I am reading seed catalogs in the morning sun. A thread. 🌻🥦🌽🍅🍆🥔🥒

More from Book

It has been exactly 3 years to "how fund managers .." was released. The book took a lot of time to write. Here is a short thread about how it happened ..

2/n the idea came from @kan_writersside who got me in touch with Dibakar Ghosh at @Rupa_Books .. we discussed the idea that it has been 2 decades to the fund management industry and it deserves a book. A lot was written about about Bharat Shah, Prashant Jain and S.Arora..

3/n but there was not much information about investment philosophies and the overall environment of the mid 90s and later on. Kanishk and Dibakar wanted a broader book for everyone and not just the stock market reader. We went to work

4/n we decided to write about the dotcom boom and bust where it all started. The start fund managers came from there. In Feb 2000 IT index had a pe multiple of 420 and the market cap of the sector was 34% of the market. Banks were 5% and some analysts were still bullish

5/n prashant Jain was one of the few fund managers who was out of the sector in November itself and was quietly watching the index go up. There were others but the legend of Jain was at the top of the mind because it is believed he refused to meet the CFO of a big IT company ..

Bharat shah's Word of wisdom

— Investment Books (@InvestmentBook1) December 5, 2020

-Thumb rule to create Value Investing

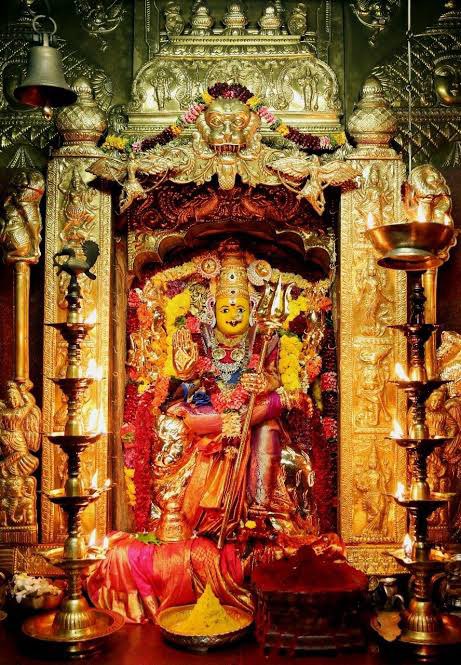

Image Courtesy : @ms89_meet

How Fund Managers are Making You Rich: Discover Ways to Tame the Bear and Ride the Bull by @lonelycrowd https://t.co/hKirKY0BtC pic.twitter.com/mbh2gm3Iuo

2/n the idea came from @kan_writersside who got me in touch with Dibakar Ghosh at @Rupa_Books .. we discussed the idea that it has been 2 decades to the fund management industry and it deserves a book. A lot was written about about Bharat Shah, Prashant Jain and S.Arora..

3/n but there was not much information about investment philosophies and the overall environment of the mid 90s and later on. Kanishk and Dibakar wanted a broader book for everyone and not just the stock market reader. We went to work

4/n we decided to write about the dotcom boom and bust where it all started. The start fund managers came from there. In Feb 2000 IT index had a pe multiple of 420 and the market cap of the sector was 34% of the market. Banks were 5% and some analysts were still bullish

5/n prashant Jain was one of the few fund managers who was out of the sector in November itself and was quietly watching the index go up. There were others but the legend of Jain was at the top of the mind because it is believed he refused to meet the CFO of a big IT company ..