China have MANY medical problems. These include: poor structure of the Chinese medical system, inadequate/unequal resources, long waiting time, expensive medical services, sub-par medical quality and insufficient or unskilled medical staff.

$JD Health and $BABA AliHealth

$JD Health and $BABA Ali Health are $JD and $BABA's newest competition ground and the two biggest online medical platforms in China . Here is a thread on the things you need to know for $JD health and $Ali health.

Let’s get started! 👇👇

China have MANY medical problems. These include: poor structure of the Chinese medical system, inadequate/unequal resources, long waiting time, expensive medical services, sub-par medical quality and insufficient or unskilled medical staff.

It is very inconvenient to visit a doctor in China unless you go to expensive private ones. There is not a clear distinction between a GP and a specialist, causing many elderlies, to crowd the hospital even when they only have a small medical issue.

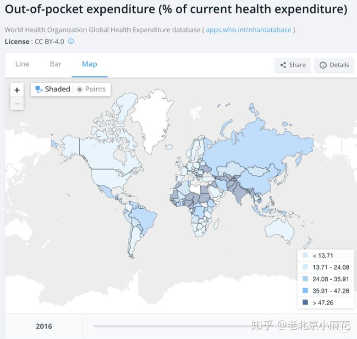

Although the Chinese medical system has been improving, it is still unorganised and inefficient, causing medical services/medicine to be ‘expensive’, especially to low-income earners in China. Medical service is more expensive in China than the US % wise.

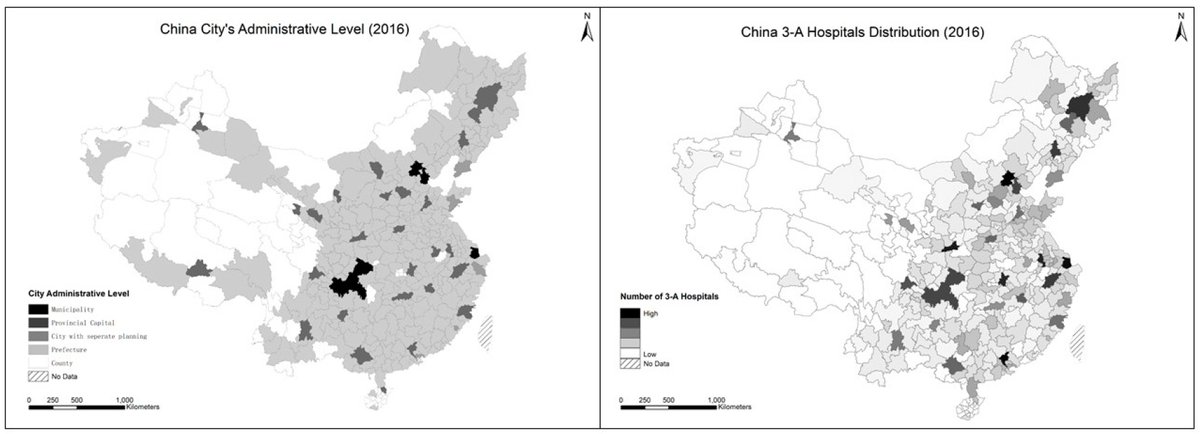

Third level grade A hospitals are the best hospitals in China. The graph below shows an uneven distribution of medical resources between different regions, especially between cities and rural areas, in China.

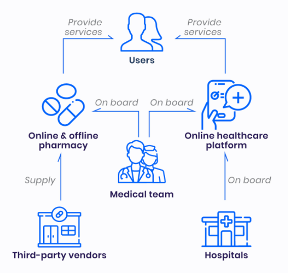

Both $JD Health and $BABA AliHealth offer a solution to these problems. $JD health and $BABA AliHealth enable people to buy medicine, have doctor consultations and regular checkups ALL ONLINE. Thereby, saving BOTH time and cost for their users.

$JD Health aims to become the trusted ‘Chief Health Manager’ for their users. $JD Health seeks to build an online healthcare platform that provides medicine through $JD’s robust supply chain alongside with healthcare services that covers a user’s full life span.

$BABA AliHealth seeks to offer an online medical platform that provides ‘Double H’, Health and Happiness, to their users. $BABA AliHealth provides an integrated solution covering all online medical service and medicine needs.

$JD Health and $BABA AliHealth have a similar business model, where they offer B2B, B2C and O2O services (Online to Offline commonly refers to emergency service, and 24/7 delivery), on their platforms.

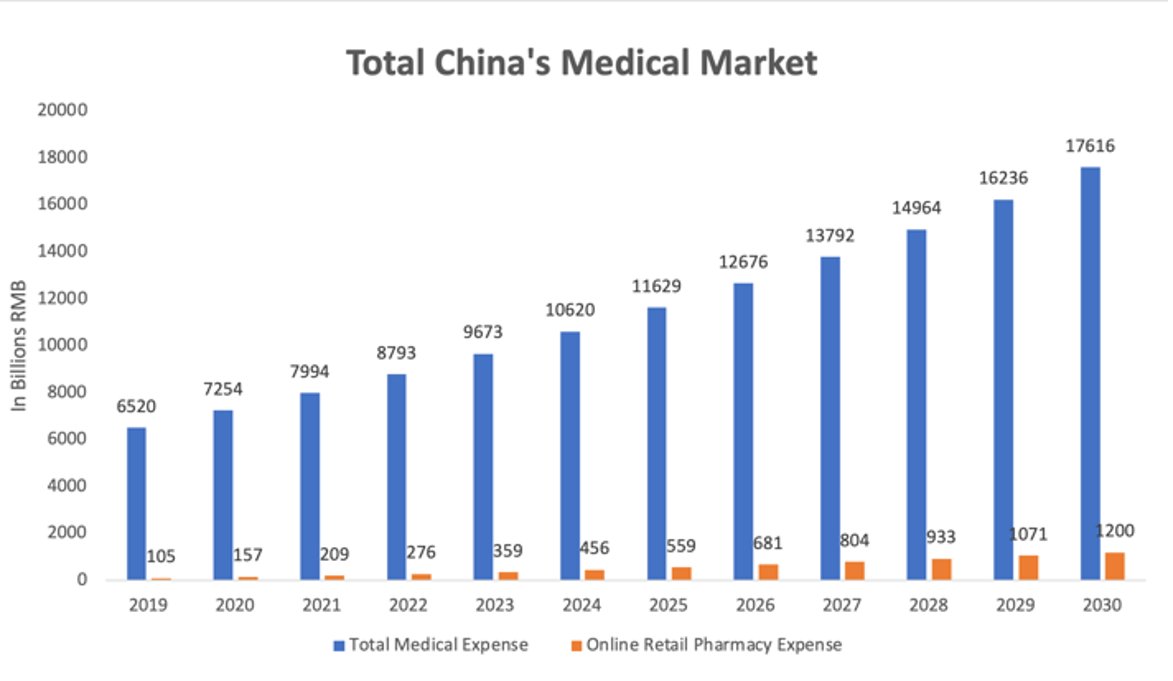

China’s total medical expenses are expected to grow from $7.254 to $17.616 trillion RMB ($2.73 trillion USD) from 2020-2030, a CAGR of 9.28%. The online pharmacy % of total medical expenses is expected to grow from 1.6% to 6.8% from 2019-2030

In August 2019, the Chinese Medicine Management Law, abolishes the restriction on third-party online platform ($JD Health and $BABA AliHealth) to sell prescribed medicine. Online platform can sale prescriptions now if they hold pharmacy license

Covid has created a lot of demand and awareness for Telehealth in China. $JD Health has captured more online pharmacy market share than the 4 biggest pharmacies, Yixintang, LBX, Yifeng and DaShenLin, in China during Covid-19.

Interesting fact: $JD Health’s $JD pharmacy only took 3 years after its launch to become the largest pharmacy in China.

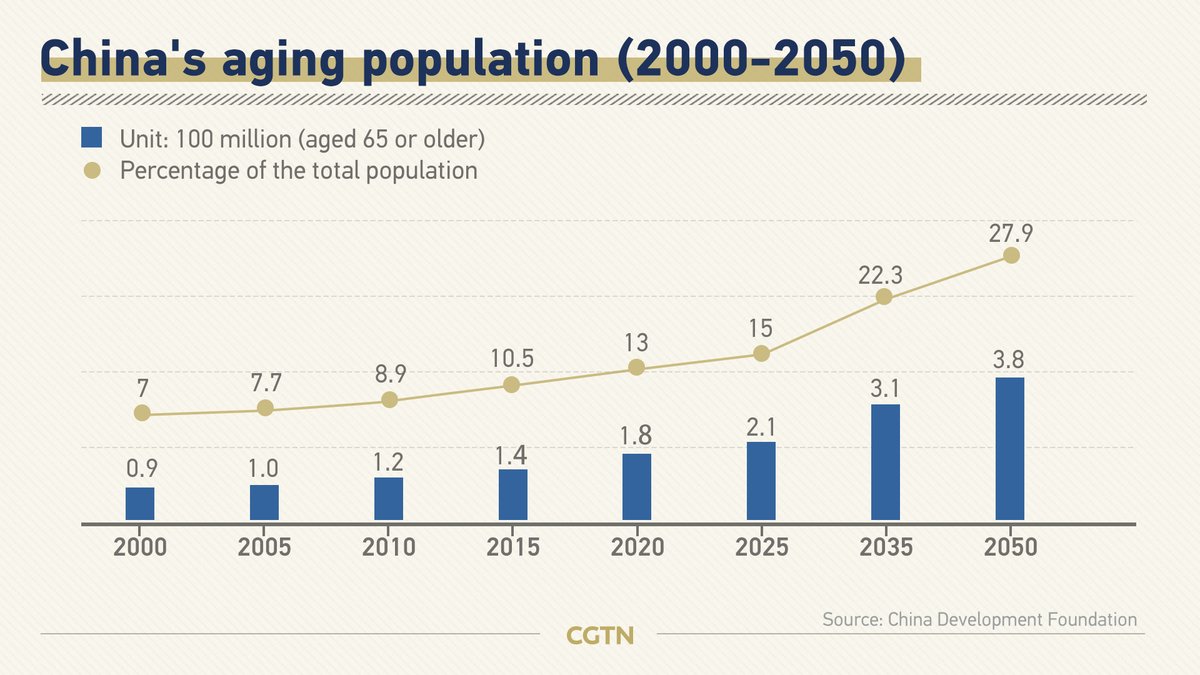

China’s population has been aging and will continue to age for the coming decades. An aging population will likely increase medical needs and worsen China’s medical issues, thereby facilitating telehealth growth.

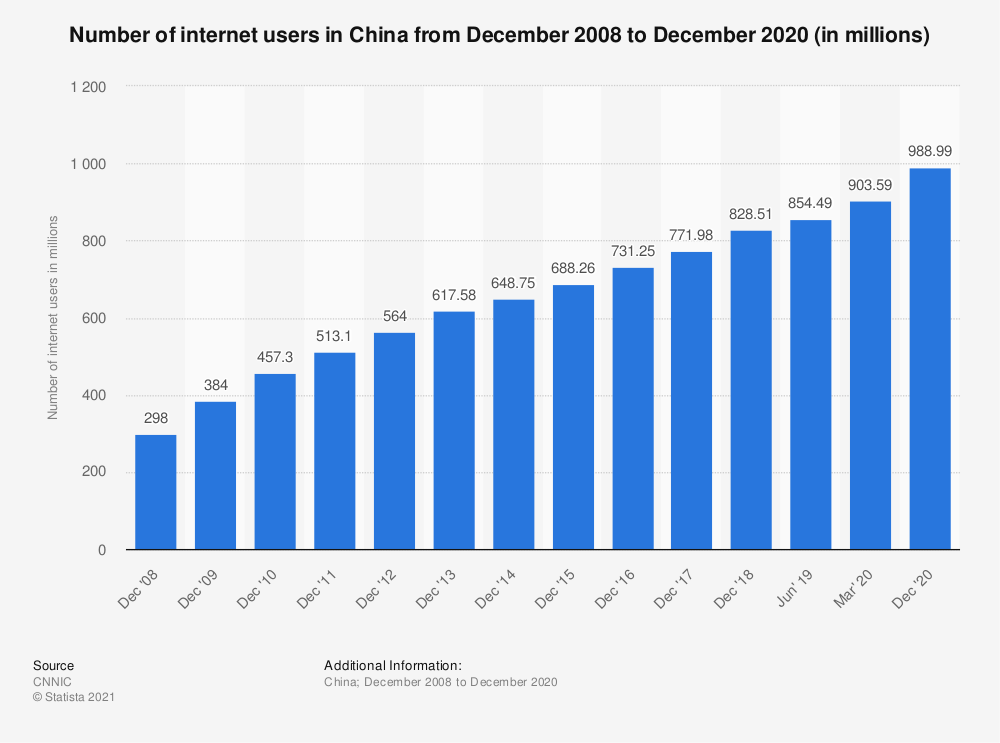

As of 2020, China have almost 1 billion internet users with a penetration rate of 64.5%. All these internet users may be potential users of telehealth services, pointing to telehealth’s potential in China. CONTINUE

$JD Health and $BABA AliHealth generally offers cheaper medicine prices compare to offline’s ‘suggested retail price’. This is because both $JD and $BABA can enjoy cheaper prices directly from upstream suppliers due to their E-Commerce dominance.

‘Weikangling Jiaonang’, a medicine for stomachache, has a suggested retail price of $37.4 RMB. On $BABA AliHealth, it only costs $28.4 RMB.

More than half of the medicine purchased on $JD Health have been delivered to 3rd-tiered cities , indicating $JD Health (and similarly $BABA AliHealth’s) importance to deliver medical resources to less benefitted areas.

Both $JD Health and $BABA AliHealth have a high app store review but $BABA AliHealth have more reviews and more downloads over $JD Health.

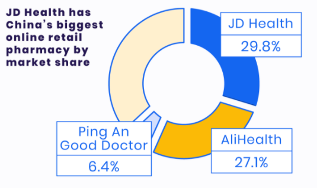

$JD Health and $BABA AliHealth are the two biggest online pharmacies in China by market share. The 3rd place, Ping An Good Doctor, is considerably behind.

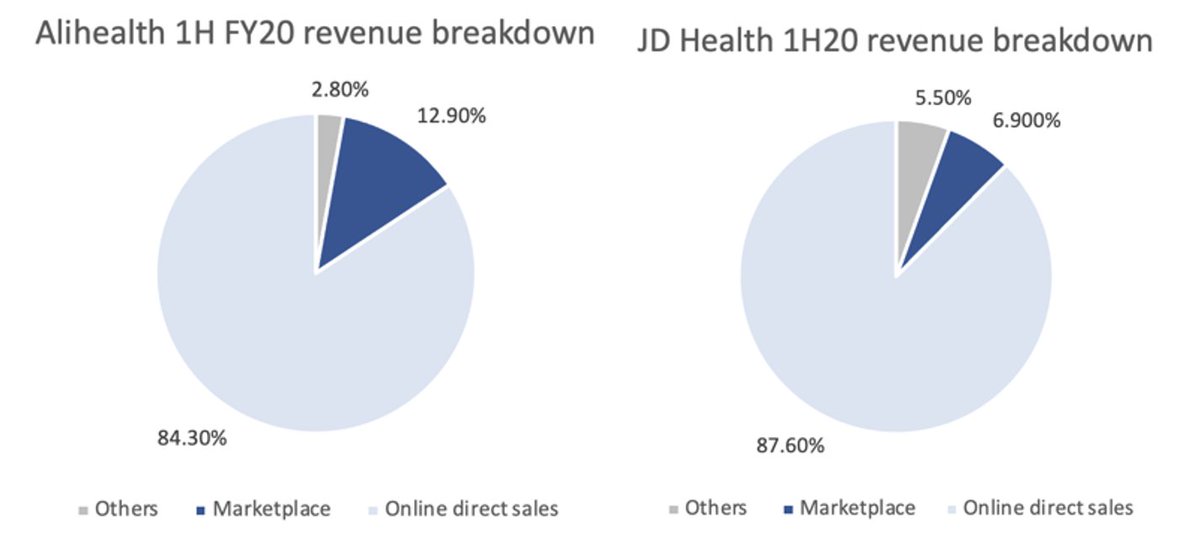

Both $JD Health and $BABA AliHealth earns their revenue primarily from online direct sales of medicine and medical related products. AliHealth have a higher revenue from marketplace because more third-party stores are on $BABA Health.

Interestingly, medicine makes up less than 30% of $JD Health’s direct sales revenue and non-medicine such as healthcare products, supplements, healthcare equipment, rehab and health monitoring equipment make up 70%.

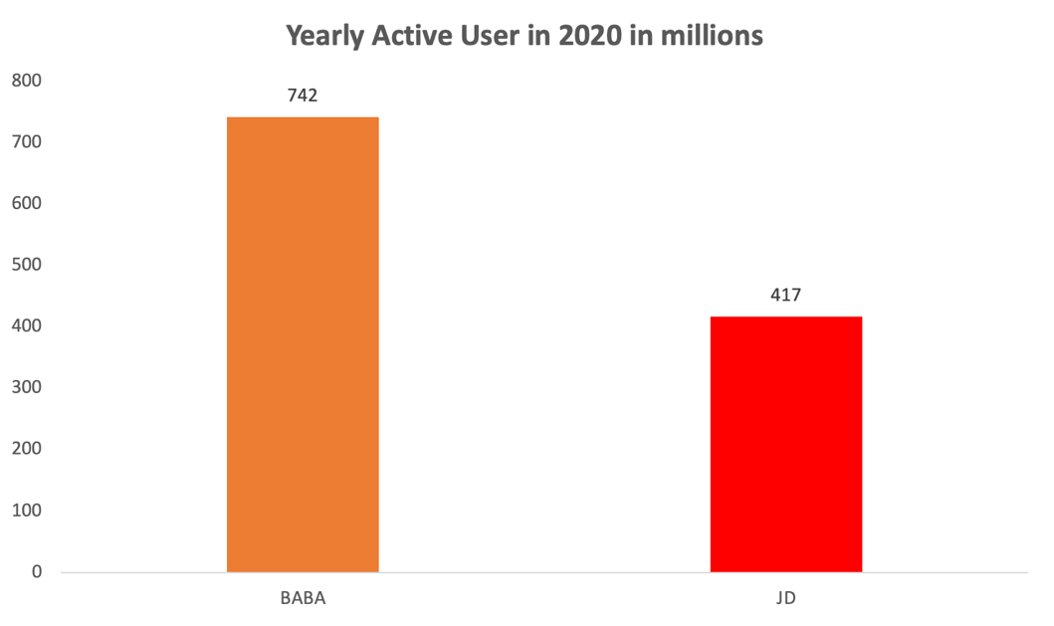

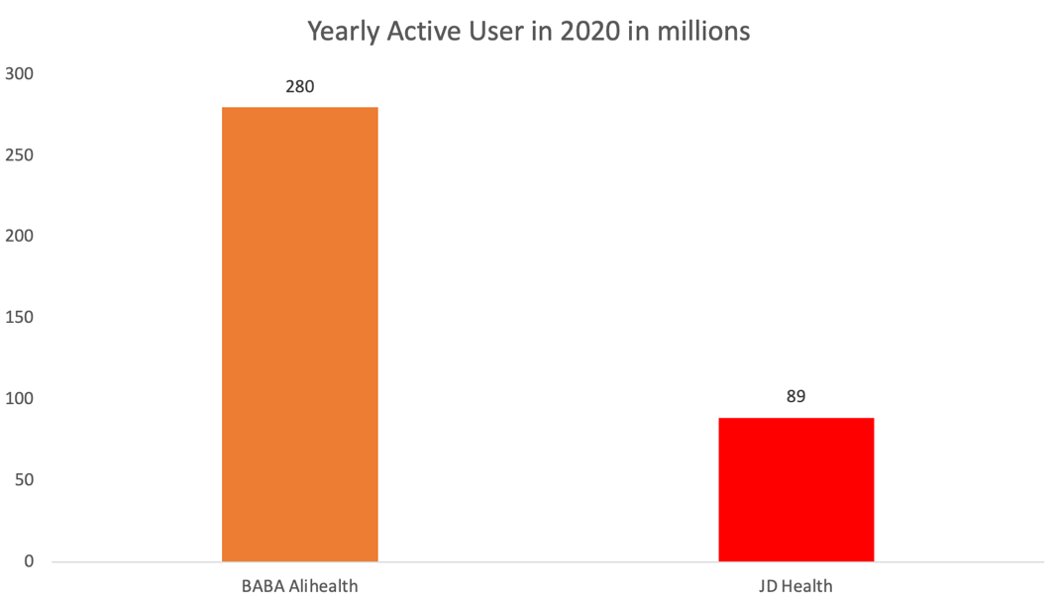

As of Q2 2020, $BABA has an AAU of 742 million, whereas $JD only has 417 million, a 43.8% difference, meaning that $BABA AliHealth has a bigger pool of customers to draw from compare to $JD Health.

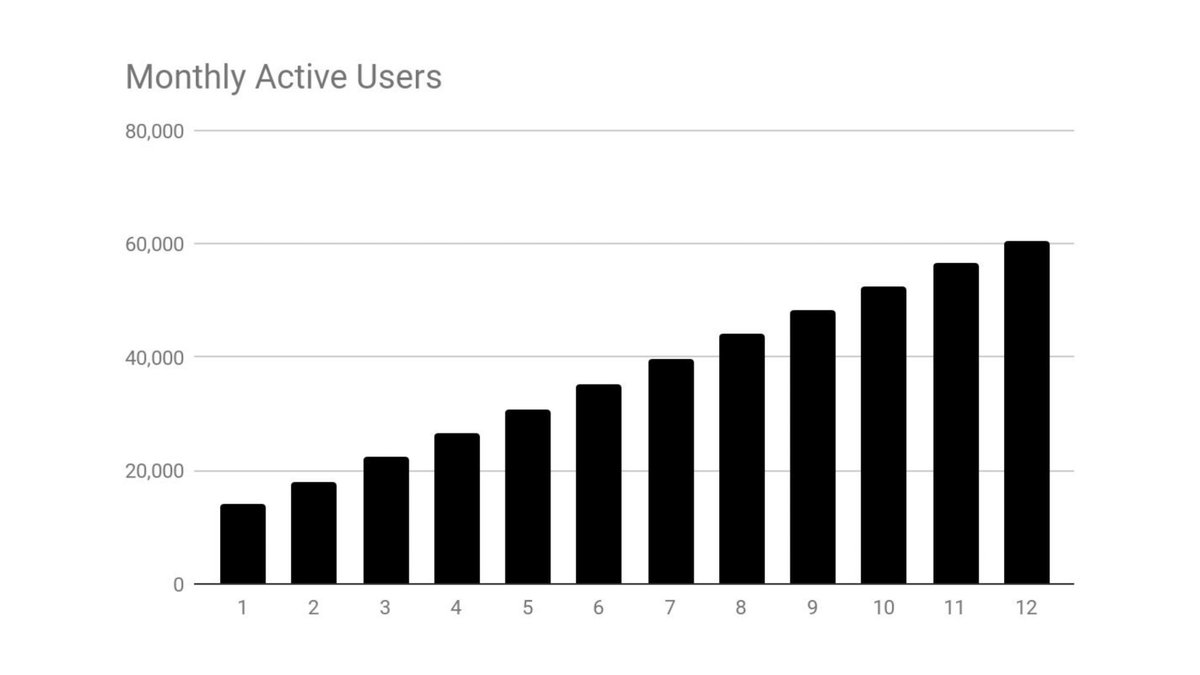

In 2020, $JD health has a total AAU of 89 million people, an increase of 33.7 million people (60% annual growth). Whereas, $BABA AliHealth’s medical platform has a higher total annual active user oat 280 million people.

As of September 2020, there are 65k doctors on $JD health, whereas $BABA AliHealth have around 60k doctors. $JD Health’s numbers of doctors have double from June 2020 to September 2020, showing the increasing demand of online consultation.

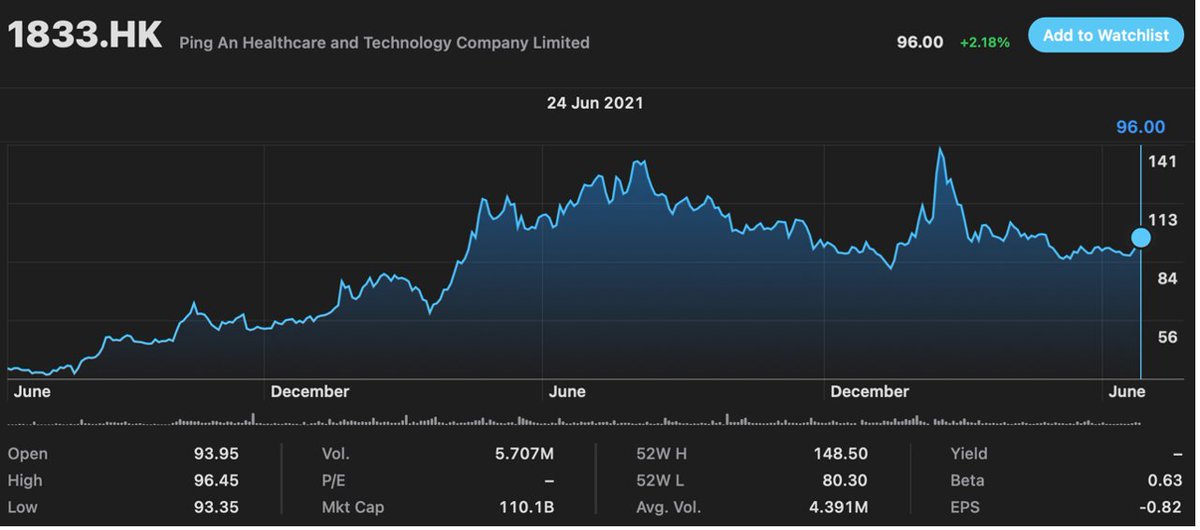

Ping An Good Doctor is the third largest Telehealth platform in terms of market cap behind $JD health and $BABA AliHealth. Ping An Good Doctor is weaker in ‘online pharmacy’ because they do not have strong support from big Chinese E commerce players.

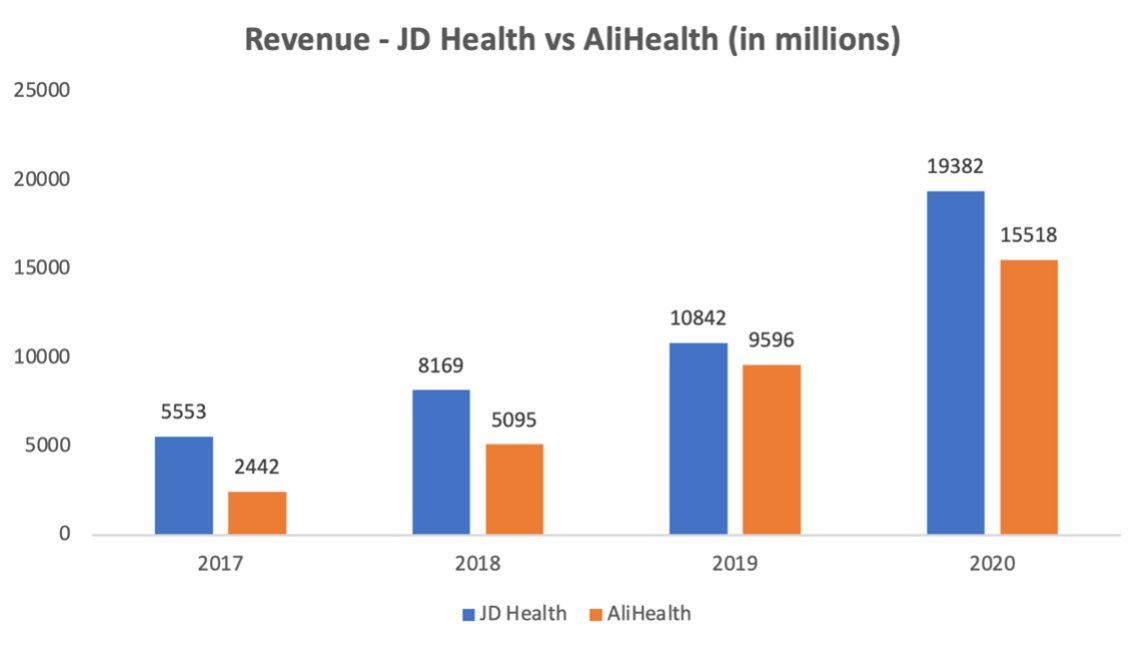

$JD Health’s has recorded a revenue of 19.38 billion RMB for 2020. $JD Health’s revenue has grown at a CAGR of 51.69% from 2017 to 2020. $BABA Health has recorded a revenue of 15.52 billion RMB from March 2020 to March 2021, a CAGR of 85.21% from 2017 to 2020.

$BABA AliHealth has a bigger GMV at 55.4 billion RMB compare to $JD Health’s 22.4 billion RMB for 1H 2020. However, AliHealth’s lower revenue indicates that more GMV incurred by ‘third party stores’ sales on $BABA AliHealth compare to $JD Health

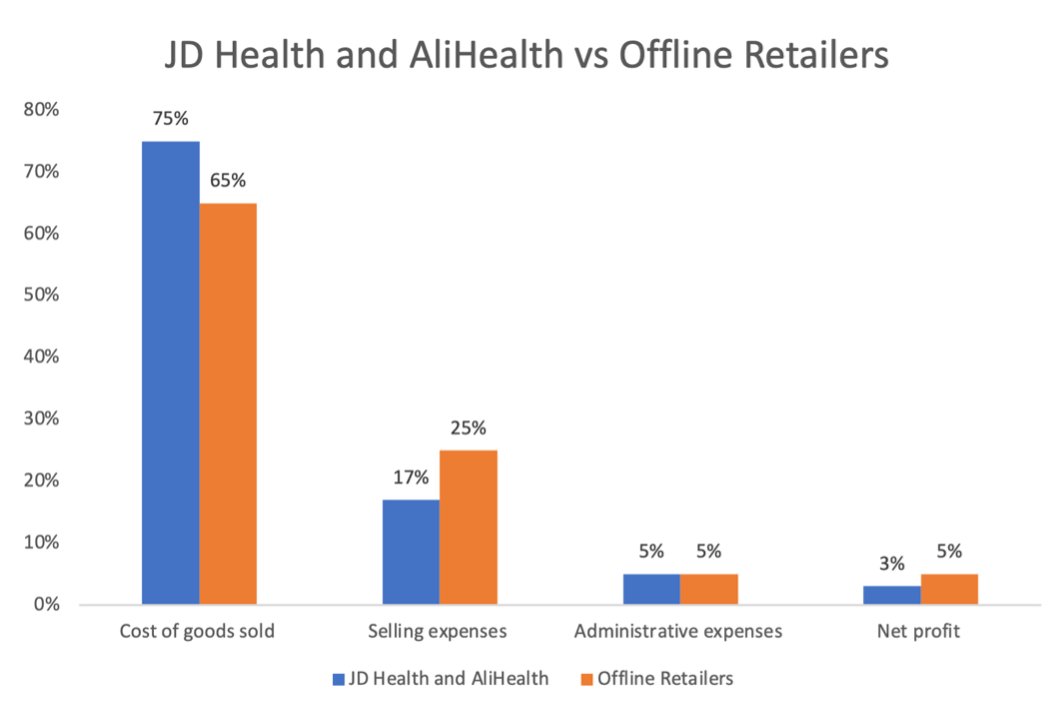

$BABA AliHealth has a gross margin of 25.97% and $JD Health 25.26% for 2020 H1. Both have a net margin before extraordinary profit or loss of around 3-4%. Interestingly, this is slightly lower than the net margin of offline retailers as offline

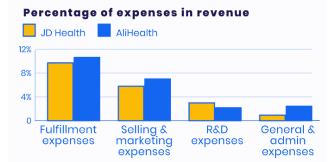

For $JD Health, cost of goods sold takes up the majority at around 74.7%, storage and delivery cost at 10.4%, advertisement at 6.2%, R&D and administration at 4.2%, which result in a net profit margin of around 4%.

$JD Health has recorded a net income before extraordinary profit or loss of 748 million, whereas $BABA AliHealth 342.68 million. These numbers are still relatively small, as both companies are prioritizing acquiring market share and customers.

$JD Health is currently valued at 363.34 billion HKD (46.81 billion USD) and $BABA AliHealth, 244.12Billion (31.45 billion USD). $JD Health has a P/S ratio of 18.75, EV/sales of 15.87 and $BABA AliHealth P/S ratio of 15.73 and EV/sales of 13.68.

China’s telehealth and online pharmacy market is poise to grow in the coming decades due to greater convenience brought by the internet and Chinese medical system’s inherent problems. Both $JD Health and $BABA AliHealth (and also Ping An Good Doctors) have

$JD Health and $BABA AliHealth are still largely ‘online pharmacy’ now rather than a comprehensive ‘online hospital/telehealth platform’ like Ping An Good Doctor.

@daniel_toloko @TanArrowz @DennisHong17 @jablamsky @Matematikern3 @TanArrowz @EugeneNg_VCap @BuyandHoldd @FinanceGhost @Krevix @TomInvesting @MT_Capital1

Would really appreciate any feedback, comments, insights from you! Thank you very much for your time and support!