Covering one of the most unique set ups: Extended moves & Reversal plays

Time for a 🧵 to learn the above from @iManasArora

What qualifies for an extended move?

30-40% move in just 5-6 days is one example of extended move

How Manas used this info to book

The stock exploded & went up as much as 63% from my price.

— Manas Arora (@iManasArora) June 22, 2020

Closed my position entirely today!#BroTip pic.twitter.com/CRbQh3kvMM

Post that the plight of the

What an extended (away from averages) move looks like!!

— Manas Arora (@iManasArora) June 24, 2020

If you don't learn to sell into strength, be ready to give away the majority of your gains.#GLENMARK pic.twitter.com/5DsRTUaGO2

Example 2: Booking profits when the stock is extended from 10WMA

10WMA =

#HIKAL

— Manas Arora (@iManasArora) July 2, 2021

Closed remaining at 560

Reason: It is 40+% from 10wma. Super extended

Total revenue: 11R * 0.25 (size) = 2.75% on portfolio

Trade closed pic.twitter.com/YDDvhz8swT

Another hack to identify extended move in a stock:

Too many green days!

Read

When you see 15 green weeks in a row, that's the end of the move. *Extended*

— Manas Arora (@iManasArora) August 26, 2019

Simple price action analysis.#Seamecltd https://t.co/gR9xzgeb9K

Folks you can check his y'days video

Although, I have learnt this extended move set up from @iManasArora 🙌

Do follow him & check his timeline for such set ups!

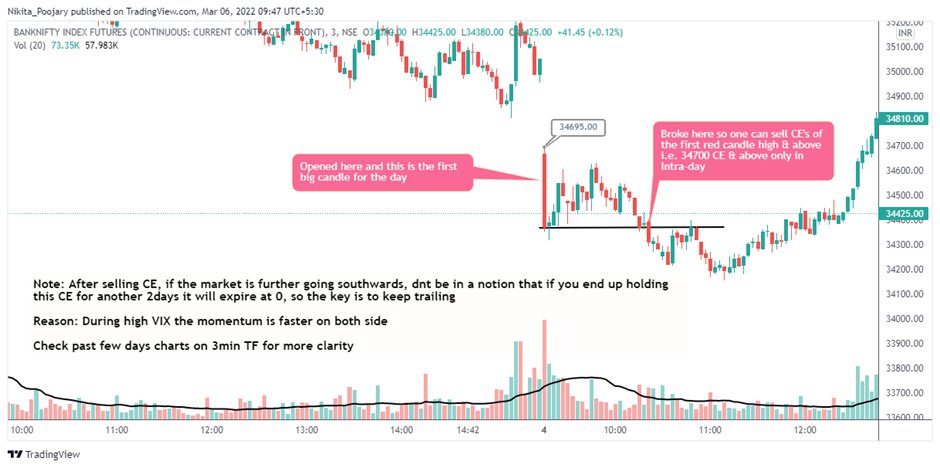

#BANKNIFTY

— Nikita Poojary (@niki_poojary) November 30, 2021

90degree upmove qualifies for abnormality, be cautious \U0001f6a8 pic.twitter.com/uyFCMpGOuR

I shorted the ATM CE's which Subasish Pani does, and hence I mentioned strike selection inspired by Mr. Pani!

THREAD: Playbook on option selling to grow your knowledge & P/L account

Collaborated with @AdityaTodmal

1. Basics of Option selling

• The A,B,C,D one should be aware of before taking a plunge into option selling

THREAD: 14 of the best resources/topics for anyone who wants to start option selling as a career. \U0001f9f5

— Aditya Todmal (@AdityaTodmal) March 13, 2022

Collaborated with @niki_poojary

2. @Mitesh_Engr Sir's process for positional option selling

A Thread on the Boss himself @Mitesh_Engr

— Aditya Todmal (@AdityaTodmal) July 4, 2021

Mitesh Sir's Positional Option Selling 101:

\u2022 How to find direction

\u2022 Which options to sell

\u2022 How to deploy capital

\u2022 Exit criteria

\u2022 What ROI he targets weekly

\u2022 What % risk he takes

Done with the help of @niki_poojary pic.twitter.com/tcTKV02oO2

3. How @Mitesh_Engr sells options on an

Catch me if you can @Mitesh_Engr

— Nikita Poojary (@niki_poojary) July 17, 2021

Time for a\U0001f9f5

Mitesh Sir's EXPIRY Option Selling 101:

\u2022 What to look for?

\u2022 Strike Selection & Ratios

\u2022 SL mgmt

\u2022 Avoiding freezes

\u2022 Monthy Expiry

\u2022 Event days

\u2022 How he would have traded last expiry?

In collaboration with @AdityaTodmal pic.twitter.com/9uN2vQQ4hc

4. Transcript of @Mitesh_Engr Sir's “F&O Pe Charcha - Diary Of An Option

Time for a Thread\U0001f9f5On yesterday\u2019s \u201cF&O Pe Charcha - Diary Of An Option Seller\u201d with @Mitesh_Engr by @Paytm Money

— Nikita Poojary (@niki_poojary) August 1, 2021

👉Free trading scanners

👉Powerful lessons from Power of Stocks videos

👉Mr. Radhakishan Damani's inspiring journey as a trader, investor and entrepreneur & much more

🧵 The 10 best threads from April 2022 (that you may have missed):

10 Powerful learnings on Directional trading:

The best traders are all directional traders.

— Aditya Todmal (@AdityaTodmal) April 1, 2022

We should be investing our time into learning what the best traders are doing.

I have traded with @niki_poojary for the past year, who is an aggressive directional trader.

Here are my 10 learnings trading with her: \U0001f9f5

Best Threads from Q1

Twitter is a free university.

— Aditya Todmal (@AdityaTodmal) April 3, 2022

But 98.8% missed out on the best content on this platform.

Here are the best threads from Q1 2022:

Collaborated with @niki_poojary

How to develop a right mindset and draw inspiration from Pro traders

"Nothing can stop the man with right mental attitude from achieving his goal, nothing on earth can help the man with the wrong mental attitude" - Thomas Jefferson

— Nikita Poojary (@niki_poojary) April 2, 2022

Thread: Psychology, being grateful, draw inspiration & the trading RoI's\U0001f9f5

Collaborated with @AdityaTodmal

12 Powerful concepts from Power of Stocks (by Subashish Pani)

There are plenty of videos of Subhasish Pani from Power of Stocks.

— Aditya Todmal (@AdityaTodmal) April 17, 2022

You already know those.

Instead, here are 12 concepts from his videos that will make you a better trader\u2013\u2013not worse:\U0001f9f5

Collaborated with @niki_poojary

• Creative enough to look beyond the obvious

• Covering another unique set up: Rating Houses Contra Trades or as he calls it "Moody-no-so-Moody indicator"

🧵 to learn from @iManasArora

• Usually international rating agencies come with a downgrade only after a massive correction in the stock

• Similarly these rating agencies come with an upgrade report post a sharp rise in the stock

• Don't take them on face value and DYOR!

• How Ultra Bullish articles from rating/broker houses is used to dump the stock to retail

• New traders provide liquidity for BIG players to offload their stocks

#HEG

• Example 1: BofAML sees 100% rise

• Read this thread to know in detail

Next 2-4 weeks are crucial for #HEG. If it does not hold up the current level plus minus 5%, there will be an 80% chance of a 20% drop which could extend to up to 50% drop.

— Manas Arora (@iManasArora) October 19, 2018

News based rally on a low volume could turn into a classic case of late stage base fail. pic.twitter.com/eh3ncaSxoy

Look how it took support of the upward sloping black trendline https://t.co/mhqkIzBkQN

#BANKNIFTY

— Nikita Poojary (@niki_poojary) February 6, 2022

\U0001d403\U0001d41a\U0001d422\U0001d425\U0001d432 \U0001d413\U0001d405: 38855 is the BO level on daily TF which was taken out on Feb 2 & if BNF sustains above 39500 level in the coming week then we can see a fresh leg of upmove

Formation of rising wedge i.e. HH & HL pattern

S/R on daily mentioned pic.twitter.com/liaqfEezkW

Anyone remember this???

Well I still remember a lot of ppl criticized me for this

Patterns work the same across charts! https://t.co/R8GHJpWw0m

#US10Y

— Nikita Poojary (@niki_poojary) January 26, 2022

BO of symmetrical indicating interest rates to rise to 2.1% to ~2.5%.

The TF for this tgt is on or before Feb 2023 pic.twitter.com/9KJO0OU9v5