a $250M fund could do a $5-10M deal every month for two years and still be under-allocated

and there aren’t enough companies raising series B / C / D rounds!!!

every deal i’ve done lately is under $50M valuation

1/ Figure I should get out ahead of this issue:

— Dan McArdle (@robustus) June 22, 2018

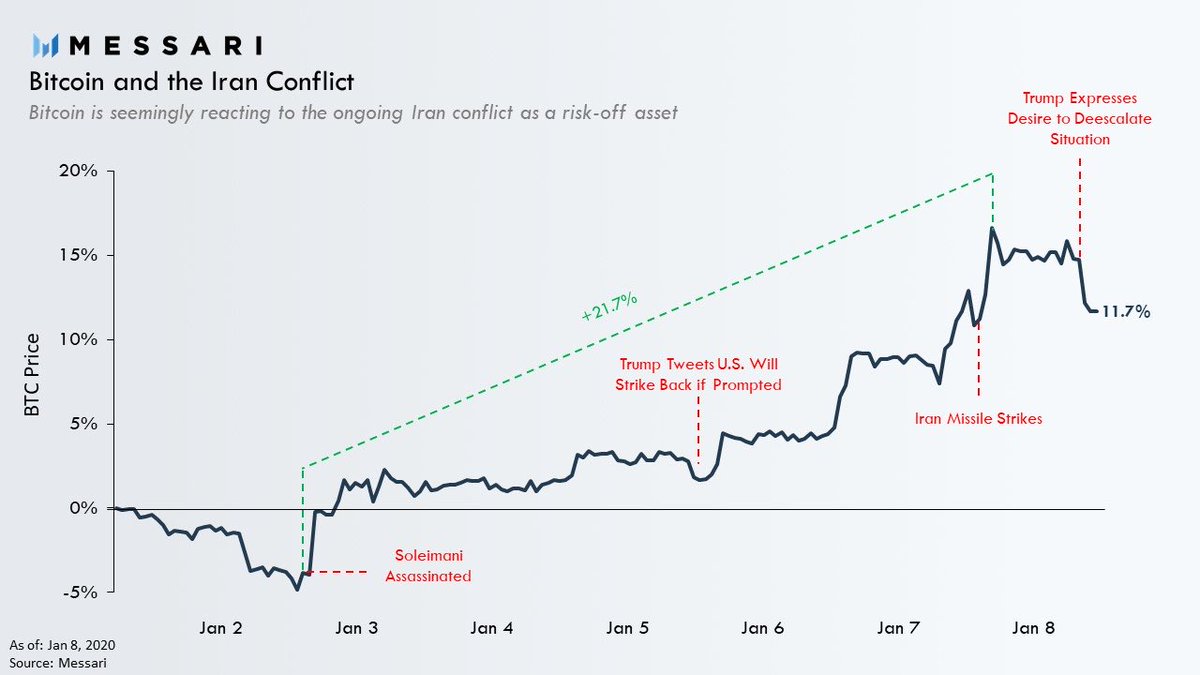

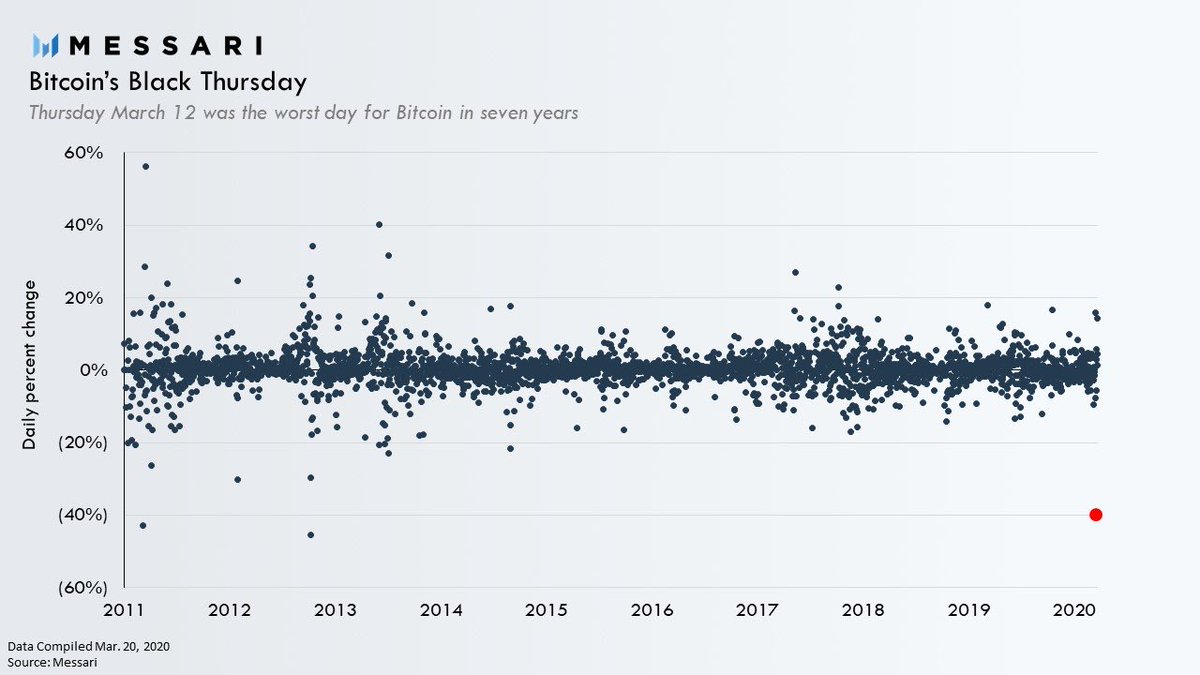

Bitcoin is a hedge against inflation & loss of confidence in fiat, NOT a hedge against a typical recession.

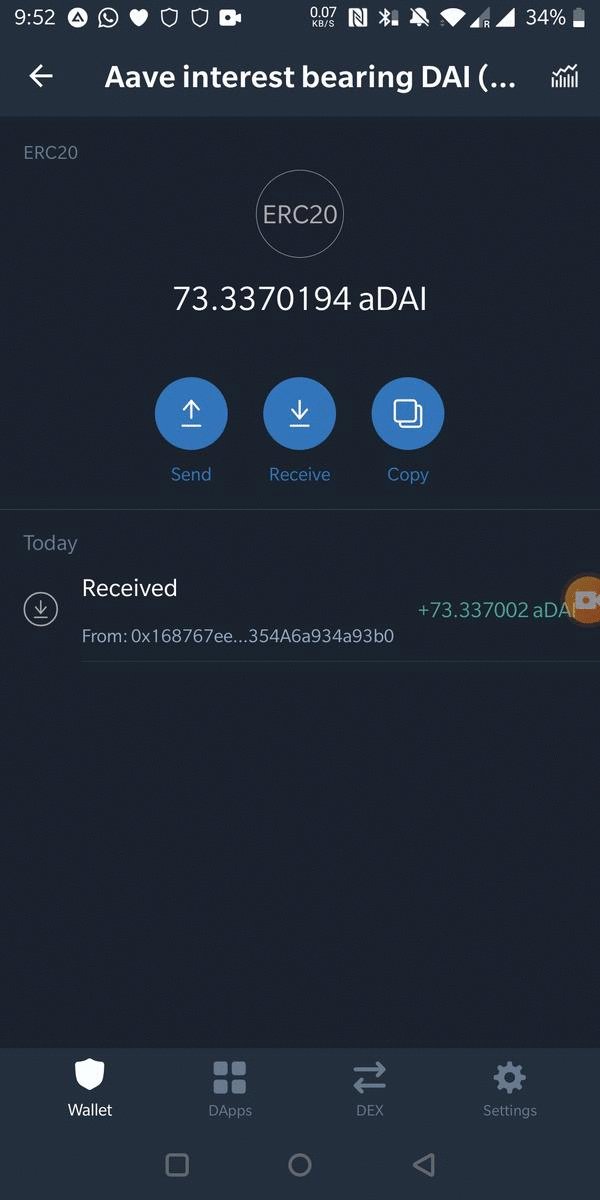

It pays to be a web3 power user.

— Coopahtroopa \U0001f525_\U0001f525 (@Cooopahtroopa) December 9, 2020

Five networks that issued retroactive airdrops to value added actors \U0001f4dd

BAL is live!

— Balancer Labs (@BalancerLabs) June 23, 2020

The 435k BAL for liquidity providers of the first three weeks of liquidity mining (145k per week) have just been sent out to the wallets used to provide liquidity on Balancer.https://t.co/pkXFzwzPVC

Check out @Cooopahtroopa's latest post for all the #DeFi farmers out there \U0001f468\u200d\U0001f33e

— Zerion \U0001f3e6 (@zerion_io) June 26, 2020

Turns out @synthetix_io & @CurveFinance were ploughing the fields long before $COMP & $BAL came along.

Learn how to put your #crypto to work with this #yieldfarming 101 \U0001f4b8

\U0001f449 https://t.co/zYUKtqx3BK

2/ What is a Fair Launch?

— fair launch capital (@fairlaunchcap) August 26, 2020

A FL enables founders to bootstrap new crypto networks that are earned, owned, and governed by their community from the outset.

In this dynamic, everyone participates on equal footing\u2014there is no early access, pre-mine, or allocation of tokens.

ok, I lied. but strictly it's not a new graph, just a new trendline (now a quadratic on the log plot). looks um... quite a good fit. so I'd say that was interesting. pic.twitter.com/qkgyMf1ya8

— James Ward (@JamesWard73) January 27, 2021

Been thinking about where we are, where we might be going, what effect vaccines might have and how to tell. This thread may not happen all at once, and will get a bit mathematical in a couple of places (sorry!), but I will put in pictures. It's yet another argument for log scales

— Oliver Johnson (@BristOliver) January 24, 2021