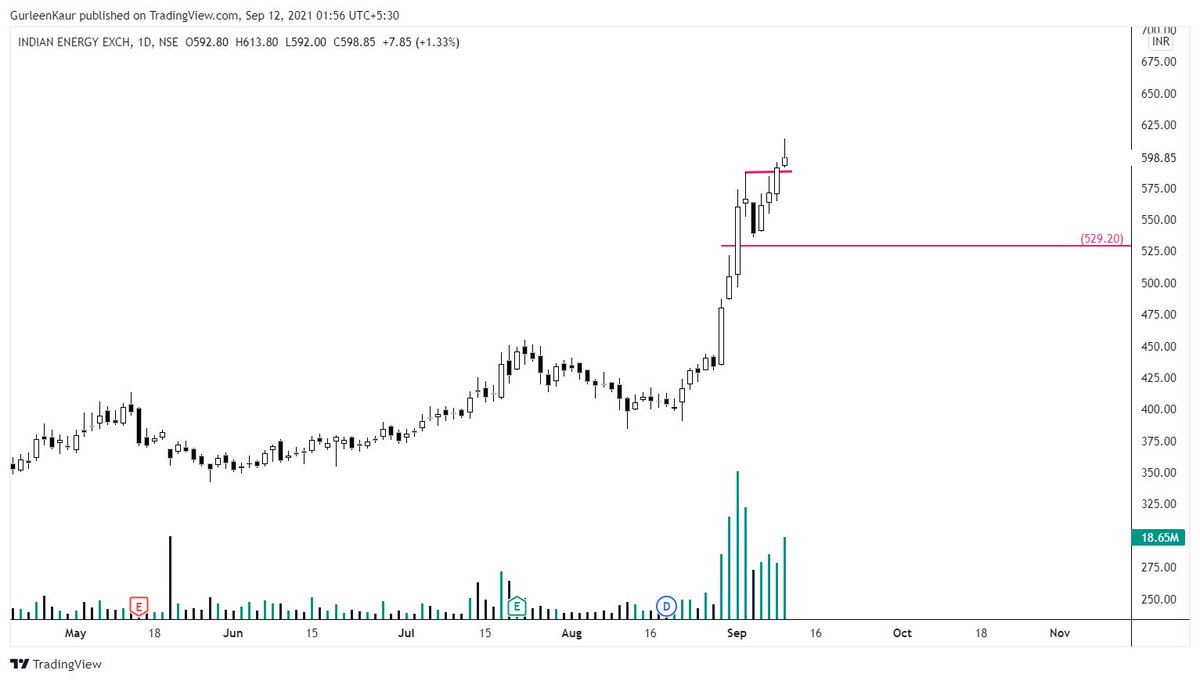

Price characterized by a clear direction of the price trend.

Followed by a consolidation in the form of converging action which is an indicative of resumption of the trend.

A breakout at 613.80 would mark the price towards 700. https://t.co/MvoUQ1Y5gA

#IEX

— Gurleen (@GurleenKaur_19) September 12, 2021

In daily; 0.382 Fib support level intact.

Till the time it holds above 565.60, Potential upside can be seen towards 630 followed by 700.#StockMarket #StocksInFocus pic.twitter.com/cYLaRsUOGZ

A quick thread 🧵

Daily TF

With the turn-around in price from the initial harmonic pattern, Consequent LH-LL's in place.

Below $101.56, We might catch sight of $87 followed by $78 https://t.co/nvzolftng6

$USOIL

— Gurleen (@GurleenKaur_19) June 6, 2022

With the inching up of reaction lows, the targets are placed at $125 and $134.

In a different case scenario, Let's not rule out the possibility- If the price continues to sustain above the level of $104, Might see a hit towards the level of $150 as well. #CrudeOil pic.twitter.com/p52TnRkBqC

On the Weekly TF, If the price slips and closes below $92.96, the target would be $70.

Ready for yet another move? 📈

Daily and weekly charts attached highlighting good price volume action. Key level for upside action 1458.50

[Holding only 30% since 1200 levels]

#TataSteel #StockMarket #StocksInFocus https://t.co/bG2Gj9bFRX

#TATASTEEL Update

— Gurleen (@GurleenKaur_19) July 29, 2021

All Target's Hit \U0001f4cd

But due to the bullishness in Metal's, I'll keep on holding 30% Quantity with TSL.#StockMarket #StocksToTrade https://t.co/JukaAHg73A

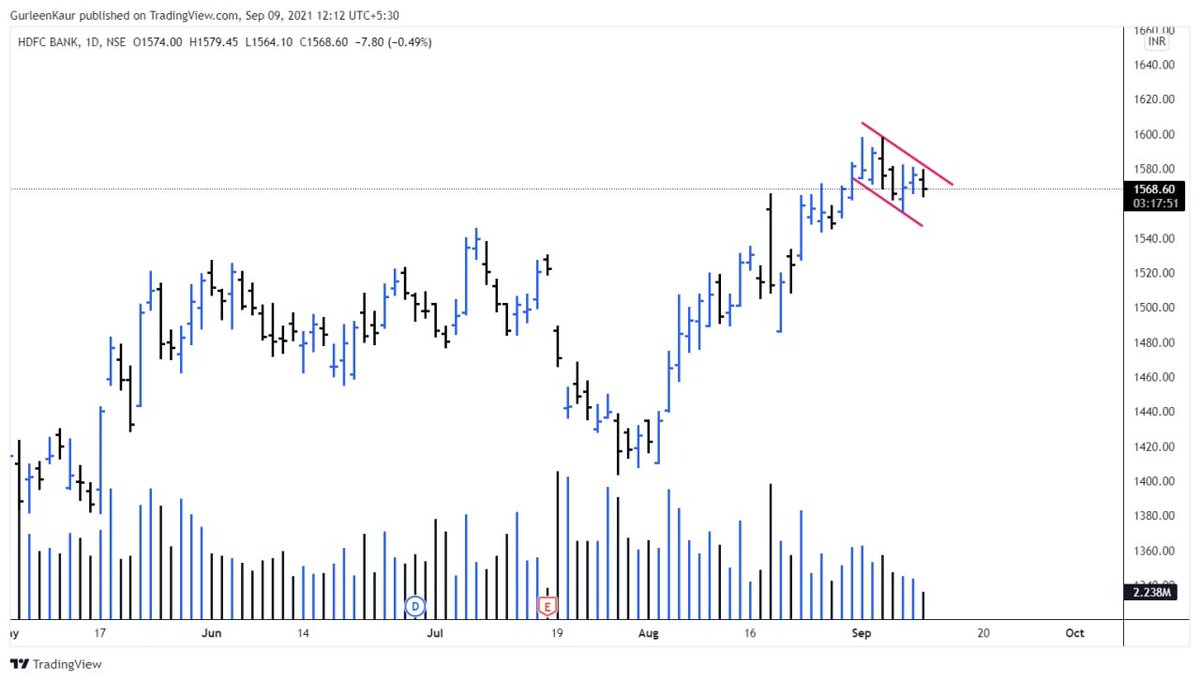

Let's look at the Multi-TF Technical aspect~

In weekly; Price marked by converging trend lines.

Representing consolidation prior to continuing in the direction of existing trend.

Sustenance above 1531 and a break-through at 1579.35 would trigger 1640+

+

In daily; it's showing a counter-trend move that has followed after a sharp price movement.

Rejection level at 1579.35 which needs to be breached for extended upside.

Both Weekly and daily charts are indicating the resumption of the prior trend.

+

It has been on my radar since August series and I have been watching out for these levels to be neatly breached for a bullish move.

#HDFCBANK

— Gurleen (@GurleenKaur_19) August 10, 2021

The setup looks favorable above 1531 for target's of 1640+#StockMarket #StocksToWatch pic.twitter.com/jbQrbjuYHy

The news is also favorable for #HDFCBANK.

In their last commentary, Bank said~ the transportation finance disbursements are 110% of May numbers.

July was 40% higher than the month of June and August was twenty 25% higher than July.

+

Bank is very upbeat about it's growth in rural and semi-rural areas.

Right now they are active in total of 1 Lac villages.

Within two years they aim to expand it to 2 Lac villages as it's going to be major part of their loan book.

+

2279 📍

On weekly log scale; The trend remains intact towards the upside. Next up would be 2340.

#StockMarket https://t.co/cUERcUA6BU

#DEEPAKNITRITE Update

— Gurleen (@GurleenKaur_19) August 3, 2021

2150 \U0001f4cd

On weekly log scale; The trend remains intact towards the upside. Next up would be 2340.

[As mentioned; this can be in one's long term portfolio, Targets would keep on becoming elongated.] #StockMarket #StocksInFocus #investing https://t.co/HJH5XwMRf5 pic.twitter.com/PWwLqZph9c

Seems like another retest along with a follow through move. Even the support at 6100 has been taken out.

In swing support placed at 5590 followed by 4960.

#StockMarket #StocksToWatch https://t.co/bekQfLgWEK

#ULTRACEM

— Gurleen (@GurleenKaur_19) May 1, 2022

With the breakdown & retest. The major support is placed at 6100 levels. pic.twitter.com/IsoZd1grIx

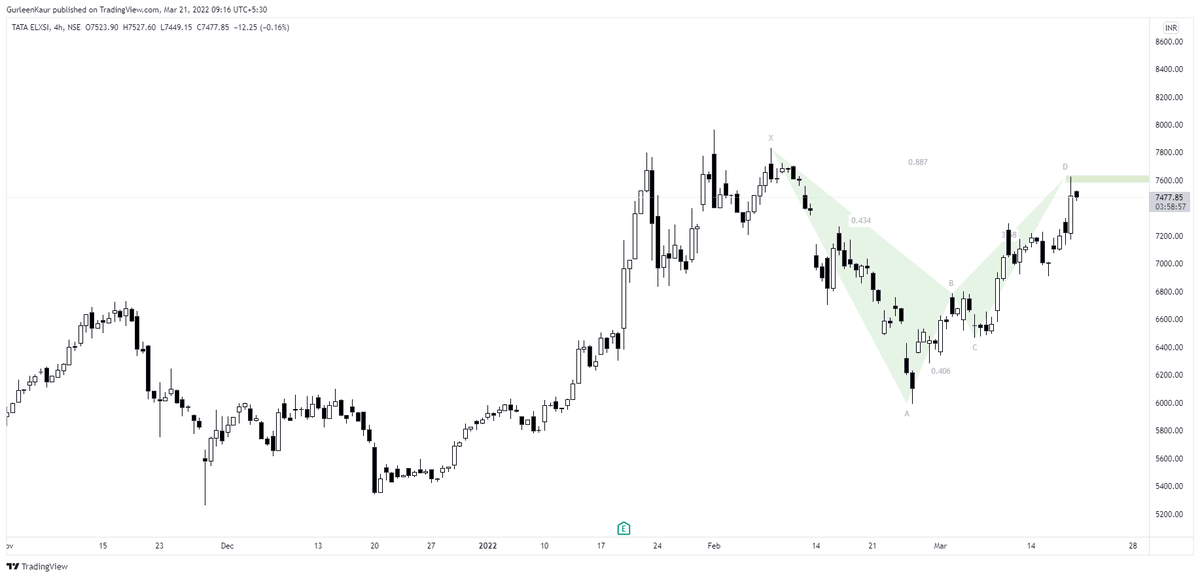

The price has now reached Point D and looks ready to take a dive from here.

Avoid fresh longs here. https://t.co/JpzNfzNRW1

#TVSMOTOR

— Gurleen (@GurleenKaur_19) June 26, 2022

The price advance might turn back from either the initial peak or Point D.

Let's see how it rolls out. pic.twitter.com/Lpf5ONGahd