SAnngeri's Categories

SAnngeri's Authors

Latest Saves

Needs to break below this level for real impact. https://t.co/r5KoExzFKc

NYMEX Crude Oil update !

— Professor (@DillikiBiili) July 1, 2022

Its not ready to come below US$ 100 which is a big psychological level ! Everytime it comes near that zone, it takes a bounce. https://t.co/xQ3dZZXNiu pic.twitter.com/7WS38JU6JF

Positive signs on inflation include fertilizer prices peaking and trending downward. Used Car prices are also down (which led inflation). The recent price break on the $XLE - which emerged almost to the day the market topped, could be an indication that we are close to a low. pic.twitter.com/2MtcKjjmAz

— Mark Minervini (@markminervini) June 23, 2022

The 3 most important rules which I follow in spotting a major trend reversal laid out in this stock, 'as it is'.

1. Trend reversal

2. Price patterns

3. Indicator confirmation

Perfect TA chart.

All boxes ticked !!

Do comment, like and share !!!

#DRREDDY https://t.co/4JGg71GenE

Today at 2 pm:

— Kunal Bothra (@kbbothra) July 5, 2022

I will bring to you one of the SUPER FINEST TECHNICAL CHART setup on a largecap name.

Agar yeh nahi chal paya toh kuch nahi chal paayega\u2026

Retweeet tsunami has to come for this one\u2026 #stock #breakout #technical

#nifty50 https://t.co/64ZktWHQev

This is the maximum upside for now, post that I am looking for an 8-9% fall in index.#nifty50 pic.twitter.com/BcSOiwWuBs

— Aakash Gangwar (@akashgngwr823) June 24, 2022

Here are some ways how you can do it, when you can do it and the right position sizing for doing it... 🧵 (1/25)

Traders who are trading in cash and want to explore options generally start with options buying without much knowledge. They buy OTM strikes and trade with wrong position sizing. With no idea about the perfect entry, they end up feeling that F&O is risky. (2/25)

After losses in F&O buying, this is how I approached it and it rewarded me pretty well in initial phase. I find this strategy easy to start things off. And then, you can explore other strategies too and find what works for you. (3/25)

Vertical spread is a directional, defined risk options trading strategy:

1. Bull call spread (Debit spread)

2. Bull put spread (Credit spread)

3. Bear call spread (Credit spread)

4. Bear put spread (Debit spread)

Read about these strategies in the below articles. (4/25)

https://t.co/KQvYOsu9kv

While going through these strategies, you must have thought you have to wait till expiry for profits/loss. (5/25)

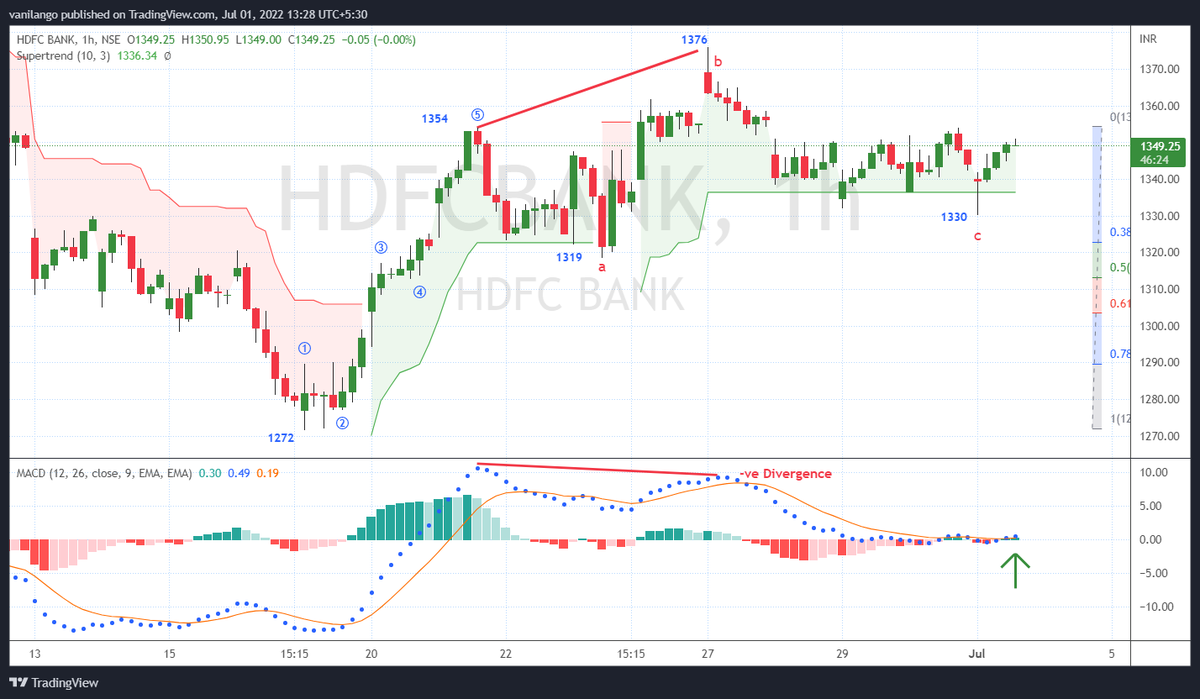

An "ABC" correction ended & "C" wave's "12345" ended in this highly traded stock.

#Elliottwave captures Nature's law, human actions in a collective way

and,

in Top gainers' https://t.co/9bw8A0tgUp

#bajfinance is almost @ sloping channel bottom & has entered the demand zone.

— Van ilango (JustNifty) (@JustNifty) June 22, 2022

One of few stocks that are displaying +ve #Divergence in "Day t/f"

"ABC" correction "almost" done.

Above 5650, mild strength. https://t.co/IJlQ0GKtN3 pic.twitter.com/4uqY0DRqiW