SAnngeri Categories Screeners

#bearrun

#BearMarket

Head & Shoulders pattern, double top and bearish RSI divergences fail more often in bull market and generally gives a very good SAR trade. Vice versa is also true for bear market.#bullrun #BullMarket

— Aakash Gangwar (@akashgngwr823) February 9, 2021

Simple: When 13 moves above 21 in "15 Minute t/f for Intraday only", BUY

When 13 moves below 21 in "15 Minute t/f for Intraday only", SELL as in a SAR system

Master just one doubt about the re-entry part

— Sunny Singh (@SurendraSinghJi) February 10, 2022

You mentioned to re-enter at 17430 levels.

How to initiate the trade at the lowest point when the candle is in the formation mode.

Is it that when the price touches 21ma we should entry longs till 13ma is above 21ma.

Show path \U0001f64f

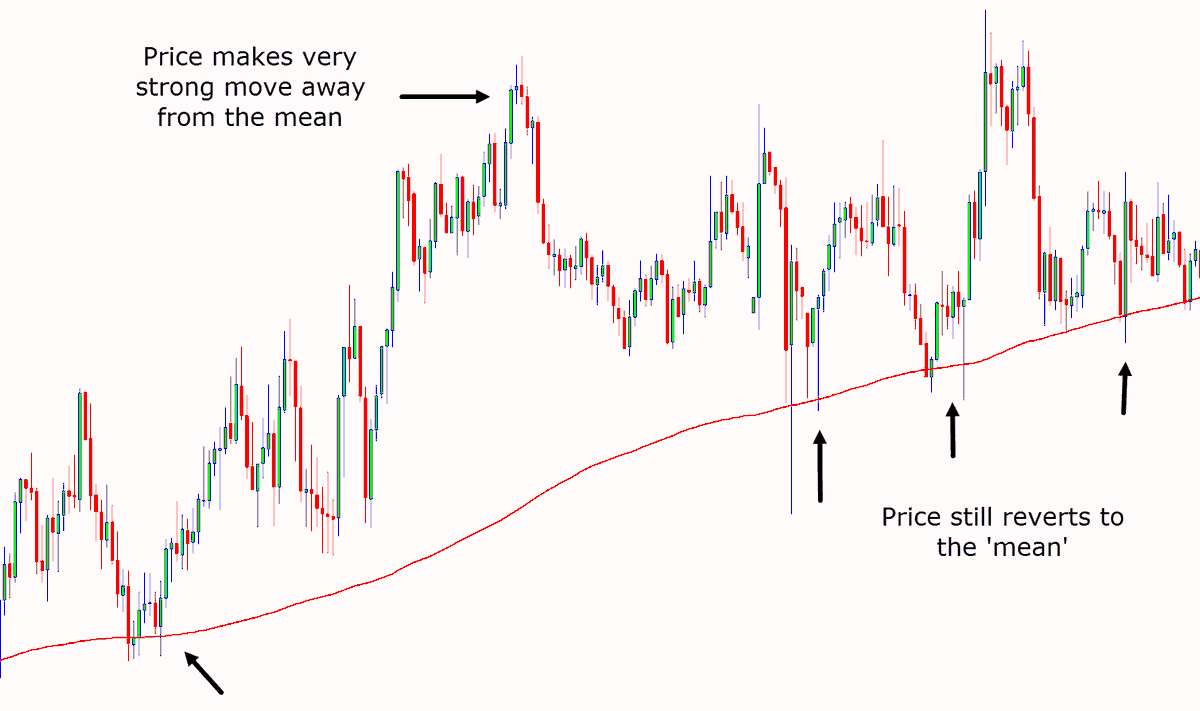

Addl.strategy: When prices move far from MA, say 150 to 200 pts, "Part book" & re-enter when prices pull back to MA

Choose to do this way 1 or 2 times only for intraday

Idea is "Mean Reversion" - Prices tend to move back to MA IF they move far away from MA in a trending phase.🙏

1. Go through Zerodha Varsity chapters on Technical Analysis at least 2 times.

2. Then read 'Technical Analysis Explained' by Martin Pring

3. Finally read 'Price Action bar by bar' by Al Books (Not for casual reader).

Sir @DillikiBiili , could you please suggest a book for technical analysis ?

— Pawan Yadav (@pawan_yadav86) March 25, 2022

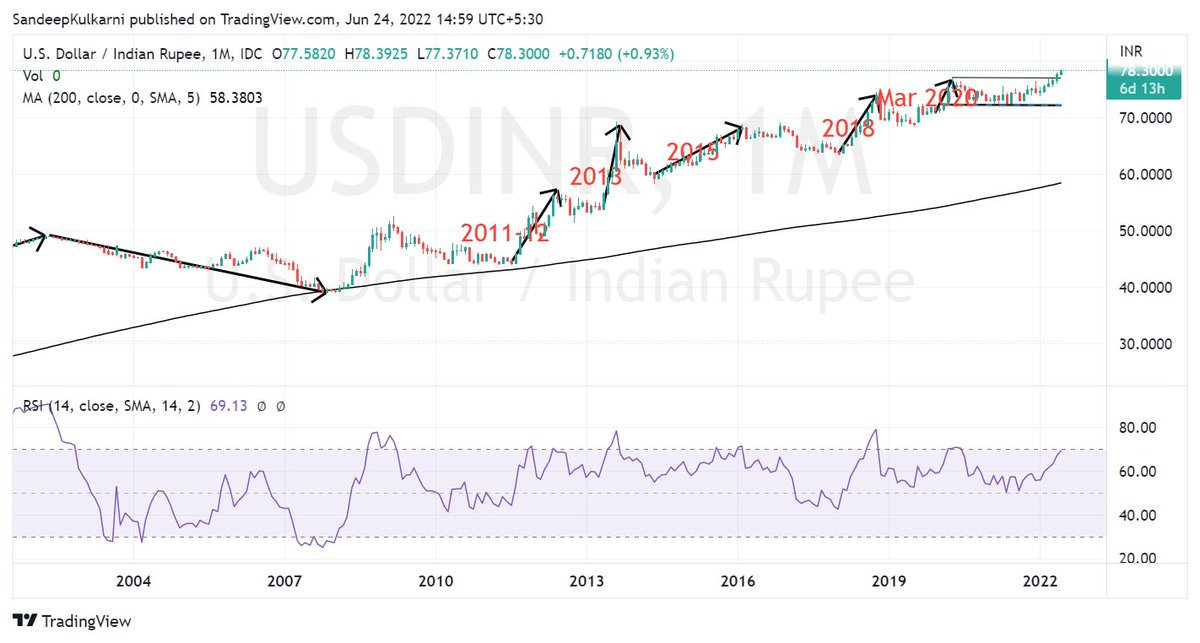

BTW Nifty Metal has inverse correlation with USDINR. https://t.co/X6cqVcYF3V

We know how our stock market has weathered the FII selling.

— Sandeep Kulkarni (@moneyworks4u_fa) June 10, 2022

But the equally big story is how Rupee has weathered $50bn+ outflows since Oct 2021. Hats off to RBI Governor Das & his team for having the vision of building huge reserves in his tenure. pic.twitter.com/CVuF9dM361

See Large OIl buildup kin strikes par hai and in between strikes data kaise move ho raha hai.

Thumb Rule:

Calls Reduction + Puts addition = Upthrust

Calls Addition + Put Reduction = Down move

Higher the Delta OI velocity, faster is the move.

For Nifty Intraday Traders: As of now, this seems to be a buy on dip market and looks like there won't be any juicy trades on short side. Will update if data changes. https://t.co/PCIyyPld4A pic.twitter.com/ES3o4z60rY

— Professor (@DillikiBiili) March 11, 2022

This is Nifty's chart from 2004 to 2006. Back then also US interest rates had gone up. Markets had corrected well before Fed had hiked rates for first time in 2004, from then it hiked rates 17 times by 4.25% over next 2 yrs and yet market kept making new highs. @shivaji_1983 pic.twitter.com/EAFhske9EE

— Sandeep Kulkarni (@moneyworks4u_fa) February 11, 2022

0/ Tomorrow I am posting a thread on how you can make such a weekly trading plan for yourself.

Will be using this thread as an example at the end of that thread tomorrow.

Anyways, let's begin!

1/ October 2nd Week

#BANKNIFTY

— Nikita Poojary (@niki_poojary) October 10, 2021

Outlook for the week Oct 11 - Oct 14, 2021

Compiled here\U0001f447

2/ October 3rd

#BANKNIFTY

— Nikita Poojary (@niki_poojary) October 17, 2021

Outlook for the week Oct 18 - Oct 21, 2021

Clear BO on the Weekly TF

1/4 pic.twitter.com/oh7F1AEsH7

3/ November 1st

#BANKNIFTY

— Nikita Poojary (@niki_poojary) October 31, 2021

Outlook for the truncated week Nov 1- Nov 3, 2021

On a higher TF structure has changed to -ve, bounces would be utilized as a selling opportunity

However this is the first selling so first pullback can be expected

Detailed explanation on the charts pic.twitter.com/7UxQBZ3QFq