1/ Don’t Fear Tether

Whenever Bitcoin has a bull run, naysayers try to cope with missing the boat by rationalizing why it will fail through FUD. Most of these are completely unsubstantiated, but annoyingly persist as negative narratives Bitcoin must fight against.

More from Dan Held

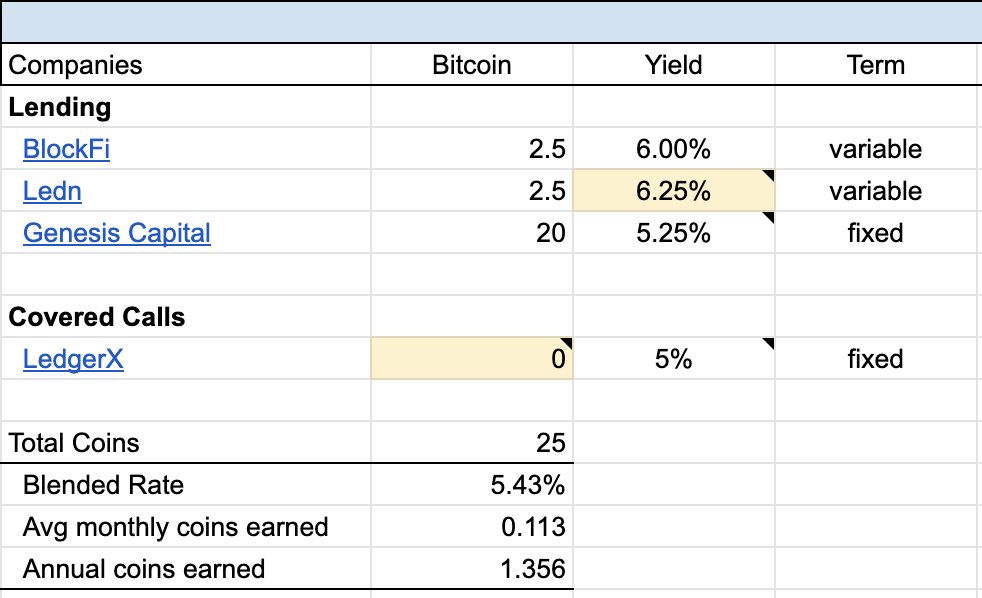

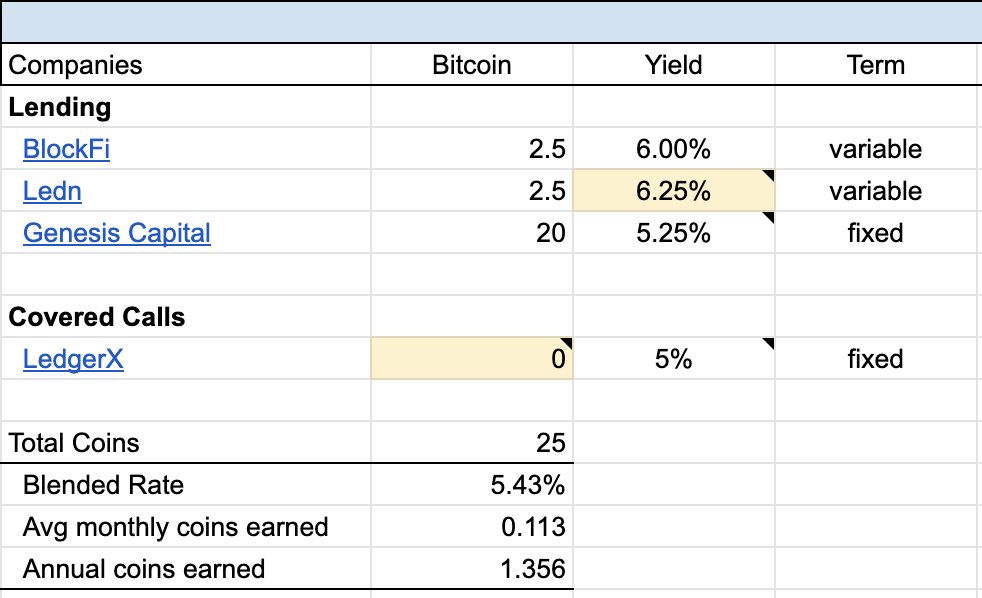

1/ [December Bitcoin yield update]

Over the last year and a half, I’ve earned ~1.2BTC with various yield generating services to earn an average of 5% on 30 BTC.

Here’s my journey and how to guide👇

2/ Here are the ways you can earn yield:

Lending (Easiest/most popular)

Yield: 3-6%

- Ledn: https://t.co/4x0YATuQ0v

- BlockFi: https://t.co/90Xtg2cNka

Covered calls (Harder)

Yield: 1-80%

- Deribit: https://t.co/2iQVkXlylP

- LedgerX:

3/ Earning a yield enables you to stack more sats (what I’m doing), or reduce the temptation to sell your coin through earning an income.

The yield you earn comes with RISK!

Below is my current allocation for Dec (will update MoM)

(yellow = changes)

https://t.co/PZwVYs8lFT

4a/ [Nov > Dec Changelog]

- Covered calls: approx. 4 BTC was in $40k 12/28/20 contracts. Those closed without them being exercised (a good outcome for me). However, I was nervous about my January 1/28 $50k contract so I decided to close out my position at a small loss.

4b/ [Nov > Dec Changelog]

- In process of reallocating the 5 BTC (probably will be a lending platform).

- I incorrectly had my Ledn rate at 6.5%, it's 6.25%

Over the last year and a half, I’ve earned ~1.2BTC with various yield generating services to earn an average of 5% on 30 BTC.

Here’s my journey and how to guide👇

2/ Here are the ways you can earn yield:

Lending (Easiest/most popular)

Yield: 3-6%

- Ledn: https://t.co/4x0YATuQ0v

- BlockFi: https://t.co/90Xtg2cNka

Covered calls (Harder)

Yield: 1-80%

- Deribit: https://t.co/2iQVkXlylP

- LedgerX:

3/ Earning a yield enables you to stack more sats (what I’m doing), or reduce the temptation to sell your coin through earning an income.

The yield you earn comes with RISK!

Below is my current allocation for Dec (will update MoM)

(yellow = changes)

https://t.co/PZwVYs8lFT

4a/ [Nov > Dec Changelog]

- Covered calls: approx. 4 BTC was in $40k 12/28/20 contracts. Those closed without them being exercised (a good outcome for me). However, I was nervous about my January 1/28 $50k contract so I decided to close out my position at a small loss.

4b/ [Nov > Dec Changelog]

- In process of reallocating the 5 BTC (probably will be a lending platform).

- I incorrectly had my Ledn rate at 6.5%, it's 6.25%

More from Bitcoin

Ok, so what is the significance of the @lagarde statement on bitcoin?

We were offered a very open insight (but slightly flawed analysis) into top level policy perspective behind the crack down on selfhosted wallets.

https://t.co/1LTzrxHbgs 1/32

'It is a speculative asset, by any account. If you look at the price movements... '

It starts with an economic price perspective and we can learn that ECB is closely monitoring this price movement as one of the many indicators.

So we are in the classic central bank frame 2/32

'Those who thought it would turn into a currency. Sorry, it is an asset not a currency.'

Here she summarises a classic debate on what is currency and what is needed for that. Based on the holy three: unit of account, means of payment, store of value. 3/32

The summary is classic, but too narrow and does not incorporate the wider financial history viewpoints on money, currencies and the way we pay. 4/32

ECB overlooks the de facto unit of account role of bitcoin, having been used to 200 years of having cash around whic is both the unit of account and a means of payment. 5/32

We were offered a very open insight (but slightly flawed analysis) into top level policy perspective behind the crack down on selfhosted wallets.

https://t.co/1LTzrxHbgs 1/32

ECB President Christine Lagarde called for global regulation of #Bitcoin, saying the digital currency had been used for money laundering activities in some instances and that any loopholes needed to be closed. Follow #ReutersNext updates here: https://t.co/4MgFy4jnw5 pic.twitter.com/qlBtoDuZLW

— Reuters (@Reuters) January 13, 2021

'It is a speculative asset, by any account. If you look at the price movements... '

It starts with an economic price perspective and we can learn that ECB is closely monitoring this price movement as one of the many indicators.

So we are in the classic central bank frame 2/32

'Those who thought it would turn into a currency. Sorry, it is an asset not a currency.'

Here she summarises a classic debate on what is currency and what is needed for that. Based on the holy three: unit of account, means of payment, store of value. 3/32

The summary is classic, but too narrow and does not incorporate the wider financial history viewpoints on money, currencies and the way we pay. 4/32

ECB overlooks the de facto unit of account role of bitcoin, having been used to 200 years of having cash around whic is both the unit of account and a means of payment. 5/32