So, above Rs 250 Cr market cap (thats where I like to play mostly), out of 1168 companies, change in last 1 week

> 40% correction : 6 to 7%

> 30% correction : 18 to 21%

> 20% correction : 45 to 57%

Bulk of correction between 20-30% from highs

So, above Rs 250 Cr market cap (thats where I like to play mostly), out of 1168 companies:

— kumar saurabh (@suru27) November 22, 2021

> 40% correction : 6% companies

> 30% correction : 18% companies

> 20% correction : 45% companies

Not bad. So, almost evey second company is down by 20% from life time high

More from kumar saurabh

You May Also Like

First update to https://t.co/lDdqjtKTZL since the challenge ended – Medium links!! Go add your Medium profile now 👀📝 (thanks @diannamallen for the suggestion 😁)

Just added Telegram links to https://t.co/lDdqjtKTZL too! Now you can provide a nice easy way for people to message you :)

Less than 1 hour since I started adding stuff to https://t.co/lDdqjtKTZL again, and profile pages are now responsive!!! 🥳 Check it out -> https://t.co/fVkEL4fu0L

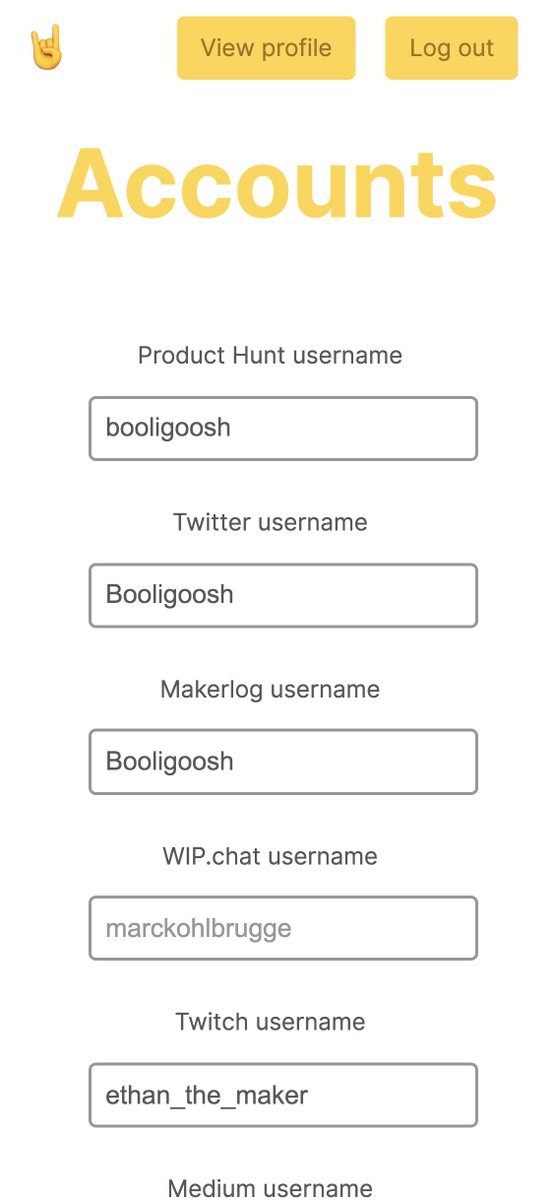

Accounts page is now also responsive!! 📱✨

💪 I managed to make the whole site responsive in about an hour. On my roadmap I had it down as 4-5 hours!!! 🤘🤠🤘

Just added Telegram links to https://t.co/lDdqjtKTZL too! Now you can provide a nice easy way for people to message you :)

Less than 1 hour since I started adding stuff to https://t.co/lDdqjtKTZL again, and profile pages are now responsive!!! 🥳 Check it out -> https://t.co/fVkEL4fu0L

Accounts page is now also responsive!! 📱✨

💪 I managed to make the whole site responsive in about an hour. On my roadmap I had it down as 4-5 hours!!! 🤘🤠🤘

Trump is gonna let the Mueller investigation end all on it's own. It's obvious. All the hysteria of the past 2 weeks about his supposed impending firing of Mueller was a distraction. He was never going to fire Mueller and he's not going to

Mueller's officially end his investigation all on his own and he's gonna say he found no evidence of Trump campaign/Russian collusion during the 2016 election.

Democrats & DNC Media are going to LITERALLY have nothing coherent to say in response to that.

Mueller's team was 100% partisan.

That's why it's brilliant. NOBODY will be able to claim this team of partisan Democrats didn't go the EXTRA 20 MILES looking for ANY evidence they could find of Trump campaign/Russian collusion during the 2016 election

They looked high.

They looked low.

They looked underneath every rock, behind every tree, into every bush.

And they found...NOTHING.

Those saying Mueller will file obstruction charges against Trump: laughable.

What documents did Trump tell the Mueller team it couldn't have? What witnesses were withheld and never interviewed?

THERE WEREN'T ANY.

Mueller got full 100% cooperation as the record will show.

BREAKING: President Donald Trump has submitted his answers to questions from special counsel Robert Mueller

— Ryan Saavedra (@RealSaavedra) November 20, 2018

Mueller's officially end his investigation all on his own and he's gonna say he found no evidence of Trump campaign/Russian collusion during the 2016 election.

Democrats & DNC Media are going to LITERALLY have nothing coherent to say in response to that.

Mueller's team was 100% partisan.

That's why it's brilliant. NOBODY will be able to claim this team of partisan Democrats didn't go the EXTRA 20 MILES looking for ANY evidence they could find of Trump campaign/Russian collusion during the 2016 election

They looked high.

They looked low.

They looked underneath every rock, behind every tree, into every bush.

And they found...NOTHING.

Those saying Mueller will file obstruction charges against Trump: laughable.

What documents did Trump tell the Mueller team it couldn't have? What witnesses were withheld and never interviewed?

THERE WEREN'T ANY.

Mueller got full 100% cooperation as the record will show.