More from Professor

So friends here is the thread on the recommended pathway for new entrants in the stock market.

Here I will share what I believe are essentials for anybody who is interested in stock markets and the resources to learn them, its from my experience and by no means exhaustive..

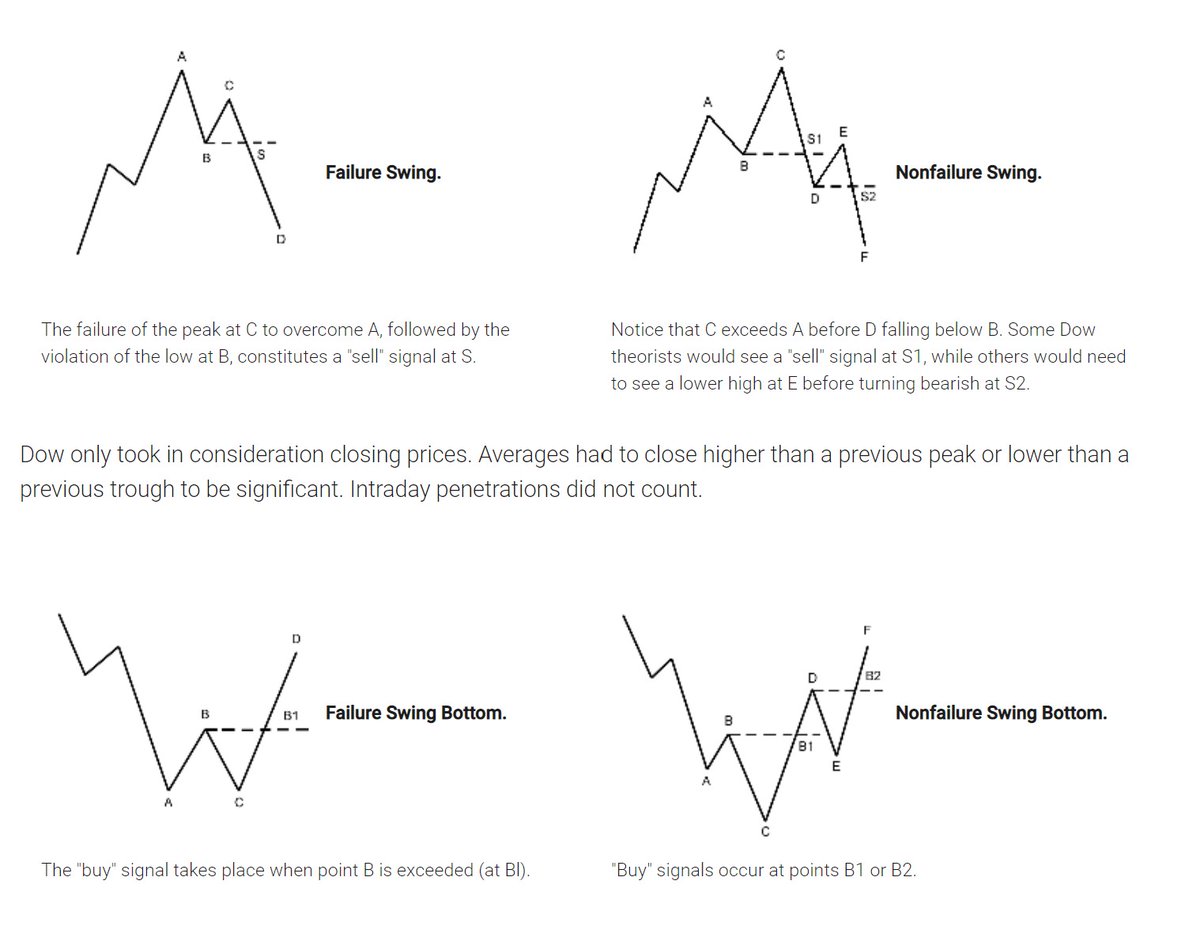

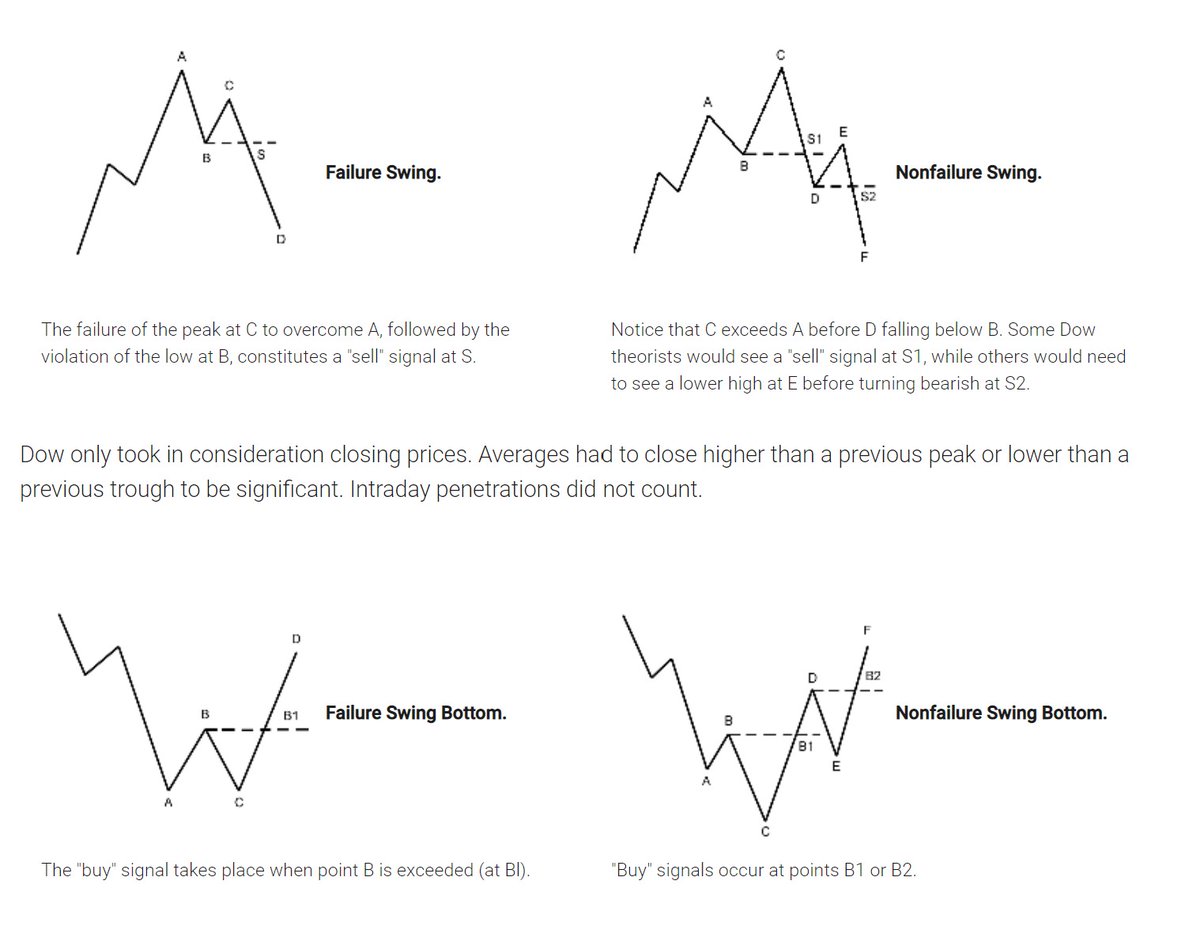

First the very basic : The Dow theory, Everybody must have basic understanding of it and must learn to observe High Highs, Higher Lows, Lower Highs and Lowers lows on charts and their

Even those who are more inclined towards fundamental side can also benefit from Dow theory, as it can hint start & end of Bull/Bear runs thereby indication entry and exits.

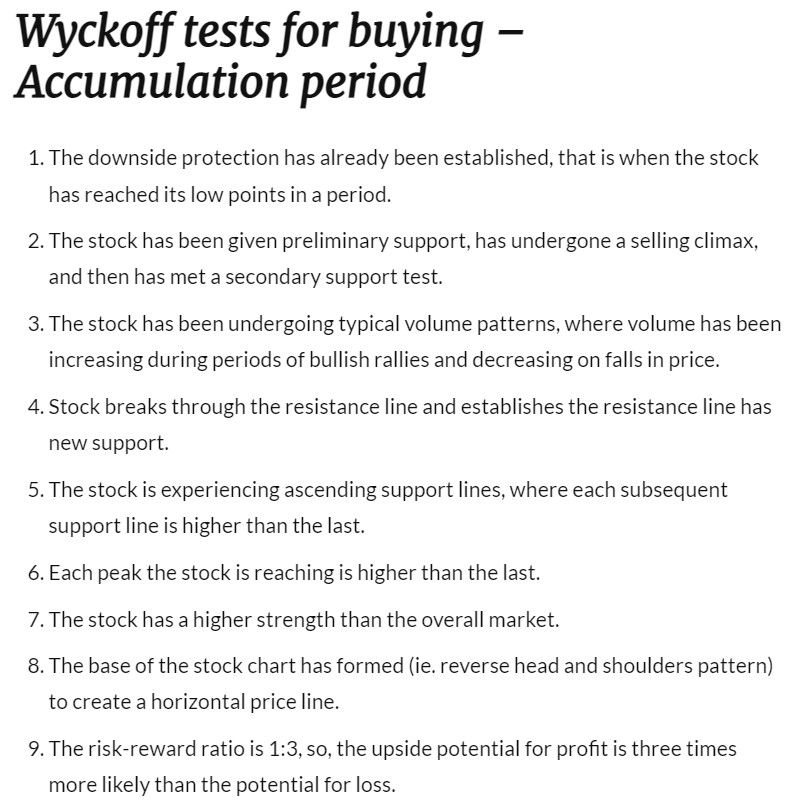

Next basic is Wyckoff's Theory. It tells how accumulation and distribution happens with regularity and how the market actually

Dow theory is old but

Here I will share what I believe are essentials for anybody who is interested in stock markets and the resources to learn them, its from my experience and by no means exhaustive..

First the very basic : The Dow theory, Everybody must have basic understanding of it and must learn to observe High Highs, Higher Lows, Lower Highs and Lowers lows on charts and their

Even those who are more inclined towards fundamental side can also benefit from Dow theory, as it can hint start & end of Bull/Bear runs thereby indication entry and exits.

Next basic is Wyckoff's Theory. It tells how accumulation and distribution happens with regularity and how the market actually

Dow theory is old but

Old is Gold....

— Professor (@DillikiBiili) January 23, 2020

this Bharti Airtel chart is a true copy of the Wyckoff Pattern propounded in 1931....... pic.twitter.com/tQ1PNebq7d

More pointers to help in identifying whether its accumulation or Distribution.

Lest some charlie jumps to point out, let me make it clear that I haven't invented anything in stock market, all my knowledge of stock market comes from old farts. Just my observation is my own. https://t.co/uHNw8tV4AO

Lest some charlie jumps to point out, let me make it clear that I haven't invented anything in stock market, all my knowledge of stock market comes from old farts. Just my observation is my own. https://t.co/uHNw8tV4AO

Plz advice how to identify accumulation and distribution phase...... to me Both looks same

— VIVEK VAID (@bobvaid) February 12, 2022

More from Asianpaints

As rightly pointed out by experts, Asian Paints' dominance in the Paints Industry is unshakable. Even the entry of a formidable rival, the specter of a lock-down & alleged nose-bleed valuations of 88x has made no difference to the megabagger. The stock is up 83% on a YoY basis. https://t.co/OFnFAbnQGA

Asian Paints vs. Grasim: Paints is not a very easy industry at all. It is a low-capex consumer business. Asian Paints has built its business over last 35-40 years. The Birlas are not in any consumer businesses. So it is going to be tough for Grasim https://t.co/CqkmFnsaiT pic.twitter.com/iK8ZcvYxpJ

— RJ Stocks (@RakJhun) January 25, 2021