SAnngeri's Categories

SAnngeri's Authors

Latest Saves

This topic is for everyone, whether you manage your money yourself or through your advisor, it will go a long way in managing your finances.

Do re-tweet & help us educate retail investors (1/n)

Subscribe to our YouTube for some interesting educational content around Personal Finance - https://t.co/jvgNEDWiAZ

And you can also join our Telegram channel for regular updates – https://t.co/Ekz6I8pDGt (2/n)

(1) Lets start with Life Insurance

Term Insurance is the best way to take an insurance cover & probably the only product to buy in life insurance. Make sure u disclose all the necessary information before taking the insurance. Smoking, Alcohol, any pre-existing deceases etc(3/n)

Have atleast 10-15 times of your annual income as insurance cover

But there are variants of term insurance that you should avoid (4/n)

(A) Term plan with return of premium

For a non-smoker born on the 1st Jan 1985 & policy term 39 years (till age 75), the regular premium for a 1-cr term insurance is 22,157 (inclusive of GST) but with returns of premium is 42670 (inclusive of GST). An increase of 20,513 (5/n)

The content in the articles has been written in a very simple language which will help you learn everything about the sector and/or the company!

Do Retweet and help your fellow tweeples learn!

Let's go 👇

Starting with Financials -

A to Z of Banking, all basics of banking explained -

https://t.co/tMfB73CHYs

Top 5 Banks and their strategies -

https://t.co/aivfUtuw9g

Large Bank - HDFC Bank - How did HDFC Bank become HDFC Bank -

Mid Sized Bank - Kotak Mahindra Bank

How did they avoid all NPAs from 1999? What makes Uday Kotak's Concalls a goldmine of information on the Banking sector? Everything explained!

We have given details from 1999! The most comprehensive article ever!

Large NBFC - Consumer Durables Play - Bajaj Finance

From its origins to how it gives 0% EMI to how it earns money from manufacturers - everything explained!

More - Origins, Products, Loan Book, Cross-Selling, Risk management, Concalls of 8 Years,

Gold NBFC - Manappuram Finance

Origins (with fun facts)

Products, 10Y Financials, Business model and how do they make money, How does a gold loan work, Operational efficiency, peer comparison, mgmt commentary, why we don't like the stock, and much

Thanks for reading :)

Pyramiding

A thread on Pyramiding- pic.twitter.com/8EOSSFMZ2w

— Trader knight (@Traderknight007) December 27, 2020

Don't change your trading

"Don't change the trading rules after every trade."

— Trader knight (@Traderknight007) November 29, 2020

If you do change them frequently then this thread is for you.

Let's talk about the law of large numbers and how it benefits traders to be profitable.

[Thread]\U0001f447\U0001f447\U0001f447 pic.twitter.com/pEUr0wH354

Trendlines

A thread on Trend-lines pic.twitter.com/GsLGzl8A3c

— Trader knight (@Traderknight007) January 2, 2021

Scaling in-out

A thread on SCALING IN - OUT METHOD - pic.twitter.com/bJ1N5ZjAiK

— Trader knight (@Traderknight007) January 9, 2021

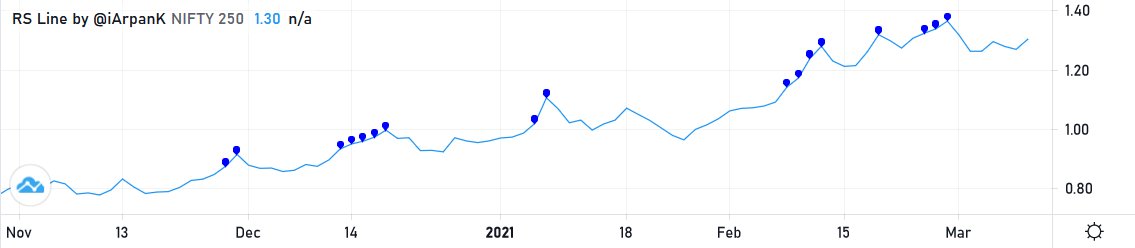

𝗥𝗲𝗹𝗮𝘁𝗶𝘃𝗲 𝗦𝘁𝗿𝗲𝗻𝗴𝘁𝗵 𝗟𝗶𝗻𝗲 𝗯𝘆 @𝗶𝗔𝗿𝗽𝗮𝗻𝗞 v1.0

Read full thread for steps

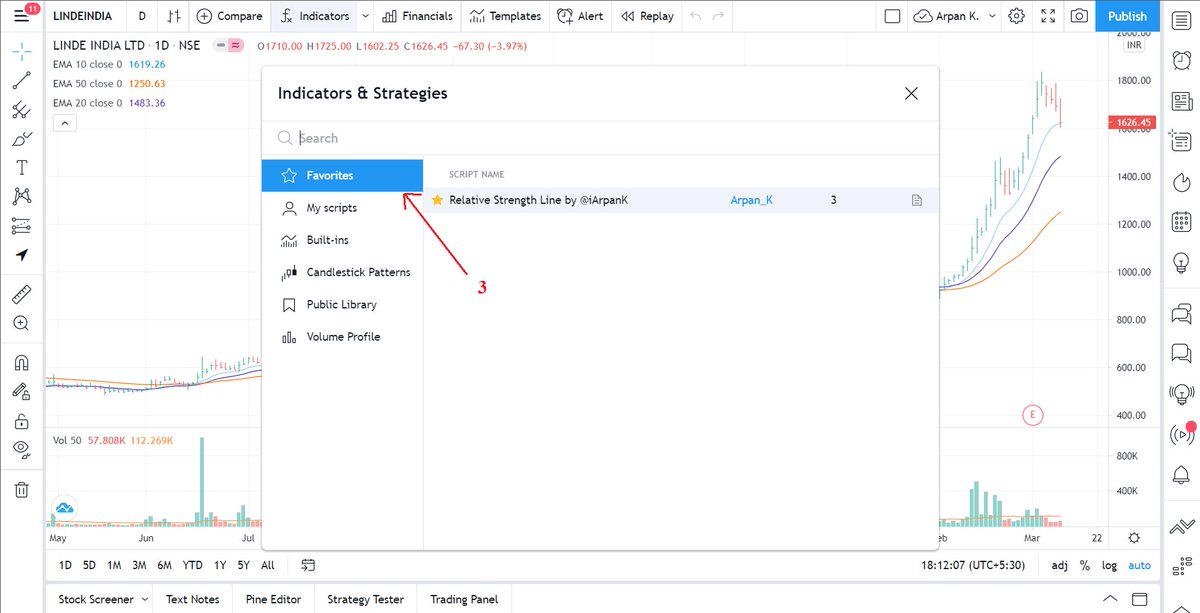

Step #1

Head to the indicators tab on top of your TradingView chart and search for the indicator name or my id - 𝗶𝗔𝗿𝗽𝗮𝗻𝗞

You'll find my indicator there.

Step #2

Click on 'Add to favorites' as shown in image below

Step #3

Go to the 'Favorites' section in the same dialog box, as shown in image below.

You'll find the indicator there. Now click on it and it gets added to your chart! Now you can access this indicator anytime from Indicators -> Favorites.

Finally, we have the RS line indicator on the bottom of the chart with blue dots denoting new highs in RS!

By default, blue dots show new 250 days high in RS (~1 year high)

But you can change the indicator period, colors, symbols by heading to the settings tab of the indicator.

You can check the full documentation of the script with complete user settings & usage details on https://t.co/3q9UOn5GF7

Use it in your day-to-day trading & let me know your experience :)

Decoded his way of analysis/logics for everyone to easily understand.

Have covered:

1. Analysis of volatility, how to foresee/signs.

2. Workbook

3. When to sell options

4. Diff category of days

5. How movement of option prices tell us what will happen

1. Keeps following volatility super closely.

Makes 7-8 different strategies to give him a sense of what's going on.

Whichever gives highest profit he trades in.

I am quite different from your style. I follow the market's volatility very closely. I have mock positions in 7-8 different strategies which allows me to stay connected. Whichever gives best profit is usually the one i trade in.

— Sarang Sood (@SarangSood) August 13, 2019

2. Theta falls when market moves.

Falls where market is headed towards not on our original position.

Anilji most of the time these days Theta only falls when market moves. So the Theta actually falls where market has moved to, not where our position was in the first place. By shifting we can come close to capturing the Theta fall but not always.

— Sarang Sood (@SarangSood) June 24, 2019

3. If you're an options seller then sell only when volatility is dropping, there is a high probability of you making the right trade and getting profit as a result

He believes in a market operator, if market mover sells volatility Sarang Sir joins him.

This week has been great so far. The main aim is to be in the right side of the volatility, rest the market will reward.

— Sarang Sood (@SarangSood) July 3, 2019

4. Theta decay vs Fall in vega

Sell when Vega is falling rather than for theta decay. You won't be trapped and higher probability of making profit.

There is a difference between theta decay & fall in vega. Decay is certain but there is no guaranteed profit as delta moves can increase cost. Fall in vega on the other hand is backed by a powerful force that sells options and gives handsome returns. Our job is to identify them.

— Sarang Sood (@SarangSood) February 12, 2020