In this thread, we'll learn about -

1. Features

2. Method to draw

3. Uses

4. Two Specific setups

5. Five crucial Tips

Super thread on Trendlines & Two High-Quality Setups based on them.

— The Cnceptual Trader \U0001f1ee\U0001f1f3 (@CnceptualTrader) September 18, 2022

\U0001f9f5

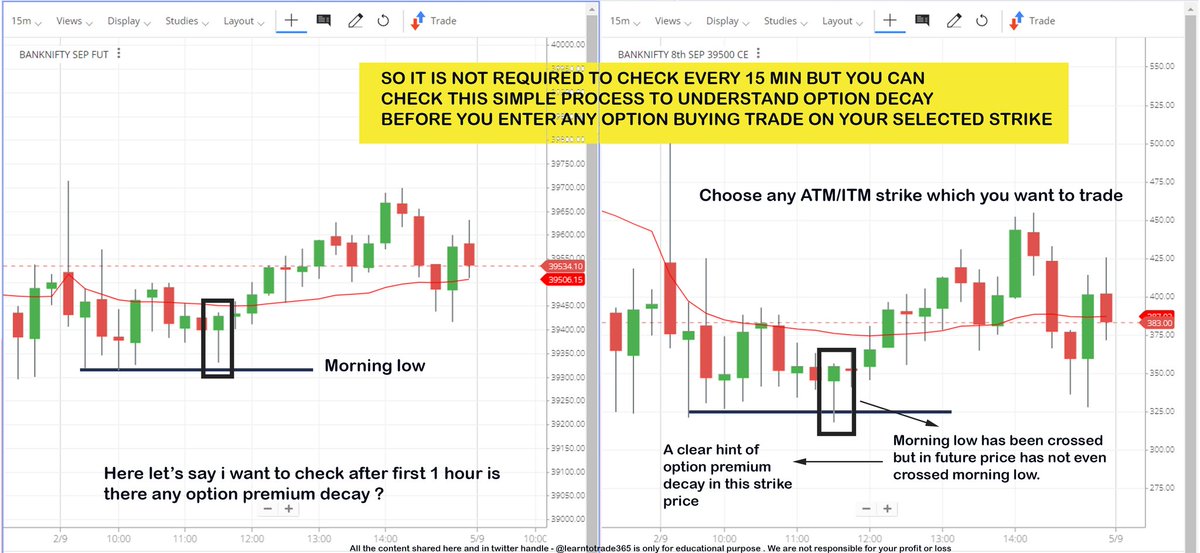

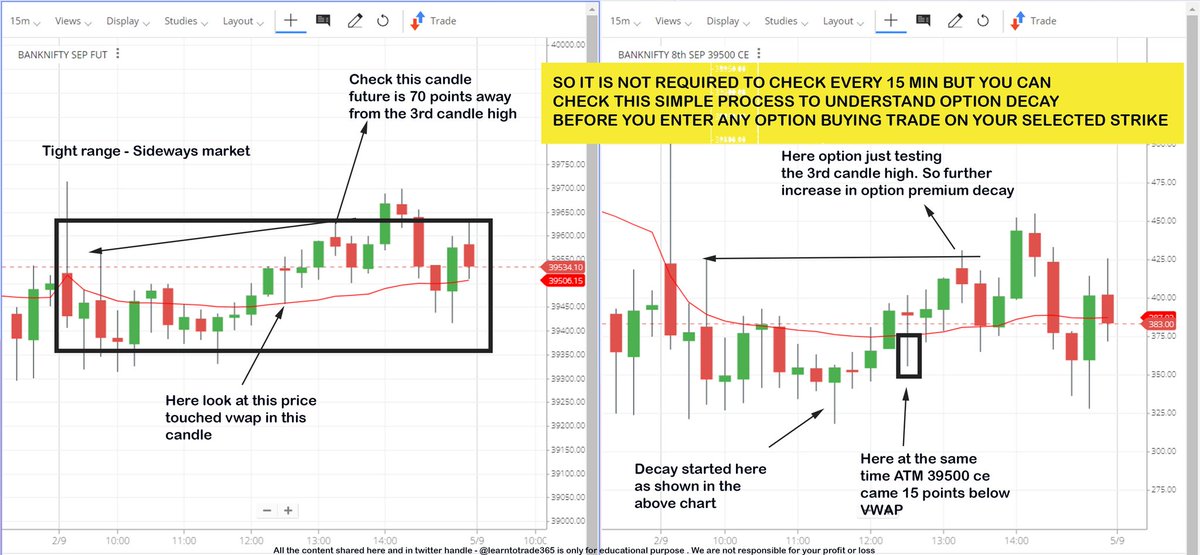

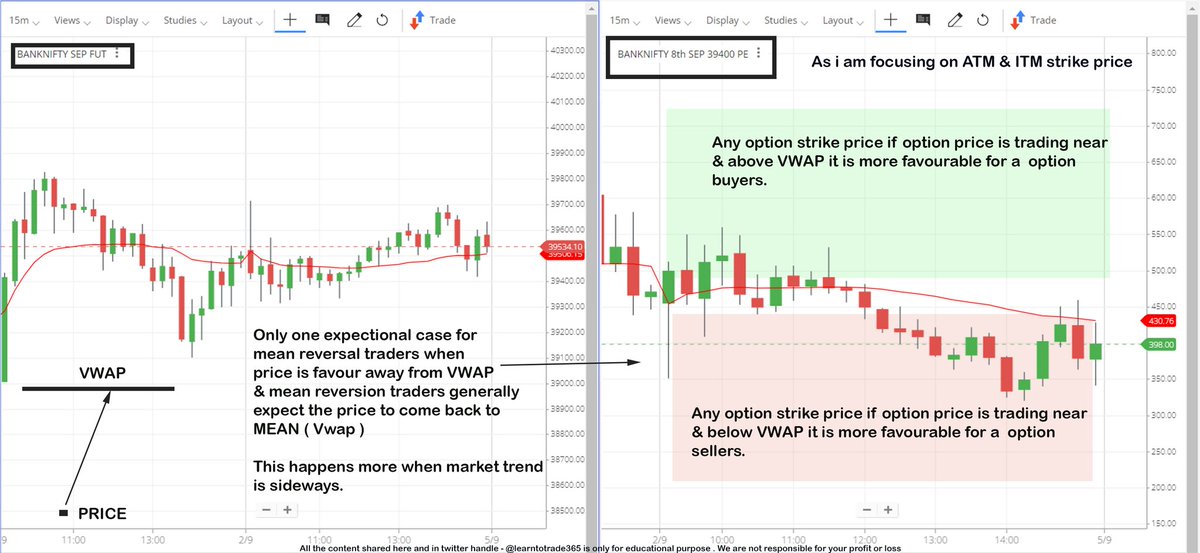

Option Buying Simplified

— Learn to Trade (@learntotrade365) August 31, 2022

Very important thread for all option buyers \U0001f9f5

Just 5 minutes to read but it can change your trading a lot.

Support us by RETWEET this tweet to help most option buyers to gain knowledge & to avoid getting trapped from big players pic.twitter.com/BaaTjJix7F

Price Action Trading ( Without Indicators)

— Learn to Trade (@learntotrade365) August 20, 2022

Intraday Trading strategy for all Directional traders.

Intraday Trading Strategy Thread \U0001f9f5

Support us by RETWEET to reach and benefit maximum traders

Scroll down \U0001f447 pic.twitter.com/AVsKmWroMc

Vwap with Pivot Points

— Learn to Trade (@learntotrade365) August 14, 2022

Intraday Trading strategy for Trend followers ( Will share also for mean reversion trader as soon as possible )

Intraday Trading Strategy Thread \U0001f9f5

Support us by Retweet to reach and benefit maximum traders

Scroll down \U0001f447 pic.twitter.com/xYPPnqWQ02

Buyers vs Sellers

— Learn to Trade (@learntotrade365) August 13, 2022

A simple technique to understand the index direction using candlesticks chart.

Intraday Trading Thread \U0001f9f5

Retweet to reach & benefit maximum traders

Scroll down \U0001f447 pic.twitter.com/6vMK92EqDo