SAnngeri Categories Screeners

📌Rs + Macd Strategy

📌Darvas Box Strategy

📌Breakout Trading

📌Retest Trading

📌Range Trading

Retweet and Share !

@kuttrapali26 @Techno_Charts

1/no

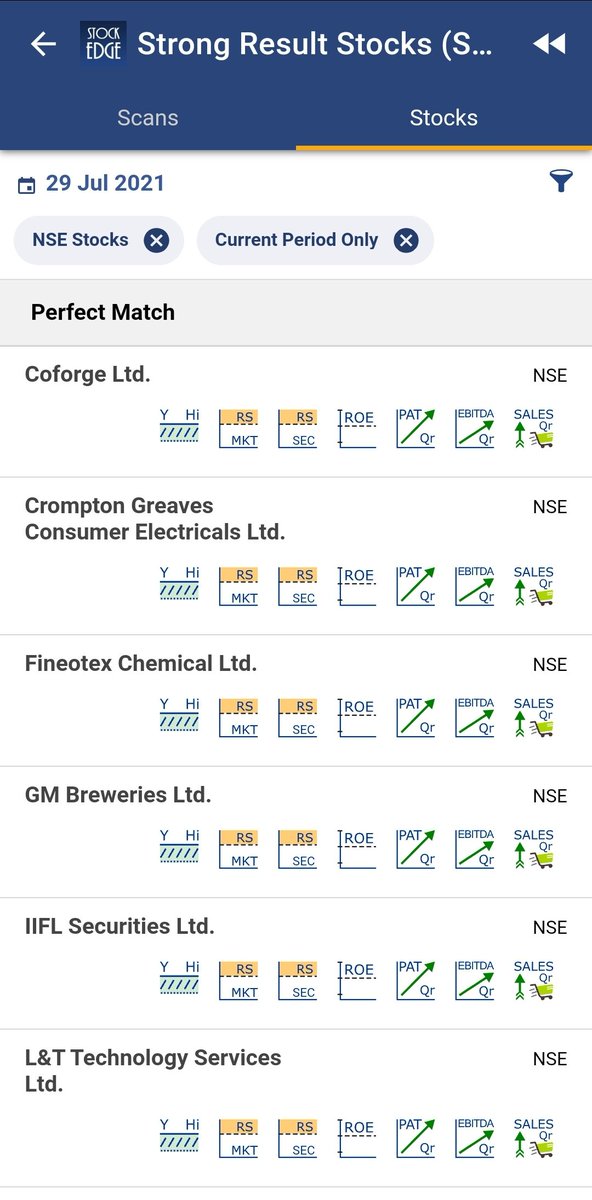

RS + MACD Strategy

Swing Trading Strategy

— JayneshKasliwal (@JayneshKasliwal) November 12, 2021

That can help you generate 3 to 5% Monthly

A thread \U0001f4d5

Using RS , MACD , 21 EMA and Price Action

All Concepts Explained !

RETWEET AND SHARE !#StockMarket @kuttrapali26 @ArjunB9591

1/n

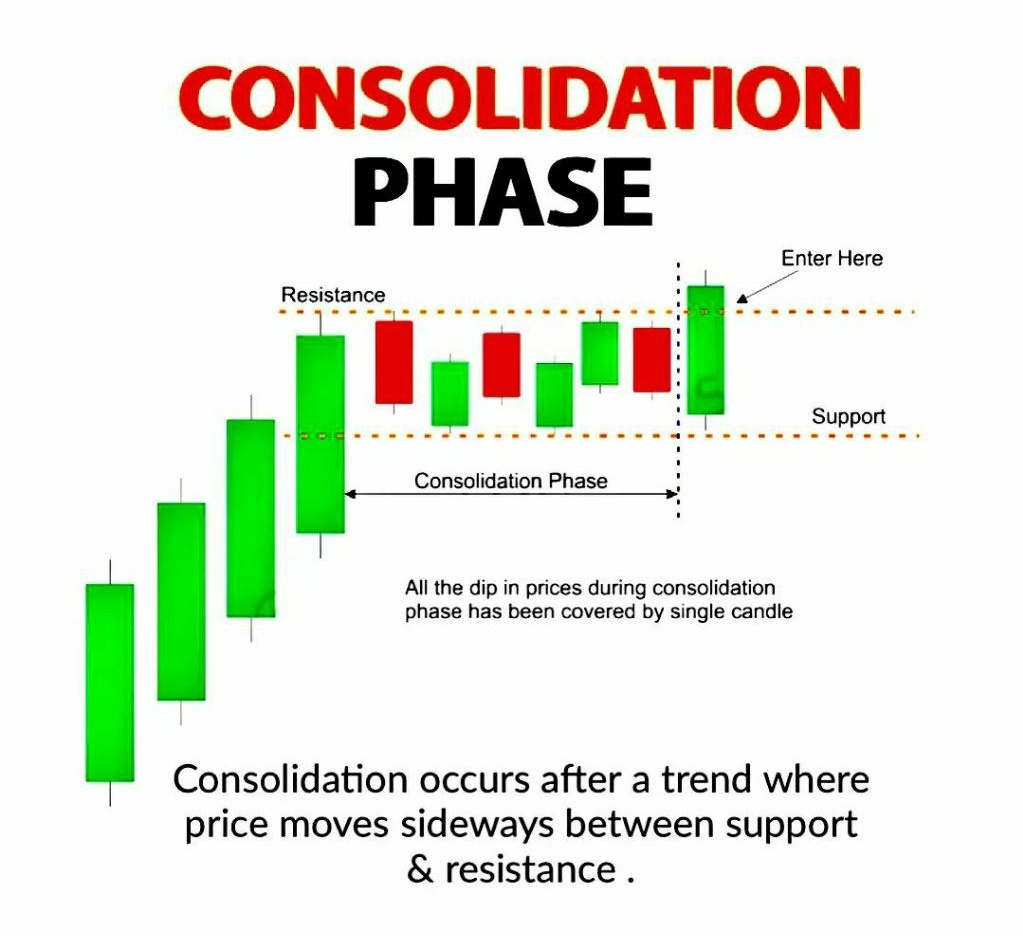

Range Trading Strategy

SWING TRADING STRATEGY FOR RANGE BOUND STOCKS

— JayneshKasliwal (@JayneshKasliwal) December 23, 2021

A Thread :

Using Concept of Support and Resistance

Using Minimum StopLoss

Retweet And Share !

1/n

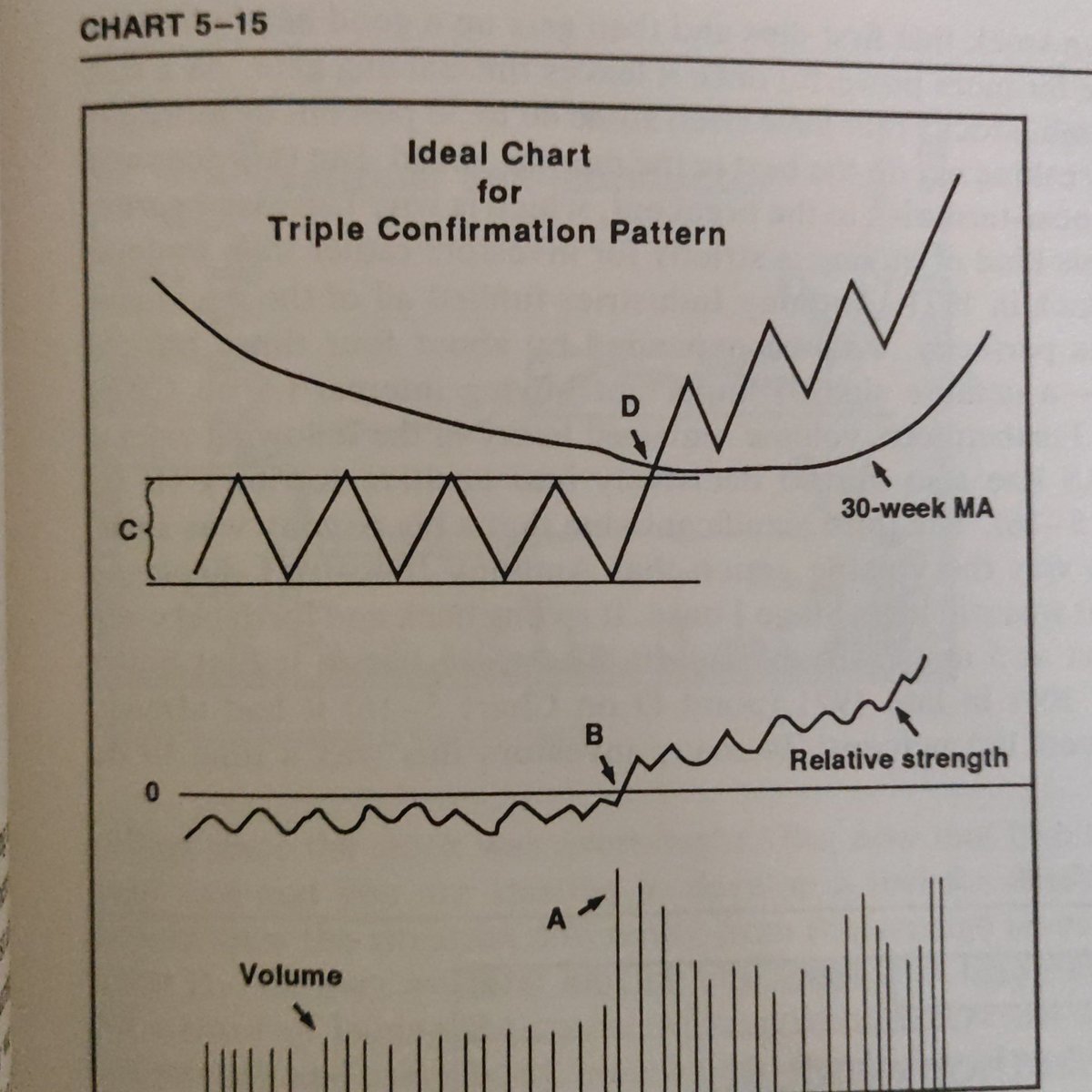

Darvas Box Trading Strategy

The Darvas Box Trading Strategy

— JayneshKasliwal (@JayneshKasliwal) December 30, 2021

A Detailed Thread \U0001f516 + 1 Book Give Away !

Rules For Giveaway :

Follow @JayneshKasliwal

\U0001f504Retweet and

\u2665\ufe0f Like this Tweet

One Lucky Winner will be Selected in Live for the Giveaway #StockMarket #darvasbox pic.twitter.com/pYdofszMML

Breakout Trading

Breakout Trading Strategy

— JayneshKasliwal (@JayneshKasliwal) November 17, 2021

How to Trade Breakouts Effectively?

How to avoid Big losses in BO Failures ?

How to Position Size?

A THREAD\U0001f516

RETWEET SHARE!\U0001f504@kuttrapali26 @AdityaTodmal

1/n

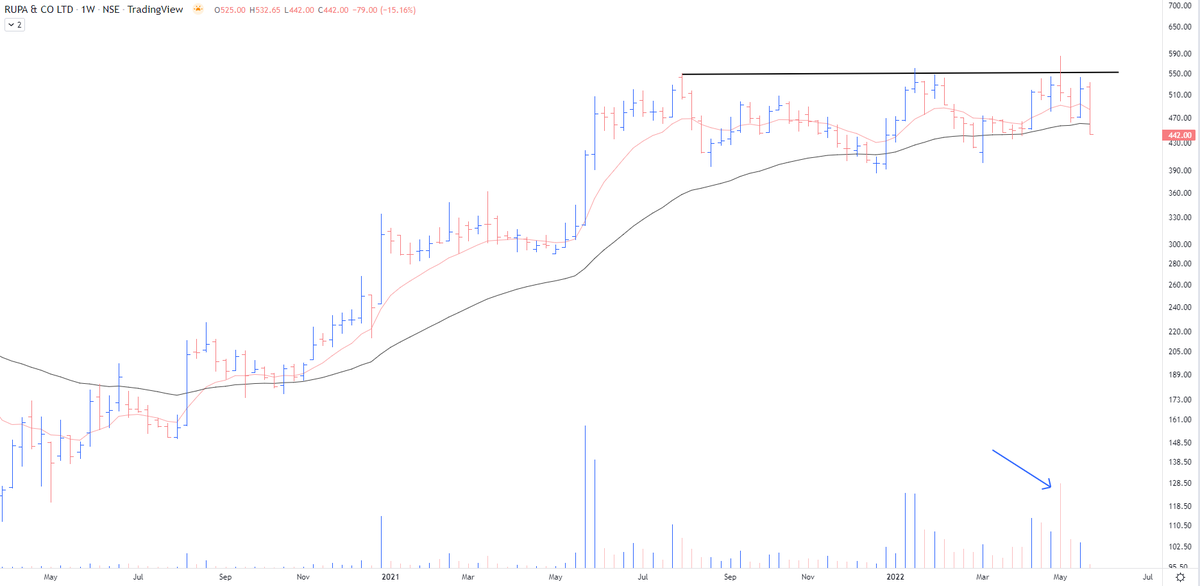

Fresh case - RUPA https://t.co/nqq5nI1wLU

Respect your stop losses in the stocks that have gone down today with heavy volumes even on a strong day.

— The_Chartist \U0001f4c8 (@charts_zone) March 17, 2022

VTL pic.twitter.com/3pJ9XngCDL

Wish to build a multi-year, resilient equity #portfolio? On #TheMoneyShow today, @vivbajaj, Co-founder of StockEdge & elearnmarkets shared set a of valuation metrics that can guide your right stock selection strategy@alexandermats pic.twitter.com/qMbNqxHG0M

— ET NOW (@ETNOWlive) January 13, 2022

🧵on

• Uses of RSI

• Rakesh Jhunjhunwala

• Volume Analysis

• Cash Investing Strategy

• How should new entrants learn quickly?

• How to use Nifty to beat its own returns?

• Compilations of many threads

🧵Superb Thread on RSI

1. Uses of RSI.

2. Investment strategy based on

#RSI is a common indicator which most of us use in the stock market.

— Yash Mehta (@YMehta_) October 22, 2021

This learning thread would be on

"\U0001d650\U0001d668\U0001d65a\U0001d668 \U0001d664\U0001d65b \U0001d64d\U0001d64e\U0001d644"

Like\U0001f44d & Retweet\U0001f504 for wider reach and for more such learning thread in the future.

Also, an investment strategy is shared using RSI in the end.

1/16

🧵How did Rakesh Jhunjhunwala make his money from trading? Covered very well.

Rakesh Jhunjhunwala became rich initially by Trading and not Investing.

— ARJUN BHATIA (@ArjunB9591) October 21, 2021

Thread on the same \U0001f9f5

It is called genius because Jhunjhunwala made Rs 20 lakh to Rs 15,000 crore in 30 years through the stock market. And that Rs 20 lakh was also borrowed money at 20% interest. pic.twitter.com/ZkGU4iG5UR

🧵Amazing thread on various indicators.

(@Prashantshah267)

This is not a thread from the current week but @ArjunB9591 brought this to my notice so I shared it.

Thread of threads I have written on the Twitter:

— Prashant Shah (@Prashantshah267) November 29, 2020

Link to my books, blogs and videos:https://t.co/yZjlVPpKs4

🧵on Volume

Full #volume anlaysis thread \U0001f9f5

— Vikrant (@Trading0secrets) October 20, 2021

One thing which big player can never hide - VOLUME https://t.co/MjtFq384N0