ThomassRichards Categories Finance

7 days

30 days

All time

Recent

Popular

💥This is a story about a supermarket chain.

- One of the largest employers in the U.S. (~193,000 employees)

- ~$38 B in revenue

- 1200+ locations in 7 states

- Employee owned with majority shares still owned by the Jenkins family members

It’s called PUBLIX

THREAD

1/

I deleted an earlier tweet because I started to quickly. Forgive me for jumping the gun.

It was about a story that came out today in the WSJ about a big Trump Donor helping fund the #EllipseRally in D.C.

Great reporting by @rebeccaballhaus @shalini @AlexandraBerzon

2/

https://t.co/ru13PVfTzp

Here’s that story

3/

The donor who gave the money to help fund the #EllipseRally in DC that led to domestic terrorists storming the capital was Julie Ansley Jenkins Fancelli.

Julie gave $300,000 to help fund that rally.

But this THREAD is also about PUBLIX.

4/

Julie is the daughter of George Jenkins, the original founder of PUBLIX. It began as one store in 1930 and grew to what it is today, despite the Great Depression and World Wars.

But that’s another story.

5/

- One of the largest employers in the U.S. (~193,000 employees)

- ~$38 B in revenue

- 1200+ locations in 7 states

- Employee owned with majority shares still owned by the Jenkins family members

It’s called PUBLIX

THREAD

1/

I deleted an earlier tweet because I started to quickly. Forgive me for jumping the gun.

It was about a story that came out today in the WSJ about a big Trump Donor helping fund the #EllipseRally in D.C.

Great reporting by @rebeccaballhaus @shalini @AlexandraBerzon

2/

https://t.co/ru13PVfTzp

Here’s that story

3/

The donor who gave the money to help fund the #EllipseRally in DC that led to domestic terrorists storming the capital was Julie Ansley Jenkins Fancelli.

Julie gave $300,000 to help fund that rally.

But this THREAD is also about PUBLIX.

4/

Julie is the daughter of George Jenkins, the original founder of PUBLIX. It began as one store in 1930 and grew to what it is today, despite the Great Depression and World Wars.

But that’s another story.

5/

Money Stress: Let's Talk About Money

[THREAD]

Not all of us taught the basics of money in the past.

But it doesn't matter who we were. It more matters who we are and how we relearn and unlearn things we know now.

Work on your relationship with money.

Each. Single. Day.

The goal for 2021:

Get RICH.

1) Money Anxiety

Financial stress comes from being in debt. Not earning money.

Lower your expenses to reduce your worry.

Tip 1: Create a Budget

2) Money Psychology

Humans are emotional species. We all get wrong with the money concept.

Learn to be less dependable. Gain more time.

Time > Money

Tip 2: Worth Your Money

3) Money Currency

We are all Child of Our Time.

The baby boomers are very privileged with gold.

The millennials support the decentralized currency and see Bitcoin as "Millennial Gold".

https://t.co/B04l2VeYPV

Tip 3: Treat Your Time Like Currency

[THREAD]

Not all of us taught the basics of money in the past.

But it doesn't matter who we were. It more matters who we are and how we relearn and unlearn things we know now.

Work on your relationship with money.

Each. Single. Day.

The goal for 2021:

Get RICH.

1) Money Anxiety

Financial stress comes from being in debt. Not earning money.

Lower your expenses to reduce your worry.

Tip 1: Create a Budget

2) Money Psychology

Humans are emotional species. We all get wrong with the money concept.

Learn to be less dependable. Gain more time.

Time > Money

Tip 2: Worth Your Money

3) Money Currency

We are all Child of Our Time.

The baby boomers are very privileged with gold.

The millennials support the decentralized currency and see Bitcoin as "Millennial Gold".

https://t.co/B04l2VeYPV

Tip 3: Treat Your Time Like Currency

Bitcoin cannot be coerced.

— Naval (@naval) January 11, 2021

That\u2019s why it\u2019s the most important experiment in the world.

$VMNT @Vemanti 💎🙌 to $10 due diligence

•$30,000,000 funding secured and 2 institutional partnership

•$5,000,000 stock buy from Livetrade

•Marena Gold Mali Acquisition

•Uplisting QB to NASDAQ

#VMNTDD

CEO of vemanti secures $30,000,000 and partners with 2 institutional investors.

Source:

https://t.co/bYj7HrvfRJ

Accial Capital

https://t.co/jpdSEmqdJR

Variant

Interview with the CEO of @Vemanti $VMNT, @tanctran after securing $30,000,000

🔈🔉🔊

LiveTrade To Acquire $5M USD Worth of Vemanti Group $VMNT

$VMNT CEO @tanctran talks uplisting...

We're fast tracking to NASDAQ via SPAC and minimum opening price is $4.00. CEO goal is a $1B Market cap . That puts us at $15 per share

🔈🔉🔊

•$30,000,000 funding secured and 2 institutional partnership

•$5,000,000 stock buy from Livetrade

•Marena Gold Mali Acquisition

•Uplisting QB to NASDAQ

#VMNTDD

CEO of vemanti secures $30,000,000 and partners with 2 institutional investors.

Source:

https://t.co/bYj7HrvfRJ

Accial Capital

https://t.co/jpdSEmqdJR

Variant

Interview with the CEO of @Vemanti $VMNT, @tanctran after securing $30,000,000

🔈🔉🔊

LiveTrade To Acquire $5M USD Worth of Vemanti Group $VMNT

$VMNT CEO @tanctran talks uplisting...

We're fast tracking to NASDAQ via SPAC and minimum opening price is $4.00. CEO goal is a $1B Market cap . That puts us at $15 per share

🔈🔉🔊

A THREAD: Groups claiming to be “pro-family” (but really supported by billionaires) are mobilizing against Biden’s proposal of $300 monthly checks to children under 6, and $250 checks to older children.#1

Their claim that these checks would do more harm than good for families is COMPLETELY WRONG. Real experts on family wellbeing patently disagree with them. (See this report, for example. https://t.co/olDXKL3ljq Disclosure: I was on this international panel.)#2

1 in 5 US children now lives in poverty, including almost 1 in 4 Black and Hispanic children. Nearly 1 in 6 children aren’t even getting enough to eat. Monthly checks would ensure a “floor” of income to these children.#3

But it’s more than poor families who need these checks: Almost 1/2 of US households in the United States lost employment income since March 2020, and disproportionately those with children. (No surprise, given widespread school and daycare closures require parents to be home.)#4

Even before COVID, 1/2 of US families had no savings to cover emergency expenses. Their loss of income this year means their spending on children will take a hit. But research shows that whether children get consistent resources critically affects their development.#5

Conservative policy-world beginning to mobilize against Biden's proposed expansion of child benefits@AngelaRachidi warns "extending cash benefits to nonworking parents through the tax code has no precedent in our nation," calls for cutting taxes insteadhttps://t.co/YCargBOEsj

— Jeff Stein (@JStein_WaPo) January 28, 2021

Their claim that these checks would do more harm than good for families is COMPLETELY WRONG. Real experts on family wellbeing patently disagree with them. (See this report, for example. https://t.co/olDXKL3ljq Disclosure: I was on this international panel.)#2

1 in 5 US children now lives in poverty, including almost 1 in 4 Black and Hispanic children. Nearly 1 in 6 children aren’t even getting enough to eat. Monthly checks would ensure a “floor” of income to these children.#3

But it’s more than poor families who need these checks: Almost 1/2 of US households in the United States lost employment income since March 2020, and disproportionately those with children. (No surprise, given widespread school and daycare closures require parents to be home.)#4

Even before COVID, 1/2 of US families had no savings to cover emergency expenses. Their loss of income this year means their spending on children will take a hit. But research shows that whether children get consistent resources critically affects their development.#5

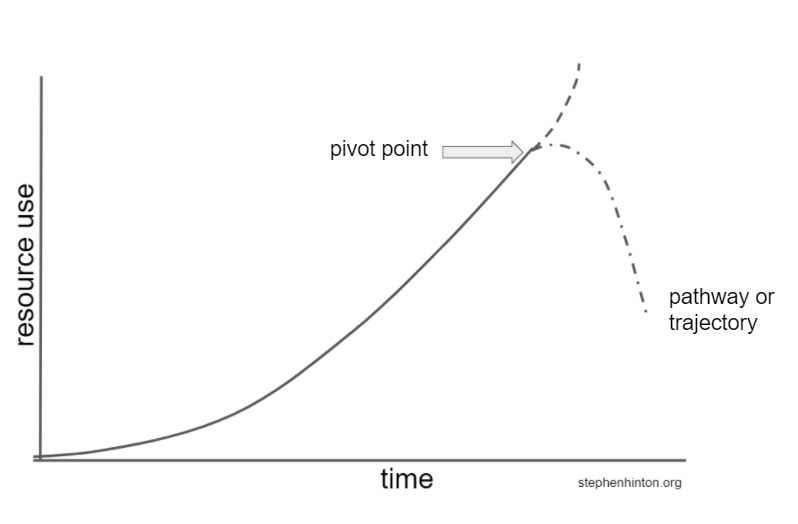

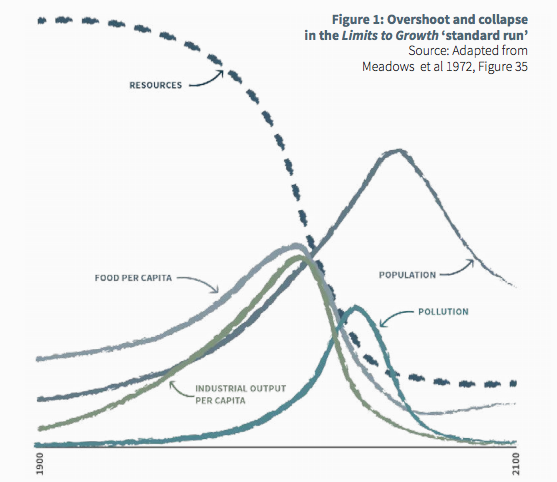

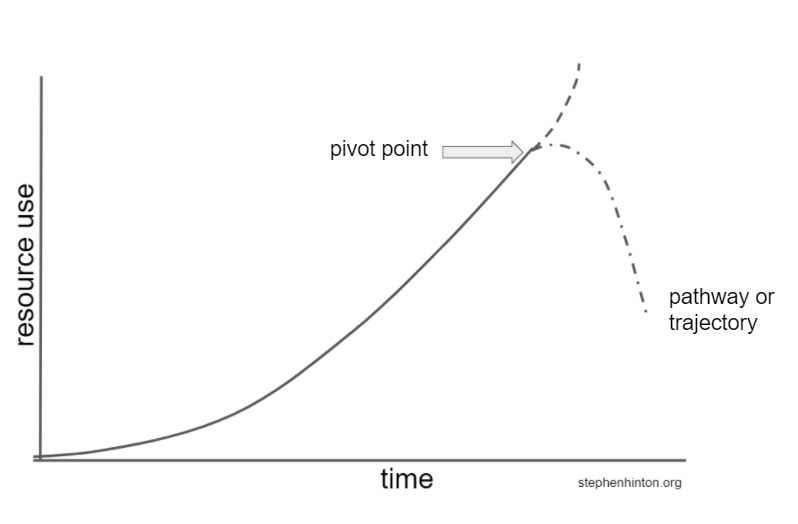

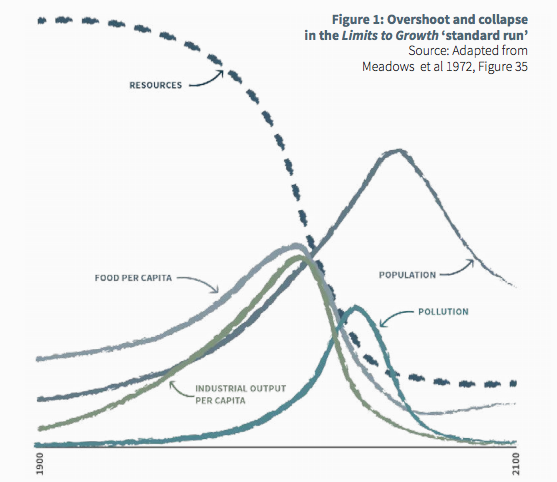

THREAD: one more time on the need for citizens to understand the need for, then demand, then deliberate on, then manage - a total pivotal change. Next tweet..what is a pivot and why we need one 1/

We all did this as kids: Walk up a see-saw, you keep going fine until you cross the fulcrum then WHAM! It flips.This is what happens in nature when resources are used up faster than they are replenished. All goes fine until nearly half are used up. All who study biology know..2/

This flip is a population crash. It is natural. Important to know: the crash comes after the point where more resources are being used up than are being replenished. There is a period of overshoot. The crash comes some time after overshoot. Can that happen to humans? 3/

According to Joseph Tainter (1988) there have been three:

Ancient Rome

Mayan Civilisation

Ancestral Puebloans

Modern society is exhibiting all the signs (Club of Rome 1972) 4/

https://t.co/ND85PXV9MB

All of this is well-known by scholars. But somehow it does not seem to have sunk in with citizens in general. The urgency. So let me say it again in a retweet-worthy way 5/

We all did this as kids: Walk up a see-saw, you keep going fine until you cross the fulcrum then WHAM! It flips.This is what happens in nature when resources are used up faster than they are replenished. All goes fine until nearly half are used up. All who study biology know..2/

This flip is a population crash. It is natural. Important to know: the crash comes after the point where more resources are being used up than are being replenished. There is a period of overshoot. The crash comes some time after overshoot. Can that happen to humans? 3/

According to Joseph Tainter (1988) there have been three:

Ancient Rome

Mayan Civilisation

Ancestral Puebloans

Modern society is exhibiting all the signs (Club of Rome 1972) 4/

https://t.co/ND85PXV9MB

All of this is well-known by scholars. But somehow it does not seem to have sunk in with citizens in general. The urgency. So let me say it again in a retweet-worthy way 5/

Today's Twitter threads (a Twitter thread).

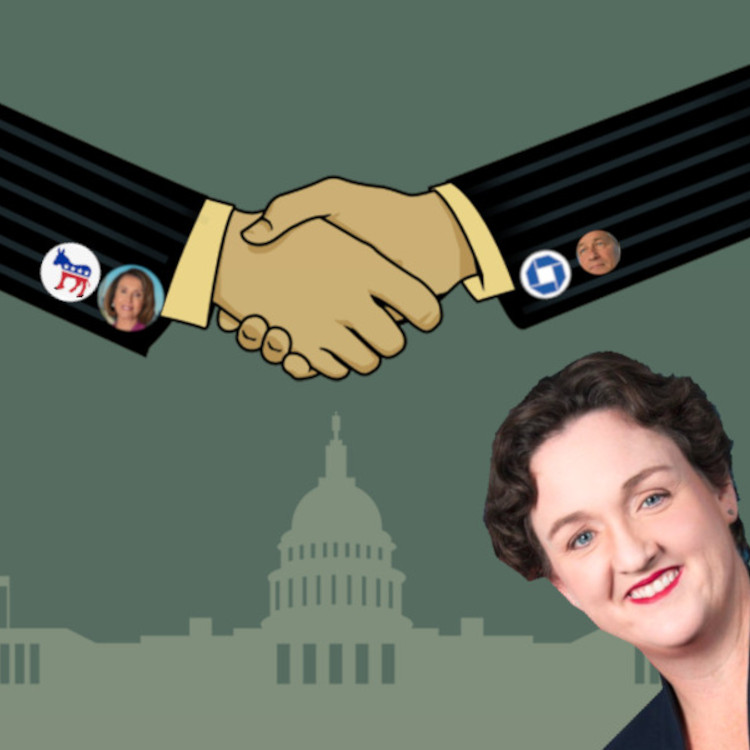

Inside: Pelosi kicks Katie Porter off the Finance Committee; and more!

Archived at: https://t.co/zf4VwiHi1P

#Pluralistic

1/

Pelosi kicks Katie Porter off the Finance Committee: Paging Upton Sinclair, Mr Sinclair to the white courtesy phone.

https://t.co/dZSiJ1xFry

2/

#20yrsago Teresa Nielsen Hayden’s formal excommunication https://t.co/7YzBVPa9pr

#15yrsago New discussion draft of GNU General Public License is released https://t.co/s75A4o6n6G

#15yrsago Firefly fans trying to raise enough $ to produce a new season

#15yrsago King Foundation uses copyright to suppress “I Have a Dream” speech https://t.co/PeYSLzHkuq

#5yrsago Worried about Chinese spies, the FBI freaked out about Epcot Center https://t.co/yzSSdYBikn

4/

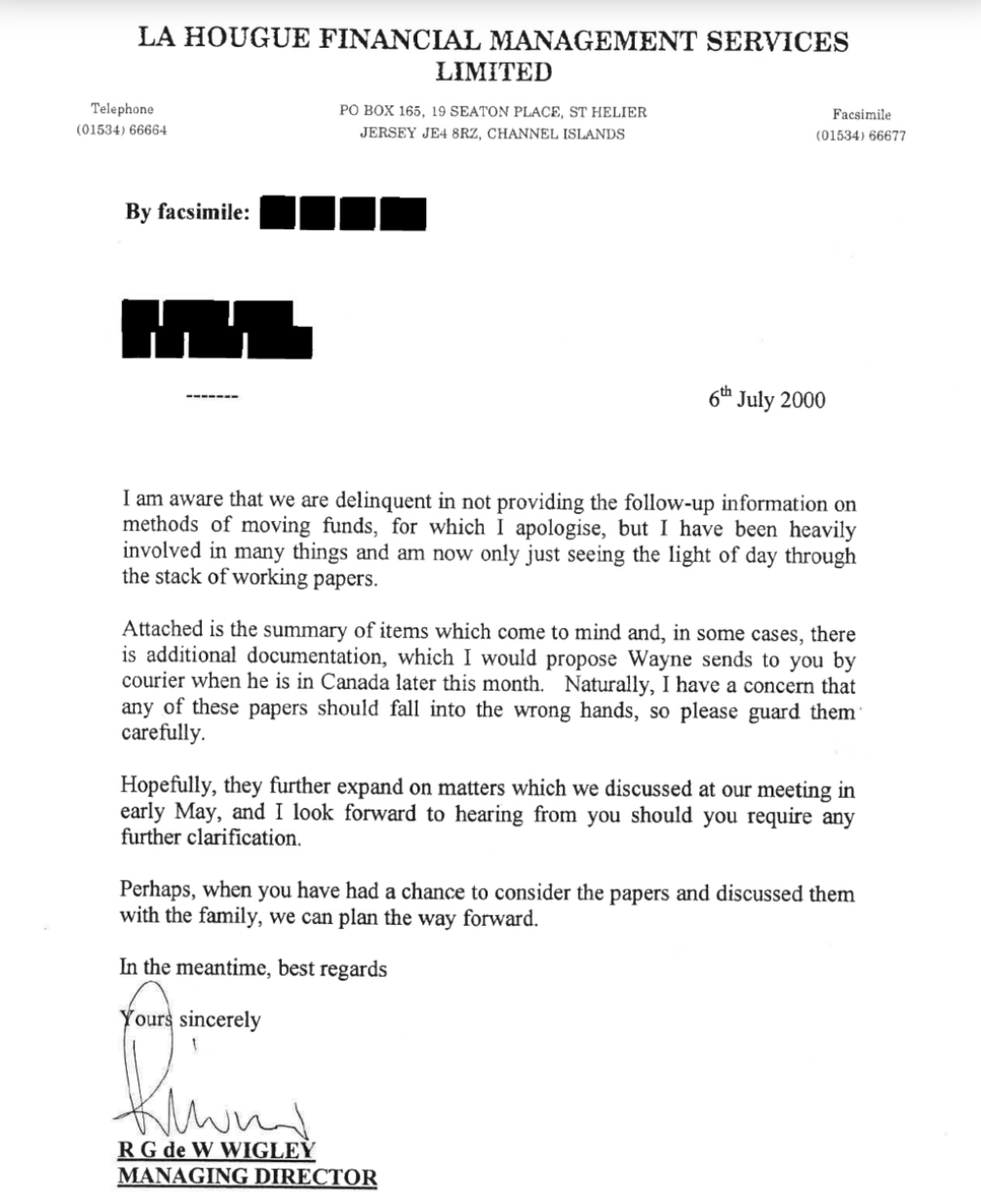

#1yrago Court case lays bare KPMG’s crimes: poaching employees from its own regulators and making them steal government secrets https://t.co/JdLATfUqF2

5/

Inside: Pelosi kicks Katie Porter off the Finance Committee; and more!

Archived at: https://t.co/zf4VwiHi1P

#Pluralistic

1/

Pelosi kicks Katie Porter off the Finance Committee: Paging Upton Sinclair, Mr Sinclair to the white courtesy phone.

https://t.co/dZSiJ1xFry

2/

The Democrats are at least two parties. The progressive wing of the party (which is by no means unified) and the finance wing of the party, which is also the party leadership.

— Cory Doctorow #BLM (@doctorow) January 16, 2021

1/

#20yrsago Teresa Nielsen Hayden’s formal excommunication https://t.co/7YzBVPa9pr

#15yrsago New discussion draft of GNU General Public License is released https://t.co/s75A4o6n6G

#15yrsago Firefly fans trying to raise enough $ to produce a new season

#15yrsago King Foundation uses copyright to suppress “I Have a Dream” speech https://t.co/PeYSLzHkuq

#5yrsago Worried about Chinese spies, the FBI freaked out about Epcot Center https://t.co/yzSSdYBikn

4/

#1yrago Court case lays bare KPMG’s crimes: poaching employees from its own regulators and making them steal government secrets https://t.co/JdLATfUqF2

5/

My take on YOLO short squeeze and volatility..

I guess much has been said/written/memed about the most recent r/WSB YOLO short squeeze, and tbh have nothing really smart to add... but i'm puzzled by the pro-investment community reaction to this (namely HFs, bank sales desks

and prop traders)...

While squeezing traders position has long been a guilty pleasure of the Hedge Fund community (and few aggressive banks, with questionable motives to skew prices), everybody seem to be shocked that retail traders do that, and running a decent risk management

scheme...

My best recollection of a brutal position squeeze was the $12bn JPM lost on CDX spread (aka, the London Whale)

https://t.co/bDHAL2UwpX

Back in these days the entire market knew that JP's trader was, in fact, the entire position in the illiquid index (off-the-run)

so almost every credit trader that I knew traded against that position... Now, that's perfectly legal right? it's not crossing any legal boundaries of price manipulation, so why is it ok for pro traders to do that but it becomes shocking when your neighbor's kid does that?

and the CDX example is only one of a handful of examples of skewed position that got squeezed hard, the only difference is the orderbook distribution...

While in "normal" markets orderbook distribution oscillates between normal to slightly skewed, in the YOLO case I think that

I guess much has been said/written/memed about the most recent r/WSB YOLO short squeeze, and tbh have nothing really smart to add... but i'm puzzled by the pro-investment community reaction to this (namely HFs, bank sales desks

and prop traders)...

While squeezing traders position has long been a guilty pleasure of the Hedge Fund community (and few aggressive banks, with questionable motives to skew prices), everybody seem to be shocked that retail traders do that, and running a decent risk management

scheme...

My best recollection of a brutal position squeeze was the $12bn JPM lost on CDX spread (aka, the London Whale)

https://t.co/bDHAL2UwpX

Back in these days the entire market knew that JP's trader was, in fact, the entire position in the illiquid index (off-the-run)

so almost every credit trader that I knew traded against that position... Now, that's perfectly legal right? it's not crossing any legal boundaries of price manipulation, so why is it ok for pro traders to do that but it becomes shocking when your neighbor's kid does that?

and the CDX example is only one of a handful of examples of skewed position that got squeezed hard, the only difference is the orderbook distribution...

While in "normal" markets orderbook distribution oscillates between normal to slightly skewed, in the YOLO case I think that