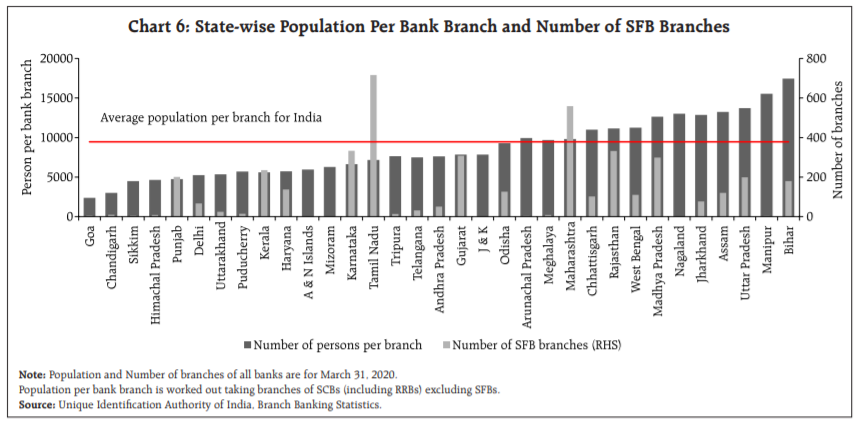

🧵While we in Fintech are Hoping for Challenger/Neo Banking Licences from RBI. Let's understand more about Small Finance Bank and from their success, try to see if a balance between Profitability (for business) and Financial Inclusion (for RBI) can be made for future usecase?👇

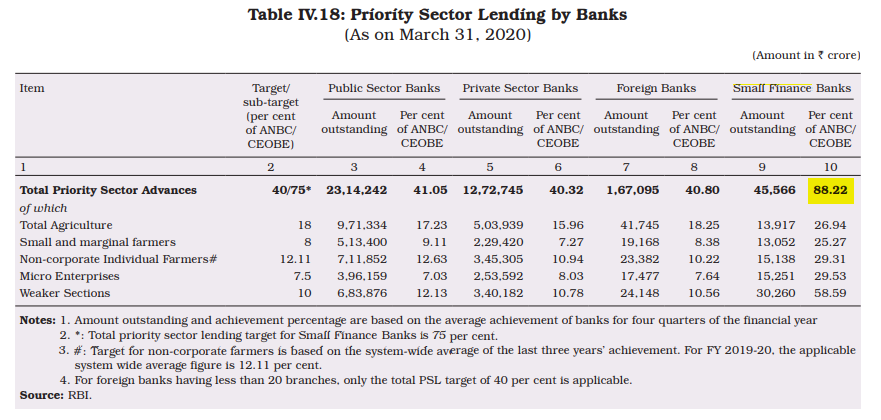

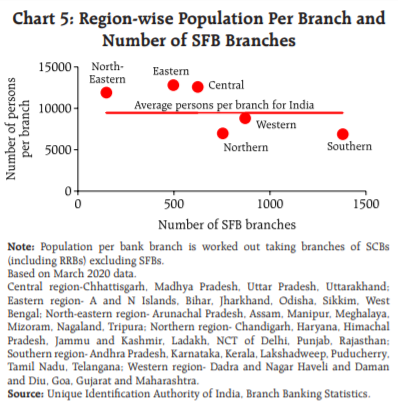

1. Priority Sector Lending (75% of their total lending) and 2. Branches for Unbanked (SFB were required to have 25% of their branches in rural unbanked centres (population shall be less than 10,000)

More from Business

Facebook originally a CIA program called "LifeLog".

LifeLog, via DARPA, terminated on Feb 4th, 2004.

Facebook was launched on Feb 4th, 2004.

Many of the LifeLog team became execs at FB.

Zuckerberg is a figurehead.

CIA allowed Cambridge to help Trump win

https://t.co/enzOXDCogV

Pentagon Kills LifeLog

LifeLog, via DARPA, terminated on Feb 4th, 2004.

Facebook was launched on Feb 4th, 2004.

Many of the LifeLog team became execs at FB.

Zuckerberg is a figurehead.

CIA allowed Cambridge to help Trump win

https://t.co/enzOXDCogV

Project: Lifelog

— Robert Horan (@Robby12692) December 13, 2018

Started by DARPA in 1999, the goal of Lifelog was to create a database on civilians without their knowledge, and track everything they do.

The project "ended" on Feb 4th, 2004.

Facebook began the exact same day.

The CIA funneled tens of millions into Facebook. pic.twitter.com/r7hwF0v9kh

Pentagon Kills LifeLog

You May Also Like

Great article from @AsheSchow. I lived thru the 'Satanic Panic' of the 1980's/early 1990's asking myself "Has eveyrbody lost their GODDAMN MINDS?!"

The 3 big things that made the 1980's/early 1990's surreal for me.

1) Satanic Panic - satanism in the day cares ahhhh!

2) "Repressed memory" syndrome

3) Facilitated Communication [FC]

All 3 led to massive abuse.

"Therapists" -and I use the term to describe these quacks loosely - would hypnotize people & convince they they were 'reliving' past memories of Mom & Dad killing babies in Satanic rituals in the basement while they were growing up.

Other 'therapists' would badger kids until they invented stories about watching alligators eat babies dropped into a lake from a hot air balloon. Kids would deny anything happened for hours until the therapist 'broke through' and 'found' the 'truth'.

FC was a movement that started with the claim severely handicapped individuals were able to 'type' legible sentences & communicate if a 'helper' guided their hands over a keyboard.

For three years I have wanted to write an article on moral panics. I have collected anecdotes and similarities between today\u2019s moral panic and those of the past - particularly the Satanic Panic of the 80s.

— Ashe Schow (@AsheSchow) September 29, 2018

This is my finished product: https://t.co/otcM1uuUDk

The 3 big things that made the 1980's/early 1990's surreal for me.

1) Satanic Panic - satanism in the day cares ahhhh!

2) "Repressed memory" syndrome

3) Facilitated Communication [FC]

All 3 led to massive abuse.

"Therapists" -and I use the term to describe these quacks loosely - would hypnotize people & convince they they were 'reliving' past memories of Mom & Dad killing babies in Satanic rituals in the basement while they were growing up.

Other 'therapists' would badger kids until they invented stories about watching alligators eat babies dropped into a lake from a hot air balloon. Kids would deny anything happened for hours until the therapist 'broke through' and 'found' the 'truth'.

FC was a movement that started with the claim severely handicapped individuals were able to 'type' legible sentences & communicate if a 'helper' guided their hands over a keyboard.