2/

Thread:

While the entire US crypto industry (exchanges, funds, associations, PsPs, lobbyists, etc) is currently focused on fighting the AML rules proposed by FinCEN, the XRP Community has been left ALONE fighting the securities battle FOR THE BENEFIT of the whole industry.

1/

2/

3/

4/

With such precedent (which the SEC hasn't been able to obtain so far, as a result of the early settlements reached with other crypto projects), the SEC would be ...

5/

6/

7/

8/

More from Crypto

Michael Pettis @michaelxpettis argues that it is not always obvious who (China or the U.S.) adjusts best to "turbulent changes."

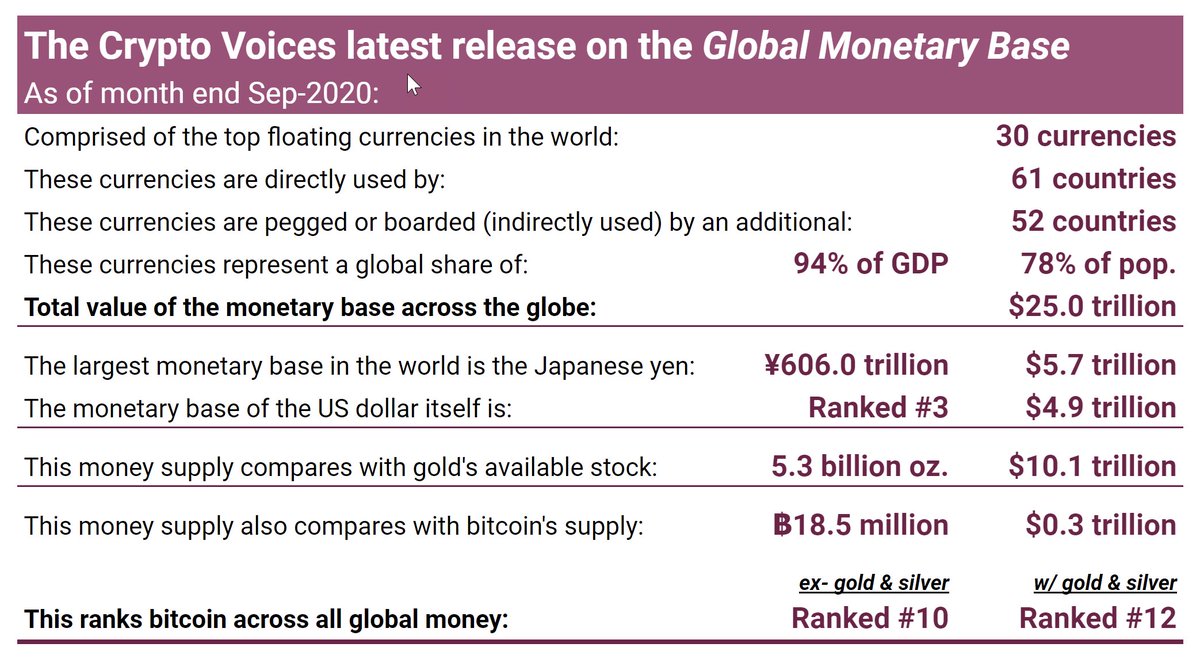

Bitcoin answers that question.

Thread:

World economies currently suffer four major redistribution challenges:

The most important is increasing government stealth use of the monetary system to confiscate assets from productive actors.

/2

That process is exacerbated by "Cantillon Effect" transfers to interest groups close to government ("the entitled class," public sector workers, the medical industrial complex, academia, etc....), which is destroying much of that wealth /3

The shadow nature (see Keynes) of government inflation makes the process unidentifiable, un-addressable and undemocratic.

The biggest victims (America's poorly educated young) are unequipped to counter generational confiscation tactics of today's wily senior beneficiaries. /4

Government control of the numéraire in key economic statistics (GDP, inflation, etc...) makes it impossible for economic actors to measure progress and liabilities. /5

Bitcoin answers that question.

Thread:

1/11

— Michael Pettis (@michaelxpettis) January 11, 2021

An article worth thinking about: \u201cAs changes to the world structure accelerate, China\u2019s rule is in sharp contrast with the turmoil in the West,\u201d says Beijing.

I agree, but I draw a different conclusion. The world is certainly currently going...https://t.co/ugha7ygqqx

World economies currently suffer four major redistribution challenges:

The most important is increasing government stealth use of the monetary system to confiscate assets from productive actors.

/2

That process is exacerbated by "Cantillon Effect" transfers to interest groups close to government ("the entitled class," public sector workers, the medical industrial complex, academia, etc....), which is destroying much of that wealth /3

The shadow nature (see Keynes) of government inflation makes the process unidentifiable, un-addressable and undemocratic.

The biggest victims (America's poorly educated young) are unequipped to counter generational confiscation tactics of today's wily senior beneficiaries. /4

Government control of the numéraire in key economic statistics (GDP, inflation, etc...) makes it impossible for economic actors to measure progress and liabilities. /5

You May Also Like

1/Politics thread time.

To me, the most important aspect of the 2018 midterms wasn't even about partisan control, but about democracy and voting rights. That's the real battle.

2/The good news: It's now an issue that everyone's talking about, and that everyone cares about.

3/More good news: Florida's proposition to give felons voting rights won. But it didn't just win - it won with substantial support from Republican voters.

That suggests there is still SOME grassroots support for democracy that transcends

4/Yet more good news: Michigan made it easier to vote. Again, by plebiscite, showing broad support for voting rights as an

5/OK, now the bad news.

We seem to have accepted electoral dysfunction in Florida as a permanent thing. The 2000 election has never really

To me, the most important aspect of the 2018 midterms wasn't even about partisan control, but about democracy and voting rights. That's the real battle.

2/The good news: It's now an issue that everyone's talking about, and that everyone cares about.

3/More good news: Florida's proposition to give felons voting rights won. But it didn't just win - it won with substantial support from Republican voters.

That suggests there is still SOME grassroots support for democracy that transcends

4/Yet more good news: Michigan made it easier to vote. Again, by plebiscite, showing broad support for voting rights as an

5/OK, now the bad news.

We seem to have accepted electoral dysfunction in Florida as a permanent thing. The 2000 election has never really

Bad ballot design led to a lot of undervotes for Bill Nelson in Broward Co., possibly even enough to cost him his Senate seat. They do appear to be real undervotes, though, instead of tabulation errors. He doesn't really seem to have a path to victory. https://t.co/utUhY2KTaR

— Nate Silver (@NateSilver538) November 16, 2018