In technical analysis, majority of the patterns were first observed visually and then the rules made. Observing this interesting phenomenon on BNF over the past one month.

Any strong up day on BNF is immediately followed by a gap down open from the previous closing

Technical analysis of stock trends by Edwards and Magee

https://t.co/O8yWYpWC2W

More from Subhadip Nandy

The most important question now on the mind of all analysts and traders. Is this a bear market rally or is this the start of a bull move. Retweeting this as I will need a few tweets to explain my view

Everyone knows the HH-HL or LH-LL as per Dow theory. This can be a bit confusing on how one marks the Highs and Lows. Long back, I picked up this trick from one of the neo-Dow theorists on what to do in scenarios like this

Simply plot a 5 period exponential moving average on a different panel. A 5-EMA simply shows you a running weekly perspective and kind of smoothens the price where a single spike high/low is not of that much importance

You will see this 5-ema also making HH.HL.LH.LL. So now, rather than focusing on the highs/lows on the charts, focusing on highs/lows on the 5-ema gives a cleaner perspective

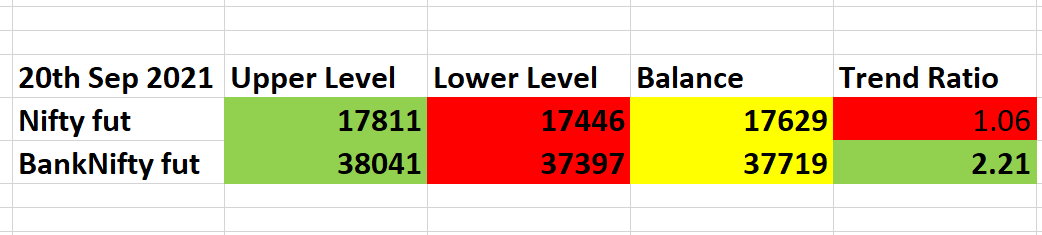

As per this charts, unless the 5-ema now closes above 17540 ( the ema, not Nifty price) I will not play this as a bull market. I will deal with this market as a counter move against the major bear trend

Is Nifty bullish, or bearish?

— AP (@ap_pune) March 19, 2022

Replies MUST be ONLY with charts, not just 'views', no Russia Ukraine, crude, gold etc.

Can be levels....abv/below

Just technicals....maybe with trend lines, indicators or any other study (EW, harmonics etc)

Charts can be daily, weekly or monthly.

Everyone knows the HH-HL or LH-LL as per Dow theory. This can be a bit confusing on how one marks the Highs and Lows. Long back, I picked up this trick from one of the neo-Dow theorists on what to do in scenarios like this

Simply plot a 5 period exponential moving average on a different panel. A 5-EMA simply shows you a running weekly perspective and kind of smoothens the price where a single spike high/low is not of that much importance

You will see this 5-ema also making HH.HL.LH.LL. So now, rather than focusing on the highs/lows on the charts, focusing on highs/lows on the 5-ema gives a cleaner perspective

As per this charts, unless the 5-ema now closes above 17540 ( the ema, not Nifty price) I will not play this as a bull market. I will deal with this market as a counter move against the major bear trend