1/ Satoshi’s Vision™ is a silly endeavor, as it doesn’t matter what it was, we are where we are now. However, those pushing the “Bitcoin was first made for payments” narrative insist on cherry-picking sentences from the white paper and forum posts to champion their perspective.

“[with Bitcoin] we can win a major battle in the arms race and gain a new territory of freedom for several years.” — Satoshi Nakamoto

“Bitcoin [is] more like a collectible or commodity.” - Satoshi

Satoshi here clearly highlights that Bitcoin’s scarcity gives it value… as a SoV. Limited supply is meaningless for VISA

Bitcoin’s launch during the 08' financial crisis was not coincidental. Satoshi had been coding Bitcoin for the last 2 years. Let’s look at the sequence of events

Sept 15: Lehman Brothers files for bankruptcy, the largest in U.S. history ($600B)

Sept 17: Investors withdrew a record $144B from their money market accounts. During a typical week, only about $7B is withdrawn

Oct 13: Treasury Secretary Paulson talks with 9 major bank CEOs. The total bailout package ~$2.25T

Oct 21: Fed lends $540B to bail out money market funds

Oct 31: Satoshi publishes the Bitcoin whitepaper

https://t.co/Bf8X1VI7Qo

“A purely peer-to-peer version of electronic [bearer assets] that would allow online payments to be sent directly from one party to another without going through a financial institution."

@pierre_rochard

Aka the whitepaper was marketing, the important details are coming.

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

What he was trying to accomplish was clear, he wanted to build a new backbone for the financial system. Bitcoin isn't merely digital cash, but an alternative to banks.

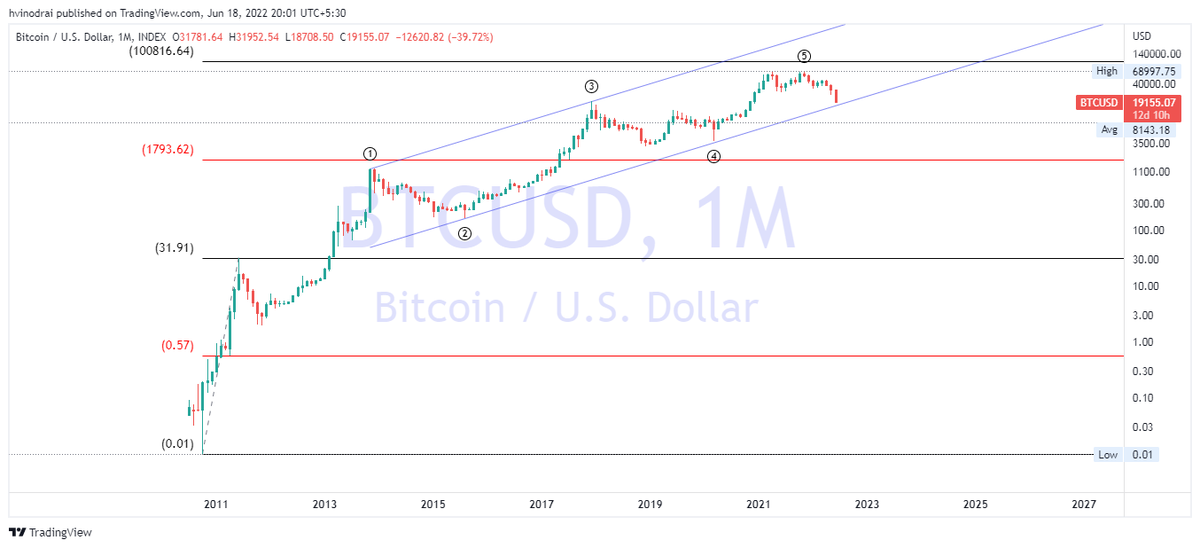

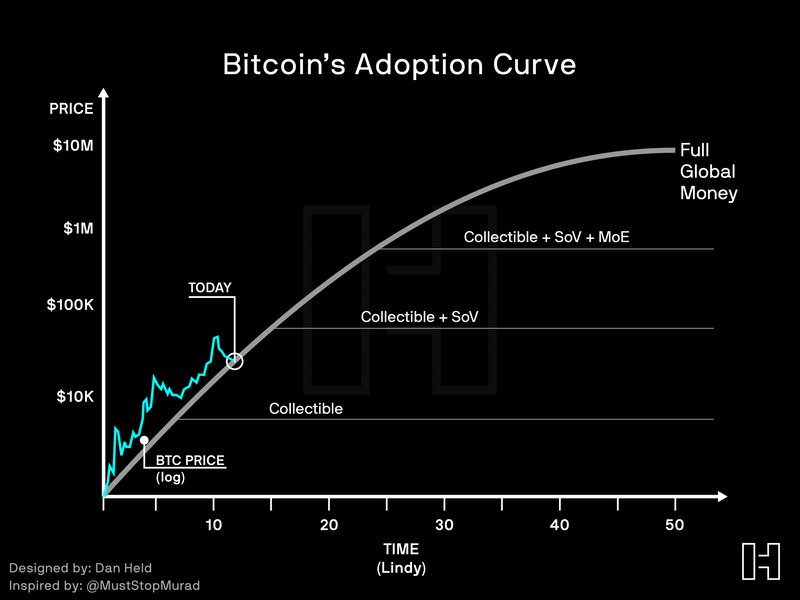

SoV and MoE aren’t mutually exclusive. It’s about where in the cycle of appreciation we’re in. At maturity, the payment use case finally makes sense.

https://t.co/C6kpf8cjKX

A/ Satoshi used it to attract the cypherpunks

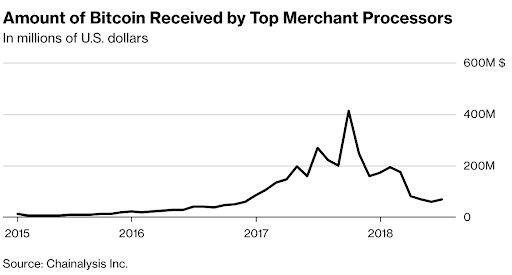

B/ HODLing isn’t good for business. In order to command higher valuations, startups latched onto narratives that VCs would fund. And in 2013-2016 that was “merchant processing.”

and @ChangeTip, both attempted to get people to use Bitcoin for payments. Consumers couldn't care less, which is entirely intuitive: right now it’s not faster, cheaper, or easier to use for 99.99% of use cases.

https://t.co/TYJDEruzvc

More from Dan Held

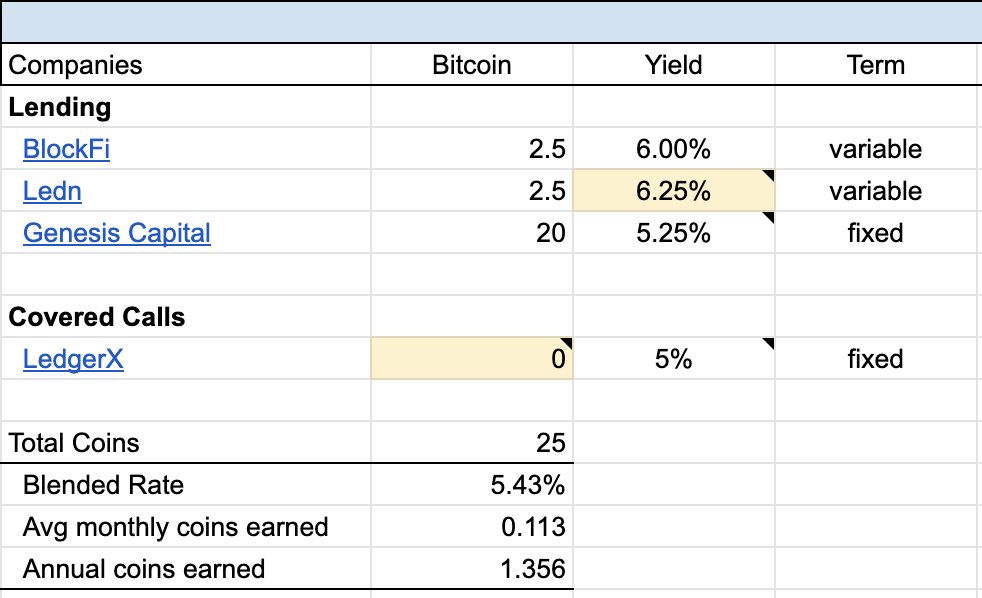

1/ [December Bitcoin yield update]

Over the last year and a half, I’ve earned ~1.2BTC with various yield generating services to earn an average of 5% on 30 BTC.

Here’s my journey and how to guide👇

2/ Here are the ways you can earn yield:

Lending (Easiest/most popular)

Yield: 3-6%

- Ledn: https://t.co/4x0YATuQ0v

- BlockFi: https://t.co/90Xtg2cNka

Covered calls (Harder)

Yield: 1-80%

- Deribit: https://t.co/2iQVkXlylP

- LedgerX:

3/ Earning a yield enables you to stack more sats (what I’m doing), or reduce the temptation to sell your coin through earning an income.

The yield you earn comes with RISK!

Below is my current allocation for Dec (will update MoM)

(yellow = changes)

https://t.co/PZwVYs8lFT

4a/ [Nov > Dec Changelog]

- Covered calls: approx. 4 BTC was in $40k 12/28/20 contracts. Those closed without them being exercised (a good outcome for me). However, I was nervous about my January 1/28 $50k contract so I decided to close out my position at a small loss.

4b/ [Nov > Dec Changelog]

- In process of reallocating the 5 BTC (probably will be a lending platform).

- I incorrectly had my Ledn rate at 6.5%, it's 6.25%

Over the last year and a half, I’ve earned ~1.2BTC with various yield generating services to earn an average of 5% on 30 BTC.

Here’s my journey and how to guide👇

2/ Here are the ways you can earn yield:

Lending (Easiest/most popular)

Yield: 3-6%

- Ledn: https://t.co/4x0YATuQ0v

- BlockFi: https://t.co/90Xtg2cNka

Covered calls (Harder)

Yield: 1-80%

- Deribit: https://t.co/2iQVkXlylP

- LedgerX:

3/ Earning a yield enables you to stack more sats (what I’m doing), or reduce the temptation to sell your coin through earning an income.

The yield you earn comes with RISK!

Below is my current allocation for Dec (will update MoM)

(yellow = changes)

https://t.co/PZwVYs8lFT

4a/ [Nov > Dec Changelog]

- Covered calls: approx. 4 BTC was in $40k 12/28/20 contracts. Those closed without them being exercised (a good outcome for me). However, I was nervous about my January 1/28 $50k contract so I decided to close out my position at a small loss.

4b/ [Nov > Dec Changelog]

- In process of reallocating the 5 BTC (probably will be a lending platform).

- I incorrectly had my Ledn rate at 6.5%, it's 6.25%

More from Bitcoin

You May Also Like

@EricTopol @NBA @StephenKissler @yhgrad B.1.1.7 reveals clearly that SARS-CoV-2 is reverting to its original pre-outbreak condition, i.e. adapted to transgenic hACE2 mice (either Baric's BALB/c ones or others used at WIV labs during chimeric bat coronavirus experiments aimed at developing a pan betacoronavirus vaccine)

@NBA @StephenKissler @yhgrad 1. From Day 1, SARS-COV-2 was very well adapted to humans .....and transgenic hACE2 Mice

@NBA @StephenKissler @yhgrad 2. High Probability of serial passaging in Transgenic Mice expressing hACE2 in genesis of SARS-COV-2

@NBA @StephenKissler @yhgrad B.1.1.7 has an unusually large number of genetic changes, ... found to date in mouse-adapted SARS-CoV2 and is also seen in ferret infections.

https://t.co/9Z4oJmkcKj

@NBA @StephenKissler @yhgrad We adapted a clinical isolate of SARS-CoV-2 by serial passaging in the ... Thus, this mouse-adapted strain and associated challenge model should be ... (B) SARS-CoV-2 genomic RNA loads in mouse lung homogenates at P0 to P6.

https://t.co/I90OOCJg7o

@NBA @StephenKissler @yhgrad 1. From Day 1, SARS-COV-2 was very well adapted to humans .....and transgenic hACE2 Mice

1. From Day 1, SARS-COV-2 was very well adapted to humans .....and transgenic hACE2 Mice

— Billy Bostickson \U0001f3f4\U0001f441&\U0001f441 \U0001f193 (@BillyBostickson) January 30, 2021

"we generated a mouse model expressing hACE2 by using CRISPR/Cas9 knockin technology. In comparison with wild-type C57BL/6 mice, both young & aged hACE2 mice sustained high viral loads... pic.twitter.com/j94XtSkscj

@NBA @StephenKissler @yhgrad 2. High Probability of serial passaging in Transgenic Mice expressing hACE2 in genesis of SARS-COV-2

1. High Probability of serial passaging in Transgenic Mice expressing hACE2 in genesis of SARS-COV-2!

— Billy Bostickson \U0001f3f4\U0001f441&\U0001f441 \U0001f193 (@BillyBostickson) January 2, 2021

2 papers:

Human\u2013viral molecular mimicryhttps://t.co/irfH0Zgrve

Molecular Mimicryhttps://t.co/yLQoUtfS6s https://t.co/lsCv2iMEQz

@NBA @StephenKissler @yhgrad B.1.1.7 has an unusually large number of genetic changes, ... found to date in mouse-adapted SARS-CoV2 and is also seen in ferret infections.

https://t.co/9Z4oJmkcKj

@NBA @StephenKissler @yhgrad We adapted a clinical isolate of SARS-CoV-2 by serial passaging in the ... Thus, this mouse-adapted strain and associated challenge model should be ... (B) SARS-CoV-2 genomic RNA loads in mouse lung homogenates at P0 to P6.

https://t.co/I90OOCJg7o