Unique evolution,

On getting a license, it was created out of a demerger of infrastructure financing business followed by the merger of erstwhile Capital First;

Stress build-up and franchise investment resulted in a weak Return profile during the transition phase;

2/25

After merger of Capital First, with Mr. V. Vaidyanathan at the helm, management is focused on building a high-yielding retail banking franchise (average retail yield at >15%);

Infrastructure loans to be completely run down, selective lending in non-infra corporate segment:

3/25

Of the wholesale exposure, infra book has been almost halved since merger to Rs108bn and will be further rationalized to a very negligible proportion in 3-5 years;

4/25

Remarkable transition in asset and liability profile post the merger:

After having rolled out a 5-year strategic roadmap towards targeted RoA and RoE of 1.4-1.6% and 13-15% respectively, it has made significant strides on most operating parameters:-

5/25

1) Realization of assets (>30% CAGR over FY19-FY21, constituting 63% of assets);

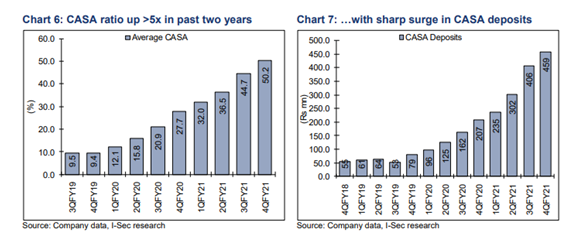

2) Granularity of deposits – average CASA deposits surged to ~50% & deposits of

3) Sharp spike in NIM from <2% in FY18 to ~5% in FY21 and very much on track towards 5.0 - 5.5%.

Retail GNPAs rise amidst disruption; wholesale portfolio adequately covered:

With FY21 slippage run-rate of >5% (>7% for retail), GNPAs rose to 4.15% (from 2.6% in FY20);

Retail GNPAs at 4.01% are higher by 175bps from the pre-covid average.

7/25

Restructured pool is equivalent to 1.3% of retail assets.

Despite the incremental stress in FY21, credit cost was contained at 250bps for FY21 supported from adequately covered and write-back in wholesale portfolio;

8/25

Quarterly run-rate accretion of Rs 50bn-70bn of retail assets suggests it is on track towards the targeted Rs 1trn of retail assets By FY23/FY24. On overall loan base of Rs1.4trn -1.7trn by then, it would contribute 70-75% to the overall AUM.

9/25

Coming from a high-growth phase in retail (>25% in FY21), the impact of covid second wave disruption needs to be closely monitored.

Post becoming a bank, the erstwhile IDFC Bank took early steps to diversify away from infrastructure into corporate and retail banking;

10/25

Bank has actively invested in people, processes, products, infrastructure and technology to put together all the necessary building blocks towards a stronger foundation Essential for a long-term sustainable growth engine;

11/25

However, this has come at a cost, and the cost structure hovers much higher compared to peers (IDFCFB’s ‘cost to income’ at >70%);

Current return profile is dragged by higher ‘cost to income’, lower fee income, and elevated credit cost;

12/25

Rapid progress in realization of liabilities:

It has devised a strategy to build CASA deposit franchise that has scaled up more than 5x since FY19

Average CASA deposits in FY21 surged to ~50% (from less than 10% in FY19); this compares with the target of 30% set for FY24

13/25

Reduced concentration of bulk deposits/borrowings:

Bank has successfully replaced wholesale deposits/borrowings with retail customer deposits – proportion of core retail deposits is now up to 77% (targeted to breach target of 80% by FY24);

14/25

Consequently, concentration of the top 10 depositors is down to mere 6% (from 29% during merger) as wholesale deposits have contracted more than 25% in a single year;

Bank is still carrying a legacy long-term/infra & other bonds of Rs 240bn at a higher cost of 8.5-9.0%;

15/25

Replacement of the same with low-cost retail deposits will itself support reduction in the cost of funding lower even from the current level.

16/25

Bank added more than 350 branches in past 24 months taking total tally to 596 branches;

Medium-term plan is to take it to 800-900 branches in 3-4 years; However, it will now allow churning & productivity ramp-up of the existing network before aggressively adding more branches.

Two consecutive savings rate cut of 100bps each (in Feb’21 and May’21) to 5% will further cushion average savings deposit cost that hovered high at 6.8% in 9MFY21;

18/25

Passing the benefit of this lowered cost, the bank is planning to participate in the prime home loan market at competitive rates – though this will not entirely offset the benefit and reflect in an uptick in NIM.

19/25

Retail GNPA & NNPA as of FY21 are higher by 175bps & 77bps respectively from pre-covid average GNPA & NNPA;

Bank restructured loans worth Rs10.7bn of which, Rs9.6bn was in retail segment & Rs1bn in corporate; This is equivalent to 1.3% of retail assets & 0.9% of the overall AUM.

The quality of customer profile has improved with ‘new to credit’ customers constituting 10% of the disbursals (By value) in Q4FY21 vs 18% in Q4FY19. Also, 83% of the customers sourced (by value) in Q4FY21 had credit bureau score above 700 as compared to 61% in Q4FY19.

21/25

Cost efficiency and retail fee enhancers– triggers to RoA improvement:

22/25

Despite the incremental stress in FY21, credit cost was contained at 250bps for FY21;

In the context of covid second wave and coming from a high growth phase in retail (>25% in FY21), the impact of disruption needs to be closely monitored.

23/25

RoE profile still low; incremental unit economics superior:

Incremental retail disbursements have potential RoE profile of >20%- albeit currently retail liabilities (due to huge investments), corporate centre cost (due to legacy borrowings) are dragging it down;

24/25

Key risk factors:

👉Strategy execution

👉Retailisation of liabilities- Behavior of SA deposits in the coming deposits will be key to garner confidence on the strength of the liability franchise foundation it has built over past 2-3 years;

End of Thread 🧵

25/25