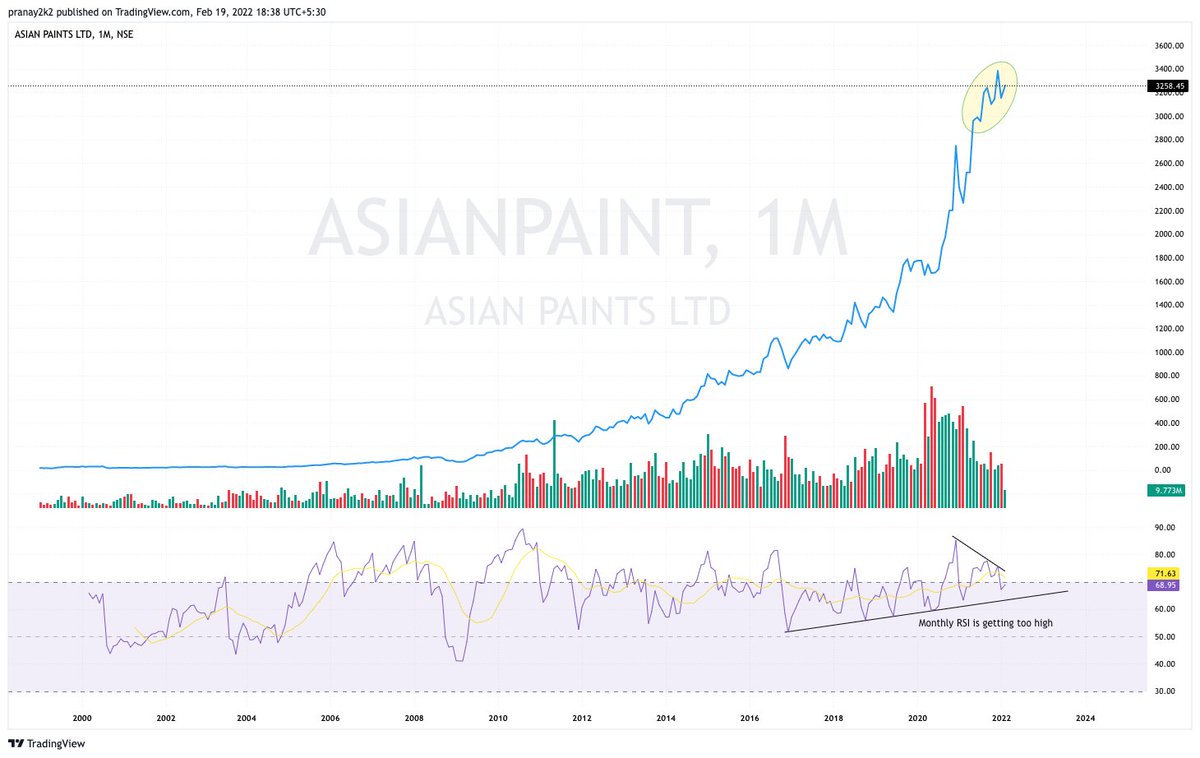

ASIANPAINT

Double Top Buy above 2924.49 daily close on 3% Box Size chart! https://t.co/Uv3YpW3bfJ

ASIANPAINT could be a great buy in the range of 1900-2000, channel support also converges with the previous high. pic.twitter.com/QOZKxlEplv

— Saket Reddy (@saketreddy) February 26, 2021

More from Saket Reddy

Haters are still hating it, time to pyramid once again!

Double Top Buy, T20 Pattern - Bullish & Super Pattern - Bullish above 625.07 daily close on 1% Box Size chart. https://t.co/EDqa7dAAKn

LAURUSLABS

— Saket Reddy (@saketreddy) May 3, 2021

Haters are gonna hate, but IMO, this is the best opportunity to start pyramiding and make it a well sized holding.

A trio of patterns coming together, has one of the highest success rate!

Double Top Buy, T20 Pattern - Bullish & Super pattern - Bullish above 477.81! https://t.co/SqzkTyb9wx pic.twitter.com/hTj7mfAOqy

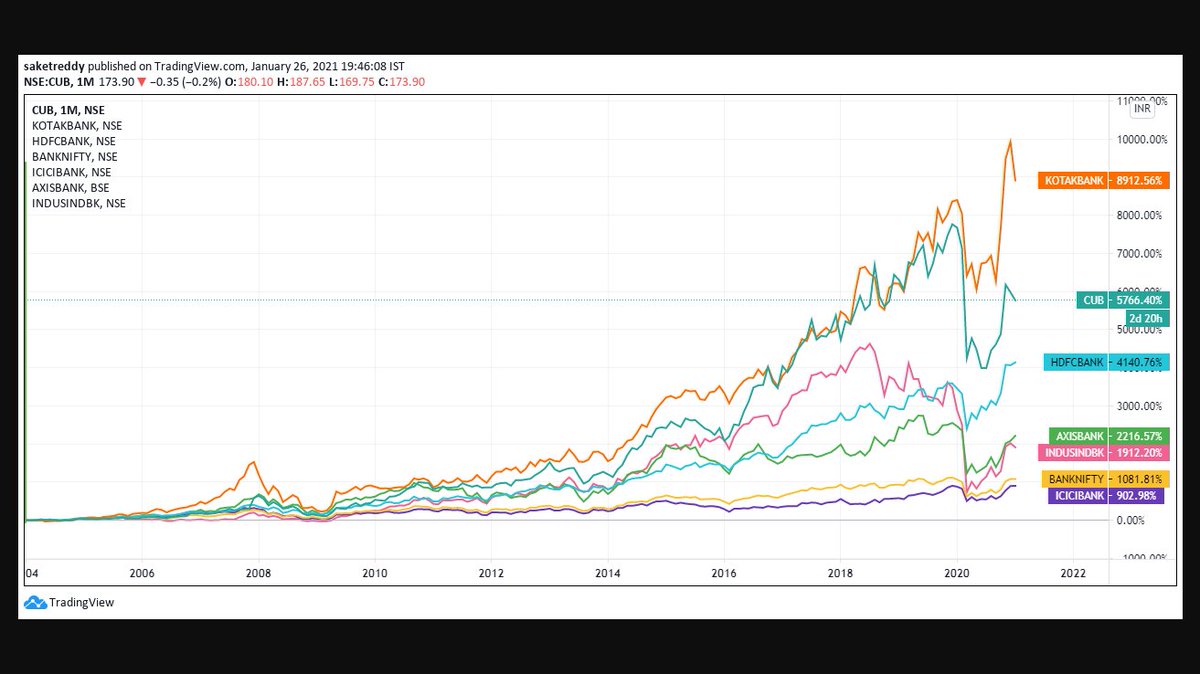

They are the real compounders, they've created massive wealth compared to others! https://t.co/PluVwU5OXG

Hope Everyone saw BANDHANBNK Numbers. I feel many such banks will go through a massive NPA Cycle followed by depleted Tier 1.

— Saket Reddy (@saketreddy) January 24, 2021

Hence, stay with the Top 3 banks :-

HDFCBANK

KOTAKBANK

CUB

They've low cost of funding, well provisioned Moratorium book, high ROEs & high Tier 1 CAR.

More from Asianpaints

#AsianPaint

— \U0001f1ee\U0001f1f3 \U0001d4d0\U0001d4f6\U0001d4f2\U0001d4fd \U0001d4e2\U0001d4ee\U0001d4fd\U0001d4f1 (@MaverickAmit01) May 23, 2022

Is it an Out of Box Idea \U0001f914 pic.twitter.com/Lg6m0AfVXB

You May Also Like

Funny there are those who think these migrant caravans were a FANTASTIC idea that's going to take the immigration issue away from you.

— Brian Cates (@drawandstrike) November 26, 2018

Like several weeks watching a rampaging horde storm the fences & throw rocks at our border patrol agents & getting gassed = great optics!

This media manipulation effort was inspired by the success of the "kids in cages" freakout, a 100% Stalinist propaganda drive that required people to forget about Obama putting migrant children in cells. It worked, so now they want pics of Trump "gassing children on the border."

There's a heavy air of Pallywood around the whole thing as well. If the Palestinians can stage huge theatrical performances of victimhood with the willing cooperation of Western media, why shouldn't the migrant caravan organizers expect the same?

It's business as usual for Anarchy, Inc. - the worldwide shredding of national sovereignty to increase the power of transnational organizations and left-wing ideology. Many in the media are true believers. Others just cannot resist the narrative of "change" and "social justice."

The product sold by Anarchy, Inc. is victimhood. It always boils down to the same formula: once the existing order can be painted as oppressors and children as their victims, chaos wins and order loses. Look at the lefties shrieking in unison about "Trump gassing children" today.

Curated the best tweets from the best traders who are exceptional at managing strangles.

• Positional Strangles

• Intraday Strangles

• Position Sizing

• How to do Adjustments

• Plenty of Examples

• When to avoid

• Exit Criteria

How to sell Strangles in weekly expiry as explained by boss himself. @Mitesh_Engr

• When to sell

• How to do Adjustments

• Exit

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Beautiful explanation on positional option selling by @Mitesh_Engr

Sir on how to sell low premium strangles yourself without paying anyone. This is a free mini course in

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

1st Live example of managing a strangle by Mitesh Sir. @Mitesh_Engr

• Sold Strangles 20% cap used

• Added 20% cap more when in profit

• Booked profitable leg and rolled up

• Kept rolling up profitable leg

• Booked loss in calls

• Sold only

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

2nd example by @Mitesh_Engr Sir on converting a directional trade into strangles. Option Sellers can use this for consistent profit.

• Identified a reversal and sold puts

• Puts decayed a lot

• When achieved 2% profit through puts then sold

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0