Thread:

1. Who runs Taiwan's media? For the longest time, I've said that Taiwanese media is just US MSM translated into Chinese, regardless of whether it is pan-blue (KMT-leaning) or pan-green (DPP-leaning). Below is a breakdown of some shareholder information.

More from China

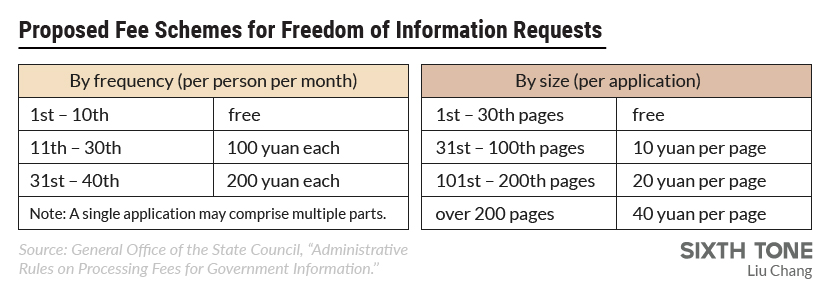

According to a notice published Dec. 1, government offices will be able to choose from two different rate schemes: one based on frequency, one based on size. https://t.co/KxUSE3dXEu

The “size” route is especially problematic. Here’s why:

If you’re an activist or a lawyer seeking a copy of an 800-page environmental impact assessment report, it’s going to cost you around $4,000 under this scheme.

In the past, disclosure requests were essentially free in China because there were no rules for charging fees.

In fact, last December an administrative agency in Shenzhen was ordered to reimburse an applicant after sending him a pay-on-delivery parcel.

According to the State Council’s Dec. 1 notice, the aim of adding the fees isn’t to generate revenue, but to “guide applicants to exercise their rights reasonably.”

Regardless of intention, however, the new costs will likely be a hindrance to those seeking public information.

You May Also Like

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

Here are the setups from @Pathik_Trader Sir first.

1. Open Drive (Intraday Setup explained)

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

Bactesting results of Open Drive

Already explained strategy of #opendrive

— Pathik (@Pathik_Trader) May 27, 2020

Backtested results in 30 stocks and nifty, banknifty.

Success ratio : approx 40-45%

RR average 1:2

Entry as per strategy

Stoploss = Open level

Exit 3:15 PM Or SL

39 months 14 months -ve, 25 +ve

Yearly all 4 years +ve performance. pic.twitter.com/nGqhzMKGVy

2. Two Price Action setups to get good long side trade for intraday.

1. PDC Acts as Support

2. PDH Acts as

So today we will discuss two more price action setups to get good long side trade for intraday.

— Pathik (@Pathik_Trader) June 20, 2020

1. PDC Acts as Support

2. PDH Acts as Support

Example of PDC/PDH Setup given

#nifty

— Pathik (@Pathik_Trader) June 23, 2020

This is how it created long setup by taking support at PDC.

hopefully shared setup on last weekend helped. pic.twitter.com/2mduSUpMn5