1/ Here's a thread on the constitutional challenges to the midnight rulemaking that @coincenter is holding in reserve. They boil down to your rights against warrantless search and seizure (4th amendment) and your rights to assemble anonymously (1st amendment).

More from Crypto

The vast majority of its success was fueled by #DeFi.

Here's what happened in 5 Tweets 🔽

1) Governance Tokens 🪙

Projects gave complete ownership of billion dollar protocols to their users, often using retroactive airdrops.

Early adopters earned tokens for past usage, and token-based voting now dictates all technical

It pays to be a web3 power user.

— Coopahtroopa \U0001f525_\U0001f525 (@Cooopahtroopa) December 9, 2020

Five networks that issued retroactive airdrops to value added actors \U0001f4dd

2) Liquidity Mining ⛏️

Power users were the first to earn on-going distribution by providing liquidity.

$COMP sparked the wave, with $BAL coining the term a few weeks

BAL is live!

— Balancer Labs (@BalancerLabs) June 23, 2020

The 435k BAL for liquidity providers of the first three weeks of liquidity mining (145k per week) have just been sent out to the wallets used to provide liquidity on Balancer.https://t.co/pkXFzwzPVC

3) Yield Faming 🌾

Projects coupled liquidity mining and governance tokens to boost 'yields' by combining lending rates with an incentive layer.

APYs peaked as high as 1M% during 'DeFi summer', leading to a 'food coin' craze like $YAM and

Check out @Cooopahtroopa's latest post for all the #DeFi farmers out there \U0001f468\u200d\U0001f33e

— Zerion \U0001f3e6 (@zerion_io) June 26, 2020

Turns out @synthetix_io & @CurveFinance were ploughing the fields long before $COMP & $BAL came along.

Learn how to put your #crypto to work with this #yieldfarming 101 \U0001f4b8

\U0001f449 https://t.co/zYUKtqx3BK

4) Fair Launches ✅

Who needs investment when you can launch using yield farming?

@iearnfinance debuted $YFI with no formal funding, seeding a community treasury for self-sustainability.

The notion of a core team and community became one and the

2/ What is a Fair Launch?

— fair launch capital (@fairlaunchcap) August 26, 2020

A FL enables founders to bootstrap new crypto networks that are earned, owned, and governed by their community from the outset.

In this dynamic, everyone participates on equal footing\u2014there is no early access, pre-mine, or allocation of tokens.

Share it with a friend who needs it!

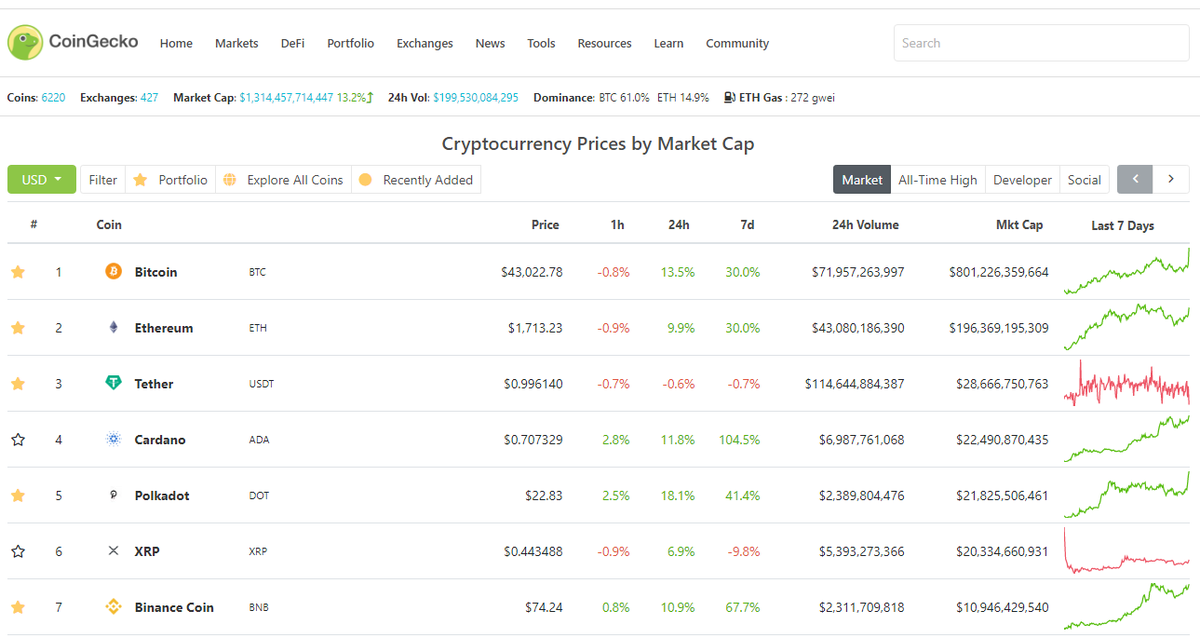

1/ Getting started with crypto and want to check prices/projects? https://t.co/LFnk4vukxj has info on just about every crypto you'll need :)

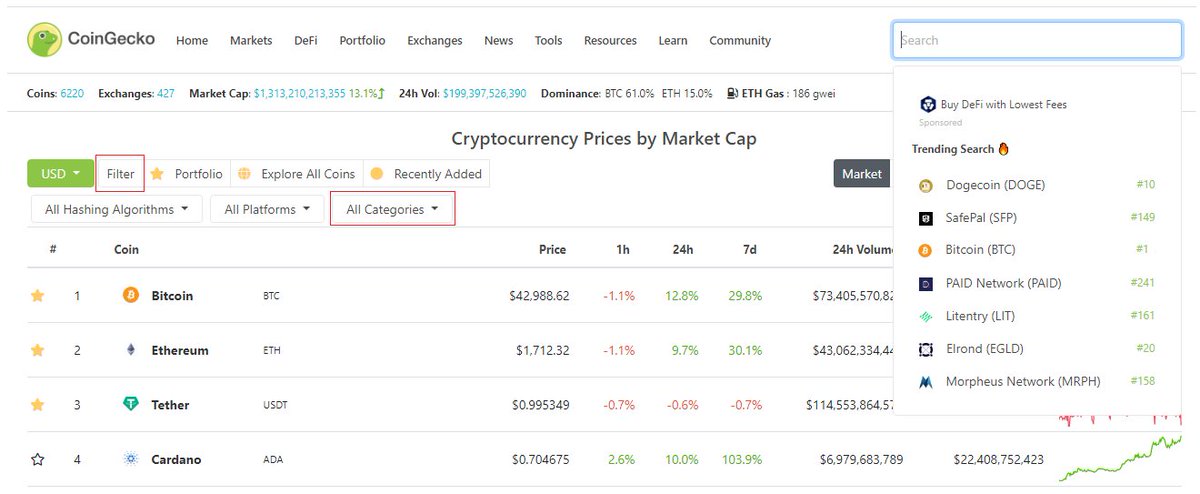

2/ Search over 6000+ cryptocurrencies available on the market. You can see what's trending in the space as well.

Researching by categories? Filter (left side) -> Select categories -> DeFi, DOT ecosystem, Exchange-based tokens, NFTs - anything!

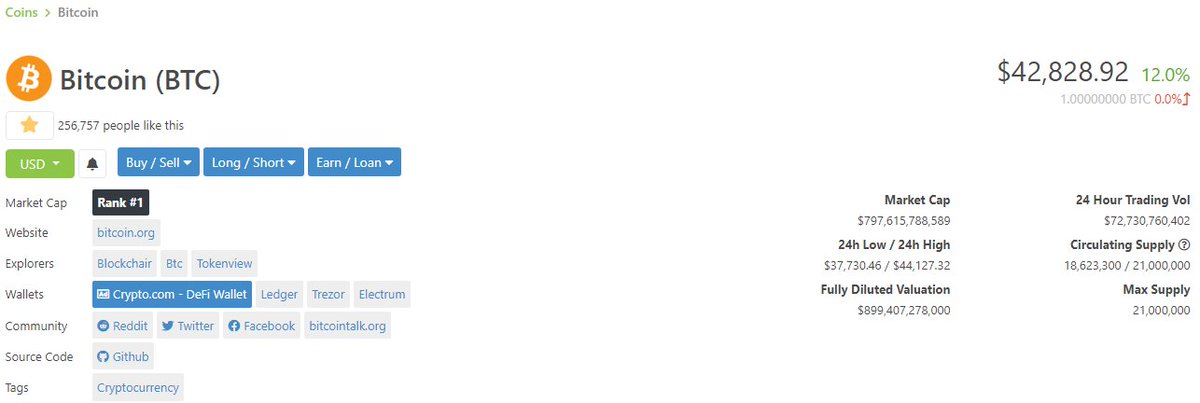

3/ Lets say you're looking at #Bitcoin https://t.co/g205lj03pG

At a glance you get:

- Price

- Mkt Capitalization (valuation)

- Circulating/Total supply

- 24h trading volume

- Links to websites, social media, block explorers

- Calculator

Next - check valuation?

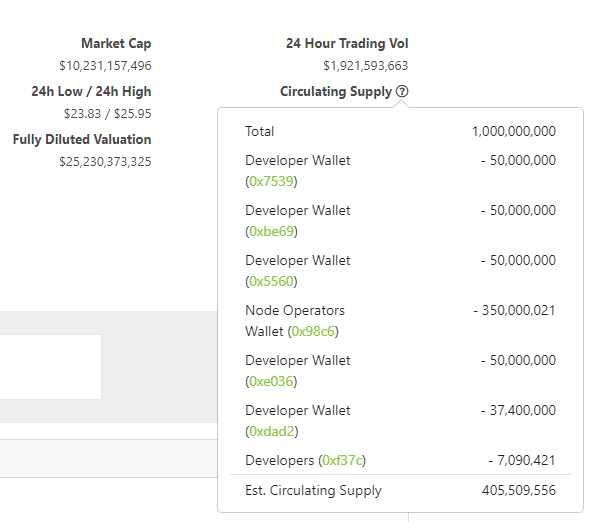

4/ Market cap is used to rank coins, and we'll show you how its calculated - Hover over Circulating Supply (?) for breakdown.

Note: used @chainlink as example here - https://t.co/Jc46fe79Ag

While MC is important also consider product fit, narrative, team, community etc.

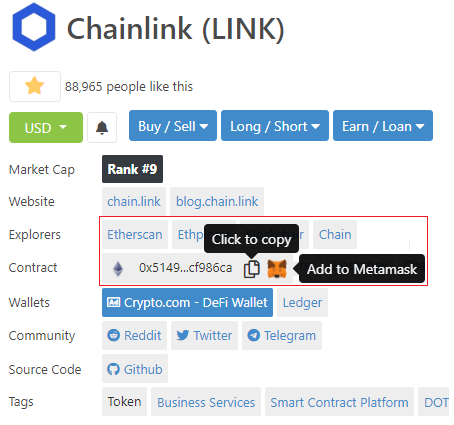

5/ If you're trading on AMMs like @Uniswap or @SushiSwap, you can copy the contract address directly to your clipboard.

Using @metamask_io? Add the token directly so it shows as one of the "Assets" that you own in the wallet.

See: https://t.co/94XihMf5oz

Introducing an effortless way to add tokens to your @metamask_io wallet \U0001f4e5

— CoinGecko (@coingecko) February 8, 2021

Skip the hassle of copying/pasting contract addresses to your wallet. Add an asset and it'll appear in your wallet with just a click - tap the \U0001f98a and try it out for yourself! pic.twitter.com/u26BA29ubs

Short version:

The NFT token you bought either points to a URL on the internet, or an IPFS hash. In most circumstances it references an IPFS gateway on the internet run by the startup you bought the NFT from.

Oh, and that URL is not the media. That URL is a JSON metadata file

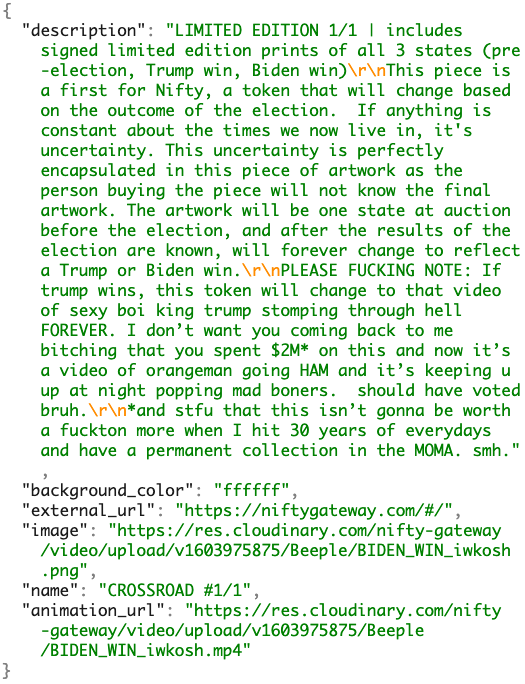

Here's an example. This artwork is by Beeple and sold via Nifty:

https://t.co/TlJKH8kAew

The NFT token is for this JSON file hosted directly on Nifty's servers:

https://t.co/GQUaCnObvX

THAT file refers to the actual media you just "bought". Which in this case is hosted via a @cloudinary CDN, served by Nifty's servers again.

So if Nifty goes bust, your token is now worthless. It refers to nothing. This can't be changed.

"But you said some use IPFS!"

Let's look at the $65m Beeple, sold by Christies. Fancy.

https://t.co/1G9nCAdetk

That NFT token refers directly to an IPFS hash (https://t.co/QUdtdgtssH). We can take that IPFS hash and fetch the JSON metadata using a public gateway:

https://t.co/CoML7psBhF