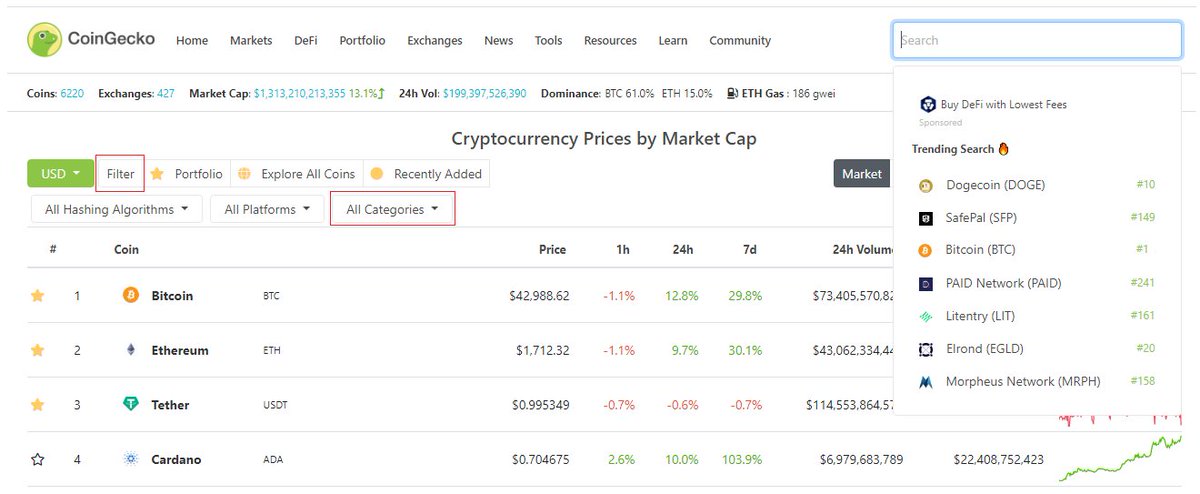

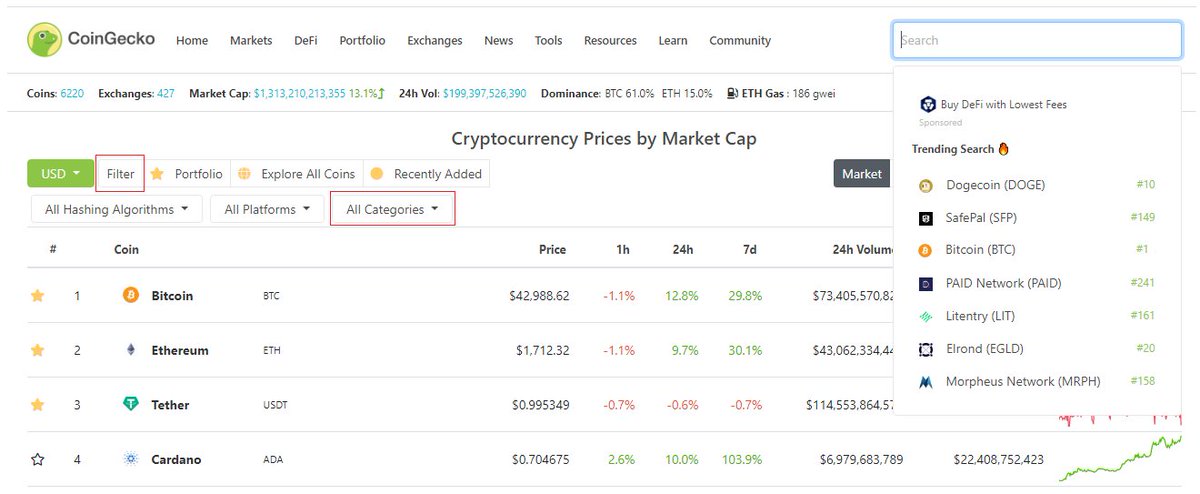

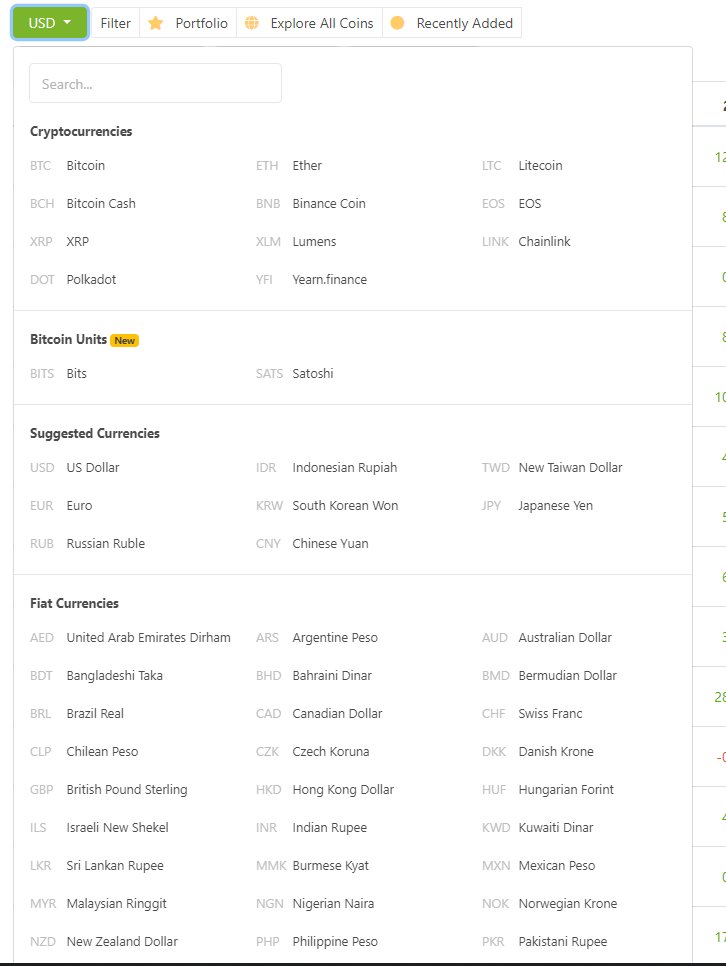

Researching by categories? Filter (left side) -> Select categories -> DeFi, DOT ecosystem, Exchange-based tokens, NFTs - anything!

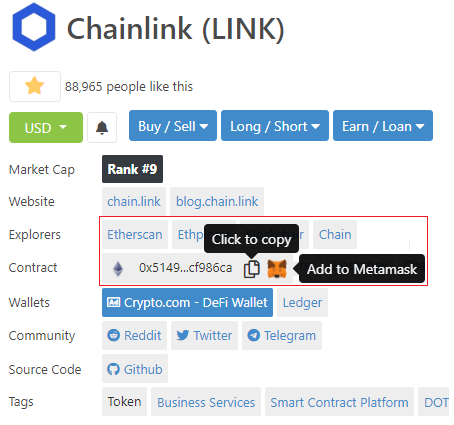

Introducing an effortless way to add tokens to your @metamask_io wallet \U0001f4e5

— CoinGecko (@coingecko) February 8, 2021

Skip the hassle of copying/pasting contract addresses to your wallet. Add an asset and it'll appear in your wallet with just a click - tap the \U0001f98a and try it out for yourself! pic.twitter.com/u26BA29ubs

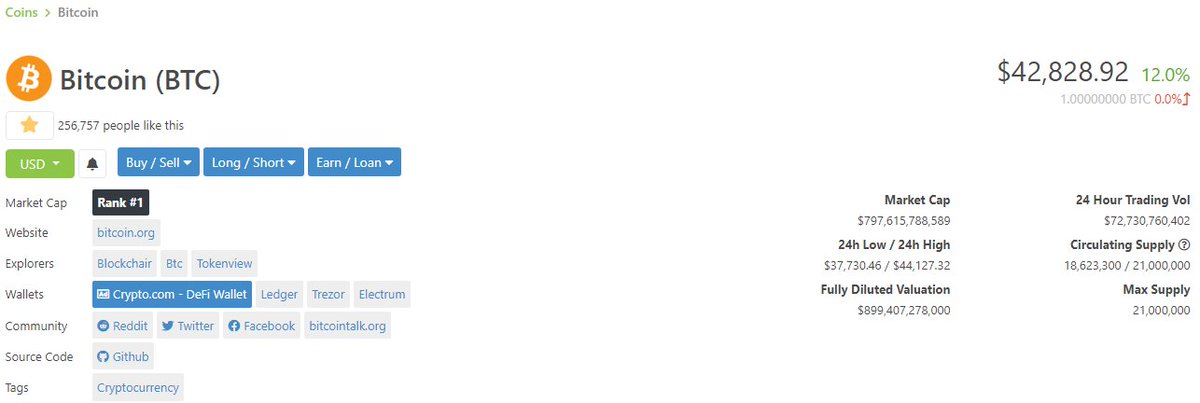

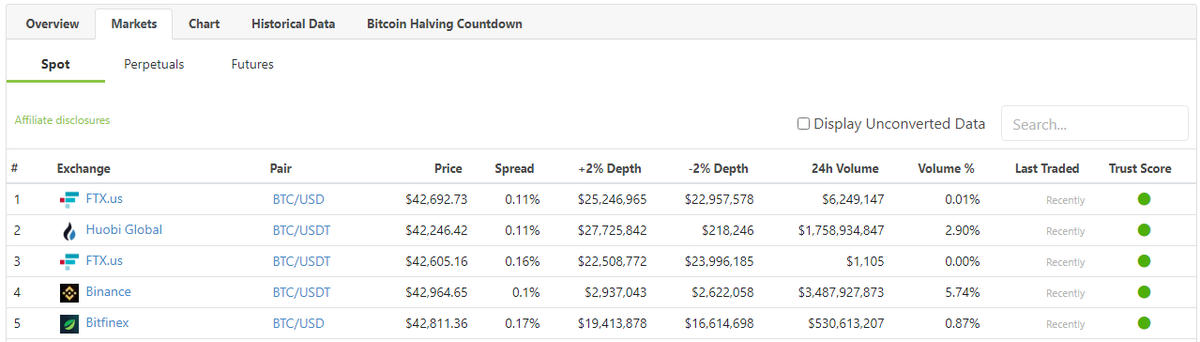

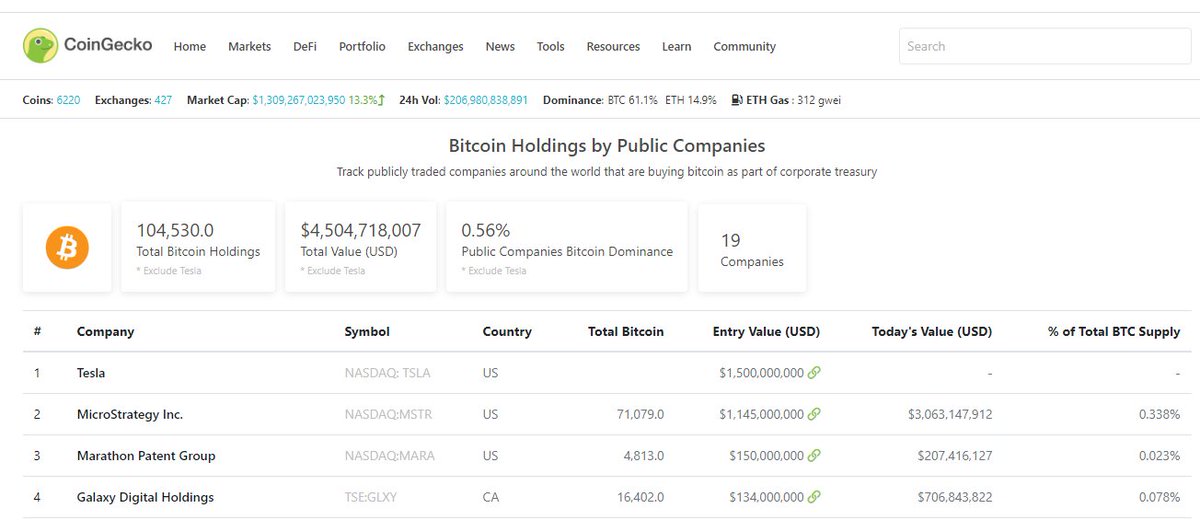

Sooo... @Tesla just invested $1.5B in #Bitcoin and everyone loses their minds\U0001f92f

— CoinGecko (@coingecko) February 8, 2021

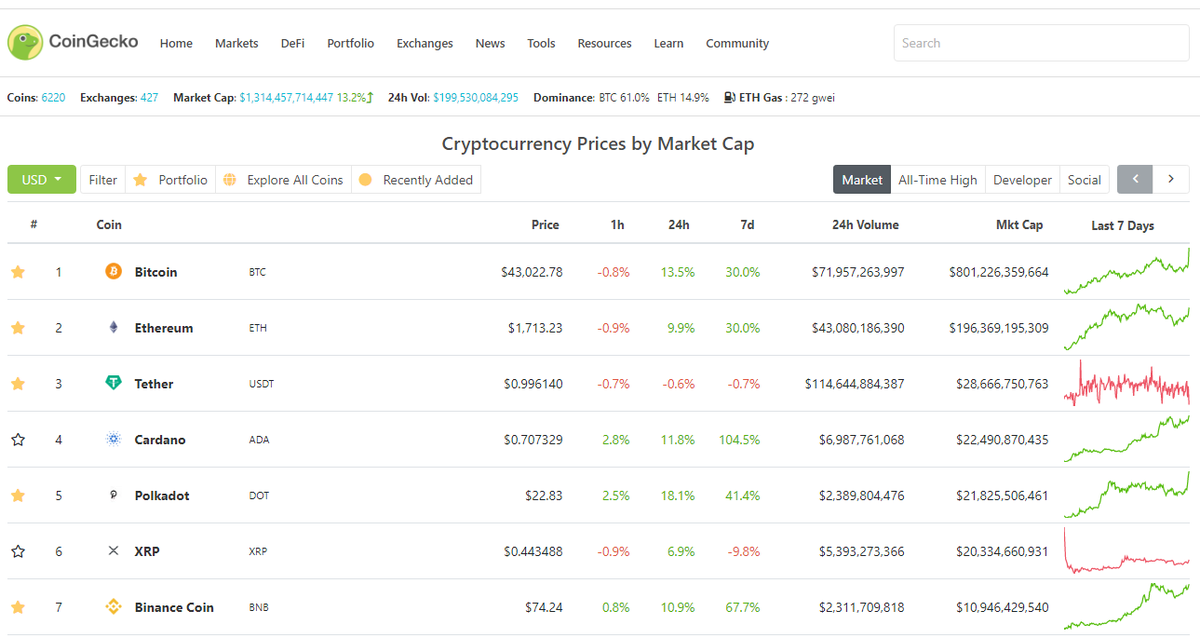

As of today, 19 publicly traded companies hold 104,530 BTC (~0.57%) of Bitcoin's supply.

When 1%? Which company will be next? We'll be keeping tabs on that for you here: https://t.co/tn28BdjjS5 \U0001f680\U0001f680 pic.twitter.com/ZnBqU2iNNx

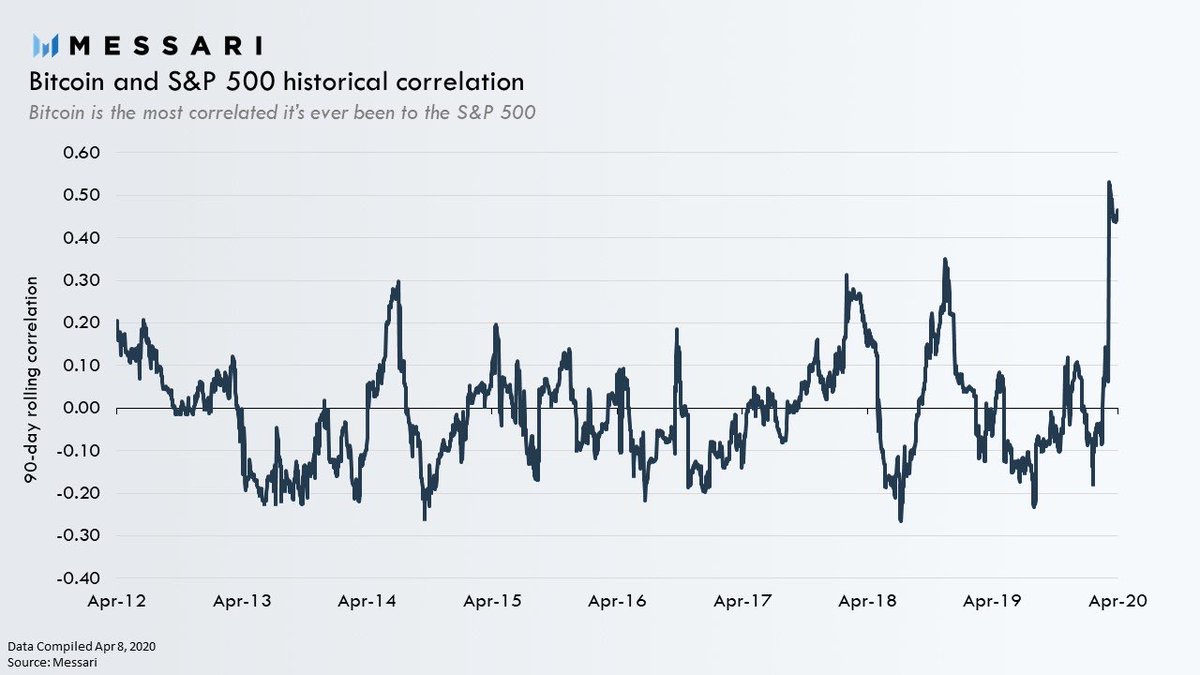

1/ Figure I should get out ahead of this issue:

— Dan McArdle (@robustus) June 22, 2018

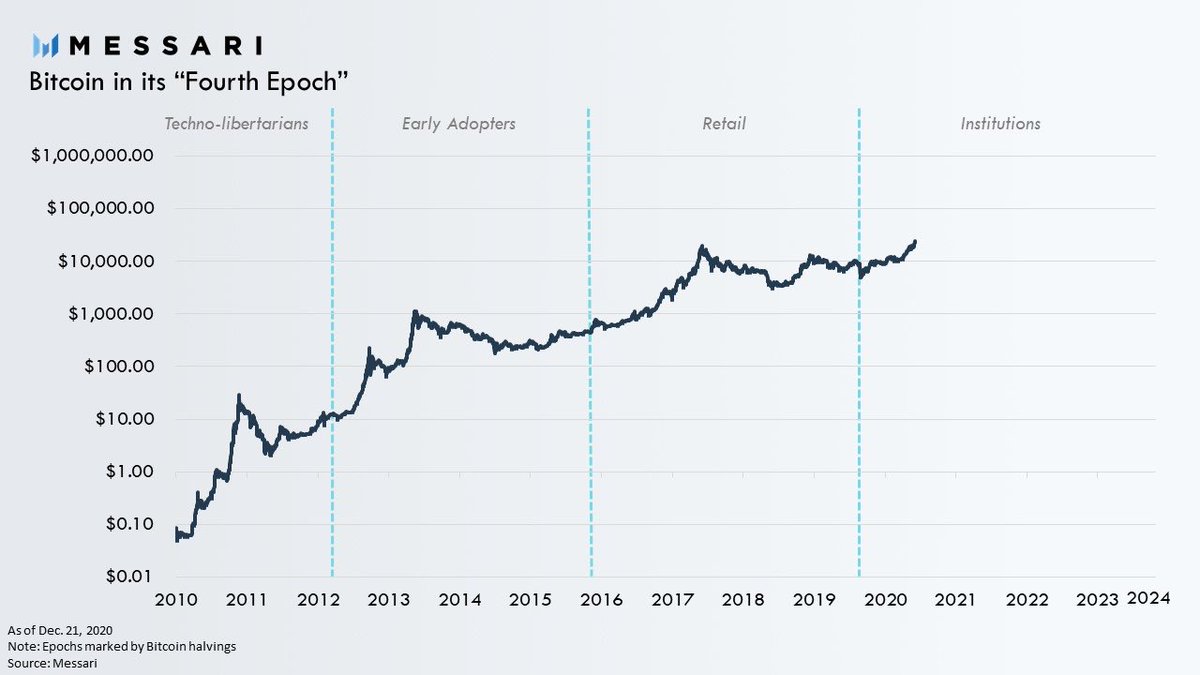

Bitcoin is a hedge against inflation & loss of confidence in fiat, NOT a hedge against a typical recession.

Proof-Of-Work is the name of a cryptographic algorithm that is used for some blockchains when new blocks are to be appended to the chain.

— Oliver Jumpertz (@oliverjumpertz) April 3, 2021

Let's take a higher-level look at how this one works, shall we?

\U0001f9f5\U0001f53d

— Andre Cronje (@AndreCronjeTech) January 15, 2021

I interviewed 5 billionaires this week

— GREG ISENBERG (@gregisenberg) January 23, 2021

I asked them to share their lessons learned on startups, life and entrepreneurship:

Here's what they told me:

To outperform, you need serious competitive advantages.

— Sahil Bloom (@SahilBloom) March 20, 2021

But contrary to what you have been told, most of them don't require talent.

10 competitive advantages that you can start developing today:

I\u2019ve gotten a lot of bad advice in my career and I see even more of it here on Twitter.

— Nick Huber (@sweatystartup) January 3, 2021

Time for a stiff drink and some truth you probably dont want to hear.

\U0001f447\U0001f447

THREAD: 10 significant lies you're told about the world.

— Julian Shapiro (@Julian) January 9, 2021

On startups, writing, and your career: