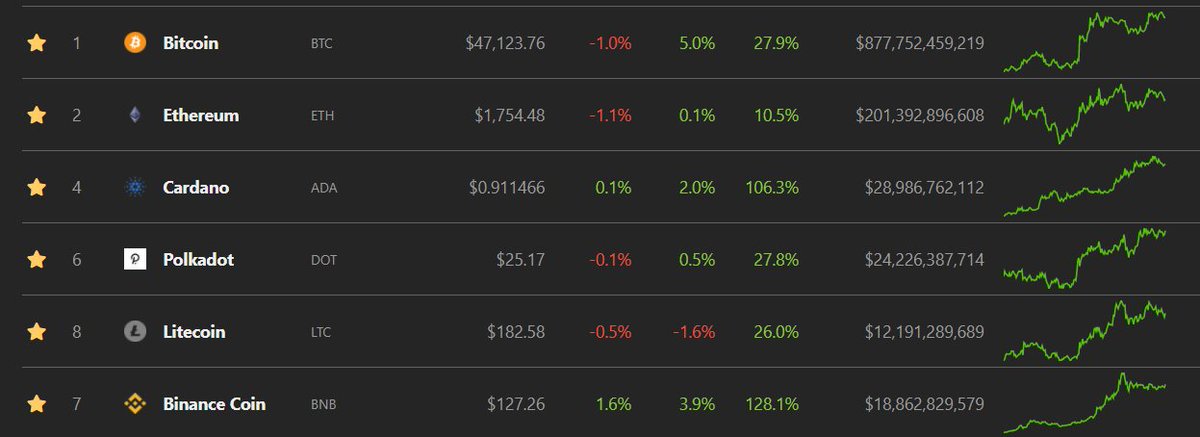

Obviously, like all of crypto, it is extremely risky and can go to 0. That said, given the magnitude of potential outcomes, it just doesn't have to succeed that often to make it a massively +EV bet

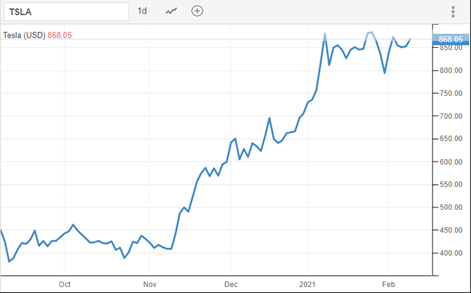

While my time investing in crypto and previously playing poker has gotten me used to experiencing large daily personal net worth volatility, it's never a pleasant experience

Short thread (by my standards...) with some ramblings that help me get through it 👇

Obviously, like all of crypto, it is extremely risky and can go to 0. That said, given the magnitude of potential outcomes, it just doesn't have to succeed that often to make it a massively +EV bet

Unlike early stage tech, crypto investors will have liquidity, i.e. the possibility, and thus the temptation, to sell

This is both a blessing and a curse

Crypto, as early stage tech, is much riskier than established public companies and thus even higher vol too

However, one should not let the liquidity take advantage of us

However, the fundamentals themselves rarely change that much in such short periods of time and so neither should one's investments

Occasionally they may prompt a reevaluation of the thesis, but if one is investing based on fundamentals this should imo be rare

Beware of the rationalisations for selling that spring up during downturns

If anything, it should happen more during upturns as the investment becomes more expensive and therefore riskier

For most of us working + investing in the space, our net worths are already extremely correlated to crypto prices

More from Crypto

1/ @MIT discussing the need for blockchain gateways to achieve interoperability across different blockchain networks, and to support the cross-blockchain mobility of virtual assets

https://t.co/PbjQkSlTT3

@quant_network are collaborating with MIT in the creation of ODAP

$QNT

2/ "In order for blockchain-based services to scale globally, blockchain networks must be able to interoperate with one another following a standardized protocol and interfaces (APIs)"

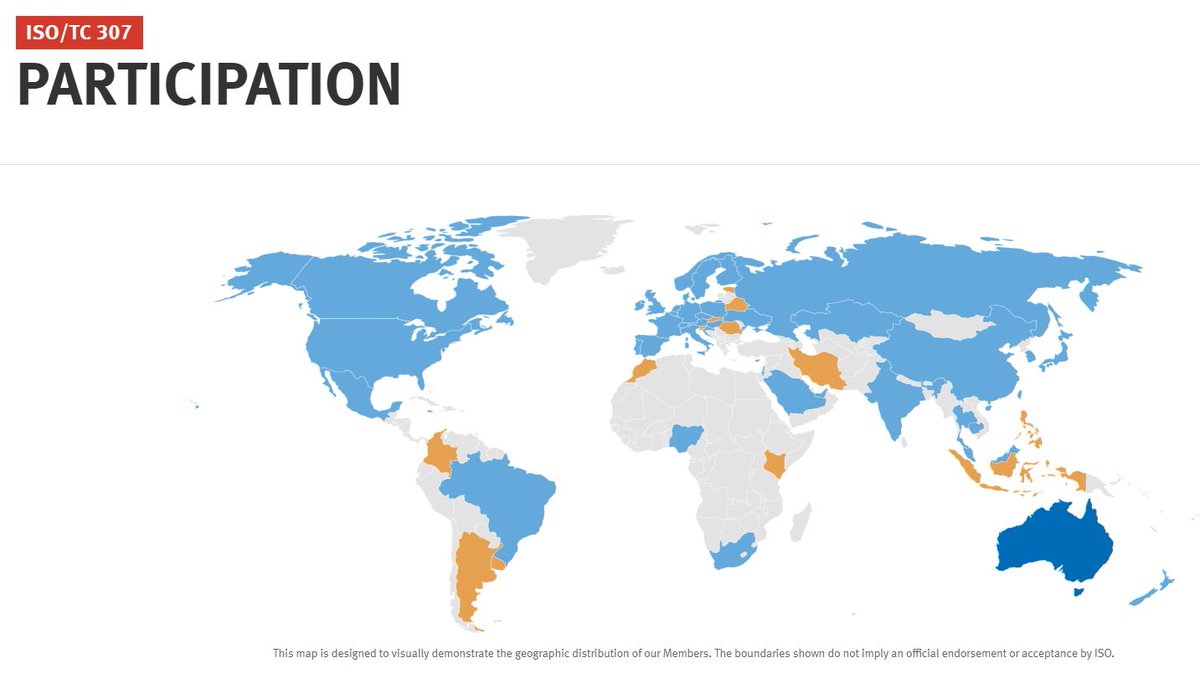

Gilbert founded ISO TC307 which 60 countries are working towards standardizing the interfaces

3/ "We believe that a blockchain gateway is needed for blockchain networks to interoperate in a manner similar

to border gateway routers in IP networks. Just as border gateway routers use the BGPv4 protocol to interact with one another in a peered fashion we believe that a...

4/ blockchain gateway protocol will be needed to permit the movement of virtual assets and related information across blockchain networks in a secure and privacy-preserving manner"

You can read more about the gateway protocol ODAP in this 21 tweet

5/

"We motivate the need for blockchain gateways and blockchain gateway protocols in the following summary:

✅Enables blockchain interoperability:

Blockchain gateways provide an interface for the interoperability between blockchain/DLT systems that operate distinct consensus...

https://t.co/PbjQkSlTT3

@quant_network are collaborating with MIT in the creation of ODAP

$QNT

2/ "In order for blockchain-based services to scale globally, blockchain networks must be able to interoperate with one another following a standardized protocol and interfaces (APIs)"

Gilbert founded ISO TC307 which 60 countries are working towards standardizing the interfaces

3/ "We believe that a blockchain gateway is needed for blockchain networks to interoperate in a manner similar

to border gateway routers in IP networks. Just as border gateway routers use the BGPv4 protocol to interact with one another in a peered fashion we believe that a...

4/ blockchain gateway protocol will be needed to permit the movement of virtual assets and related information across blockchain networks in a secure and privacy-preserving manner"

You can read more about the gateway protocol ODAP in this 21 tweet

See this 21-tweet thread about the creation of an Internet scale protocol to move digital assets involving Quant, MIT, US Government, Intel, Juniper, Payment and Telecom companies \U0001f447https://t.co/n7VGIIlAvq pic.twitter.com/mTUEmCMFZM

— Seq (@CryptoSeq) December 22, 2020

5/

"We motivate the need for blockchain gateways and blockchain gateway protocols in the following summary:

✅Enables blockchain interoperability:

Blockchain gateways provide an interface for the interoperability between blockchain/DLT systems that operate distinct consensus...

You May Also Like

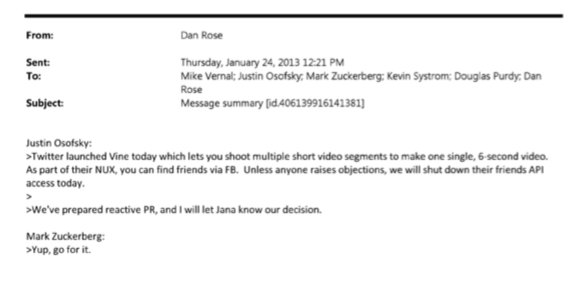

BREAKING: @CommonsCMS @DamianCollins just released previously sealed #Six4Three @Facebook documents:

Some random interesting tidbits:

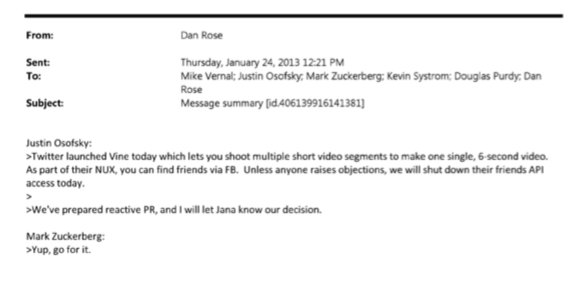

1) Zuck approves shutting down platform API access for Twitter's when Vine is released #competition

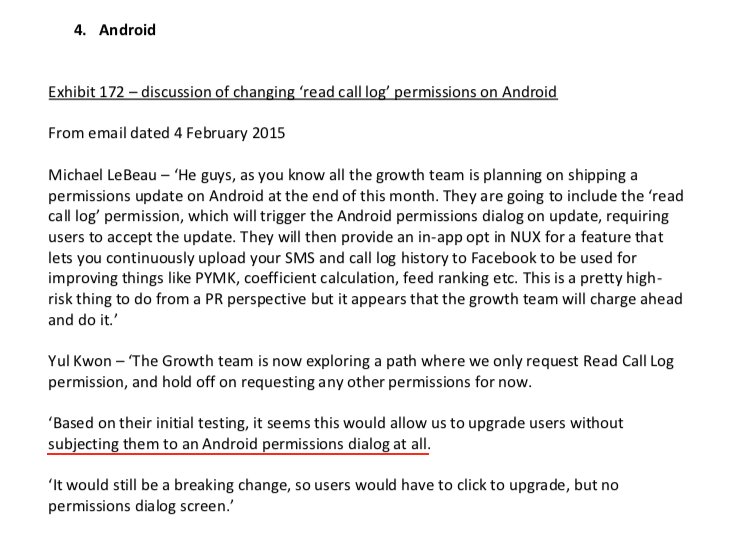

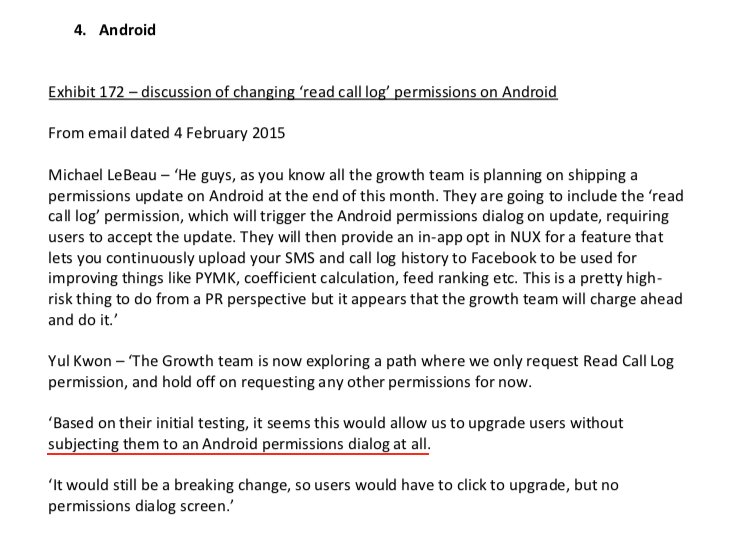

2) Facebook engineered ways to access user's call history w/o alerting users:

Team considered access to call history considered 'high PR risk' but 'growth team will charge ahead'. @Facebook created upgrade path to access data w/o subjecting users to Android permissions dialogue.

3) The above also confirms @kashhill and other's suspicion that call history was used to improve PYMK (People You May Know) suggestions and newsfeed rankings.

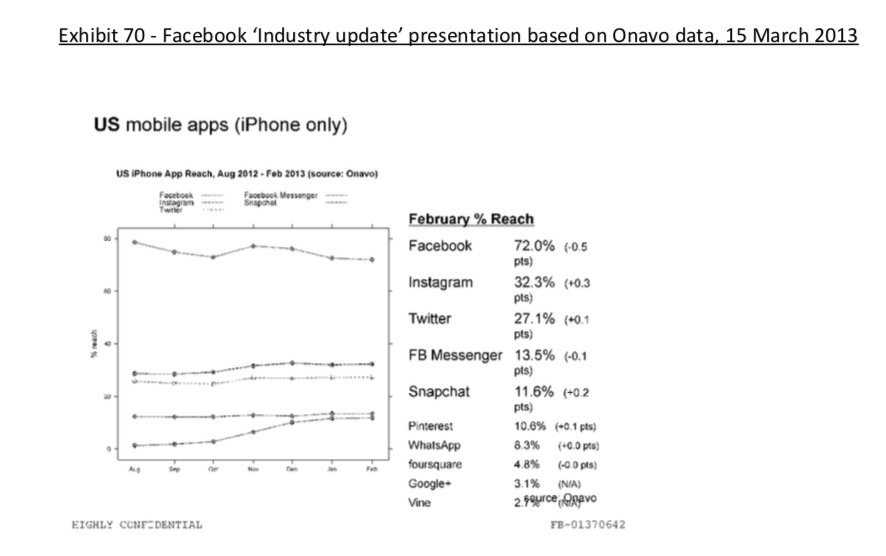

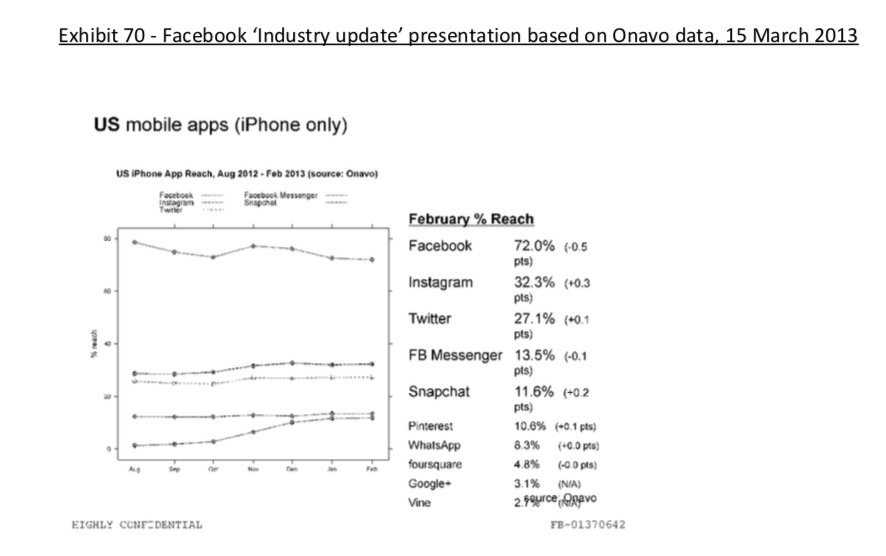

4) Docs also shed more light into @dseetharaman's story on @Facebook monitoring users' @Onavo VPN activity to determine what competitors to mimic or acquire in 2013.

https://t.co/PwiRIL3v9x

Some random interesting tidbits:

1) Zuck approves shutting down platform API access for Twitter's when Vine is released #competition

2) Facebook engineered ways to access user's call history w/o alerting users:

Team considered access to call history considered 'high PR risk' but 'growth team will charge ahead'. @Facebook created upgrade path to access data w/o subjecting users to Android permissions dialogue.

3) The above also confirms @kashhill and other's suspicion that call history was used to improve PYMK (People You May Know) suggestions and newsfeed rankings.

4) Docs also shed more light into @dseetharaman's story on @Facebook monitoring users' @Onavo VPN activity to determine what competitors to mimic or acquire in 2013.

https://t.co/PwiRIL3v9x