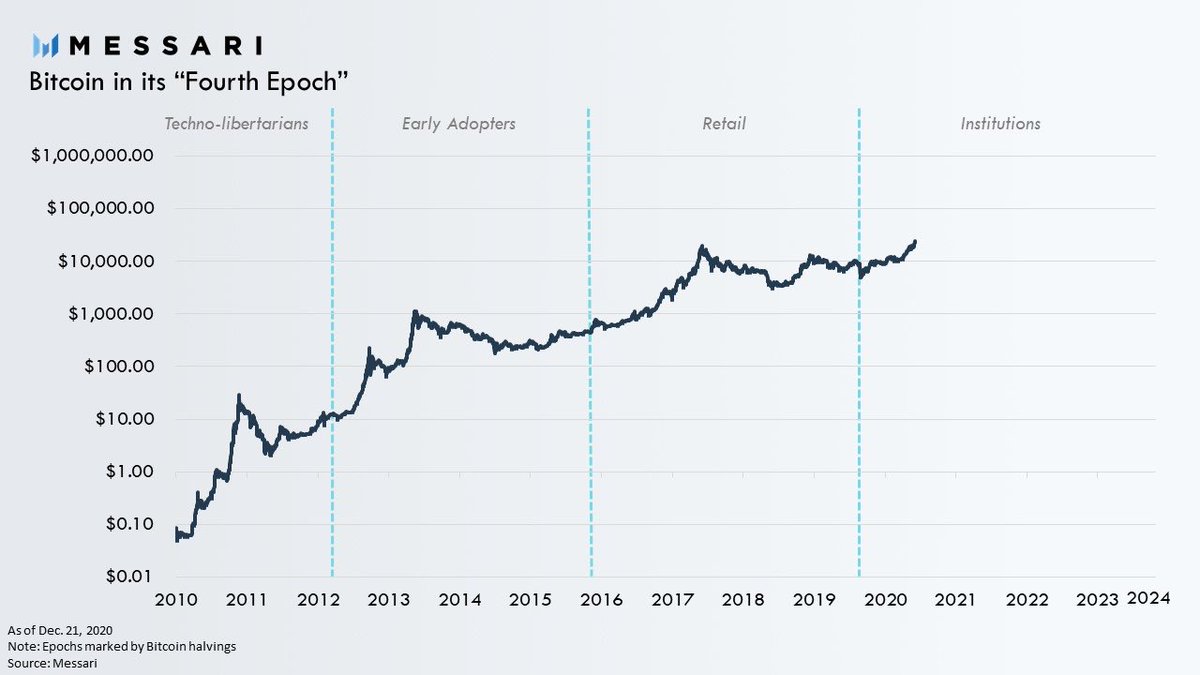

2020 will be remembered as the year the long fabled institutions finally arrived and #Bitcoin became a bonafide macroeconomic asset.

Below are the top highlights of each month for Bitcoin’s historic year.

1/

Bitcoin is now at all-time highs capping off an extremely successful year.

But it was by no means stable ride up.

2020 was a historically volatile year.

@YoungCryptoPM and I provided a detailed overview of every month of 2020 in all its

Jan.

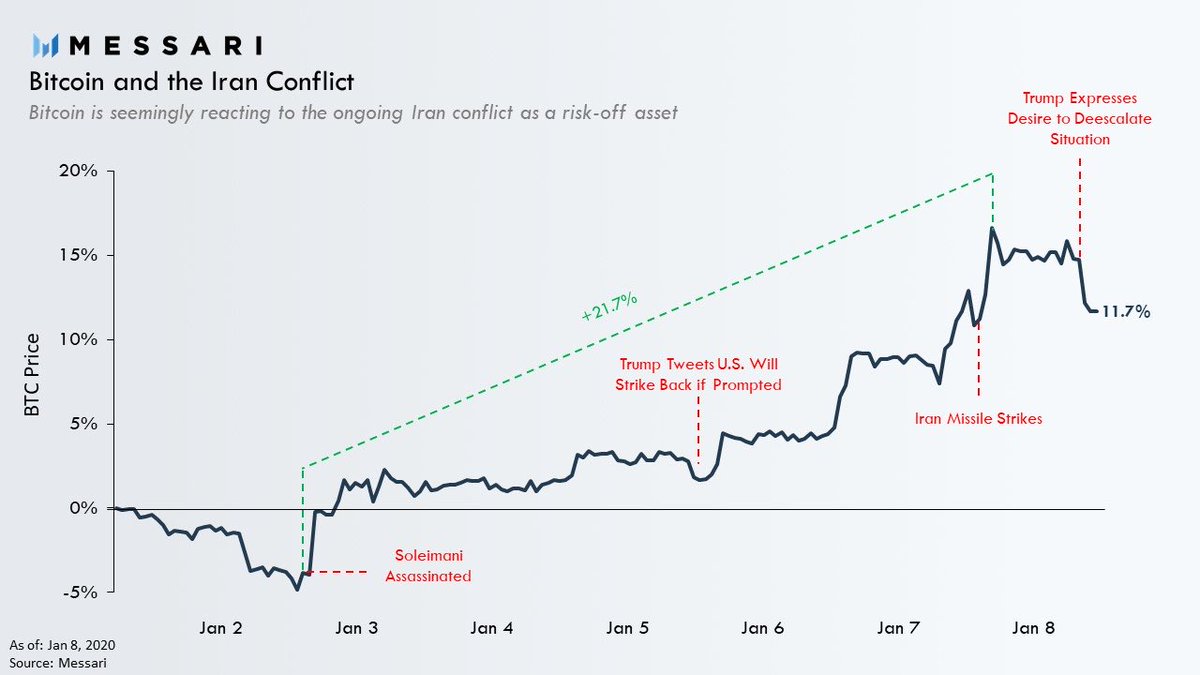

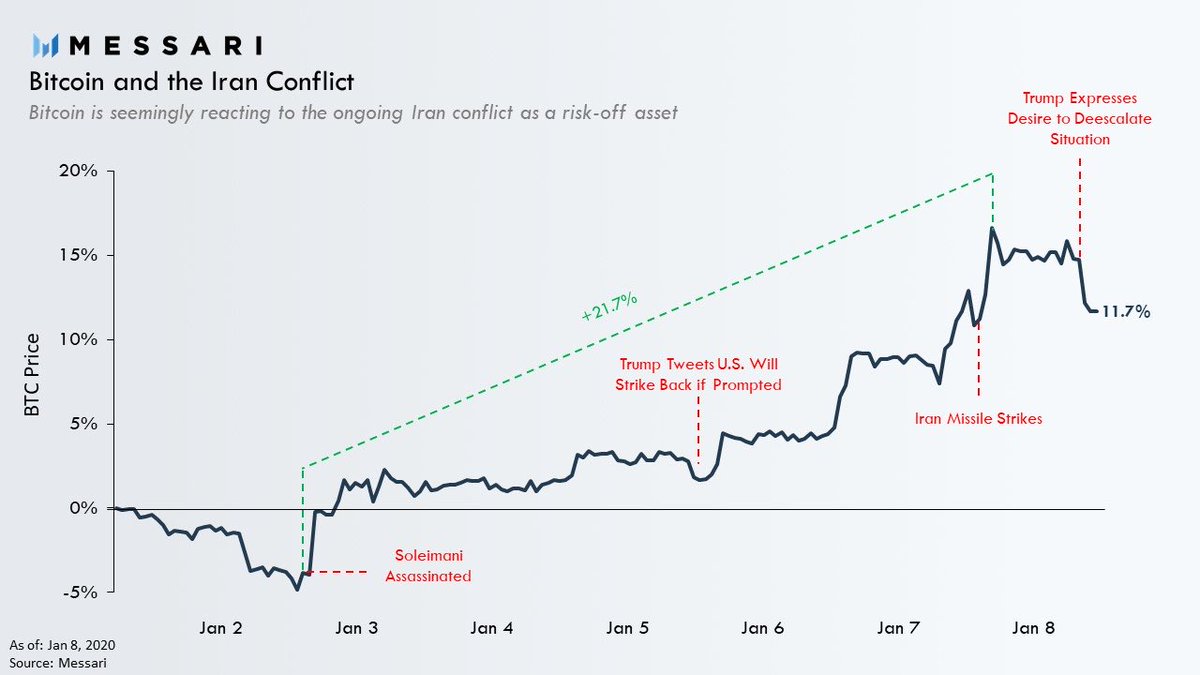

3 days into the new year the US assassinated Iran’s top general Soleimani.

BTC surprisingly reacted to the events behaving like a safe haven as the risk of war increased.

The events provided the first hints of BTC potentially having graduated to a legitimate macro asset.

Feb.

COVID-19 reached a tipping point causing markets to crash.

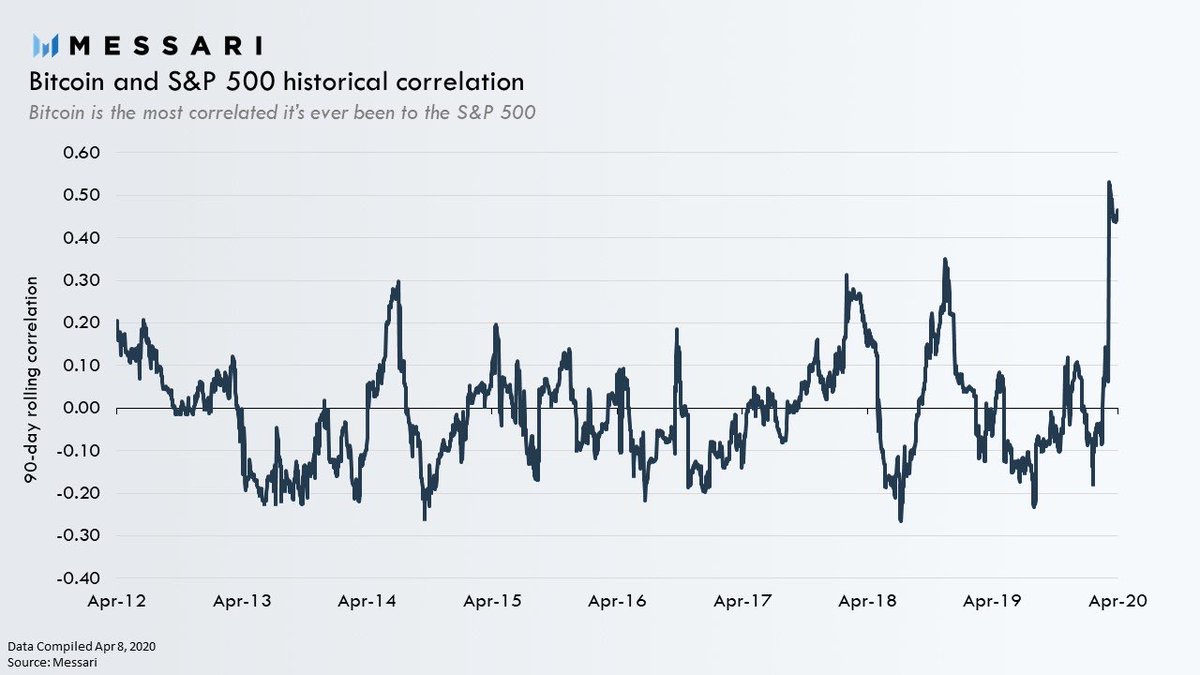

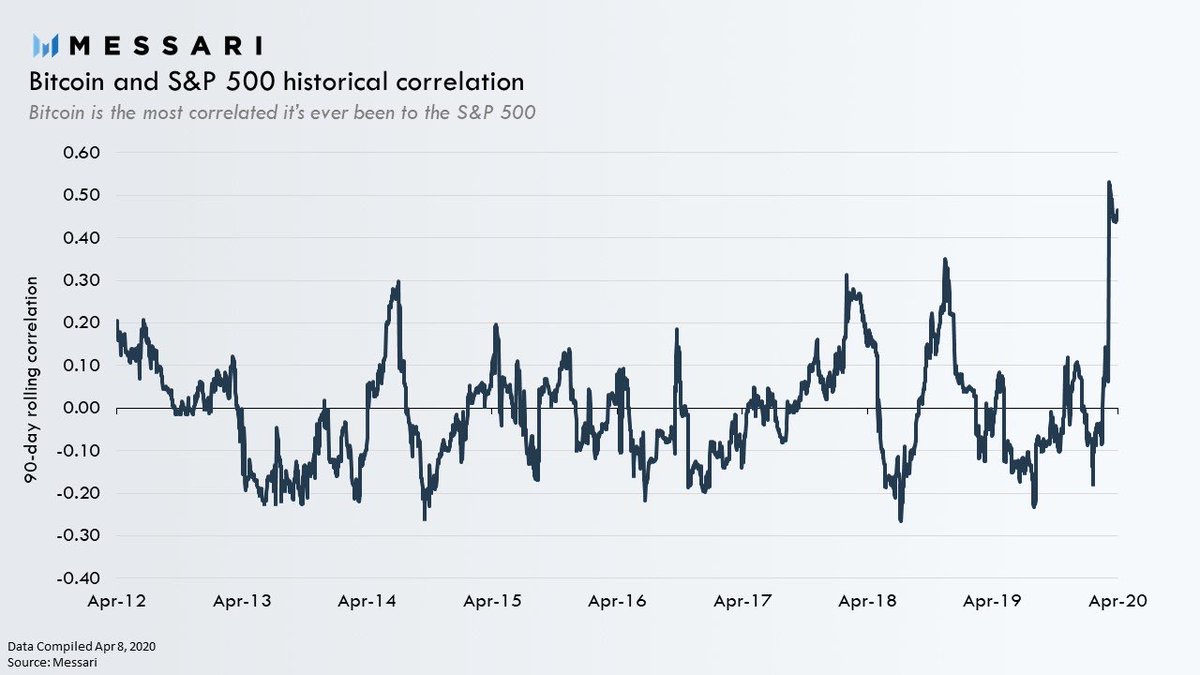

BTC’s correlation with the S&P 500 reached an ATH in the following weeks.

This is when everyone learned BTC was not a recession hedge, it was a hedge against inflation and loss of confidence in fiat currencies. https://t.co/JB7dJ3qp6M

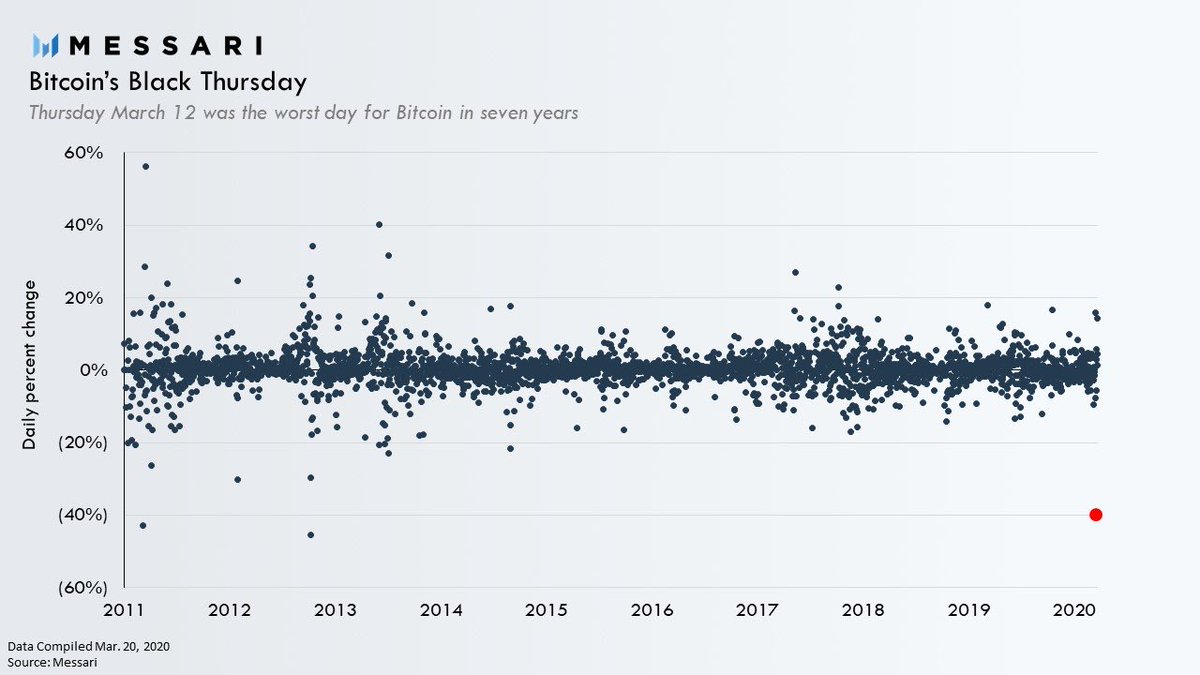

Mar.

Financial markets in free fall.

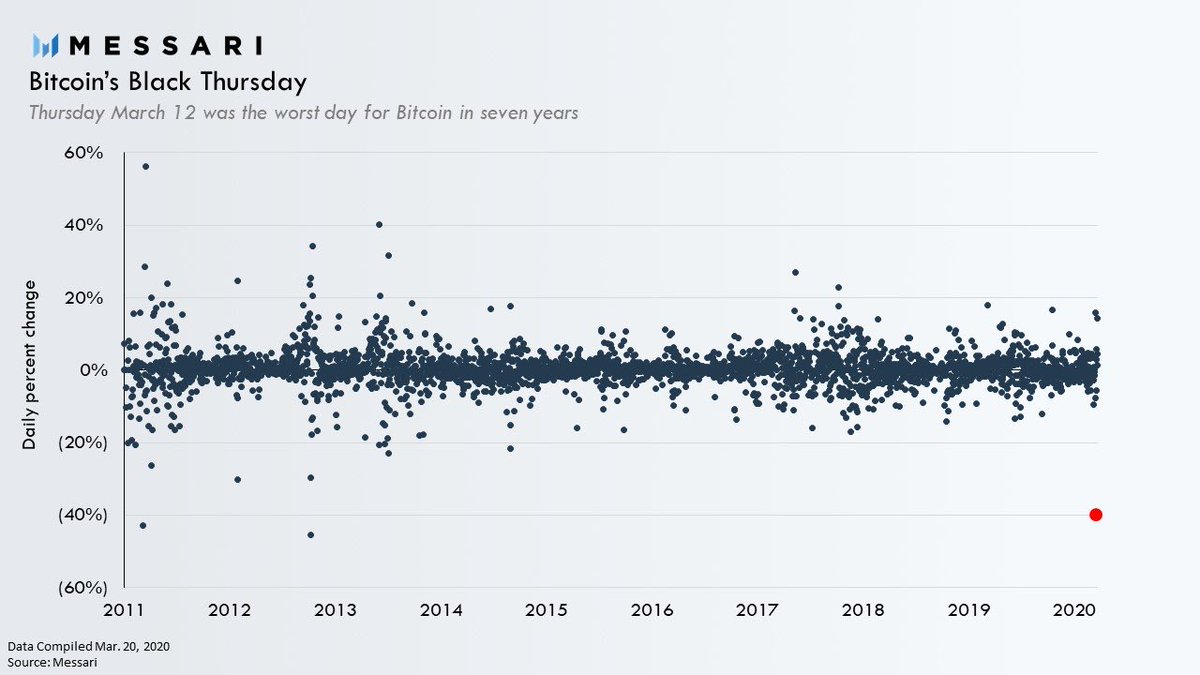

The liquidity crisis was so severe BTC experienced one of it’s worst days ever.

Now known as Black Thursday, on March 12, BTC plummeted as much as 50% to below $4,000 at its lowest point on the day.

BTC closed the day down 40%

2020 will be remembered as the year the long fabled institutions finally arrived and #Bitcoin became a bonafide macroeconomic asset.

Below are the top highlights of each month for Bitcoin’s historic year.

1/

Bitcoin is now at all-time highs capping off an extremely successful year.

But it was by no means stable ride up.

2020 was a historically volatile year.

@YoungCryptoPM and I provided a detailed overview of every month of 2020 in all its

Jan.

3 days into the new year the US assassinated Iran’s top general Soleimani.

BTC surprisingly reacted to the events behaving like a safe haven as the risk of war increased.

The events provided the first hints of BTC potentially having graduated to a legitimate macro asset.

Feb.

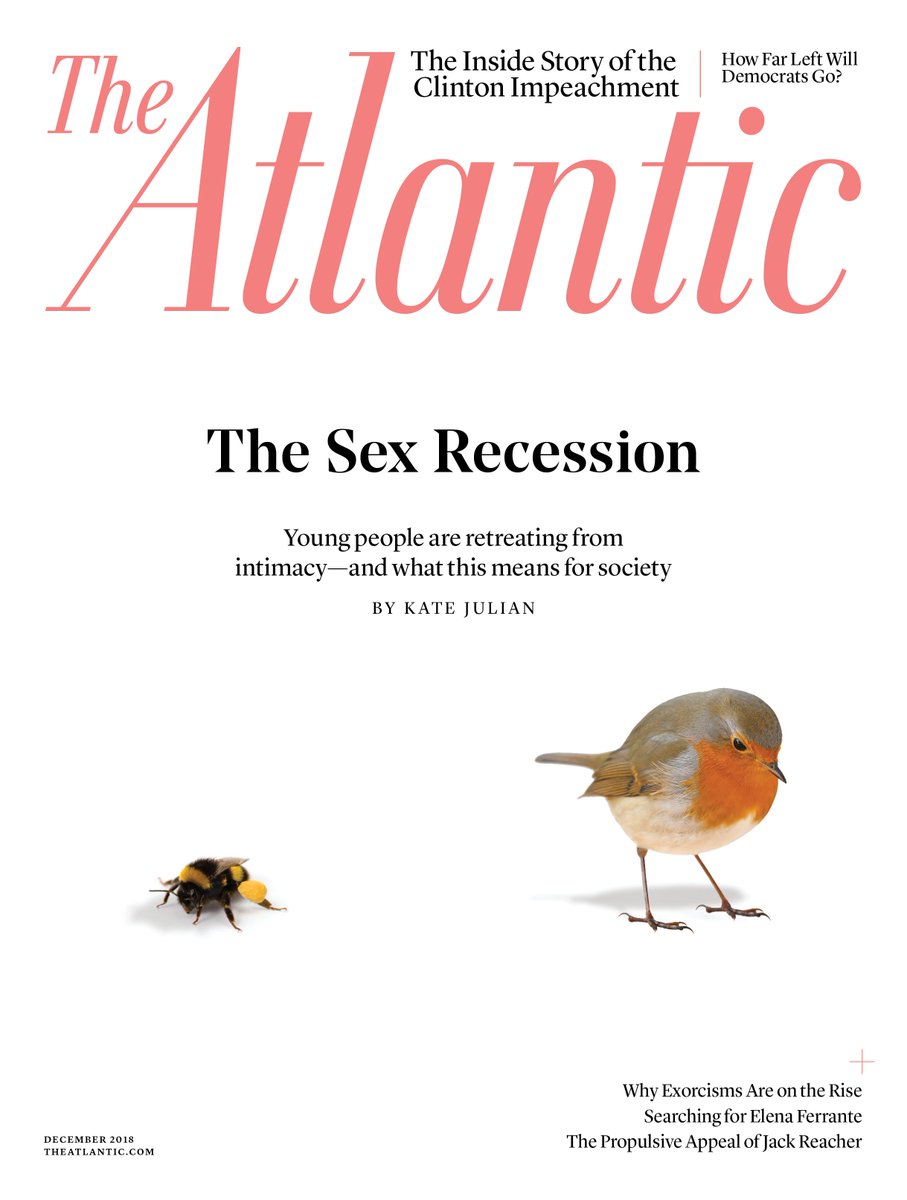

COVID-19 reached a tipping point causing markets to crash.

BTC’s correlation with the S&P 500 reached an ATH in the following weeks.

This is when everyone learned BTC was not a recession hedge, it was a hedge against inflation and loss of confidence in fiat currencies. https://t.co/JB7dJ3qp6M

1/ Figure I should get out ahead of this issue:

— Dan McArdle (@robustus) June 22, 2018

Bitcoin is a hedge against inflation & loss of confidence in fiat, NOT a hedge against a typical recession.

Mar.

Financial markets in free fall.

The liquidity crisis was so severe BTC experienced one of it’s worst days ever.

Now known as Black Thursday, on March 12, BTC plummeted as much as 50% to below $4,000 at its lowest point on the day.

BTC closed the day down 40%